jetcityimage/iStock Editorial via Getty Images

By Brian Nelson, CFA

It’s hard to go wrong investing in one of the strongest big box retailers out there. The bear case against Walmart Inc. (NYSE:WMT) has always been that it would eventually succumb to online retailers that offer identical products but with considerably more convenience (at-home delivery) and often at a lower price. However, Walmart has bucked the trend as a big-box retailer and has retained its dominance, as it has effectively navigated and adapted to ever-changing consumer preferences and the competitive environment.

A look at the company’s recently-reported first-quarter fiscal 2023 results revealed eCommerce growth of 38% on a two-year stack basis (i.e., adding eCommerce growth in the first quarter of fiscal 2023 to the eCommerce growth in the first quarter of fiscal 2022). That is not to say that Walmart is entirely immune to the supply chain issues, inflationary pressures, and general market malaise, but it does mean that Walmart’s business is a sustainable one and won’t go the way of the dodo bird like many of the department stores and other retailers, including Kmart.

One of the big reasons why we like Walmart is not only that the company runs an effective big box operation, but also that it holds fast-growing Sam’s Club in its portfolio. During the company’s first-quarter fiscal 2023 results, the company noted that Sam’s Club comp sales came in at an impressive 10.2% growth, while membership income advanced 10.5%. Many consumers when looking to save money during this inflationary environment may seek out Sam’s Club bulk inventory and lower unit product costs. We like the positioning and value proposition that Sam’s Club offers in current uncertain economic conditions.

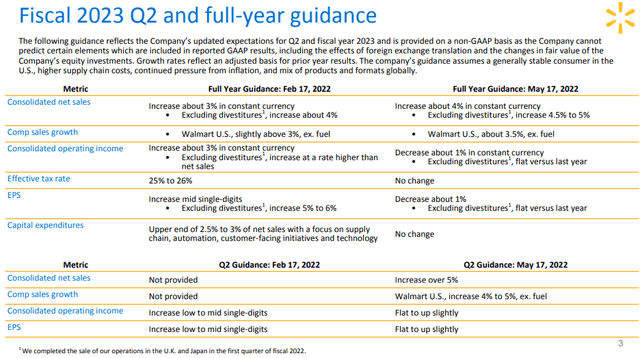

That said, the company’s first-quarter 2023 results weren’t as strong as we would have liked, as supply chain issues and product mix took their toll. The company also guided its consolidated operating income lower (as shown in the image that immediately follows). President and CEO of Walmart Doug McMillon had the following to say in the first-quarter 2023 press release:

“Bottom line results were unexpected and reflect the unusual environment. U.S. inflation levels, particularly in food and fuel, created more pressure on margin mix and operating costs than expected. We’re adjusting and will balance the needs of our customers for value with the need to deliver profit growth for our future.”

Image Source: Walmart. Walmart guided its consolidated operating income lower when it reported its first-quarter fiscal 2023 results. (Image Source: Walmart’s 1Q’23 Presentation)

Though operating profit performance during its first-quarter fiscal 2023 results left a lot to be desired, we value Walmart on the basis of mid-cycle growth margin expectations, not necessarily on what the company does one or two quarters out (or even one or two years out). At the moment, we value shares of Walmart at ~$137 each, modestly above where they are trading at the time of this writing (~$121 each). A dividend yield of ~1.9% is a nice token for long-term shareholders as they get paid to wait out the current “unusual environment,” as CEO Doug McMillon noted.

Walmart’s Investment Highlights

Walmart U.S. segment includes the company’s mass merchant concept in the U.S. The firm recently launched its Walmart+ membership program. Its Walmart International segment consists of the company’s operations outside of the U.S. We sometimes forget just how large Walmart truly is, as its international business alone hauls in ~$100 billion in annual net sales, more revenue than some of the largest companies out there. The Sam’s Club segment includes warehouse membership clubs and its namesake website. We’re huge fans of the Sam’s Club business model, as it remains one of the fastest growing retail formats.

Walmart is a great free cash flow (“FCF”) generator, though its performance during the first quarter of fiscal 2023 gave us pause in our enthusiasm in this area a bit (it burned through $7.3 billion in free cash flow in the quarter). Still, during fiscal 2021, the company generated more than $24 billion in operating cash flow and returned $15.9 billion to shareholders, both in the form of buybacks and dividends. In February 2021, Wal-Mart sold off a majority stake in the UK retailer Asda through a deal with an enterprise value of roughly £GBP6.8 billion. Walmart retained an economic interest in Asda. We like that Walmart continues to execute on a number of fronts, both organically and acquisitively.

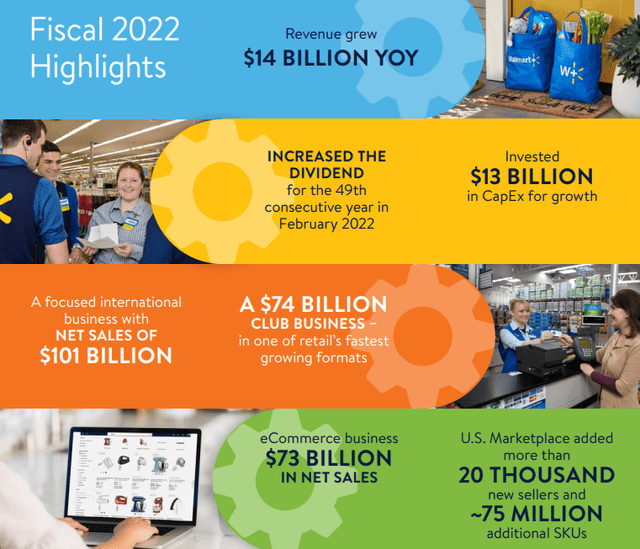

Walmart has increased its dividend over the past 45+ consecutive years, aided by the strength of its very well-known brand. Walmart thus makes the coveted Dividend Aristocrats list, and we doubt management will do anything to risk its multi-decade track record of annual payout hikes, regardless of the many challenges to its operating dynamics. The company’s ‘A-rated’ corporate credit rating (Aa2/AA/AA) and its ability to generate sizable free cash flows in almost any environment underpins why we view the firm’s large net debt load as manageable. Walmart’s eCommerce businesses continue to impress which supports its long-term growth outlook. Last fiscal year, Walmart hauled in more than $70 billion in net sales from its eCommerce operations.

Walmart had a great fiscal 2021, and we think the company is well-positioned for the current uncertain environment and may emerge as an even stronger entity. (Image Source: Walmart Annual Report.)

Headwinds from higher transportation and labor costs are likely to persist in the near term, though Walmart’s pricing power has impressed of late (though such increases haven’t been enough to keep operating profit moving in the right direction), and its eCommerce businesses continue to scale nicely. That said, we’re not taking the executive suite’s worries with respect to the ‘unusual environment’ lightly, though we do note that Walmart has endured through just about every market cycle and exogenous shock from inflation fears to the Great Financial Crisis to COVID-19 and beyond. We also like that Walmart is focused on remodeling its stores and supporting its digital initiatives as it works to keep its massive store base relevant and competitive.

In calendar year 2018, Walmart paid ~$16 billion for a 77% stake in Flipkart, an innovative e-commerce firm in India. Two years later, Walmart sold Walmart India to Flipkart, which enabled Flipkart to launch the Flipkart Wholesale digital marketplace. Walmart’s operations in India have a long growth runway, and this is but one area that the company can invest to grow. We like the long-term growth picture at Walmart, even as we say it is already a retail behemoth. Other areas of growth include riding Sam’s Club’s tremendous comp performance, or even potentially unlocking value by spinning it off as a comp to Costco Wholesale (COST).

During the past few years, Walmart invested heavily in its domestic omni-channel sales capabilities. The firm is focused on automation and robotics investments at its distribution centers to boost its productivity and improve the economics of its digital sales over time. We expect these investments to pay dividends down the road, though we can’t ignore the weakness that was prevalent with respect to profitability in the company’s most recently reported quarter.

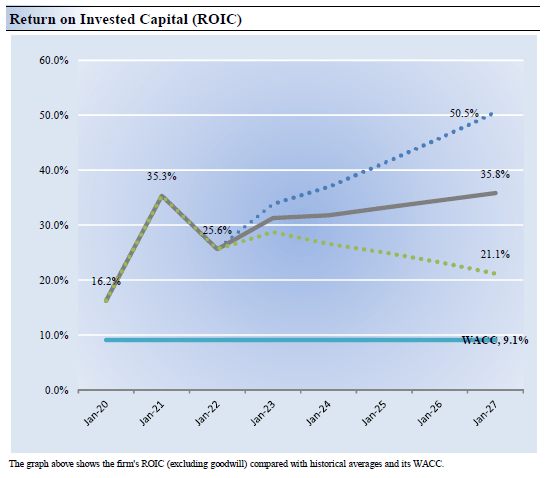

Walmart’s Economic Profit Analysis

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Walmart’s 3-year historical return on invested capital (without goodwill) is 25.7%, which is above the estimate of its cost of capital of 9.1%.

As such, we assign Walmart a ValueCreation™ rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. We expect Walmart to continue to generate value for shareholders, despite some near term challenges.

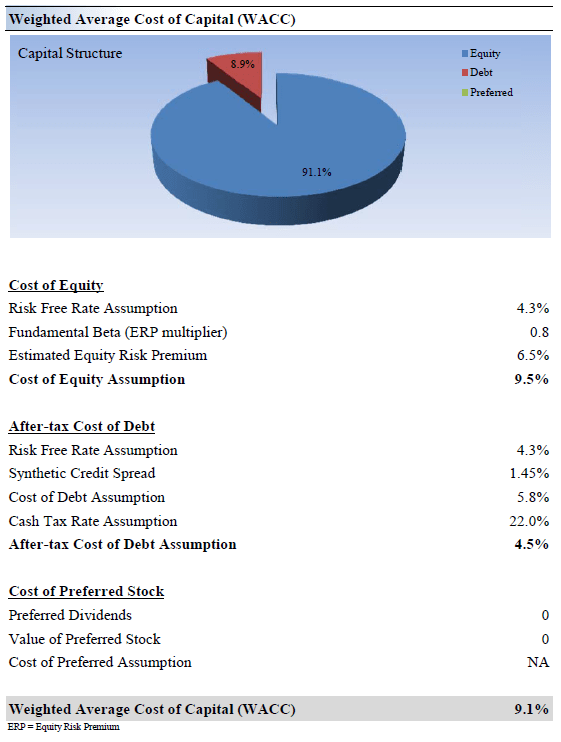

Image source: Valuentum. Our expectations for the path of Walmart’s economic profit stream in the coming years. (Image source: Valuentum) Image source: Valuentum. How we calculate Walmart’s weighted average cost of capital. (Image source: Valuentum)

Walmart’s Cash Flow and Valuation Analysis

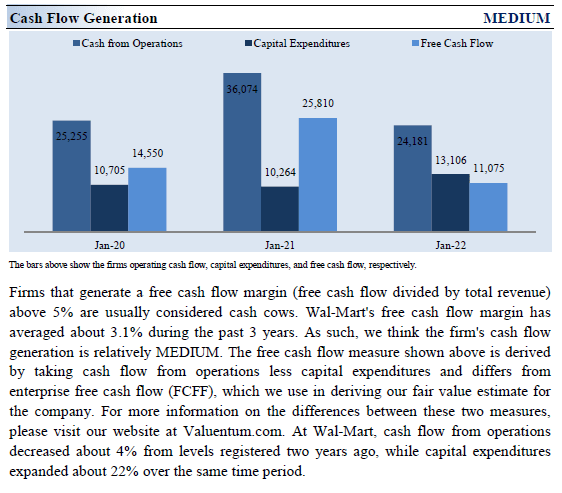

Image source: Valuentum. Walmart’s free cash flow generating capacity has been robust the past three fiscal years. We expect the strength to continue, though not without challenges in the near term. (Image source: Valuentum)

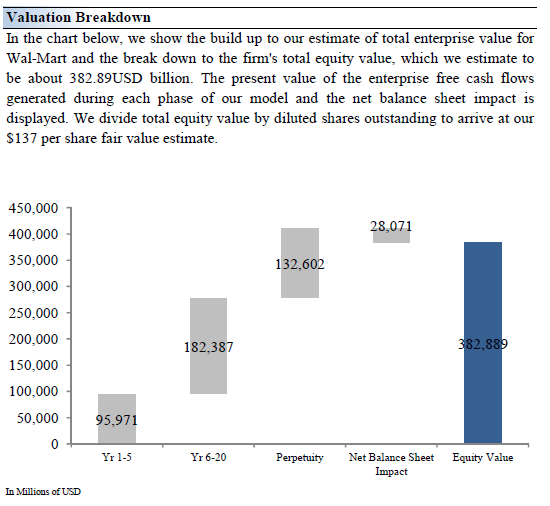

On a discounted cash flow basis, we think Wal-Mart is worth $137 per share with a fair value range of $110-$164.00. The margin of safety around our fair value estimate is driven by Walmart’s LOW ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them. Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance.

Our valuation model reflects a compound annual revenue growth rate of 3.2% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 3.6%. Our valuation model reflects a 5-year projected average operating margin of 4.9%, which is above Walmart’s trailing 3-year average.

Beyond year 5, we assume free cash flow will grow at an annual rate of 2.8% for the next 15 years and 3% in perpetuity. For Walmart, we use a 9.1% weighted average cost of capital to discount future free cash flows. In the image immediately that follows, we show the duration of Walmart’s value composition, emphasizing that the majority of the firm’s value is derived beyond year 5.

Image source: Valuentum. The duration of Walmart’s value composition. Most of its value is generated beyond year 5. (Image source: Valuentum)

Walmart’s Margin of Safety Analysis

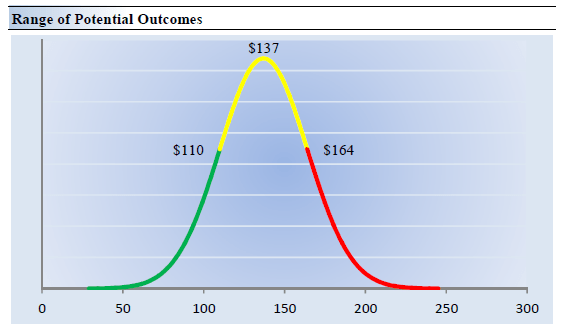

Image source: Valuentum. We embrace the concept that value is a range of potential outcomes. The most likely fair value estimate for Walmart rests on the highest point of the fair value distribution. (Image source: Valuentum.)

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Walmart’s fair value at about $137 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example).

After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values. Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Walmart.

We think the firm is attractive below $110 per share (the green line), but quite expensive above $164 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion. We view valuation as a range of probable fair value estimates.

Concluding Thoughts

Walmart’s robust Dividend Cushion ratio of 3 (more information on how we calculate it here) highlights the strength of its future expected cash flow generation, but the retail giant’s dividend payments and capital spending obligations are no small burden and should not be taken lightly.

Its large net debt load is also something that we cannot ignore, nor can we dismiss headwinds arising from increasing transportation and labor costs. Walmart operates in an incredibly competitive environment and the ongoing proliferation of eCommerce highlights the importance of digital investments.

Even if the equity markets falter and credit markets tighten, however, Walmart’s operating cash flow generation is quite robust, mitigating most problems it may have in growing or sustaining the payout. We think the company can handle this “unusual environment” quite well, and investors get paid a hefty ~1.9% dividend yield to wait.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment