trenchcoates

I’m in London for a few weeks, and since my wife is a huge Harry Potter fan, I took my family to the Warner Bros. Studio Tour – The Making of Harry Potter. While I’m no wizard, I bought several magic wands and other souvenirs at one of the studio’s magnificent gift shops. Overall, the adventure was amazing, my family had a blast, and of course, while the experience may have been priceless, it certainly wasn’t cheap. After researching, I learned that this studio tour alone brought in around $160 million in revenues during its pre-COVID high in 2019. With the COVID hysteria dying down, we should see revenues returning to similar levels in the coming years. Frankly, I was amazed at the money-making ability of the studio tour. However, when discussing Warner Bros. Discovery “WBD” (WBD), we need to consider the entire Harry Potter empire and much more. Warner Bros. Discovery has a similar studio tour in Hollywood and studios and theme parks in many parts of the world.

Some of the timeless assets owned by WBD include:

DC Films, New Line Cinema, Castle Rock Entertainment, HBO, Cartoon Network, Cinemax, CNN, and more. In addition, the company maintains the rights to mega-blockbuster franchises like Harry Potter, Lord of the Rings, The Game of Thrones, Batman, and much more. Furthermore, WBD has a similar studio tour in Hollywood and studios and theme parks in many parts of the world.

Why I Want to Double Down on My WBD Position

In addition to its stellar content, WBD reported more than 92.1 million streaming subscribers last quarter. Remarkably, WBD’s market cap is only around $32 billion today. WBD delivered $10.82 billion in revenues last quarter, and full-year revenues should be approximately $45.3 billion this year (consensus estimates).

Revenue Estimates

Revenue estimates (SeekingAlpha.com)

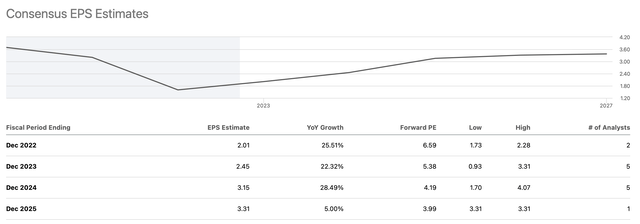

Moreover, WBD should report roughly $2 in EPS this year, and the company should provide significant growth as we advance. Therefore, WBD’s stock is trading at just 0.7 times expected sales and approximately 6.5 times this year’s earnings expectations. Furthermore, EPS growth is expected to be around 22% next year, placing WBD’s PEG ratio at a rock bottom low of approximately 0.032.

EPS Estimates

EPS estimates (SeekingAlpha.com)

Have you ever seen a stock trading at a PEG ratio of 0.032? Because I haven’t. There have probably been some exceptional instances, but we’re not talking about a no-name company here. We’re discussing a global media and entertainment giant with one of the top streaming platforms in the world. Furthermore, WBD has significant growth prospects in the U.S. and internationally. Before we examine how WBD stacks up to its completion, I want to share my viewpoint on what is happening here.

The AT&T Phenomenon

AT&T (T) “acquired” Time Warner for $85 billion in 2018. Then, AT&T spun off WarnerMedia for just $43 billion in April this year. What occurred over these several years that caused Time Warner’s valuation to crater? First, in my view, AT&T has no business running a media, entertainment, or streaming company. Time Warner and HBO Max need innovation and creativity to function effectively, grow and prosper. Unfortunately, Time Warner could not achieve its objectives under the watchful eye of AT&T’s management. It’s no secret that AT&T refused to listen to anybody at Time Warner after acquiring the media giant. You cannot micromanage a creative media company to success. Therefore, AT&T received exactly what it bargained for, a disaster merger, a horrible investment for shareholders, and a stock price that’s down by 42% over the last 10 years.

Let’s Look On The Bright Side Of Things

Now that AT&T is out of the picture, WBD’s management can be much more flexible, and the company can return to creativity, growth, and innovation. Also, when discussing streaming platforms, it’s all about content, and HBO arguably has the best content in the world. With 12 Emmy Awards this year, HBO dominated the Emmys, crushing the competitors like Netflix (NFLX), Disney (DIS), and others. HBO Max delivers some of the best content globally, and the company has massive growth ahead.

While 92.1 million global subscribers may seem like a lot, it pales compared to the company’s applicable market share. HBO Max has approximately 53 million subscribers in the U.S. However, that’s fewer than 50% of U.S. households. However, HBO Max’s real growth potential is overseas, and WBD continues launching its services in international territories. As of this April, HBO Max was present in 61 countries and territories but has plans to be in 190 countries and territories by 2026. Therefore, we could see considerable subscriber growth in the coming years, and this dynamic should lift WBD’s revenues and profits, leading to a considerably higher stock price.

Let’s Look at That Valuation Again

The combined company, WBD, has a market cap of only $32 billion. Thus, even if we put a modest valuation of $10 billion on Discovery, is the sprawling WarnerMedia empire worth only $22 billion now? Yes, the company’s valuation is ludicrous right now.

Stacking Up To The Competition

- Netflix: Market cap – $108 billion, revenues (2022 est.) – $31.7 billion, P/S valuation – 3.4, EPS (2022 est.) – $10.30, P/E ratio – 23.5, revenue growth (2023 est.) – 8%, EPS growth (2023 est.) – 7.3%, PEG ratio – 3.2.

- Disney: Market cap – $200 billion, revenues (2022 est.) – $84.5 billion, P/S valuation – 2.4, EPS (2022 est.) – $3.86, P/E ratio – 27.7, revenue growth (2023 est.) – 11.4%, EPS growth (2023 est.) – 39%, PEG ratio – 0.71.

- WBD: Market cap – $32 billion, revenues (2022 est.) – $45.3 billion, P/S valuation – 0.7, EPS (2022 est.) – $2.01, P/E ratio – 6.5, revenue growth (2023 est.) – 4%, EPS growth (2023 est.) – 22.3%, PEG ratio – 0.032.

WBD is considerably cheaper than Netflix and Disney on all metrics. Moreover, WBD’s revenue growth potential may be low-balled here, and the company may achieve 7-12% revenue growth in the coming years. Additionally, WBD should become increasingly profitable as the merger is cemented and the company advances.

Here is what WBD’s financials could look like in future years:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

| Revenue Bs | $45.3 | $50.5 | $55.6 | $60.5 | $65.4 | $70.6 |

| Revenue growth | N/A | 11.5% | 10% | 9% | 8% | 8% |

| EPS | $2.01 | $2.50 | $3.20 | $3.84 | $4.53 | $5.35 |

| Forward P/E ratio | 5.2 | 8 | 10 | 12 | 14 | 15 |

| Stock price | $13 | $26 | $38 | $54 | $75 | $90 |

Source: The Financial Prophet

It’s difficult to believe, but WBD is trading at a dirt-cheap, rock-bottom 5.2 times forward EPS estimates here. Once the company demonstrates it can achieve revenue growth and increase profitability, WBD’s P/E multiple should expand substantially, leading to significant stock price appreciation. With modest revenue and EPS growth projections, WBD’s stock can rise significantly as its P/E multiple improves in the coming years. WBD may be one of the most undervalued high-quality companies in the stock universe and could be one of the best buys for the next decade. Therefore, I’m looking for an optimal opportunity to double down on my WBD position in the upcoming days and weeks.

Risks to Warner Bros. Discovery

Despite my bullish outlook for WBD, several risks exist before investing. First, the merger may not take as well as I expect. We may not see the seamless merger required to achieve optimal financial results. Moreover, the current downturn may affect sales and subscription growth. Competition from Netflix, Disney, and other streaming services also may present problems for WBD as the company advances. Therefore, one should examine these risks and others before committing capital to WBD stock.

Be the first to comment