Deagreez

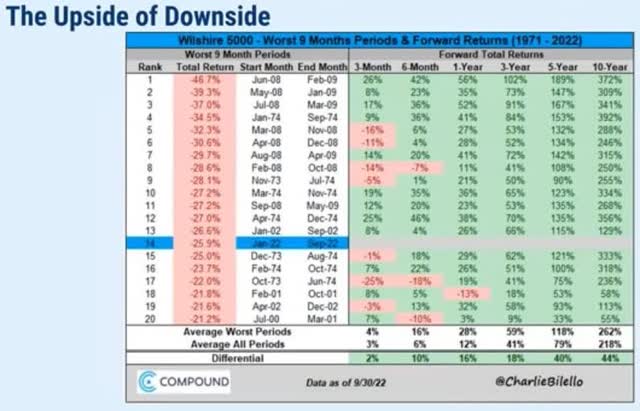

I love bear markets, though I never root for recessions. Why? Simple.

Fortunes are made in bear markets. – Value investor Todd Sullivan

During bear markets volatility is at its height and the market is 2X as likely to post its single best days, the ones that drive 99.84% of the market’s long-term returns.

Volatility isn’t risk, it’s the source of future returns. – Joshua Brown, CEO of Ritholtz Wealth Management

After bear markets like this one, stock returns for the next decade are significantly higher. How much higher? 3.7% per year on average, over the next decade.

That means an average 10 year return of 262%, or 13.7% CAGR. That’s compared to the market’s historical 10% annual return.

But you don’t have to wait 10 years to benefit from bear markets like this one.

I love safe high-yield, as do most of my followers. And guess what bear markets can bring?

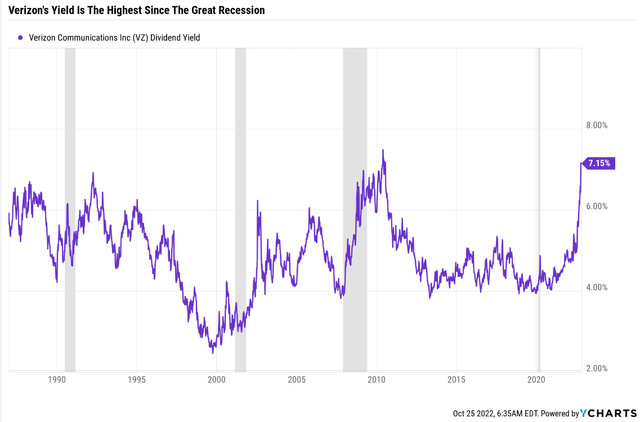

Verizon (NYSE:VZ) was already undervalued going into this bear market and is now trading at a very safe 7.2% yield. That’s literally higher than at any time in Verizon’s history other than the depths of the Great Recession.

- the economy is doing much better than it was back then

So let me walk you through why the market hates Verizon right now, and why the market is dead wrong to be so pessimistic about this ultra-yield telecom.

I’ll also show you why the same is true of Highwoods Properties (HIW), and Enterprise Products Partners (EPD), two even higher-yielding blue-chip bargains that deserve to be on your radar.

Why The Market Hates Verizon Right Now

Here is Morningstar putting it best.

The Market Continues to Overreact to the New Normal for Verizon; Shares Undervalued…

We continue to believe the market is overly focused on Verizon’s struggle to add postpaid consumer wireless customers in recent quarters. The firm is the share leader in this category, which creates a headwind in an environment where the carriers’ networks look increasingly alike and rivals are marketing with a similar level of aggression. This dynamic is especially challenging following a price increase, as Verizon instituted earlier this year, but taking up pricing is important for the long-term health of the firm and the industry. We are maintaining our $59 fair value estimate and now believe the shares are highly attractive. – Morningstar

I agree with Morningstar that Verizon is historically worth about $60 and thus 40% undervalued. How on earth can a Super SWAN (sleep well at night) blue-chip become 40% undervalued?

Largely because of short-term growth concerns.

Verizon added only 8,000 net postpaid phone customers during the quarter, with the loss of 189,000 net consumer customers largely offsetting a gain among business accounts. The firm has lost nearly 300,000 net consumers year to date, or about 1% of its customer base. – Morningstar

Verizon is the industry leader in US wireless and thus has a tougher time growing than peers like T-Mobile (TMUS).

Wall Street is worried that Verizon might not be able to grow its core business, and its broadband business could be cannibalized by TMUS’s 5G wireless offering, or SpaceX’s upcoming Starlink offering. Amazon is also planning on launching space-based wireless internet.

Verizon going up against Amazon and SpaceX, run by the mad genius Elon Musk? Scary headlines, but here’s why those fears are overblown.

Why Wall Street Is Dead Wrong About Verizon

T-Mobile’s big push into 5G internet is slowing down, as that rival learns that the economics aren’t as favorable as it once thought. And while both SpaceX and Amazon are planning on space-based wireless internet offerings, the chances of that being a major medium-term threat are lower than 5G internet.

- if it costs a lot to set up 5G internet, imagine the costs of doing it from space

The price increase caused a bigger spike in customer defections at Verizon than at AT&T. Monthly postpaid phone customer churn hit 0.92% versus a pre-pandemic norm of about 0.8% during third quarters. – Morningstar

Yes, churn increased a tad in recent quarters, but remains at under 1% per month.

- the average customer stays with VZ for almost 9 years

As with AT&T, which reported earlier, price increases provided a big lift to revenue. Consumer revenue per postpaid account increased 3% from the prior quarter, the first meaningful improvement in several quarters. Wireless revenue per business account also increased sequentially for the first time in nearly two years…

Verizon added 2.6 million gross postpaid phone customers, besting AT&T for the first time in 2022 on this metric. – Morningstar

Verizon’s most profitable customers, post-paid wireless subs, are still growing. And while that growth isn’t fast, it’s expected to continue through 2027.

VZ is expected to see slow but steady net subscriber growth to 151 million by 2027.

Its average revenue per account, ARPA, is expected to rise slowly but steadily and hit $162 by 2026, up from $148 in 2022.

- 2022 consensus sales: $136.5 billion

- 2027 consensus sales: $148.7 billion

- annual revenue growth: 1.7%

No Verizon isn’t a fast-growing company, it’s a telecom giant in a mature market.

But it is also a cash cow.

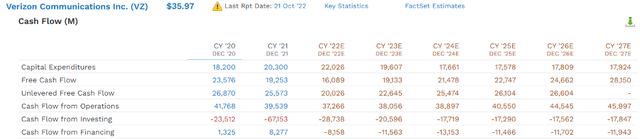

While revenue is only expected to grow 8% by 2027, free cash flow is expected to grow 75%, to $28.2 billion.

- 2027 dividend cost consensus: $12 billion

- 43% FCF payout ratio vs. 70% safe according to rating agencies

- $16.2 billion in annual retained free cash flow by 2027

What about the short-term? Is the dividend unsafe? Thanks to a spike in growth capex tied to 5G, this year’s payout ratio is 72%, far from unsafe.

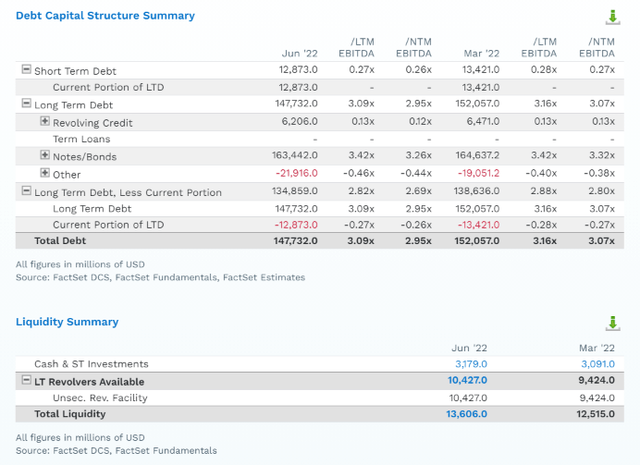

What about the balance sheet? Is Verizon drowning in debt going into a recession?

VZ’s $148 billion in debt sounds scary, except that its debt/EBITDA ratio is just 3.1 and expected to fall to 2.95X next year.

- credit rating agencies consider 3.5X or less net debt/EBITDA safe for this industry

Verizon Credit Ratings

| Rating Agency | Credit Rating | 30-Year Default/Bankruptcy Risk | Chance of Losing 100% Of Your Investment 1 In |

| S&P | BBB+ Stable Outlook | 5% | 20.0 |

| Fitch | A- Stable Outlook | 2.50% | 40.0 |

| Moody’s | Baa1 (BBB+ equivalent) Stable Outlook | 5% | 20.0 |

| Consensus | BBB+ Stable Outlook | 4.17% | 24.0 |

(Sources: S&P, Fitch, Moody’s)

VZ has $13.6 billion in liquidity available and a 4.2% long-term bankruptcy risk.

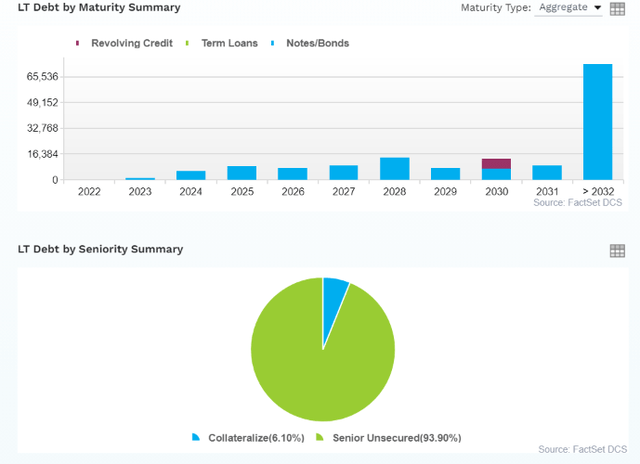

VZ has no significant debt maturing during the 2023 recession (90% probability according to the bond market). 94% of its debt is unsecured fixed-rate, giving it strong financial flexibility.

VZ locked in borrowing costs during the zero rate period, including 40 year bonds that mature in 2061 at a rate of 3.7%.

- 1.4% adjusted for inflation

The bond market, the smart money on Wall Street, is still willing to lend to it for 38 years at 6.3%, a reasonable interest rate given its 9.1% return on capital.

- VZ’s average borrowing cost is 2.14%

- -0.2% adjusted for long-term inflation

FactSet Research Terminal

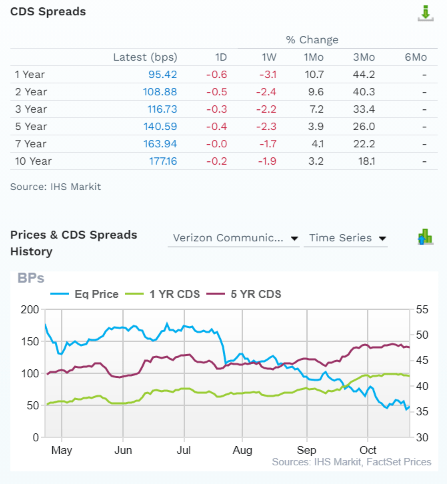

Credit default swaps are insurance policies bond investors take out against default, and provide a real-time fundamental risk-update.

VZ’s short-term bankruptcy risk has risen 44% in the last 3 months, but today stands at 0.9542% for the next year.

It’s 30-year default risk? 5.31%, consistent with its BBB+ stable credit rating.

When a stock price collapses but fundamental risk remains stable? That means you can buy with confidence.

Verizon is not a dying company, just a very slow growing one.

Slow But Steady Growth Makes For A Boring But Attractive Ultra-Yielding Blue-Chip Investment

The median long-term growth consensus from all 29 analysts is for 0.9% CAGR long-term growth. That might sound terrible, but remember that VZ is now yielding 7.2%.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| Verizon | 7.2% | 0.9% | 8.1% | 5.7% | 3.4% | 21.2 | 1.40 |

| Safe Midstream | 6.1% | 6.4% | 12.5% | 8.8% | 6.5% | 11.1 | 1.87 |

| 10-Year US Treasury | 4.2% | 0.0% | 4.2% | 2.9% | 0.7% | 107.5 | 1.07 |

| REITs | 3.9% | 6.1% | 10.0% | 7.0% | 4.7% | 15.2 | 1.59 |

| Schwab US Dividend Equity ETF | 3.8% | 8.5% | 12.3% | 8.6% | 6.3% | 11.4 | 1.84 |

| Dividend Aristocrats | 2.8% | 8.7% | 11.5% | 8.1% | 5.8% | 12.5 | 1.75 |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% | 4.9% | 14.6 | 1.62 |

| Nasdaq | 0.8% | 11.5% | 12.3% | 8.6% | 6.3% | 11.4 | 1.85 |

(Sources: DK Research Terminal, FactSet, Morningstar, Ycharts)

No Verizon isn’t going to make you rich, and likely won’t beat the S&P or aristocrats or SCHD over the long-term.

But for defensive ultra-low volatility blue-chips like this? I consider an 8% long-term return acceptable, as part of a diversified portfolio.

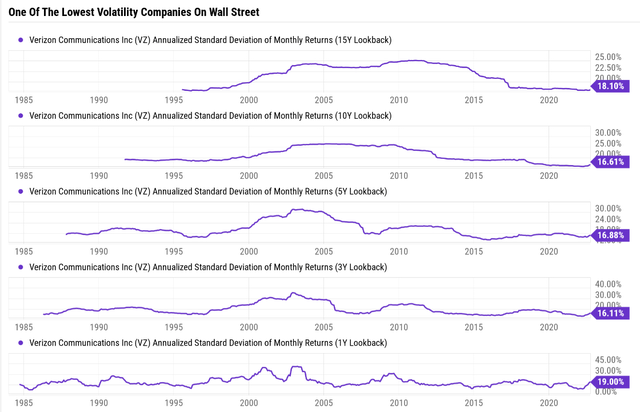

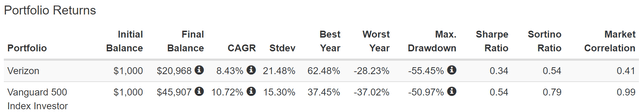

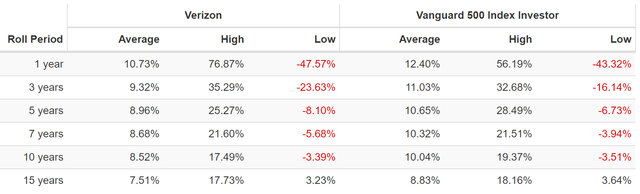

Verizon’s historical volatility is 16% to 18% per year, compared to 28% for the average standalone company and 25% for the dividend aristocrats.

Verizon Total Returns Since 1985

Verizon has been delivering about 8% annual returns for 37 years, and that’s still what analyst expect today.

But from bear market lows VZ is capable of as much as 18% annual returns for 15 years.

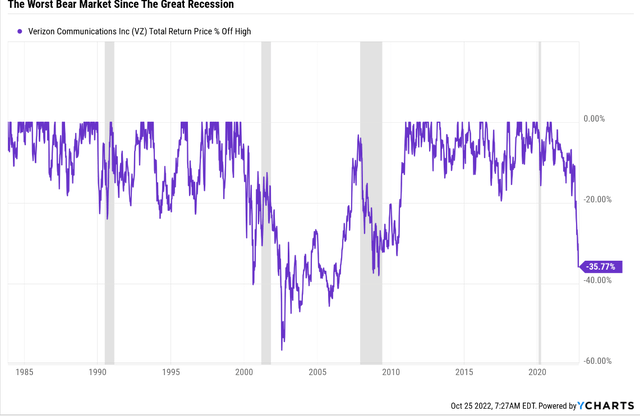

Guess what Verizon is in now?

Verizon has fallen off a cliff for no good reason, and that’s what makes it a very attractive ultra-yield blue-chip long-term opportunity.

Verizon Is An Ultra-Value Buy

| Metric | Historical Fair Value Multiples (9-Years) | 2021 | 2022 | 2023 | 2024 | 2025 |

12-Month Forward Fair Value |

| 5-Year Average Yield | 4.44% | $57.21 | $57.66 | $57.66 | $60.59 | $62.61 | |

| 13-Year Median Yield | 4.44% | $57.21 | $57.66 | $57.66 | $60.59 | $62.61 | |

| 25-year Average Yield | 4.39% | $57.86 | $58.31 | $58.31 | $61.28 | $63.33 | |

| Earnings | 12.41 | $66.89 | $62.79 | $62.79 | $70.67 | $68.50 | |

| Average | $59.53 | $59.03 | $59.03 | $63.01 | $64.17 | $59.03 | |

| Current Price | $35.97 | ||||||

|

Discount To Fair Value |

39.58% | 39.07% | 39.07% | 42.91% | 43.95% | 39.07% | |

| Upside To Fair Value | 65.50% | 64.11% | 64.11% | 75.18% | 78.41% | 71.37% | |

| 2022 EPS | 2023 EPS | 2022 Weighted EPS | 2023 Weighted EPS | 12-Month Forward EPS | 12-Month Average Fair Value Forward PE | Current Forward PE |

Cash-Adjusted PE |

| $5.06 | $5.06 | $0.78 | $4.28 | $5.06 | 11.7 | 7.1 | 6.6 |

Verizon is historically worth about 11.7X earnings and today trades at 7.1X.

According to the Graham/Dodd fair value formula VZ is priced for -2.8% CAGR growth… forever.

0.9% growth is faster than -2.8%.

In fact, Verizon is an anti-bubble blue-chip that as long as it grows faster than zero literally can’t lose you money over the long-term.

- unless you become a forced seller for emotional or financial reasons.

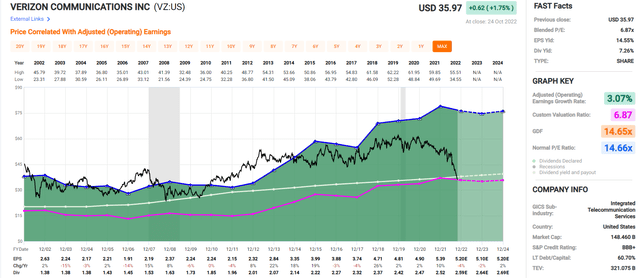

The Lowest PE In At Least 25 Years (Possibly Ever)

Verizon hasn’t had a PE this low in the Pandemic, or Great Recession, or Tech crash.

In fact, based on its yield and current PE, it’s possibly the lowest valuation in the company’s history.

What does that potentially mean for medium-term return potential?

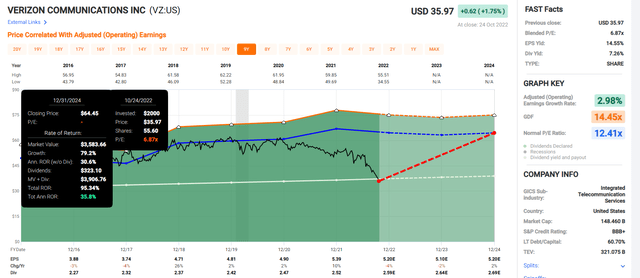

Verizon 2024 Consensus Total Return

Even with no growth through 2024, Verizon from the lowest PE in history could double within two years and deliver Buffett-like 36% annual returns.

- 2.5X more than the S&P 500

Verizon 2027 Consensus Total Return

If VZ grows as analysts expect through 2027 and returns to historical fair value, it could deliver 153% total returns or a Buffett-like 20% per year.

- about 3X more than the S&P 500

That’s the power of anti-bubble, deep value ultra-yield investing in a bear market.

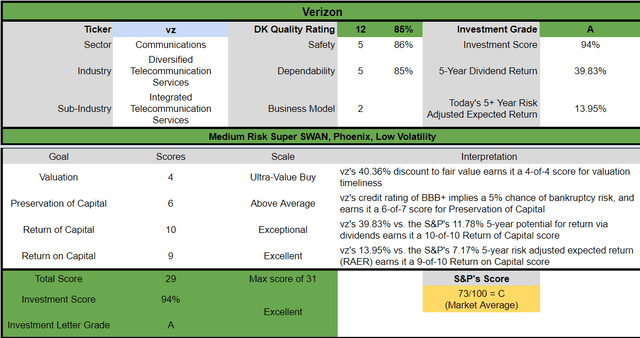

Verizon Corp Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

Verizon is a potentially excellent ultra-yield deep value dividend opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 40% discount to fair value vs. 4% S&P = 36% better valuation

- 7.2% safe yield vs. 1.8% S&P (almost 4X higher)

- about 2X higher risk-adjusted expected returns

- 4X the consensus 5-year income

But just like the market is dead wrong about Verizon, it’s dead wrong about two ultra-yield alternatives I like even more.

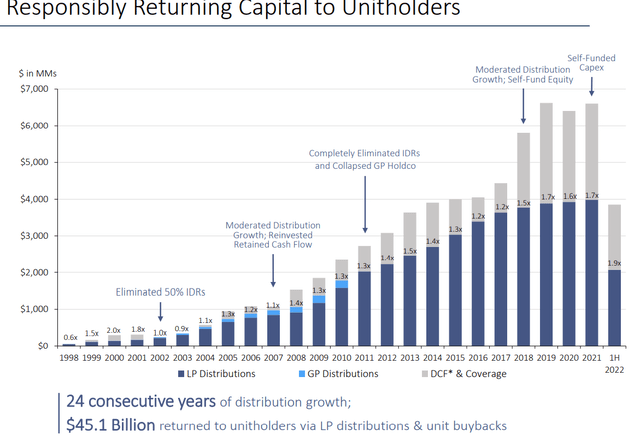

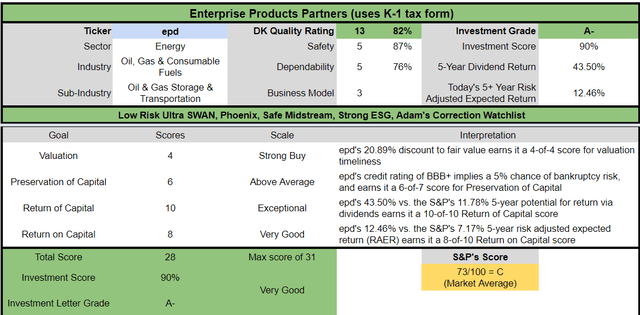

Enterprise Products Partners: The Quality King Of MLPs

Further Reading

- 7.2% Yielding Enterprise Products Is A Perfect Retirement Blue-Chip For Turbulent Times

- Full deep dive on EPD’s growth prospects, investment thesis, and risk profile

- EPD uses A K1 tax form

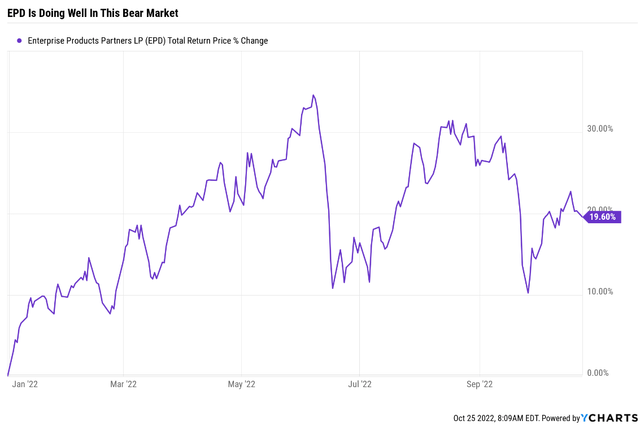

EPD isn’t suffering this year, it’s actually up 20%.

But it has recently crashed 20% due to the market’s worries about a recession hurting energy prices.

- -7% cash flow growth is expected during the recession

(Source: Investor presentation)

EPD is on track to become the 2nd dividend champion in midstream next year, a testament to its brilliant and conservative management.

- many analysts consider it the best management team in the business

A Fully FCF Self-Funding Business Model: The Platinum Standard Of Midstream Safety

| Year | Distributable Cash Flow | Free Cash Flow | Distributions | DCF Payout Ratio | FCF Payout Ratio |

| 2022 | $7,424.0 | $5,817.93 | $4,140.10 | 55.8% | 71.2% |

| 2023 | $7,176.0 | $5,752.56 | $4,314.42 | 60.1% | 75.0% |

| 2024 | $7,323.0 | $6,515.21 | $4,488.74 | 61.3% | 68.9% |

| 2025 | $7,632.0 | $6,493.42 | $4,532.32 | 59.4% | 69.8% |

| 2026 | $8,238.0 | $7,168.91 | $4,706.64 | 57.1% | 65.7% |

| 2027 | $8,733.0 | $6,863.85 | $4,837.38 | 55.4% | 70.5% |

| Annual Growth | 3.30% | 3.36% | 3.16% | -0.13% | -0.19% |

(Source: FactSet Research Terminal)

EPD isn’t just equity self-funding; it’s fully FCF self-funding.

- distributions are covered by free cash flow

- with plenty of cash left over to invest in growth, de-leveraging or buybacks

EPD’s 7.7% yield is richer than VZ’s and even safer, with a payout ratio of under 60%, and over $1 billion in free cash flow left over after paying distributions.

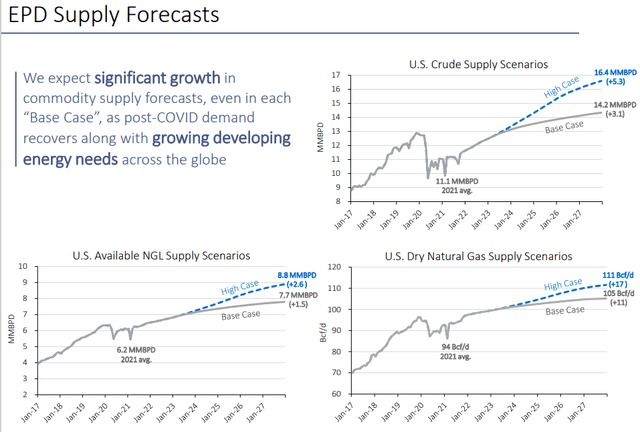

(Source: EPD investor presentation)

EPD is the largest oil exporter in the US and guess who is going to need to import a lot more oil and LNG from America to replace Russian energy? Europe, which has already said that even if the war ended tomorrow, will never again buy energy from Russia.

EPD has numerous growth opportunities in NGLs, LNG, and oil exports to drive its 4.4% CAGR long-term growth consensus, potentially for decades to come.

- 4.5X faster growth rate than VZ

Reasons To Potentially Buy Enterprise Products Today

| Metric | Enterprise Products Partners |

| Quality | 82% 13/13 Quality Ultra SWAN (Sleep Well At Night) Midstream MLP |

| Risk Rating | Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 225 |

| Quality Percentile | 56% |

| Dividend Growth Streak (Years) | 24 |

| Dividend Yield | 7.7% |

| Dividend Safety Score | 87% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.65% |

| S&P Credit Rating | BBB+ Stable |

| 30-Year Bankruptcy Risk | 5.00% |

| LT S&P Risk-Management Global Percentile | 70% Good, Low Risk |

| Fair Value | $31.41 |

| Current Price | $24.85 |

| Discount To Fair Value | 21% |

| DK Rating |

Potentially Strong Buy |

| P/Cash Flow | 6.7 |

| Net Debt-Adjusted P/Cash Flow | 9.2 |

| Growth Priced In | 1.4% |

| Historical PE | 10 to 12 |

| LT Growth Consensus/Management Guidance | 4.4% |

| PEG Ratio | 209.09 |

| 5-year consensus total return potential |

15% to 21% CAGR |

| Base Case 5-year consensus return potential |

16% CAGR (2X the S&P 500) |

| Consensus 12-month total return forecast | 35% |

| Fundamentally Justified 12-Month Return Potential | 34% |

| LT Consensus Total Return Potential | 12.1% |

| Inflation-Adjusted Consensus LT Return Potential | 9.8% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.55 |

| LT Risk-Adjusted Expected Return | 8.05% |

| LT Risk-And Inflation-Adjusted Return Potential | 5.76% |

| Conservative Years To Double | 12.51 |

(Source: Dividend Kings Zen Research Terminal)

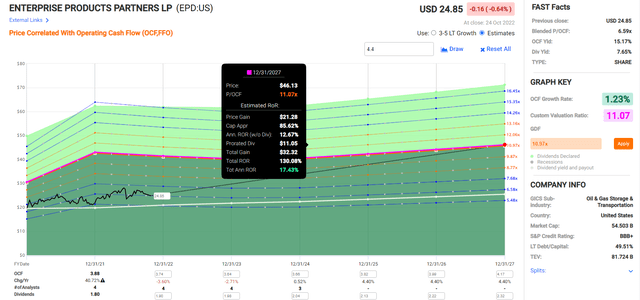

EPD is trading at 6.7X cash flow, a 22% historical discount and analysts expect a 35% gain within 12 months.

- 34% total returns are justified by fundamentals

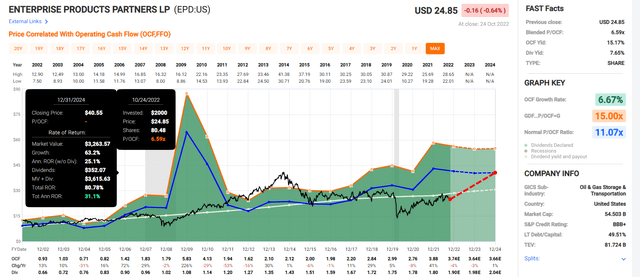

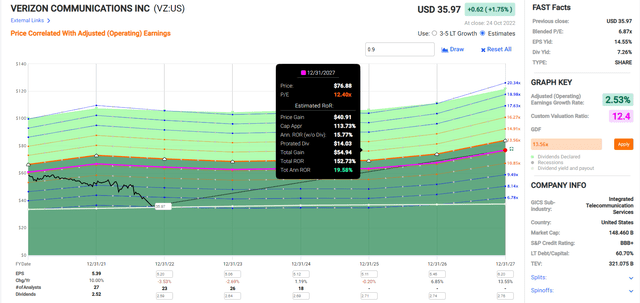

Enterprise 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Even with basically no growth through 2024, EPD is so undervalued it could deliver 80% total returns returning to historical fair value.

- Buffett-like 31% CAGR return potential from a blue-chip bargain hiding in plain sight

Enterprise 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

EPD growing as expected through 2027 and returning to historical market-determined mid-range fair value could deliver 130% total returns or 17% annually.

- 2X the S&P 500 consensus return potential

EPD Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

EPD is a potentially very good Ultra-yield Ultra SWAN dividend opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 21% discount to fair value vs. 4% S&P = 17% better valuation

- 7.7% safe yield vs. 1.8% S&P (almost 4X higher)

- 20% higher annual long-term return potential

- about 2X higher risk-adjusted expected returns

- 4X the consensus 5-year income

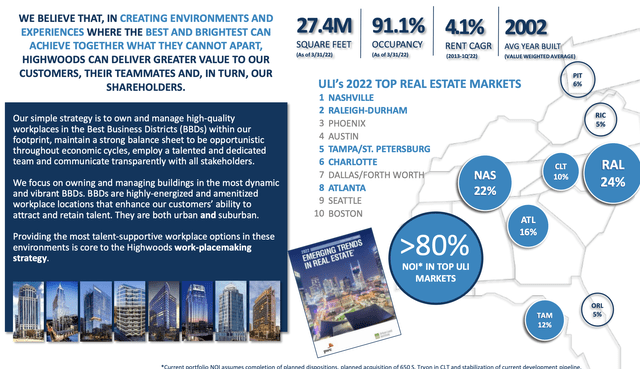

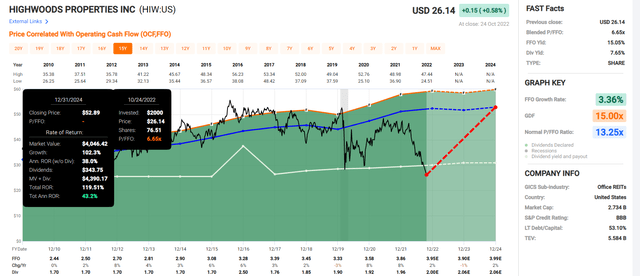

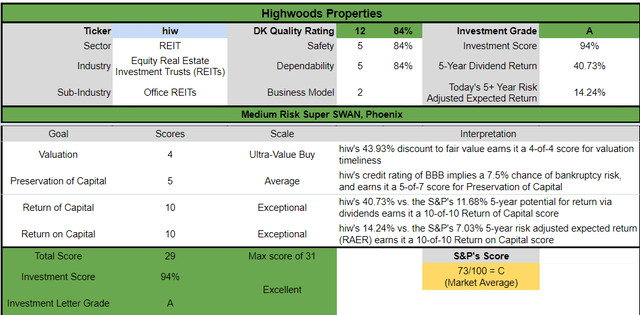

Highwoods Properties: One Of The Best Blue-Chip REITs You’ve Never Heard Of

Further Reading

- Highwoods Properties: Nothing Could Be Finer Than This REIT In Carolina

- Full analysis of HIW’s growth prospects, investment thesis, and risk profile

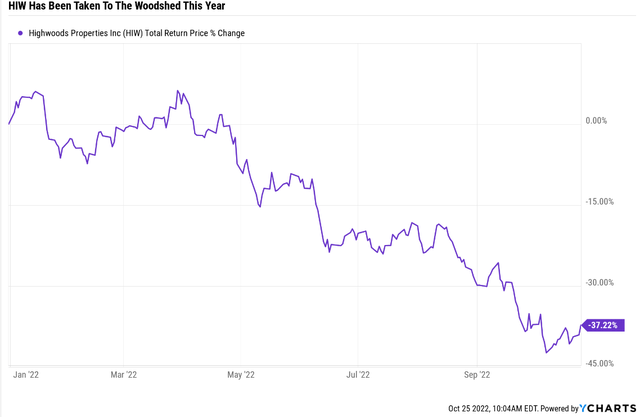

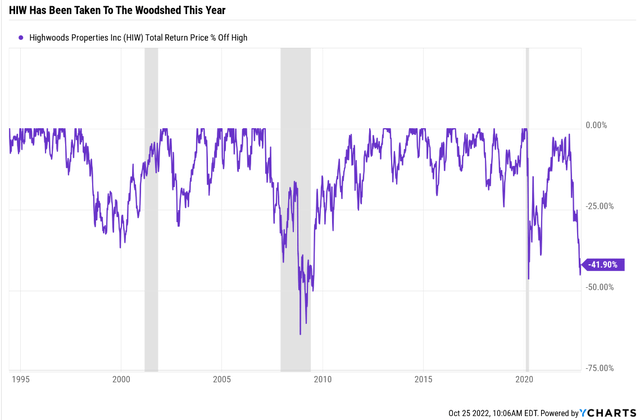

HIW has crashed impressively this year, and is in a severe bear market.

Commercial office REITs usually suffer in recessions, and that’s likely why the market is freaking out about HIW.

But here’s what the market is missing about this recession.

See how HIW actually went up in the tech crash recession? Why? Because it was so undervalued from when value crashed during the tech bubble, it was already pricing in that recession years in advance.

This time a recession might potentially help fill office space. How?

As Ritholtz CEO Joshua Brown explains, work from home became very popular in the Pandemic. And initially productivity was very high, because we were all stuck with nowhere to go and nothing to do.

But now the Pandemic has ended and the economy is reopened. Studies and economic reports are confirming that productivity is starting to suffer and businesses are eager for workers to return to their offices.

But in the tightest job market in 50 years, where there are 2 job openings for each job seeker? Employers have no bargaining power. If workers want to stay home then that’s what they’ll do.

But in a recession? Then those people so eager for flexible work schedules will be glad just to have a job and that’s why analysts are actually relatively bullish about HIW’s prospects in 2023.

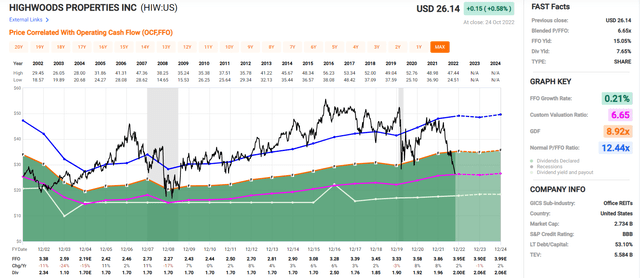

HIW: The Lowest Valuation in 20 Years

Yes FFO is expected to fall 1% in 2023, but that’s compared to a 17% decline in 2008.

In other words, while the experts that know this REIT best are expecting a very mild downturn, with a very safe 7.4% yield supported by a 78% AFFO payout ratio and BBB stable credit rating, the market is acting as if the world is ending.

(investor presentation)

In its core markets down south, HIW is thriving, not dying.

Now keep in mind that REITs are a slow growing sector, just 6.5%.

Commercial office REITs are slower growing, and HIW is growing at 3.1% CAGR.

But at its current 6.9 FFO multiple? HIW is priced for -3.2% CAGR growth, the mirror image of what analysts expect from it in the future.

As long as HIW grows faster than zero, great yield and solid returns are a 100% guarantee if you can avoid becoming a forced seller for emotional or financial reasons.

Reasons To Potentially Buy Highwoods Today

| Metric | Highwoods Properties |

| Quality | 84% 12/13 Quality Super SWAN (Sleep Well At Night) Commercial Office REIT |

| Risk Rating | Medium Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 200 |

| Quality Percentile | 60% |

| Dividend Growth Streak (Years) |

6 (No Cuts For 17 Years) |

| Dividend Yield | 7.4% |

| Dividend Safety Score | 84% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.85% |

| S&P Credit Rating | BBB Stable |

| 30-Year Bankruptcy Risk | 7.5% |

| LT S&P Risk-Management Global Percentile | 53% Average |

| Fair Value | $48.41 |

| Current Price | $27.00 |

| Discount To Fair Value | 44% |

| DK Rating |

Potential Ultra Value Buy |

| P/FFO | 6.9 |

| Growth Priced In | -3.2% |

| Historical P/FFO | 12.5 to 13.5 |

| LT Growth Consensus/Management Guidance | 3.1% |

| 5-year consensus total return potential |

20% to 23% CAGR |

| Base Case 5-year consensus return potential |

22% CAGR (4X the S&P 500) |

| Consensus 12-month total return forecast | 30% |

| Fundamentally Justified 12-Month Return Potential | 87% |

| LT Consensus Total Return Potential | 10.5% |

| Inflation-Adjusted Consensus LT Return Potential | 8.2% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.20 |

| LT Risk-Adjusted Expected Return | 6.80% |

| LT Risk-And Inflation-Adjusted Return Potential | 4.51% |

| Conservative Years To Double | 15.98 |

(Source: Dividend Kings Zen Research Terminal)

HIW was one of a handful of REITs (17) that didn’t cut its dividend during the Great Recession.

It didn’t cut during the Pandemic, and iREIT and Dividend Kings estimates its risk of cutting in the coming mild recession is approximately 1 in 200.

Highwoods Properties 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

HIW growing as expected and returning to fair value by the end of 2024 could result in 120% total returns, or 43% annually.

- about 3X more than the S&P 500

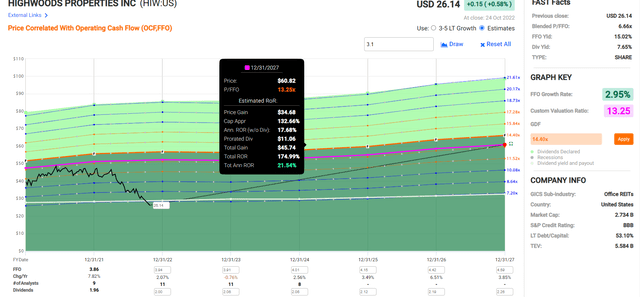

Highwoods Properties 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

HIW growing as expected and returning to historical fair value of 13.3X FFO could result in 175% total returns, or a Buffett-like 22% CAGR.

- 4X more total returns than the S&P 500 over the next five years

HIW Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

HIW is a potentially excellent ultra-yield dividend opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 44% discount to fair value vs. 4% S&P = 40% better valuation

- 7.4% very safe yield vs. 1.8% S&P (almost 4X higher)

- equal annual long-term return potential

- about 2X higher risk-adjusted expected returns

- almost 4X the consensus 5-year income

Bottom Line: Wall Street Is Dead Wrong About Verizon, Enterprise, And Highwoods Properties

Let me be clear: I’m NOT calling the bottom in VZ, EPD, or HIW (I’m not a market-timer).

Sleep Well At Night doesn’t mean “can’t fall hard in a bear market.”

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck

If your definition of investing success is instantly making money you don’t know how Wall Street works.

But if your time horizon is 3+ years? And your goal is to lock in safe or very safe 7% to 8% ultra-yield? Well, my friends that what makes bear markets your best friend.

- you can potentially earn 18% to 22% annual returns over the next five years with VZ, EPD, and HIW

- Buffett-like returns, from anti-bubble blue-chip bargains hiding in plain sight

There are no risk-free stocks, even AAA-rated companies have a 1 in 1,429 chance of going bankrupt within the next 30 years.

But if you know how to quantify and measure and track fundamental risk? That’s how you can take advantage of incredible market mistakes like Verizon, Enterprise, and Highwoods Properties.

That’s how you can buy some of the world’s best blue-chips at the lowest valuation in history.

That’s how you can earn market-beating 12% returns for decades to come.

That’s how you can maximize your chances of retiring in safety and splendor by harnessing the best blue-chip bargains of this bear market.

It’s my life’s mission and greatest joy to bring you such opportunities each week, and I plan to keep doing so for many years and decades to come.

Be the first to comment