jetcityimage

Confidence in a year-end market rebound seems to be picking up, and appetite for growth seems to be returning. After selling off tech stocks all year, investors seem to be more willing to look at the bright side of the coin; for example, chasing up Netflix (NFLX) after Q2 earnings despite a second sequential miss in subscriber counts.

Yet I don’t think we should be indiscriminately buying this year’s losers. Some tech stocks, in my view, still remain plagued by longer-term issues that will be thornier to work through. Wayfair (NYSE:W), in particular, is one stock whose YTD decline is certainly appealing – but at the same time, I view the stock as having few near-term catalysts to help spark a meaningful rebound.

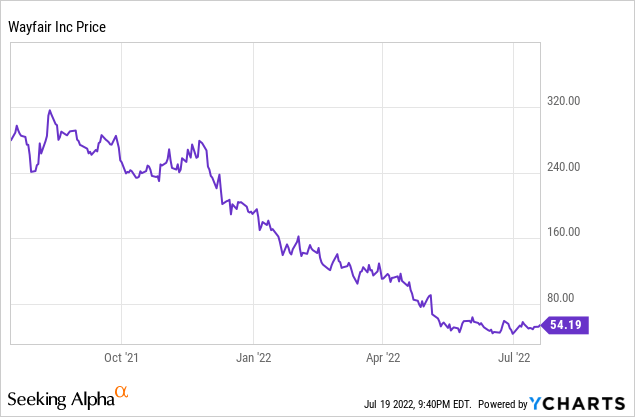

Year-to-date, shares of Wayfair have shed more than 70% of their value, one of the worst declines in the tech sector:

In spite of this sharp fall, however, I remain neutral on Wayfair’s prospects. Consistent with my prior view on Wayfair, I’m nervous about Wayfair’s ability to execute in a very tough macro environment (especially when expectations for Wayfair were very high coming out of the pandemic). While I agree that the stock has sunk to quite low levels, I view Wayfair’s valuation as appropriate given the risks on the horizon.

We’ll get more into the details of Wayfair’s latest (and quite worrying) Q1 results in the next section, but broadly speaking, there are a number of macro factors we should be considering:

- Wayfair’s pandemic boost seems to be entirely a one-time event. Wayfair started slowing down even earlier than other tech or e-commerce names, with 2021 revenue -3% y/y lower versus 2020. So far in 2022, revenue is declining at a mid-teens pace versus 2021. The company is struggling to hold onto the gains that it made.

- Housing trends are not working in Wayfair’s favor anymore. Part of the reason that 2020 was such a boom year for Wayfair was because that year cemented the “suburban move” across America, where people fled cities and moved to homes with more space – fueling demand for furniture retailers like Wayfair. Now that moving has slowed down, and especially with sharply higher interest rates curtailing new real estate activity, macro drivers are working against Wayfair’s favor.

- Inflationary pressures. Wayfair was always a low margin business to begin with, which is one of investors’ biggest complaints on the stock. Wayfair’s long-term operating model calls for gross margins only in the mid-20s and adjusted EBITDA margins of up to 10%. Now, at Wayfair’s shrunken revenue scale, gross margins are dwindling. And because the company’s headcount has swelled since the pandemic to support heightened demand, OpEx is way higher too – diminishing Wayfair’s profits at exactly the time that investors care about profitability most.

Yes, Wayfair is cheap. At current share prices of $54 (reverting Wayfair to levels not seen since the immediate aftermath of the pandemic in March 2020), the company trades at a market cap of $5.71 billion. After we net off the $1.99 billion of cash and $3.05 billion of debt on Wayfair’s most recent balance sheet, the company’s resulting enterprise value is $6.77 billion.

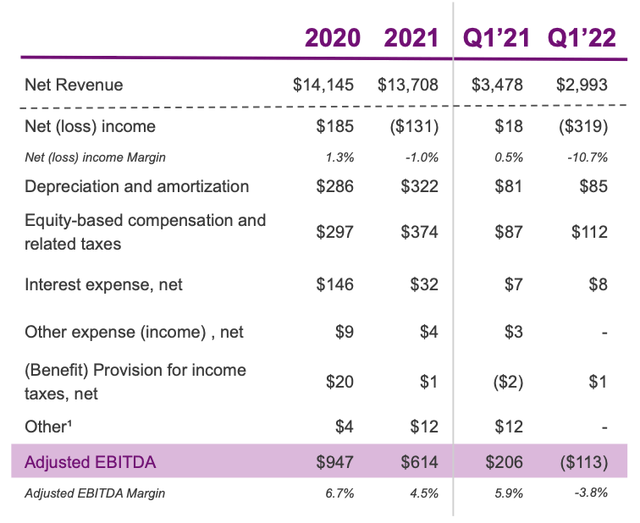

In 2021, the company was able to generate $614 million of adjusted EBITDA, so on a trailing basis, Wayfair’s valuation is a very reasonable 11.0x EV/trailing adjusted EBITDA. But the question is: Does Wayfair have the potential for a repeat performance? So far in FY22, adjusted EBITDA has turned red, and inflationary trends/revenue declines don’t seem to have an end in sight.

The bottom line here: While Wayfair’s YTD decline has certainly been staggering, there is good reason for it, and I don’t see any near-term catalysts that will enable Wayfair to claw itself out. Continue to stay on the sidelines here.

Q1 download

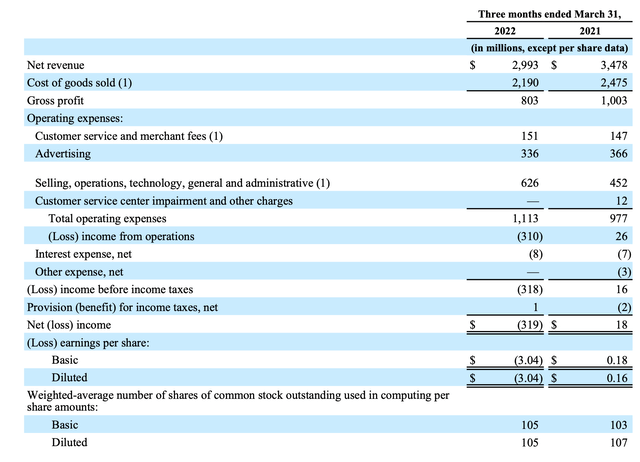

Let’s now discuss Wayfair’s latest Q1 results in greater detail. The Q1 earnings summary is shown below:

Wayfair Q1 results (Wayfair Q1 earnings release)

Wayfair’s revenue in Q1 declined -14% y/y to $2.99 billion, essentially in-line with Wall Street’s expectations of $3.00 billion. However, the company did see revenue decelerate from -11% y/y growth in Q4. Reminder as well that, as previously stated, the comp year in 2021 already represented a decline versus 2020.

Another harrowing metric: Wayfair’s active customer base continued to plummet. It’s now at 25 million active customers (defined as someone who has made at least one purchase in the trailing twelve-month period), significantly down from 33 million at the end of Q1’21. This is yet another indicator that much of the buying activity during the pandemic moving craze was one-time in nature.

The company is largely blaming macro factors as the reason for the downturn, and this makes sense. With inflation eating at the average consumer wallet, discretionary purchases like furniture are getting pushed to the side. Per CEO Niraj Shah’s prepared remarks on the Q1 earnings call:

When we spoke in February, I noted we were seeing early signs of normalization in consumer behavior as a pendulum that pulled heavily towards e-commerce in 2020 and swung back to physical retail in 2021 had begun to even out. This is still the case, but in just the two months since a lot has transpired. With rising prices across the retail universe and amidst troubling geopolitical events, our mass customers in the US and internationally appear understandably more focused on where they are spending their next dollar, pound or euro.”

Margins were also in decay mode. Gross margins for the quarter were 26.8%, 200bps weaker than 28.8% in the year-ago quarter. The primary culprit here was inflation, particularly on logistics costs.

Coupled with headcount growth, the margin reduction had a sweeping impact on Wayfair’s overall profitability. As shown in the chart below, adjusted EBITDA swung to a staggering -$113 million loss, or a -3.8% margin, which is ten points worse than 5.9% in the year-ago Q1.

Wayfair adjusted EBITDA (Wayfair Q1 earnings release)

Key takeaways

Be cautious of Wayfair, especially as both the top-line and bottom-line stories continue to struggle. Wayfair looked like it had a moment in the sun during the pandemic, but unfortunately, it was unable to hold onto the growth and margin progress that it made during 2020. Continue to watch this stock for further price deterioration or fundamental improvement, but don’t rush to buy just yet.

Be the first to comment