Jonathan Kitchen

Published on the Value Lab 11/18/22

The Direxion Daily Dow Jones Internet Bull 3X ETF (NYSEARCA:WEBL) tracks a portfolio of the major tech holdings that have dominated value-weighted ETFs in tech. While some of these elements like Meta (META) have very idiosyncratic problems, the bigger issue is that these companies have generally earned premium multiples that are under more pressure as the gravity of interest rates grows. We think that while there are signs of the CPI peaking, markets may be getting excited, and the 3x leverage in these Direxion ETFs means the reversal could be sharp. Better to avoid.

WEBL Breakdown

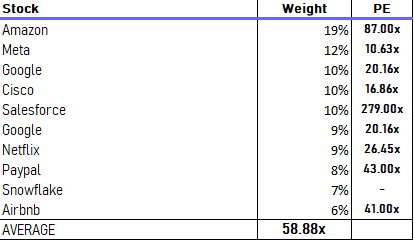

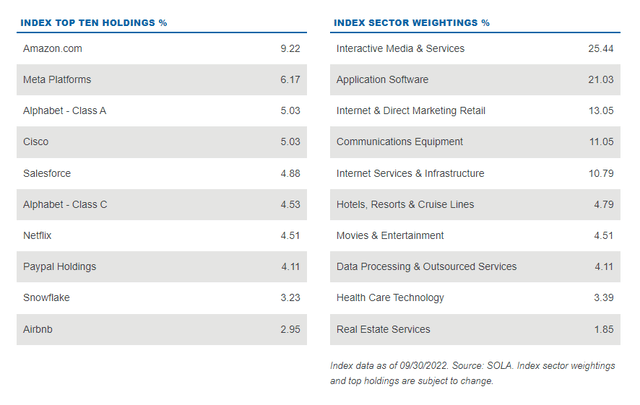

These are the top holdings in WEBL:

Their tech profile is immediately obvious, and the average PEs are at very high levels among the top 10.

PEs of Top Holdings (VTS)

There are good reasons for this. These are in some cases the largest companies in the world and they all have an essential role in how we live our lives or in the tech infrastructure that makes the services and products we consume possible. Amazon (AMZN) has been responsible for massive displacement in one of the largest sectors in the US economy: retail. Meta is the original supermassive social media platform, and they still have (somewhat) of a grip on parts of that market even though they are spending billions on the metaverse concept. Google (GOOG) is the premier search engine and is responsible for guiding the vast majority of internet searches. Cisco (CSCO) is entrenched in networks and consulting for networks. Salesforce (CRM) is a massive brand and a mainstay in most companies, although it has competition from other CRM software even if it’s perhaps still piecemeal. Netflix (NFLX) is seeing ample competition in streaming but it is still a massive brand and has displaced large industries before it. The list goes on.

Moreover, growth has been the premier place to put money in the last decade-long bull market. A degree of do-no-wrong premium has been baked into these companies, but they do bleed, and are bleeding now. Even vaunted cloud segments of the major companies like Amazon are seeing pressure, not to mention pressure on Google’s ad business. The market has admittedly taken its toll for faltering in these high multiple and high expectation stocks.

Where WEBL matches the return of this portfolio and then gives it a 3x factor on daily movements, the levy has been even more aggressive than the overall declines in these stocks which were already substantial. Late October and early November are when pressures on earnings were first observed, and the recovery has not been insubstantial from those lows as CPI figures showed a peak.

Issues

We think that while a CPI peak has been reached, and will likely come down from here as pressure releases from key bottlenecks in the supply chain, the Fed was clear with its messaging and all parameters are met for continued rate hikes. In particular, there is evidence that inflation expectations are not insubstantial for the year ahead. The Fed will stomp out any and all risks of wage-price spiral, and could very well raise rates by 75 bps another couple of times. We’ve said since May 2022 that 6% is where we’ll end up. We think that continues to be the case despite the peak and that markets will be disappointed. WEBL in particular will race downwards with its 3x factor on daily returns.

What’s more is that with WEBL you’re having to bet on the fortunes of Meta. They are spending like crazy to make their metaverse work, but Horizon Worlds is really struggling to build a user base, and is performing a lot like a ‘dead game’. The company plans to spend tens of billions more on this and investors have already voiced discontent with selling. The graphics of Horizon Worlds doesn’t go much beyond the Mii world from Nintendo’s (OTCPK:NTDOY) Wii and 3DS consoles, and isn’t any better than VR World or other ‘games’ that focus heavily on the social aspect. This may never work, and money is being burned for it. On top of that Facebook is mature now and ad spending is simply falling, from which no advertisers can escape. We see issues with Meta on top of the general market, and WEBL is to be avoided on account of rising downside risk.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment