Pgiam/iStock via Getty Images

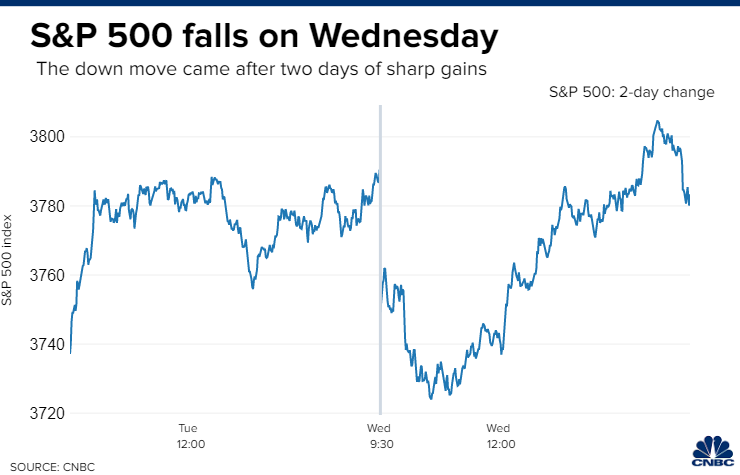

It was not surprising to see the market pull back sharply yesterday after huge gains from the prior two days, but to see the major market averages recoup nearly all of the day’s losses by the close was extremely surprising. Weaker economic data boosted investor sentiment earlier in the week, but yesterday two reports were stronger than expected. In a preview of Friday’s jobs number from the Bureau of Labor Statistics, ADP announced the economy added 208,000 private payrolls in September, which was slightly ahead of the expectation for 200,000. That raised doubts about a dovish pivot by the Fed later this year.

Finviz

Adding to those concerns, the Institute for Supply Management’s service sector survey for September also came in slightly higher than expected at 56.7, matching August’s strength. The consumer remains resilient, despite the inflationary headwinds, and there is no sign of recession on the horizon. This report was in sharp contrast with what we saw in the manufacturing sector on Monday, but there was some softness emerging in the new orders and business activity sub-indexes, which portend slower growth in services. Both reports were consistent with the prior week’s personal income and spending data, showing that spending on goods declined 0.5%, while spending on services grew 0.8% in a continued shift due to the gradual reopening of the economy.

CNBC

The good news in the ISM service sector report on the inflation front is that the supplier deliveries sub-index, which measures lead times, fell for a third consecutive month to its lowest post-pandemic level. This shows a gradual return to normal in supply chains, while the prices paid sub-index fell for the fifth month in a row to its lowest level since the fourth quarter of 2020. Both indicate that the rate of inflation is coming down. These are the granular details of this report that few take the time to read. Instead, they focus and react exclusively to the headline number.

The only downside I see in yesterday’s ISM Non-Manufacturing index (service sector) is that its strength suggests we may see a stronger payroll number tomorrow than the consensus is expecting. The service sector is still showing tremendous strength, but employment is one of the most lagging indicators in an economic cycle. I think Fed officials focus too much on it in their public discussions of the inflation data, yet they are trying to manage expectations at the same time.

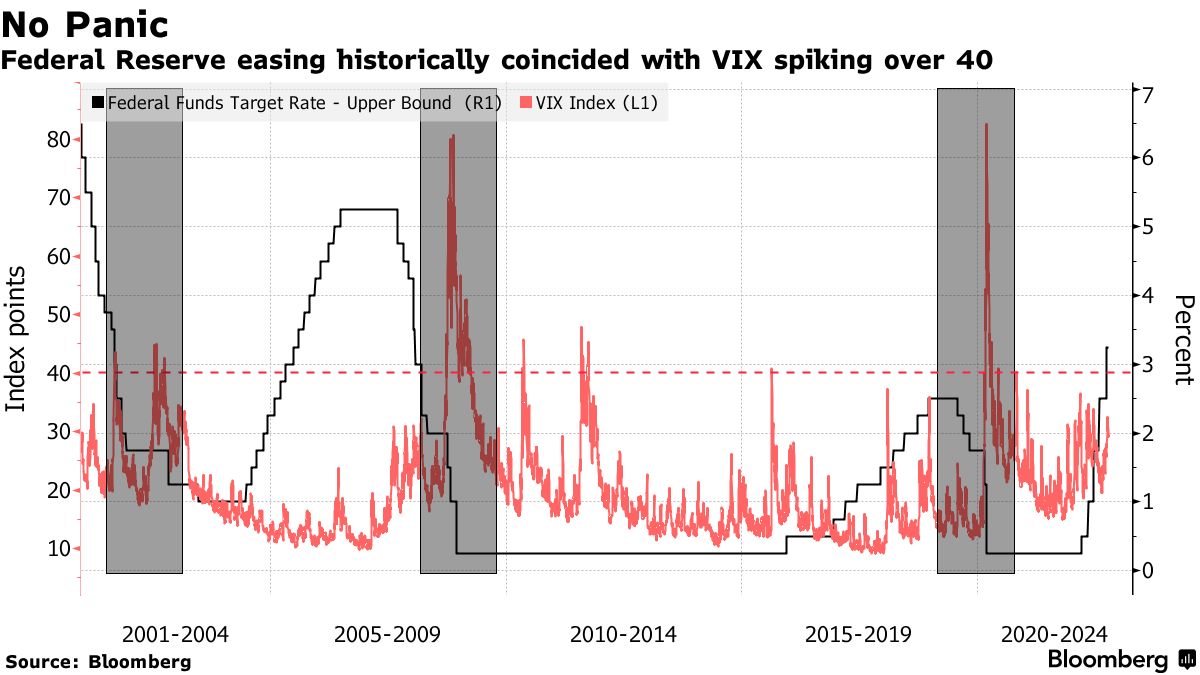

Therefore, if the headline jobs number is stronger than expected, I think we will see another spike in volatility and give back more of the early week gains in a back-and-forth that is likely to continue until we see more definitive data on the inflation front. One thing that has been missing from the ultimate-low scenario is a spike in the fear index to peaks associated with prior market lows. A Volatility Index (VIX) jump above 40 would do the trick. Perhaps tomorrow’s jobs report will do the trick.

Bloomberg

Regardless, I think the peak in short- and long-term interest rates is in with the 2-year and 10-year yields respectively reaching 4.3% and 4%. If we can see both level off during the fourth quarter with the gap between the two narrowing, it should strengthen the resolve of the bulls.

The Portfolio Architect was defensively positioned at the beginning of this year in anticipation of the bear market that has come to pass, but were you? Most pundits were riding the bull as the market hit all-time highs, while we were heavy in cash, but now that fear is reaching extremes, opportunities abound. Join us as we look to slowly position for the next bull market run.

Be the first to comment