simpson33

When Discovery closed on AT&T‘s (T) WarnerMedia assets in the second week of April, forecasts for a strong U.S. advertising market, alongside rapid subscriber growth in streaming service eyeballs and revenues, were conventional wisdom on Wall Street. Of course, a lower interest rate backdrop was also part of the merger equation, when the deal was agreed in 2021. In my view, two problems now exist for the combined Warner Bros. Discovery (NASDAQ:WBD) that were not entirely foreseen last year: (1) weaker subscription rates and backpedaling advertising market economics for online entertainment, and (2) rising interest costs on debt. In the end, I am very worried a prolonged recession and too much debt will mean equity gains are not going to happen until 2023, at the earliest.

A critical warning sign for investors is today’s stock market capitalization of $35 billion dwarfs $52 billion in debt and $89 billion in total liabilities. Wall Street is rightly concerned leverage will crush ownership values over time. An almost 3 to 1 liability setup vs. shareholder market value leaves little room for error. Successful blue chips usually trade the opposite, with total share worth outstripping underlying business liabilities by a large degree.

We still don’t have a bunch of financial data to work off, but based on the initial quarter of merged operations, June Q2 generated estimated annualized rates of $4.3 billion in operating cash flow (which should improve) vs. $2.3 billion in interest expense. 2021 proforma results issued in early April here, pegged $6 billion in combined cash flow for the calendar year vs. $2.5 billion in interest expense.

In terms of debt as a concept, it will take 9-13 years of dedicating ALL operating cash flow to pay off its debt in theory, and as many as 12-17 years to zero-out total liabilities (minus current assets), especially if cost-cutting and streaming growth do not meet rosy management forecasts. Remember, that’s without investing one cent into new capital spending or share buybacks or expansion plans.

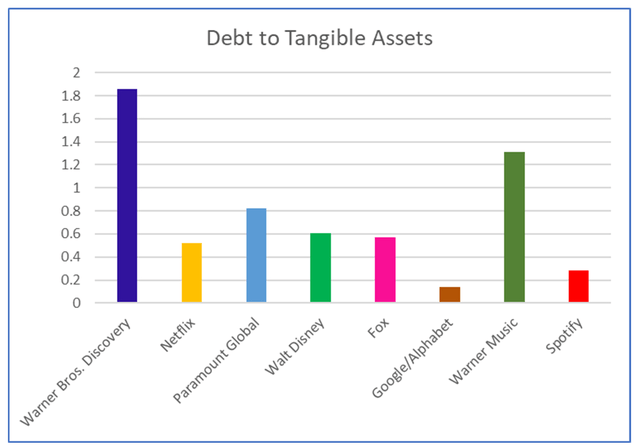

Below is a graph of total financial debt vs. tangible assets, measured against the biggest U.S. peers and competitors in streaming video and audio. The new Warner Bros. Discovery enterprise is by far the most leveraged in comparison to owned-content providers Netflix (NFLX), Paramount Global (PARA) (PARAA), Walt Disney (DIS), Fox (FOX) (FOXA), Google/Alphabet (GOOG) (GOOGL), Warner Music Group (WMG), and Spotify (SPOT). WBD’s debt to hard asset setting is triple the peer ratio vs. competitors.

Author Created, Financial Debt to Tangible Book Value, Latest Quarterly Statements – August 8th, 2022

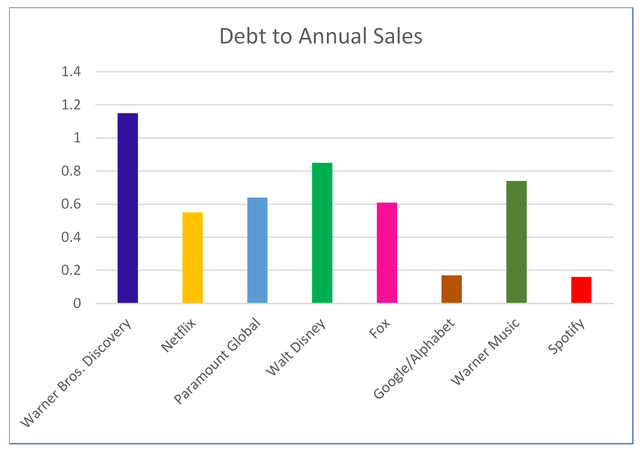

Debt to sales is no better. Using trailing 12-month results for the peer group and proforma sales for Warner Bros. Discovery, interest expense as a percentage of sales could explode with higher interest rates in the U.S. (shrinking profit margins and effectively making the business uncompetitive over time). The ratio of debt to sales is roughly double the mega-cap streaming average.

Author Created, Debt to Annual Sales, Trailing 12 Months – August 8th, 2022

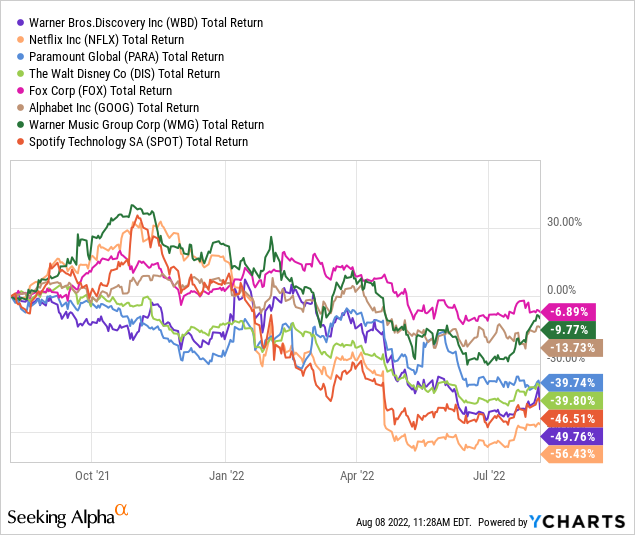

In the end, massive leverage in a slowing economy has worked sharply against shareholder gains in 2022. Below is a graph of total returns achieved over the past 52-weeks, in comparison to the peer group. Believe or not, Warner Bros. Discovery has performed just as poorly over this time frame as the complete bust in the Netflix quote!

YCharts, Peer Total Returns 1-Year

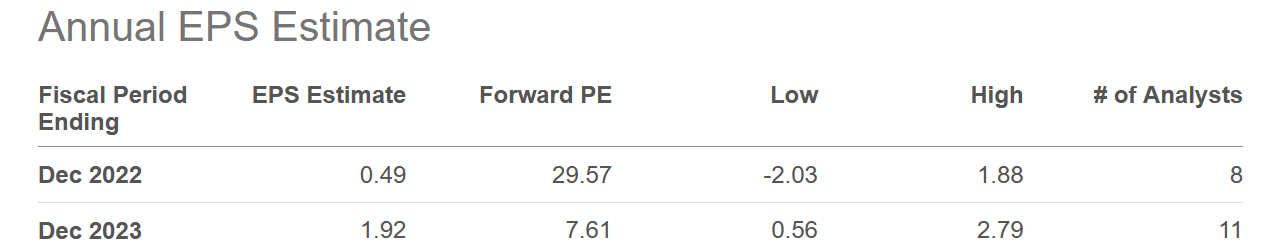

When we review current estimates for operations, some good news is analysts are expecting 2023-24 to provide solid cash flow and cash earnings (GAAP losses are expected into 2024). However, projections are all over the board, with the interest rate picture quite cloudy (affecting interest expense on all the WBD debt), and a heated debate regarding the future of the U.S. economy raging during the middle of 2022. My view is 5% YoY hourly wage income gains vs. 9% CPI is a horrific setup for U.S. consumer confidence and spending on things like discretionary streaming entertainment.

Seeking Alpha, Analyst EPS Estimates 2022-23, Warner Bros. Discovery – August 8th, 2022

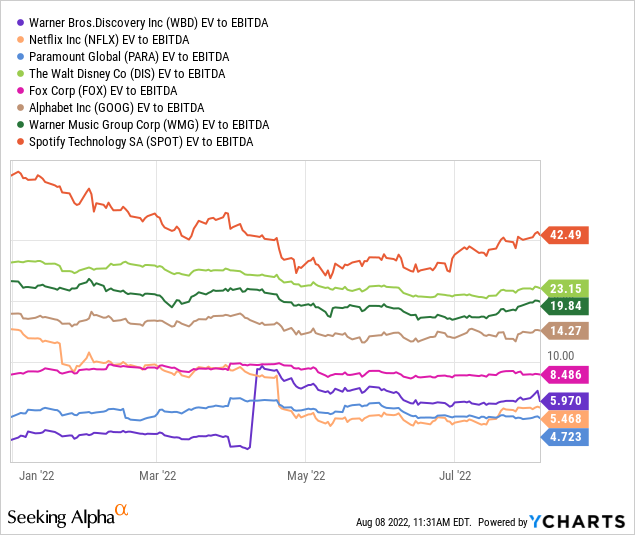

When we review trailing valuations of basic cash earnings [EBITDA], and account for the debt holdings of each peer company, Warner Bros. Discovery can be argued as cheap (using mostly pre-merger calculations). But you have to assume borrowing costs are done rising, and consumer spending will not be hit by the stealth stagflation recession this year. My forecast is calling for both rising interest rates and much weaker consumer spending by the end of the year. If this is the case, current Wall Street estimates will prove overly optimistic by a mile for WBD.

YCharts, EV to Trailing 12-month EBITDA, August 8th, 2022

I would note that I do prefer the low-EBITDA, more sustainable debt structures of Netflix and Paramount Global. I wrote bullish articles months ago on Netflix here and Paramount here, if you want to read the positive backstories for either investment idea.

Weak Trading Momentum

Because of the debt bomb sitting on its balance sheet, Warner Bros. Discovery stock has come under massive and regular selling pressure for months. The momentum trend is down impressively, and will need some sort of catalyst to stabilize.

On the weekly chart of trading action below, pictured over the last five years, we can see what I call the “trifecta” of bearish action in the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume indicators. When all three are declining sharply in unison, price finds it difficult if not impossible to rise. Other instances of this technical warning of deep and heavy sell momentum are highlighted with the green arrows, during the midst of the March 2020 pandemic panic, and following the “meme” rise in early 2021. Today’s Discovery (now WBD) quote is at a 5-year low, while ADL, NVI, and OBV numbers could be on the verge of even bigger breakdowns and failures this week.

StockCharts.com, Author Reference Points, 5-Years

Final Thoughts

The most optimistic rating I can put on Warner Bros. Discovery is a Hold or Neutral setting. If you own shares and believe the overall economy will survive 2023-24 just fine, WBD could rise some from $14 a share (perhaps to a $20 target price). However, for most investors I would just avoid this name and purchase other streaming giants utilizing less debt and leverage on the balance sheet. In a severe prolonged recession, the common equity price could theoretically fall to zero. Too much debt is never a good thing for investors in any company. A weaker ad market and declining subscription interest in Discovery+ and HBOMax could send the stock appreciably lower as climbing interest costs eventually squeeze profitability (cash generation margins) in an ultra-competitive streaming environment. Although much of the $52 billion in debt is financed long term, every 1% rise in interest costs could eventually add $520 million in annual company costs, absent real debt reduction efforts.

In other words, current risks seem to outweigh potential rewards for investors. Once the economic destruction from 2022’s spike in inflation passes, I might get more bullish on Warner Bros. Discovery. However, I believe the earliest the U.S. economy bottoms is the first quarter of 2023. Could dramatically lower WBD quotes in the single digits grab my attention? It’s possible, but any bullish outlook will depend on a reduction in the debt load, which may be hard to pull off in a recession without major new share issuance and related dilution for exiting ownership interests.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment