portishead1

Timing

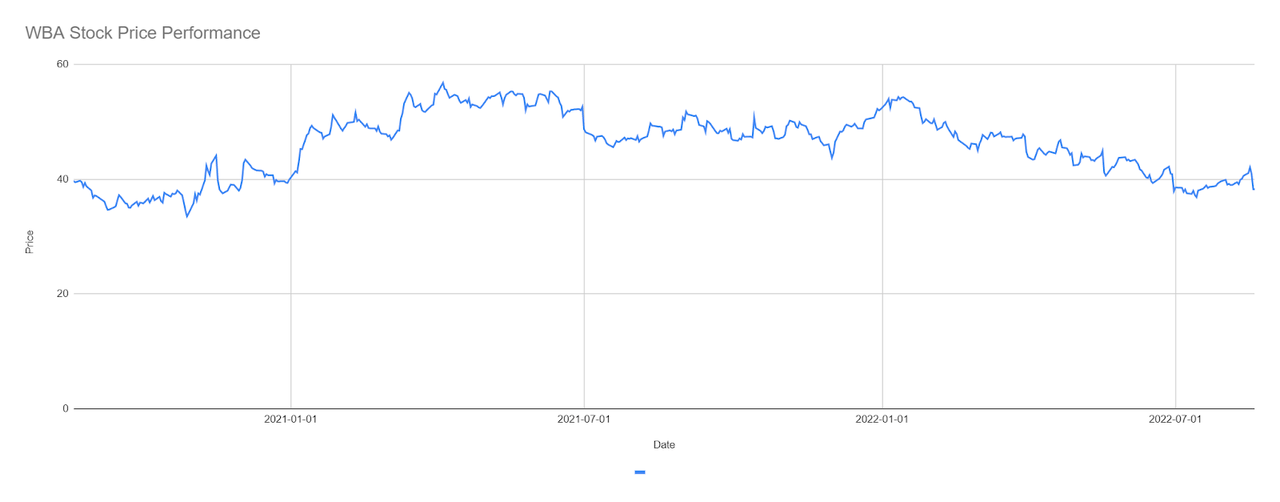

My timing could not have been worse when I wrote my last article discussing Walgreens Boots Alliance (NASDAQ:WBA). WBA’s Q3 FY ‘22 results announced on June 30 sent the stock into an all-too-familiar tailspin, just as I had argued for the firm as an undervalued, long-term buy. Moreover, I suggested, in that same article, that CVS (CVS) was overvalued and therefore its stock was due for a pullback. Instead, CVS’ stock soared following the release of their own Q2 FY ‘22 results earlier this month. While both stocks just took a beating due to (another) opioid-case ruling, my thesis in the prior article is playing out in reverse…at least for the moment.

Figure 1: WBA Stock Price Performance (Yves Sukhu) Figure 2: CVS Stock Price Performance (Yves Sukhu)

Notes:

-

Data in Figures 1 and 2 as of market close August 19, 2022.

Some readers took me to task. In my defense, I didn’t argue specifically that WBA was going to take-off following Q3 FY ‘22 results, nor that CVS would crater following their Q2 FY ‘22 earnings announcement. Rather, I proposed a “mean reversion” for both stocks, with WBA possibly advancing more quickly than a pending decline in CVS’ shares. Perhaps, I overestimated the pace of a recovery in WBA’s share price. Regardless, in this analysis, I want to table the discussion on CVS for a moment. Instead, I want to focus solely on WBA and the current bearish arguments against the stock.

From my point-of-view, the bearish position against WBA is summarized as:

1. The core (retail + pharmacy) business may be weakening.

2. Walgreens Health is an “unknown”. WBA attempted a similar strategy in the past only to see it fail. The segment presently operates at a loss and its success is far from guaranteed.

3. Sufficient capital to fuel Walgreens Health expansion may be unavailable with the core business under pressure, management’s failure to offload Boots UK, and the company’s present debt load.

In this analysis, I explore these bearish arguments against the firm under the lens of Q3 FY ‘22 results, offer a pathway to long-term growth based on a “proper” context of Q3 performance, and finally present some thoughts on where shares may be headed.

Setting Their Sights Lower

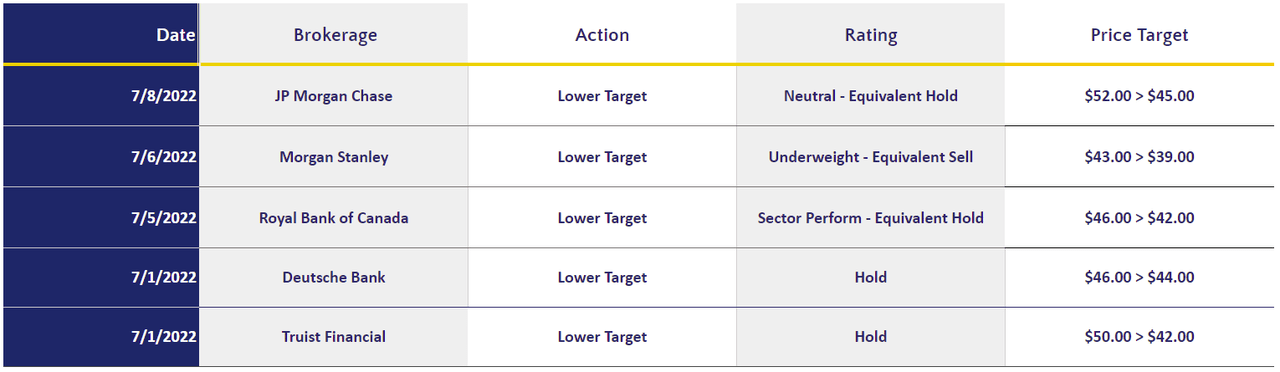

It is worth noting early on that a number of analysts turned increasingly bearish on WBA following Q3 FY ‘22 earnings, with several lowering their price targets for the firm.

Figure 3: WBA Analyst Ratings (MarketBeat)

Using the (limited) data from Figure 3, we can easily calculate that the average analyst target dipped from $47.40 to $42.40, or a decline of over (10%). The general reaction among analysts following the earnings announcement was unsurprising. Let us revisit WBA’s performance for Q3 FY ‘22, and use it as a lead-in to our main discussion.

Questioning the Core

Ok, let’s get the obvious out of the way. WBA’s Q3 FY ‘22 results weren’t that great. Among other things:

-

Sales from continuing operations of $32.6B decreased (2.8%) in constant currency. However, we should note that net sales came in slightly ahead of analysts’ average estimate of $32.2B.

-

The business incurred a GAAP operating loss of ($320M) versus GAAP operating income of $1.1B in the same prior year period. Non-GAAP operating income was $1.0B in the quarter, representing a decrease of (33.5%) versus the prior period on a constant currency basis.

-

GAAP EPS from continuing operations decreased (73.8%) to $0.33 versus the prior period. GAAP EPS was substantially below the estimate of $0.66. Bear in mind, however, that GAAP EPS includes WBA’s legal expenses associated with its opioid-case settlement with the State of Florida. Adjusted EPS of $0.96 declined (28.9%) versus the prior quarter in constant currency, but managed to beat the estimate of $0.92.

-

US segment (retail + pharmacy) gross margin declined (60) basis points to 20.8% versus 21.4% in the prior period.

-

US pharmacy comparable scripts sales declined (1.8%) versus the prior period, and total US pharmacy sales decreased (9.7%).

-

After pushing for the sale of Boots UK to free up capital for expansion of Walgreens Health and other strategic initiatives, management’s review of the business concluded with a decision to retain the business.

On the surface, these results would likely lead an investor to question the health of the core business. For example, management noted that comparable scripts sales actually grew 2.1% in the US during the quarter excluding immunizations. But, we also note that comparable scripts growth, a key profit driver, has been trending lower, with 6.2% and 4.7% growth in Q1 FY ‘22 and Q2 FY ‘22 respectively. Now, considering the “whole” of the segment, if sales and margins are declining in the United States – the firm’s largest operating segment which has generated nearly 97% of adjusted operating income YTD – these conditions obviously act to limit the amount of capital that management can divert to its “poster-child” growth engine, Walgreens Health. And, of course, WBA’s decision to retain – or failure to offload – Boots UK does not help matters since the anticipated capital from such a sale is unavailable. And, almost without question, investors would look unfavorably upon a decision by management to add to their existing $33.4B debt load to help finance their healthcare ambitions. As such, it is easy to draw the quick conclusion, if only from Q3 FY ‘22 results, that WBA’s core business is not headed in the right direction, imperiling management’s ability to grow Walgreens Health at a sufficient rate to establish a competitive presence and to offset future declines in the core.

In Context

On the surface, the picture looks somewhat bleak and Q3 FY ‘22 results seem to reflect the general perspective of Raymond James analyst John Ransom, who I noted in another article on WBA as saying:

[The] problem is I can name five things wrong with the core business and not much right.

However, as we parse WBA’s performance, perhaps we might keep a few things in mind:

1. WBA, like everyone else, was battling a tough inflationary environment at the end of their Q3 FY ‘22. And with inflation largely peaking in the May-June period, their Q3 ended during the “worst of the storm”.

2. The company was lapping a particularly strong Q3 FY ‘21 that was bolstered by COVID-19 tailwinds.

3. Many WBA locations have not yet returned to normal operating hours due to labor shortages/constraints.

4. “[Challenging] financial market conditions beyond [WBA’s] control” prevented management from offloading Boots UK, and a “fire sale” did not seem warranted given strong performance from the business.

5. Management is still in the (relatively) early stages of building out Walgreens Health. The segment is not yet profitable and introduces an EPS headwind; but that headwind is expected to decline in FY ‘23 as the operation turns to profitability thereafter.

6. WBA increased its stake in AllianceRx Walgreens specialty pharmacy to 100% in Q1 FY ‘22 noting “…there would be a 7% decline in [US] revenues as a result of roughly an $8 billion decline in the AllianceRx Walgreens Prime business. Management is presently restructuring the business, inclusive of its investment in Shields.

The points above are not meant to serve as excuses for WBA’s performance, but rather give some context for the firm’s operating environment in Q3 FY ‘22, and FY ‘22 in general. Indeed, a closer look at Q3 FY ‘22 results reveal a better performance than some may have initially understood:

-

“[Net] sales [from continuing operations] exceeded expectations, growing 3% excluding the negative impact of the decline in AllianceRx Walgreens business and the sales growth from Walgreens Health.” In other words, WBA’s core business minus specialty pharmacy still grew during Q3 FY ‘22.

-

Net sales of $100.3B for the 9 months ended May 31, 2022 reflected an increase of 2.7% in constant currency. Moreover, “…[front-of-store] margins [were] up substantially year-on-year.”

-

US retail comparable sales increased 2.4%, excluding tobacco, versus the prior quarter. The decline in the AllianceRx business, mentioned above, acted as an “…850 basis point headwind to [US] sales”. It is reasonable to expect WBA’s largest segment to return to growth as the specialty pharmacy business emerges with a “…more energized…strategy.”

-

US pharmacy sales declined (9.7%) during Q3 FY ‘22, but comparable pharmacy sales actually grew 2.0%. Again, context is important with respect to WBA’s Q3 FY ‘22 US pharmacy results, as the firm lapped a particularly strong quarter in the prior period that was bolstered by COVID-19 tailwinds. Even so, comparable pharmacy sales increased, with management explaining that “…[pharmacy] volumes remain challenged by staffing shortages and temporary operating hour reductions.”

-

International segment sales grew 9.3% in Q3 FY ‘22 to $5.3B versus the prior quarter in constant currency, with adjusted operating income doubling to $174M. The segment’s net sales for the 9 months ending May 31, 2022 stood at $16.7B, reflecting a 15.7% increase versus the prior period in constant currency. Boots UK grew sales 13.5% during the quarter and drove 103% adjusted operating income for the International segment as a whole in Q3 FY ‘22.

-

GAAP net cash from operating activities of $1.6B and free cash flow of $1.3B for Q3 FY ‘22r; GAAP net cash from operating activities of $3.8B and free cash flow of $2.6B for 9 months ended May 31, 2022. GAAP net cash from operating activities in the quarter declined (7%) and (11.5%) for the 9-month period. Free cash flow (“FCF”) declined (13%) and (22.2%) for the quarter and 9-month period, respectively. While both cash from operations and FCF decreased, again remember that WBA lapped a particularly strong Q3 FY ‘21, was managing through inflationary conditions, and many stores are still not operating on their normal schedule.

-

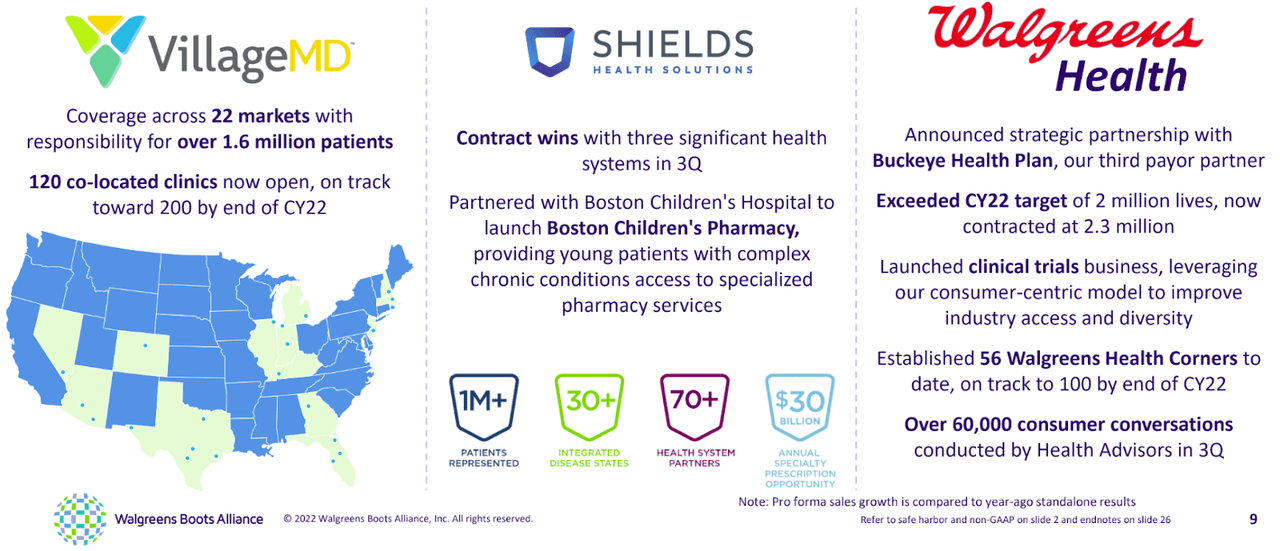

Walgreens Health sales of $596M for Q3 FY ‘22. Walgreens Health sales during the quarter increased 13% on a sequential basis, with the segment reporting $527M in sales for Q2 FY ‘22. Further, with 2.3M covered lives at the end of Q3 FY ‘22, WBA is already ahead of their 2M covered lives CY ‘22 goal.

So, with context, WBA’s Q3 FY ‘22 results were arguably not that bad.

A Model for Consistent Growth

We are now naturally led to ask how the firm will return to a path of consistent growth and improved profitability. I elaborate my thoughts as follows:

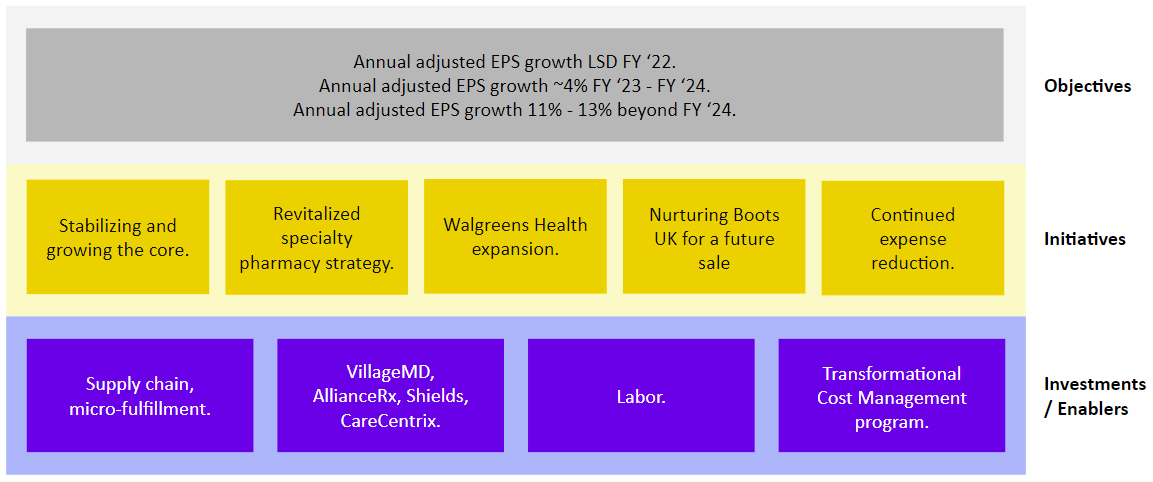

1. Stabilizing and growing the core: As mentioned above, the core business, although not without its issues, is arguably performing better than many give it credit for. Management has been working to address pharmacy staffing issues with strong hiring incentives. Further, they are working to return thousands of stores to normal operating hours. Thus, while staffing and operating challenges may lumber into Q4 FY ‘22, there is reason to hope they will be largely resolved heading into and during FY ‘23. Also, the core business may see a better margin performance in FY ‘23 with the restructure of the specialty pharmacy business, as discussed in the next point, and as management continues its push for US pharmacy efficiencies with the rollout of additional micro-fulfillment centers. These centers remove routine tasks from “the hands” of pharmacists, allowing them to focus on patient interaction and patient care. While WBA is a bit behind their anticipated rollout of these centers, the expectation is that “…[the] centers [which] fill about 20% of store scripts today, [will head] to 40% to 50% over time.”

2. A revitalized specialty pharmacy strategy: WBA CFO James Kehoe remarked during the company’s Q1 FY ‘22 earnings call that the decision to purchase 100% of AllianceRx was driven by the need to restructure the business, and the view that “…[it’s] probably better under one owner to do [it] quicker.” With that sense of urgency in mind, investors might see an improved top-line and profitability picture moving into FY ‘23 driven (in part) by the reorganized specialty pharmacy business; a business that carries higher margins than, for example, generic drugs. Moreover, the specialty pharmacy business, inclusive of Shields, will play an important role in the coming fiscal period with management noting that “…[they] expect lower levels of activity on COVID vaccinations next year…[and that] does generate a sizable headwind next year.” Accordingly, the higher margins offered by the AllianceRx business will help to offset declines in COVID-19 vaccinations. Investors should also recognize the specialty pharmacy business as a growth vehicle for WBA as that particular market maintains a CAGR that is higher than the overall prescription drug market, and represents an annual $30B opportunity according to management.

Figure 4: Walgreens Specialty Pharmacy Opportunity (WBA Q3 FY ’22 Earnings Presentation)

3. Walgreens Health expansion: Mr. Kehoe explained further during the Q3 FY ‘22 earnings call that “[WBA is] spending potentially more in the second half of [FY ‘22 on Walgreens Health] because of timing. But the headwind on Walgreens Health will go from 6% this year, down to very low single digits next year.” Hence, while Walgreens Health is likely to still produce a loss in FY ‘23, the resulting EPS headwind should be far weaker. Management reported that the company, which increased its stake in VillageMD to 63% in 2021, remains on track to open 200 co-located clinics by the end of the calendar year. These openings will be complemented by the opening of 100 Walgreens Health Corners by the end of CY ‘22, with each in-store “corner” allowing health plan patients to communicate directly with pharmacists and other medical professionals. The company seems to be “on track” to achieve $2B in net sales for the segment in CY ‘22 (not FY ‘22), and to achieve a run-rate of $10B in sales by FY ‘25.

4. Nurturing Boots UK for a future sale: Perhaps it will prove a “blessing in disguise” that management was unable to offload Boots UK with, as already mentioned, that business growing sales 13.5% during the quarter and driving 103% growth in adjusted operating income for the International segment in Q3. Obviously, should management continue to demonstrate growth in and viability of the business, the segment will fetch a greater valuation in the future, especially as global market conditions (hopefully) improve. Indeed, WBA CEO Roz Brewer made sure to mention during the Q3 FY ‘22 earnings call that “…[WBA] will stay open to all opportunities to maximize shareholder value.” Understanding that the International segment generates a minority of WBA’s profits, I have little doubt Boots UK will be sold at some point to free up capital for expansion in healthcare services and specialty pharmacy, and for debt reduction.

5. Continued expense reduction: WBA’s Transformation Cost Program, which began in December 2018, has been very successful and continues to be so. With an original target of $1.5B of annual cost savings by FY ‘22, the target has been repeatedly raised and now stands at $3.5B in annual savings by FY ‘24.

While there are no guarantees, the sum of the activities above offer a pathway for WBA to track against its long-term growth algorithm of low single-digit adjusted EPS growth in FY ‘22 (re-affirmed following Q3 FY ‘22 earnings results) and ~4% growth for FY ‘23 through FY ‘24, even as the company faces down a significant COVID-19 headwind moving into Q4 of this fiscal year and heading into FY ‘23. As I often like to do, I created the following diagram to attempt to capture the relationship between the elements of this section, namely management’s financial objectives versus their underlying initiatives and investments.

Figure 5: WBA Strategic Model (Yves Sukhu)

Note that Figure 5 above reflects my interpretation of WBA’s strategic model and does not directly map to management’s model; although, of course, they overlap.

A Strong Finish?

So, if we might agree WBA’s core business and strategy are not the “lost cause” that many might have us believe, how will the rest of the year play out? This certainly has not been a good year for WBA shares; especially when compared to CVS.

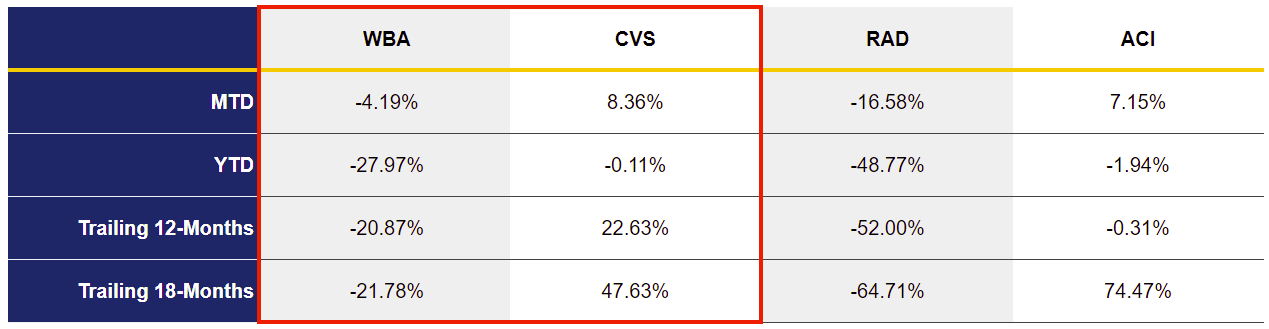

Figure 6: WBA and Selected Competitor Performance Comparison (Yves Sukhu)

Notes:

-

Data as of market close August 19, 2022.

Trying to predict what will happen at the end of WBA’s FY ‘22 is, of course, anyone’s guess. Beyond all the macroeconomic and geopolitical uncertainty, WBA management notes that they “…anticipate some headwinds in the fourth quarter…Vaccinations are an expected headwind of 15 to 17 percentage points. Investments to build out…Walgreens Health segment could result in 10% to 12% impact on fourth quarter EPS. Other headwinds include labor investments of around 5 percentage points and lapping prior year one-time gains of approximately 4 percentage points of EPS growth. Combined, these headwinds amount to an expected 34% to 38% year-on-year headwind and leads to full year EPS growth of low single digits.”

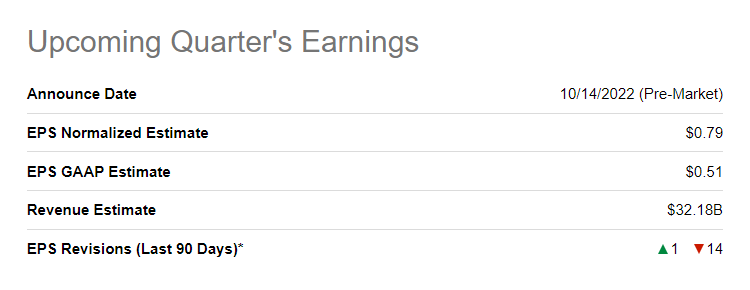

Figure 7: WBA Q4 FY ‘22 Revenue and EPS Estimates (Seeking Alpha)

Compared against Q4 FY ‘21 adjusted EPS of $1.17, the normalized EPS estimate for Q4 FY ‘22 does indeed amount to a more than (30%) decrease versus the prior period.

With shares already “beat up”, a Q4 FY ‘22 surprise could obviously spark the stock quite a bit higher. Then again, I proposed the same idea before Q3 FY ‘22 and look how that played out. But, to reiterate, WBA did beat adjusted EPS and net sales estimates in Q3; although the performance was not strong enough to excite the market.

What could lead to a substantial beat in Q4 FY ‘22? I speculate that the following could be (reasonable) possibilities:

1. Cooling inflation as a sales driver. As discussed earlier, WBA’s Q3 FY ‘22 ended just as the inflation rate was peaking in the United States. With inflation cooling off, and consumers spending their “new” savings, WBA, like other retailers, might see a sales bump through the end of the year.

2. An unexpected COVID-19 boost. While the rates of new COVID-19 infections and fatalities thankfully continue to fall, the World Health Organization just noted that there were still 15,000 COVID-related deaths in the past week around the world, describing the statistic as “completely unacceptable”. So, while WBA management is expecting a substantial COVID-19 headwind in the fourth quarter, it is still possible that a 4th COVID-19 shot recommendation may still be “in the cards”. And, as I mentioned in my last article discussing WBA, management’s FY ‘22 guidance does not factor in a 4th COVID-19 shot. As I’ve said so many times so as to sound like a “broken record”, whenever the world thinks the pandemic is “finished”, it seems to come roaring back. Hence, there is still “room” for a COVID-19 tailwind in Q4.

3. Better than expected cost management results. Again, one of management’s ongoing highlights is the success of the Transformational Cost Management Program. Optimistically, the program may over-deliver in the fourth quarter and support a better bottom-line performance as compared to current estimates.

So, I think it is reasonable, not guaranteed, to think WBA could deliver a strong finish to the current fiscal year particularly with a lot of bad news already baked into the stock price. One particular risk is WBA’s looming financial responsibility related to the Ohio opioid-case ruling mentioned earlier. However, it is not clear that WBA, or CVS and Walmart (WMT) for that matter, will be required to make any immediate payments; and WBA plans to appeal the ruling. So, shares could easily rally as the year wraps up, especially noting that the stock had been marching higher, trading above $42/share before news of the opioid-case broke.

Running Some Numbers: A Quantitative View on Shares

Beyond the reasonable possibility of a strong finish to FY ‘22, we might try to look at the remainder of the fiscal period in a more quantitative way. I still argue that WBA is undervalued and that its valuation multiples are likely to revert to the mean, especially as the company gains more traction with Walgreens Health and its specialty pharmacy businesses – two faster-growing, higher-margin segments that help to justify higher multiples for the firm. Consider WBA’s P/S and P/B multiples:

Figure 8: WBA and Selected Competitor Comparison (Yves Sukhu)

We see that WBA’s multiples are well below those of CVS. Further, WBA lags CVS on a P/E basis as well, with Seeking Alpha data providing us with trailing-twelve-month (“TTM”) P/E multiples of 7.08 and 12.14 for WBA and CVS, respectively. Of course, we can argue that CVS merits higher P/S, P/B, and P/E multiples as its benefits and pharmacy services businesses offer investors a company with a higher growth and profitability trajectory. This is a valid argument; but it doesn’t necessarily invalidate the argument that WBA could be undervalued based on its current multiples. In fact, using data from Macrotrends, WBA’s historical average P/B is revealed to be roughly in-line with CVS’ current P/B of ~1.8. Using that single data point and most-recent quarter (“MRQ”) book value data, we would arrive at a share price of $63.11.

WBA share price via P/B multiple = 1.8 * $30.38 book value/share

= $54.68

Notes:

- MRQ book value/share data from Yahoo Finance.

Macrotrends similarly offers historical P/E data for WBA with an average value of ~15. Obviously, this P/E value would result in a share price more than double what it is right now.

Am I saying that WBA shares are headed to $50+, or $60+, or even $70+? I don’t know exactly where shares are headed in the near-term. However, as Walgreens Health turns a corner “into the black” and management “rights the ship” with respect to the specialty pharmacy business to drive better overall core performance, I do think WBA shares will be trading substantially higher. Indeed, shares were trading above $70 not all that long ago in early 2019.

Again, noting that shares were trending higher before the latest opioid-case ruling, I am betting that investors picking up shares now in the high $30s have a good chance to be rewarded with the potential for a better-than-expected Q4. Even if shares only reach the average analyst target of $42.40 from Figure 3, shares today offer more than 10% upside, which is to say nothing of the current 5% dividend yield. I am bullish that shares may end the calendar year as they began: above $50. Simply, I think that the market is going to “figure out” that management is on the right track, and that shares warrant a higher valuation.

Sticking It Out

Generally, I suspect that long investors who are “willing to stick it out” as WBA achieves scale with Walgreens Health and its specialty pharmacy businesses are going to be rewarded. I, for one, have been (cautiously) adding to my long position since the stock tanked following the Q3 FY ‘22 earnings announcement.

If I come back to my outline of the 3 main components of the bear argument against WBA, I would retort as follows based on this analysis:

1. The core business performed admirably during Q3 when discounting the impact from AllianceRx and investments in Walgreens Health. This performance was delivered in spite of a tough operating environment, including high inflation and staffing challenges. Moreover, management is acting appropriately to stabilize/grow the business, particularly with respect to restructuring of the specialty pharmacy segment.

2. Walgreens Health, while still embryonic, is on track to achieve its CY ‘22 goals, including $2B in net sales and the opening of 200 co-located VillageMD locations. A key difference with WBA’s healthcare strategy “this time around” is their decision to invest in a strategic partner (i.e. VillageMD) versus trying to “go it alone”, thereby reducing their risk. While the ongoing transformation of Walgreens’ overall business will carry risk, indications so far are positive.

3. With a stable/growing core, the expectation would be that WBA’s traditional retail + pharmacy operations should be able to throw off sufficient capital to support Walgreens Health expansion, without management needing to resort to additional debt. Further, with the profitability trajectory of VillageMD locations well-understood, older (early) locations should start operating “in the black” in the near term, thereby helping to support the opening of more new locations. As more VillageMD locations cross the threshold into profitability, the cycle becomes self-reinforcing. Also, one of the proposed benefits of co-locating VillageMD primary care offices next to Walgreens pharmacies is to drive scripts growth. So, VillageMD should start to “feed” the core more and more as time goes on, providing additional support for Walgreens Health expansion. Finally, I do expect that Boots UK will be eventually sold; and management will obviously make the appropriate decision at that time if and how to distribute that capital with respect to Walgreens Health.

To reiterate, I think investors are going to “figure all this out” themselves and reward the stock appropriately. But, what about the lowered price targets offered by analysts as seen in Figure 3? Are all those analysts simply wrong with their negative outlook on shares? It is difficult to make such an assertion. However, it might be fair to say they are too pessimistic in their view. I read a report from one analyst who stated, in so many words, that he preferred to wait and see how the story with Walgreens Health plays out before making a call on the stock. But, for those investors seeking undervalued businesses, does it make sense to invest after a strategy has proven itself as such an obvious success that the stock now trades at a higher valuation? In other words, does it make sense to invest now with the stock “beat up” but with indications that the company will be successful in the long-term; or, does it make sense to invest later when the stock has “caught up” with its fair value because the market has finally recognized the firm’s strategic potential? It should be clear from this report how I feel.

As with most things in life, there are no guarantees. However, I reiterate that WBA’s strategy is one that seems to position the firm for long-term success, which will be correspondingly reflected in the share price.

Be the first to comment