Jacek_Sopotnicki/iStock Editorial via Getty Images

Considering the recent history of failures tied to major AT&T (T) corporate deals, investors shouldn’t really be surprised by the downfall of Warner Bros. Discovery (NASDAQ:WBD) during the months after closing their deal. The video streaming market has become incredibly competitive, evidenced by the Netflix (NFLX) numbers, and now the ad market is turning tough. My investment thesis isn’t prepared to buy this beaten-down stock, even at the lows.

FinViz

Messy Integration

One of the biggest issues with AT&T spinning off WarnerMedia into Discovery was the creation of a behemoth in the media market. The company already has a revenue base headed toward $50 billion eliminating some of the mobility to take market share from larger players. The big excitement over buying the HBO asset was the addition of a growth asset, yet the addition of the whole WarnerMedia asset turned WBD into the sector behemoth.

When reporting Q1’22 results back in April, the company reported revenues of $3.12 billion for 13.3% growth. The deal with AT&T closed right after the end of the quarter, and the CEO of the combined company quickly shut down the failed CNN+ launch and discussed a $500 million profit shortfall from the WarnerMedia business.

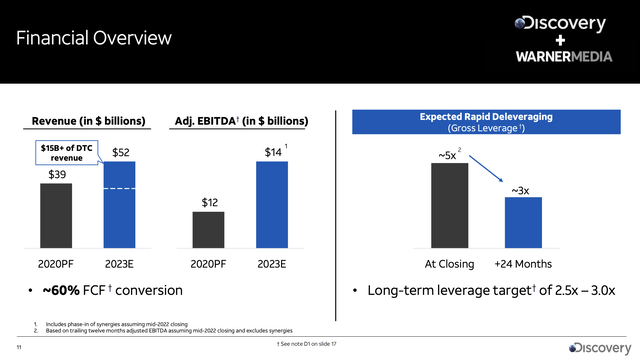

The CFO even made the suggestion WarnerMedia had $40 billion in revenues and no free cash flow due to chunky projects lacking the solid analytics behind the project spending. The media giant maintained 2023 financial targets originally set at revenues of $52 billion and adjusted EBITDA of $14 billion.

Discovery + WarnerMedia Presentation

In essence, the problem with all of these massive corporate integrations is the investment typically looks worse when the new owner gets a view behind the curtain. Not to mention, the deal took about a year to close, so a lot of such assets kinda rot on the vine over the period of being in between management teams.

Now, WBD faces a tough period where ad sales could face a tough climate with a weak economy. Combined with a WarnerMedia division struggling to generate cash flows, the company plans to cut a massive 30% of the ad sales team. The division has 3,000 employees and plans to cut up to 1,000 jobs.

The news doesn’t build a lot of confidence for investors when the deal only closed on April 8. The combined company hasn’t even reported quarterly results yet and such drastic cuts to any division can destroy morale, impacting the productivity of the remaining 2,000 employees.

The merger was announced with plans for $3 billion in cost synergies, and media mogul John Malone suggested WBD could easily find $4 billion in cost cuts from the combined company. The NY Post had already detailed shakeups in management heading into the deal close suggesting a cultural problem at the different companies with WarnerMedia staff describing Discovery management as “cheap”.

A lot of mergers fail to achieve goals due to the different corporate cultures. Considering WarnerMedia apparently has $40 billion in annual revenues and the failed launch of CNN+, one shouldn’t be shocked by a lot of job cuts, but also this can lead to a period of underperformance by the business with so many disruptions.

Slow Grower

After shifting through this messy integration period, investors have to face the reality of revenue growth in the 6% range going forward. The excitement over the DTC streaming video business has come back to the reality of the company being a slow growth behemoth in the sector with heavy content spend in a competitive sector.

Analysts only forecast Netflix revenue growth of 10% reaching $35 billion in sales, placing WBD at about 50% larger than the prior industry leader. The media company becoming the industry giant limits any growth potential going forward, considering the DTC business already has a combined 100 million subscribers.

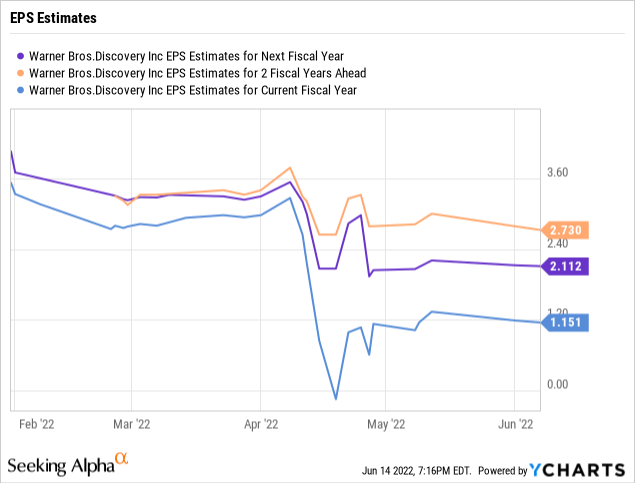

The analysts guide to the new company generating vastly higher profits of $2 to $3 per share going forward. WBD added $40 billion in net debt from the deal with AT&T while the company had $4.2 billion in cash and gross debt of $15.1 billion at the end of March. The combined company will have massive debt totals of over $50 billion here, and the cash flow picture outlined by the CEO doesn’t offer a promising picture while interest rates are surging.

The stock would become interesting at $14, if the new WBD actually achieved EPS targets above $2 in 2023 and approach $3 in 2024. A company saving up to $4 billion in costs with 2.4 billion shares outstanding would definitely quickly provide a $1+ EPS boost to the stock.

The problem is whether any of these companies shifting to video streaming will generate much in the ways of cash flow due to heavy spending on content. Netflix was spending $17 billion, and the company struggles to produce cash flows due to the aggressive spending now without any corresponding sub-growth. Not to mention, the company appears set to grow the content budget this year, though at a slower rate suggesting spending somewhere in the $18+ billion range is the target for 2022.

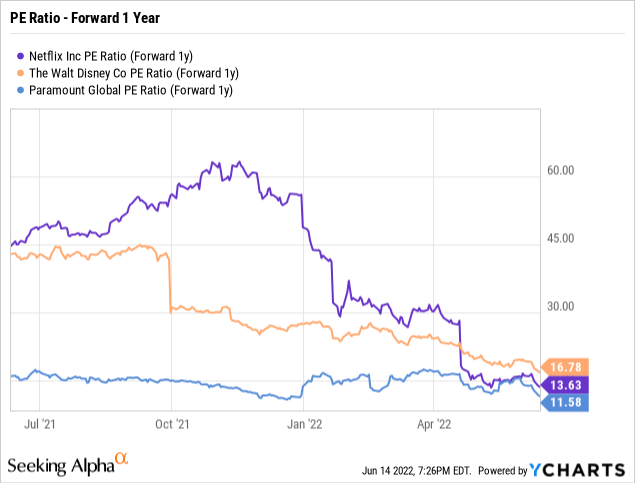

The much bigger WBD plans to spend $23 billion on content this year before CEO Zaslav eliminates any additional projects via rationalization. The stock has the potential to be cheap in comparison to the other media companies with Netflix, Disney (DIS) and Paramount Global (PARA) trading at roughly a range of 13x forward EPS target.

Even if WBD only earned $2 per share, the stock could reach $26 based on the comps. The debt levels do become problematic in a recession, possibly explaining why investors are shunning the stock. The EV is ~$86 billion now and trades at just 6x the 2023 EBITDA targets of 6x.

Takeaway

The key investor takeaway is that WBD just has too many unknowns for investors to dive into the stock here. The Discovery management team raised too many concerns regarding the WarnerMedia business entering the merger along with the apparent culture clash for an investor to get aggressive here. As the market settles down and the company clears the deck with the Q2 earnings, the stock will likely provide a more attractive setup.

Be the first to comment