Mindful Media/E+ via Getty Images

North American waste disposal company Waste Connections (NYSE:WCN) reported a good set of quarterly results overall. The key positive surprise from the print was the company’s ability to leverage its pricing power to offset any margin drag from commodity price headwinds. Recall that prior to the Q3 results, WCN stock had sold off on concerns about declining benchmark OCC prices (‘Old Corrugated Containers’ or post-use corrugated packaging material such as used boxes and container packaging). Yet, investor concerns proved unfounded as WCN’s pricing power once again came through.

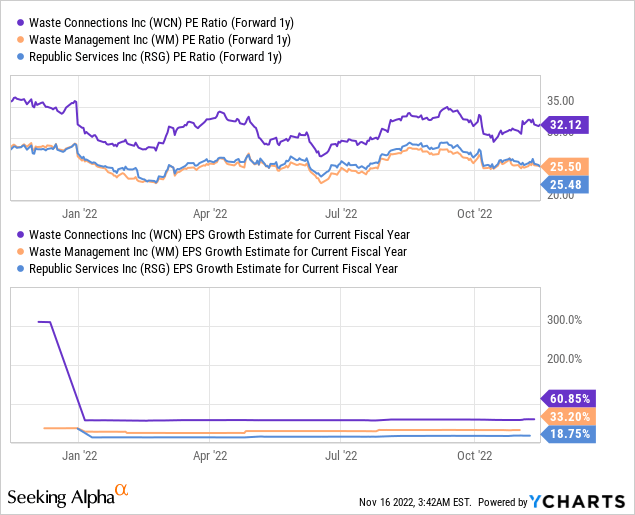

Expect more of the same in the coming years as the company solidifies its industry-leading margins and free cash conversion by further consolidating a fragmented industry. WCN stock trades at a deserved premium to its larger peers Republic Services (RSG) and Waste Management (WM), given its ability to compound earnings through the cycles with limited volatility or drawdowns.

Flexing its Pricing Power to Protect Margins

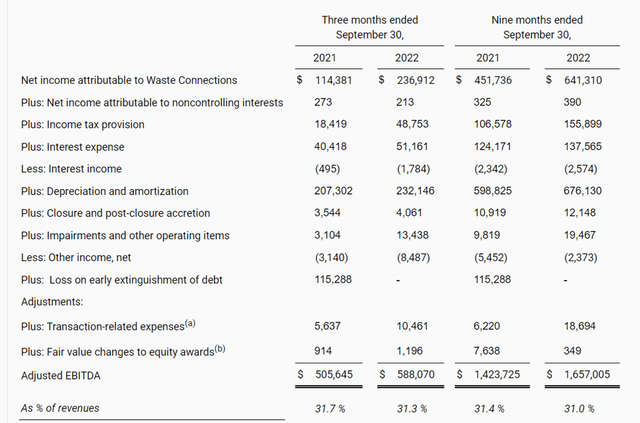

WCN ended its third quarter with adj EBITDA of $588m at a 31.3% margin (-40bps YoY), outpacing consensus estimates on underlying solid waste margin expansion of +170bps YoY. This was partly offset by recycling commodity price headwinds of -90bps, net fuel costs of -60bps, and ~60bps of M&A dilution. Helped by a lower tax rate as well, adj EPS beat consensus estimates by an even bigger margin at $1.10/share.

Breaking down the solid waste performance, the high-margin energy waste business was the standout, as WCN leaned on its pricing power to drive a +8.3% increase in core price. On an aggregate basis, an incremental 1.8%pt contribution from fuel surcharges further boosted the total price rise. This more than offset the modest decline in waste volumes at -1.5% YoY, which was largely down to the expiration of two lower-margin municipal contracts. On a YTD basis, WCN has closed $535m and signed on another $35m in M&A-driven revenue (well above the $470m of closed acquisitions in Q2 2022), signaling continued progress along the inorganic growth runway.

Raised Guidance Creates Compelling Near-Term Setup

Following the strong Q3 report, WCN increased its full-year revenue guide to $7.19bn (up ~$65m from the prior guide), citing higher price and M&A-related contribution, which should continue to offset any further recycling commodity price declines. This implies a raised Q4 2022 revenue guidance of $1.845bn, with another 10%pts contribution from higher core pricing and surcharges against a modest -2.4% decline in volumes (again due to the continued impact of expired municipal contracts). Given the accelerating pricing gains in Q3 and the prospect of more M&A rollover contribution, I feel comfortable underwriting a double-digit revenue growth scenario.

Some of the pricing will go toward covering recycling headwinds (70-100bps of margin), but most of the pricing benefits should flow through to the P&L, driving margin expansion ahead. As a result, the raised 2022 adj EBITDA guidance of $2.21bn (up ~$20M from the prior guide) came as no surprise, along with the adj EBITDA margin guide for the full year at 30.7%. As more M&A benefits come through and execution on price continues, expect accelerating pricing growth in the year ahead (management sees 8-9% at least), driving resilient unit profitability through a challenging macro.

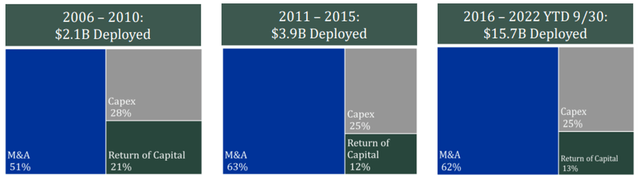

Robust M&A Pipeline Supports Growth Outlook

WCN’s FY23 guidance calls for double-digit revenue and adj FCF growth, which leans not only on more pricing gains but also a significant >4%pts of M&A contribution. I view the guidance as very achievable – the M&A pipeline is as robust as ever, with transactions in the ~$20-$40m revenue range covering integrated companies, as well as opportunities to penetrate West Coast exclusive markets. Plus, including the additional acquisitions expected to close this year, WCN is already primed for a rollover contribution of >5% based on the current acquisition pipeline.

As things stand, the waste industry in North America is fragmented, and many ‘mom-and-pop’ businesses still operate in niche markets, so there is an extensive runway here. Given WCN’s niche focus and track record of integrating value-accretive acquisitions, the company remains the best play on industry consolidation, in my view.

Industry-Leading Pricing Power Shines Through

On balance, this was a strong beat and raise quarter for WCN, as positive benefits from pricing and acquisitions more than offset recycled cardboard pricing headwinds. FY23 is gearing up to be another solid year as well, with guidance calling for double-digit revenue growth and FCF on continued pricing power and accretive M&A contribution.

Importantly, WCN’s competitive advantage appears intact, from its differentiated focus on exclusive and secondary markets in the solid waste business to its track record of streamlining operations and improving profitability post-acquisition. Heading into an economic downcycle, WCN’s consistent earnings growth is particularly attractive, along with its superior FCF conversion rates. Coupled with the capacity for more M&A activity as well as for shareholder return (via dividends and buybacks) down the line, WCN’s premium valuation seems warranted.

Be the first to comment