Explora_2005/iStock via Getty Images

Man is a creature who gets used to everything, and that, I think, is the best definition of him. ― Dostoevsky Fedor

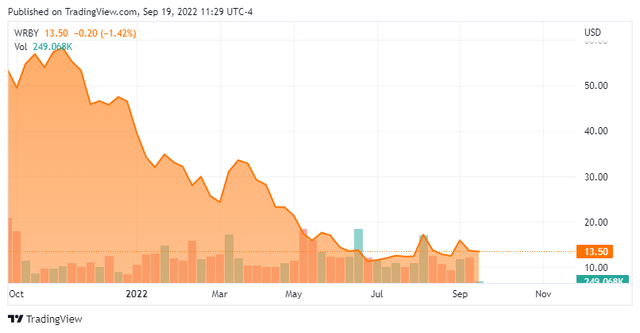

Today, we take our first look at luxury eyeglass retailer Warby Parker Inc. (NYSE:WRBY). The market has not been kind to the stock since it debuted on the market last summer. We examine the reasons for the beat down and whether the stock is now oversold via the analysis below.

Company Overview

May Company Presentation

Warby Parker Inc. is based in New York City. The company offers eyeglasses, sunglasses, light-responsive lenses, and contact lenses, as well as accessories such as cases and lenses kits through 178 retail stores as of the end of the second quarter. Warby Parker also provides eye exams and vision tests directly to consumers through its retail stores, website, and mobile apps. The company came public late in the summer of 2021 via a direct listing. The stock currently trades at around $13.50 a share and sports an approximate market cap of $1.5 billion.

May Company Presentation

Second Quarter Results

On August 11th, the company posted second quarter numbers. For the quarter, Warby Parker had a non-GAAP loss of penny a share. Revenues rose 13.7% from the same period a year ago to nearly $150 million. Both top and bottom line numbers were roughly in line with the existing consensus. Average revenue per customer increased 8.2% to $254 from 2Q2021 as active customers rose 8.7% to 2.26 million. All in all, a decent quarter given the slowing economy in 2022.

May Company Presentation

However, the stock got hit hard as management significantly lowered forward guidance to $584 million to $595 million in sales for FY2022. This is a far cry from projections leadership was making at the end of the first quarter of this year (above).

Analyst Commentary & Balance Sheet

Analyst opinion on Warby Parker has been mixed since second quarter results were posted. Both Robert W. Baird and Telsey Advisory reissued Buy ratings with identical $25 price targets. Meanwhile, Evercore ISI ($16 price target, down from $17 previously) and Stifel Nicolaus maintained Hold ratings on the stock.

A couple of beneficial owners made huge purchases in January and February totaling tens of millions of the dollars in the high $20s all the way up to the low $40s. The timing of those purchases have been atrocious in hind sight to this point. Officers of the company have sold just over $1.5 million worth of equity in aggregate since March of this year. Nearly 30% of the outstanding float is current held short as well. The company ended the second quarter of this year with just over $210 million of cash and marketable securities on its balance sheet after posting a net loss of $32.2 million during the quarter.

Verdict

The current analyst firm consensus has the company posting a small loss of 3 cents a share in FY2022 on a nice percent rise in sales to $590 million. In FY2023, the company is projected to post a profit of 13 cents a share as revenue growth returns to the high teens.

The company has grown from 145 stores when it came public to 178 as of the end of the second quarters. Revenues continue to growth but not nearly to the extent at the beginning of 2022, and the company continues to post losses thanks to a tough macroeconomic environment.

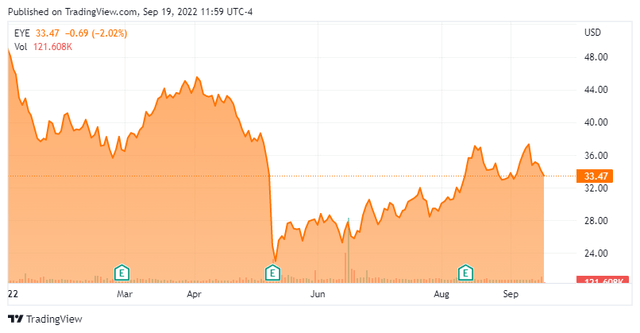

The company is hardly alone facing these headwinds in this segment. Competitor National Vision Holdings (EYE) has its stock fall by nearly a third so far in 2022 as it has posted disappointing earnings this year which its management has said is due to weakening consumer confidence, constraints on testing, inflation and supply chain issues. The same challenges Warby Parker continues to face and also referenced in their second quarter earnings conference call.

Even with the large decline in the stock since Warby Parker came public nearly a year ago, the shares are hardly cheap. They go for over just over 2.5 times FY2022’s projected sales and 100 times next fiscal year’s projected earnings. It is easy to see why over one of out of every four shares is currently held short.

It is hard to see any reason to own the stock until the company shows more signs of a turnaround in its business fundamentals. Something that is unlikely to happen until the country reemerges from the current economic contraction.

Time becomes your enemy when you convince yourself it moves faster for you than anyone else. ― David F Burrows

Be the first to comment