kzenon/iStock via Getty Images

Investment thesis

WashTec’s (OTCPK:WHTAF) shares have corrected 22% YTD, but we do not see this as a buying opportunity. A close look at Q1 FY12/2022 results show increasing cost pressures that will push down profitability and restrict free cash flow generation. On consensus estimates the shares are trading on PER FY12/2023 15.4x which looks cheap, but this view looks too optimistic. We rate the shares as a sell.

Quick primer

Founded in 1885 and based in Augsburg in Germany, WashTec AG is a leader in car wash solutions in Europe. Its solutions range from car wash systems with conventional brushes, cloth washers, and high-pressure water jets. Its client base includes gas companies, auto manufacturers, and small and medium-sized cash war businesses. There are three manufacturing sites in Germany, one in Denver in the US, one in the Czech Republic, and a site in Shanghai, China.

Geographically the key market is Europe contributing 79% of total sales FY12/2021, followed by North America at 17%, and Asia Pacific at 4%. WashTec’s European clients are predominantly filling station operators that offer on-site car washes.

It is important to note that WashTec’s dominance in the European market partly stems from Germany’s strict car washing laws. Car washing at home is banned in most parts of the country in order to prevent soap and oil from getting into the wastewater system, creating a captive domestic audience. There are more than 18,000 car wash locations in Germany versus over 80,500 locations in the US – a fairly dense network considering the difference in land size. Germans are said to wash their cars six to nine times a year.

Peers include Daifuku (OTCPK:DFKCY), Otto Christ AG (unlisted), Istobal (unlisted), and NCS National Carwash Solutions (unlisted).

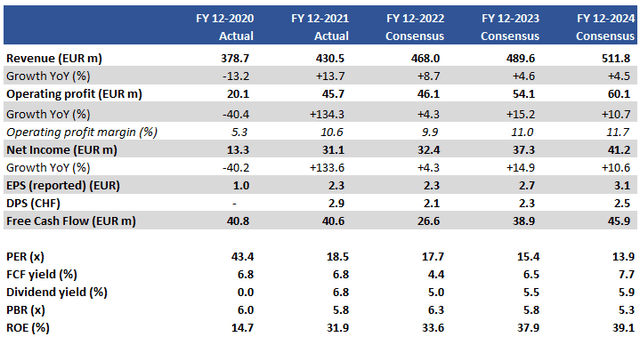

Key financials including consensus estimates

Key financials including consensus estimates (Company, Refinitiv)

Our objectives

WashTec’s shares are down 22% YTD despite consensus estimating a stable growth profile for the next 2 years (FY12/2023-FY12/2024). Q1 FY12/2022 results were said to be robust with revenue growth at 19% YoY and an improvement in EBIT margin YoY from 4.1% to 4.6%. Management also commented that the order backlog was above the previous year, which is positive for earnings visibility. In this piece, we want to assess if the recent sell-off is a buying opportunity.

Strength in North America, but core European market softer

Q1 FY12/2022 revenue growth (page 7) was notably strong in the North American market which saw 58% growth YoY, followed by Asia Pacific at 30% YoY. Although the biggest contributor by volume, sales in Europe grew 12% YoY which is respectable but highlights the relatively mature status of the market – a key sales driver was car wash chemicals illustrating repeat sales as opposed to new installation sales. One also has to note the favorable currency environment helped to boost North American sales with the weakening Euro (underlying growth was 47% YoY).

From a profitability standpoint, both Europe and Asia Pacific saw improving margins boosted by sales volume. Despite the robust sales growth, North America lowered operating loss margins but still remained in the red due to increased headcount, material costs, logistics, and other operating-related expenses.

It is a concern that the North American market is unable to generate profits in the current recovery environment. Asia Pacific is primarily China and Australia, and despite past high expectations, the former remains a challenging market to make material headway for WashTec.

Issues faced in North America highlight why the company raised FY sales guidance due to positive currency impact (€476m-€484m range versus previous €450m-€470m range), and lowered expectations for EBIT margins from double-digit to an 8% to 9% range. We look at reasons for lowered profitability.

Cost inflation cannot be ignored

The company is facing multiple procurement problems. There are supply chain issues related to semiconductor shortages and increasing freight costs. Raw material prices such as steel and cleaning agents such as Sodium Lauryl Sulphate (due to food oil shortage from the war in Ukraine) are on the rise. The company is purchasing excess inventory in order to ensure manufacturing can continue, placing more pressure on working capital. These factors explain the lowered guidance for profitability, together with lowered expectations (page 8) of generating free cash flow initially from a €28m-€32m range to €10m-€20m for the current financial year.

The company believes that it has the pricing power to offset some of these cost pressures, but there will be a delay in the impact of any price hike. Being able to offset all cost pressure present is also unrealistic in our view.

Increasing costs will result in downside risk to WashTec’s profitability. Current consensus estimates look too bullish particularly for operating margins rising to 11.7% in FY12/2024. We also believe that car washing is not a basic necessity, and with a cost-of-living crisis, spending patterns will change as people cut back or downgrade to cheaper self-service car washes.

Valuations

On consensus estimates the shares are trading on PER FY12/2023 15.4x and a dividend yield of 5.5%. We believe consensus is being too optimistic, and with downside risk to earnings, actual valuations are less appealing.

Risks

Upside risk comes from a major demand hike in the North American market. With increasing volumes and currency tailwind, generating operating profits here could be a gamechanger for the company’s medium-term outlook.

If inflationary cost pressures appear to have peaked and begin to normalize, WashTec’s outlook for profitability will be one of a gradual recovery.

Downside risk comes from sustained inflationary cost pressures which would drive down profitability.

Change in end-customer spending patterns as car washes become less frequent would be negative for new installation demand, as well as car wash subscription sales.

Conclusion

WashTec has a strong franchise in its core European market, but there is a limit to its growth potential given its mature market status and current cost pressures. Growth opportunities overseas look most promising in North America but this option is also challenged by rising costs. Despite the recent share price correction, we do not see an opportunity to invest given weakening fundamentals. We rate the shares as a sell.

Be the first to comment