kmatija

In May 2022, we have published an article on Seeking Alpha, titled: “Innovative Industrial Properties: High Yield and Growing FFO”. At that time, we have rated Innovative Industrial Properties’ (NYSE:IIPR) stock as “buy”.

The main arguments for our rating were:

- Strong financial performance and steadily growing funds from operations

- High quality assets rented out on a long-term, triple net basis

- Steadily growing dividend

- Potential benefits from expanding legalization, leading to further expanding market

On the other hand, we have also highlighted the primary risks associated with the firm, including the dependency on a limited number of tenants.

In this article, we will revisit our previous arguments and provide an updated view on the firm taking into account the recent news and events related to IIPR.

Let us start by looking at the latest quarterly results.

Financial performance

In our opinion, IIPR keeps growing at an impressive pace. The firm has beaten the revenue expectations in the second quarter by $1.44 million, reaching as much as $70.51 million. This represents a more than 44% year-over-year increase. On the other hand, IIPR missed on funds-from-operations by $0.01 per share, reaching only $1.97, representing a 26% growth compared to the same period in the past year.

Further, the firm has kept expanding its asset base by acquiring a cannabis facility in Massachusetts for$21.5 million. This property is already fully built out and operational. The company has already entered into a long-term triple-net lease deal for the asset with Curaleaf.

Despite the challenging macroeconomic environment, including rising costs, elevated inflation, supply chain disruptions and labor supplies IIPR has delivered strong results. Therefore, we believe that IIPR is well-situated to navigate in the current volatile market environment with high quality portfolio and a strong and flexible balance sheet, combined with the long-term triple-net lease contracts. However, we would like to once again emphasize the importance of the risks related to the dependency on a limited number of tenant’s and their financial situation.

During the Q2 conference call, management has pointed out that the above-mentioned macroeconomic factors can have substantial impact on the tenants and their financial performance. Further, the development of the general unit pricing in the cannabis industry also puts a meaningful downward pressure on the earnings of the producers.

In broader microeconomic terms, in recent months, we have seen a broad based tightening of the financial conditions across the US economy generally, and in the capital raising market for the regulated cannabis industry as well. Total capital raising activity for the regular cannabis industry in the US is down over 60% in the first six months in comparison to the prior year period. Inflation has also impacted operators’ cost structure, including labor, production inputs and construction costs. At the same time, we are seeing general unit pricing in the cannabis industry declining, which is further driving operators to continue to focus on efficiency in their operations. We continue to be resolute believers in the long term growth and prosperity of the regulated cannabis industry. As with any industry undergoing rapid growth and change, we expect to experience headwinds along the way.

The financial health of the tenants also plays a significant role in IIPR’s financial performance and success. In our opinion, the macroeconomic environment is likely to remain challenging for these tenants for the rest of 2022, however, at this point, we remain optimistic about IIPR both in the near future and in the long -term.

On the other hand, before starting investing in the firm, it is important to understand how the stock price could actually develop in case of the default of a tenant. Unfortunately, there has been a default earlier this year, which could serve as an example now. This takes us to our next point:

Risks associated with potential tenant defaults

Kings Garden rents 544000 square feet across 6 properties and is one of IIPR’s largest tenants by rental revenue, accounting for 8%, or ~$16.3MM in rental. In July, Kings Garden has defaulted on July rent and fees.

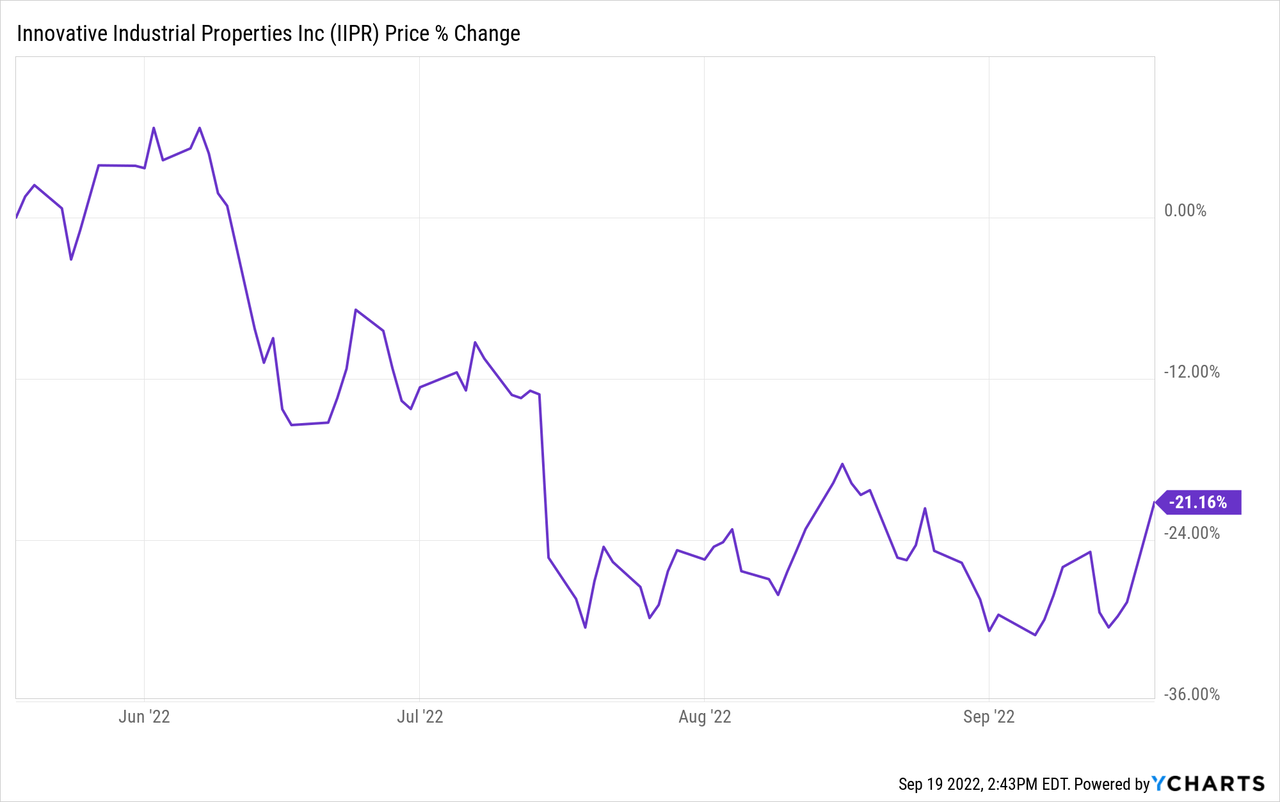

As these news came out in mid-July, IIPR’s stock price has taken a significant hit. Since our last article, the stock price has declined by as much as 21%.

This is a clear indication that any potential further default could have material impacts on the stock price.

While understanding this risk, we still believe that the stock is a buy. After the steady decline of the share price following our last writing, in our view, the firm became even more attractive from a valuation perspective. Further, the firm has recently announced a 2.9% dividend hike, taking the quarterly dividend to $1.8 per share, translating to an annual forward yield of 8.09%. We believe that this increase signals the management’s confidence in the company’s financial strength during this uncertain period, which could be a positive indication for shareholders and future investors.

Key takeaways

Regardless of the macroeconomic challenges and the default of Kings Garden, IIPR has shown great growth figures year-over-year.

The macroeconomic environment can be especially challenging for the producers, due to supply chain disruptions, elevated input costs, elevated inflation, labor shortages and the cannabis price development. In case of a potential on the rent by one of the larger tenants, the stock price can move substantially lower, as seen, when Kings Garden defaulted.

The recent dividend increase signals that the management remains confident about the firm’s financial health.

Despite the risks, we believe that IIPR remains a “buy” at the current valuations.

Be the first to comment