lucky336

Sobering Wisdom

A Seeking Alpha reader posted a sobering comment on my last Walgreens Boots Alliance, Inc. (NASDAQ:WBA) article. Here is the gentleman’s story about his experience with WBA stock (with minor edits):

There is a saying that ‘time in the market is more important versus timing the market.’ Here is my story. I inherited 250 shares of Walgreens on 17 June 2002 at a share price of $37.01. Today, as of this authorship on 22 August 2022, the stock quote for Walgreens is $37.45. No stock splits during the time interval of over twenty years.

Sometimes, if one is patient enough and waits long enough, one can end up with nothing. [The dividend from] Walgreens is good, but if it is alpha you are seeking, perhaps it is time to look elsewhere.

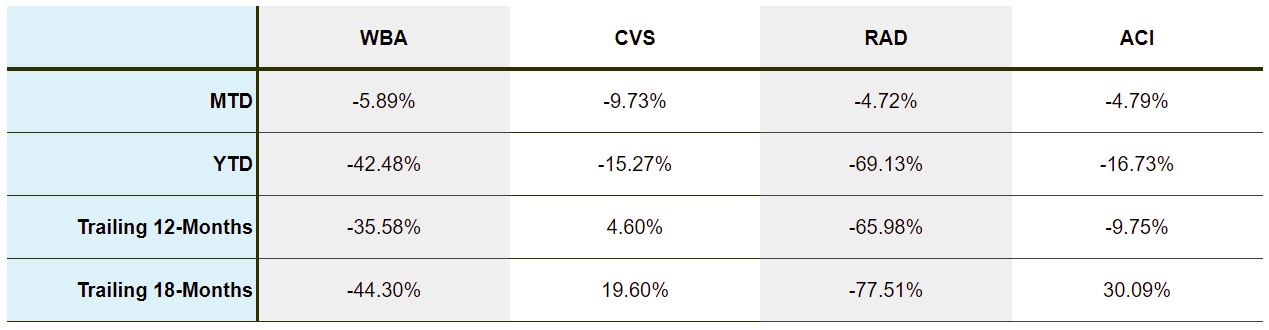

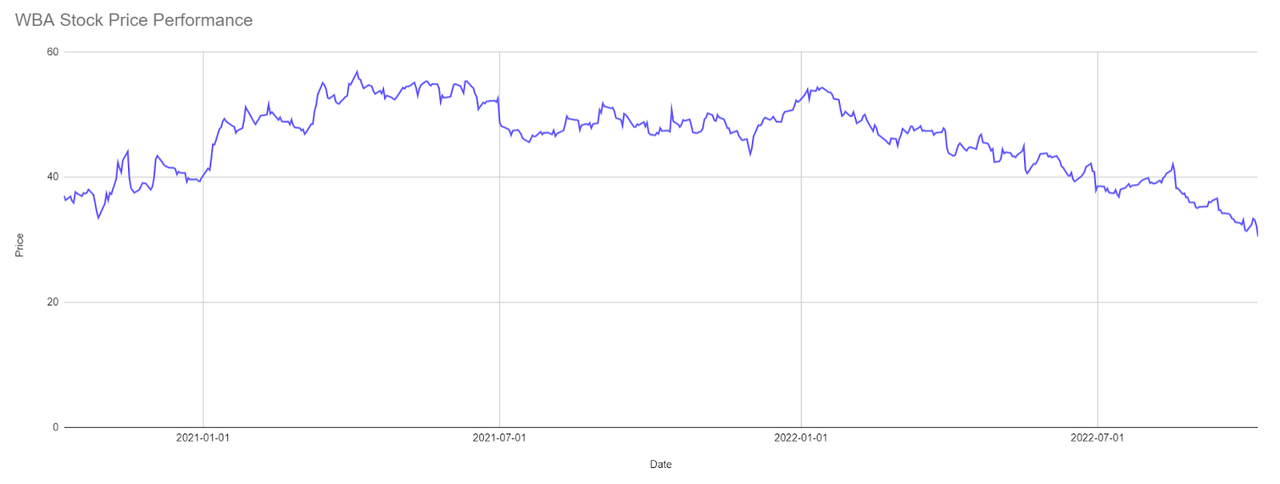

The anecdote is powerful and registers now with even greater weight since WBA shares have fallen nearly (20%) with the Friday, October 7 close of $30.52 and using the price at article publication of $37.98. The year-to-date (“YTD”) loss on WBA shares stands nearly at a staggering (43%).

Figure 1: WBA and Selected Competitor Comparison (Yves Sukhu)

Notes:

-

Data as of market close 10/7/22.

I have stayed the course with my WBA shares. But, with Q4 FY ‘22 results right around the corner, I’d be lying if I said I was not a little nervous.

There are some great WBA pre-earnings analyses on Seeking Alpha with strong fundamental analyses of the firm; and I encourage readers to check them out. In my analysis here, I’d instead like to hone in on what I see as a few key risks to earnings and sales estimates as we head into the earnings call this week.

Walgreens’ Q4 Estimates and Lowered Targets: Trouble Ahead?

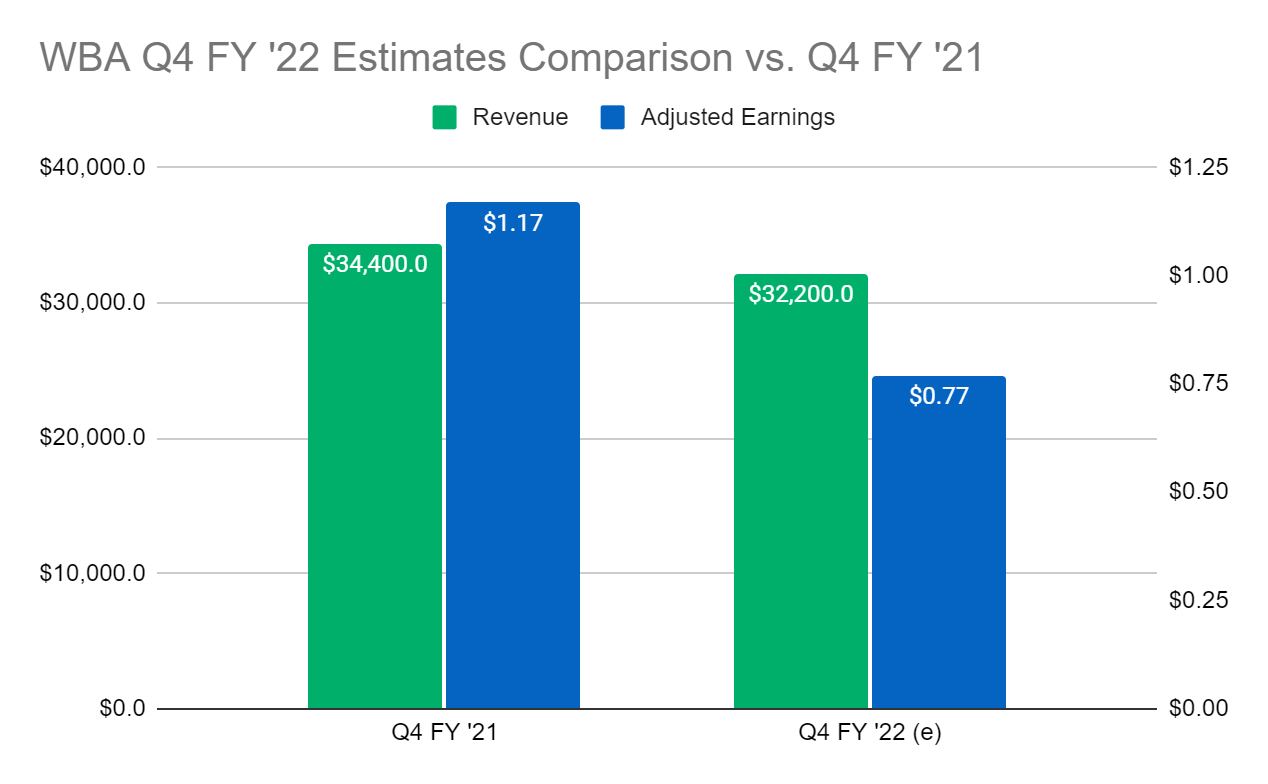

Leveraging data from Seeking Alpha, revenue and earnings are both expected to fall when WBA announces its results next week.

Figure 2: WBA Q4 FY ‘22 Estimates Comparison vs. Q4 FY ‘21 (Yves Sukhu)

Notes:

-

Revenue in $millions.

-

Comparison is not in constant currency; Q4 FY ‘21 data as reported.

Management was clear during their Q3 FY ‘22 Earnings Call that Q4 FY ‘22 earnings are going to be significantly lower. “Significantly” as in between (34%) to (38%) lower year-on-year (“YoY”) due to several headwinds:

-

Reduced vaccinations headwind of (15%) to (17%).

-

Walgreens Health headwind of (10%) to (12%).

-

Labor headwind of (5%).

-

Lapping one-time gains in the prior period of (4%).

Some investors might be expecting an even worse earnings result given how shares have performed recently. Possibly echoing that feeling, Evercore ISI slashed their price target for WBA on Monday from $41.00 to $32.00 – although they maintained their hold rating.

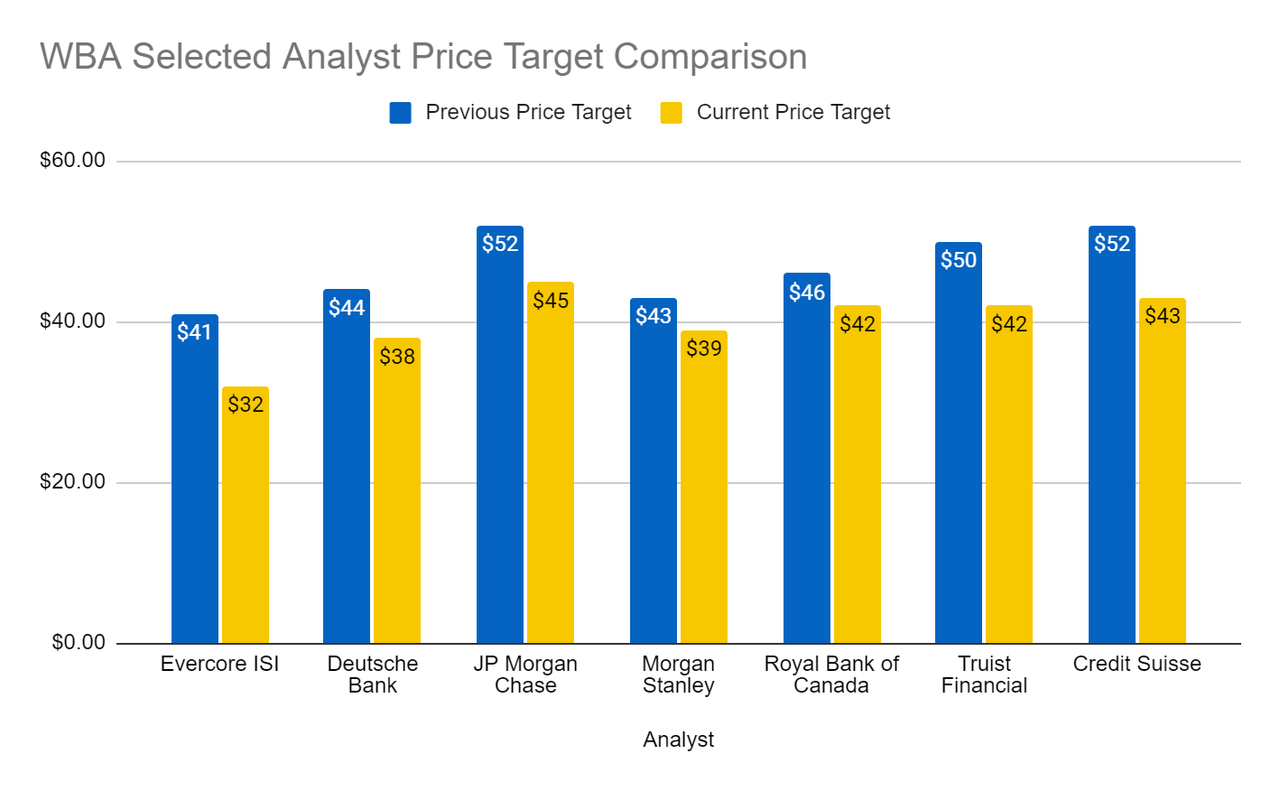

Figure 3: WBA Selected Analyst Price Target Comparison (MarketBeat)

Beyond Evercore ISI, and as the chart above lays bare, all the listed analysts have lowered their price targets for WBA. Yet, interestingly, as seen in the following table, most have kept their hold ratings on the stock.

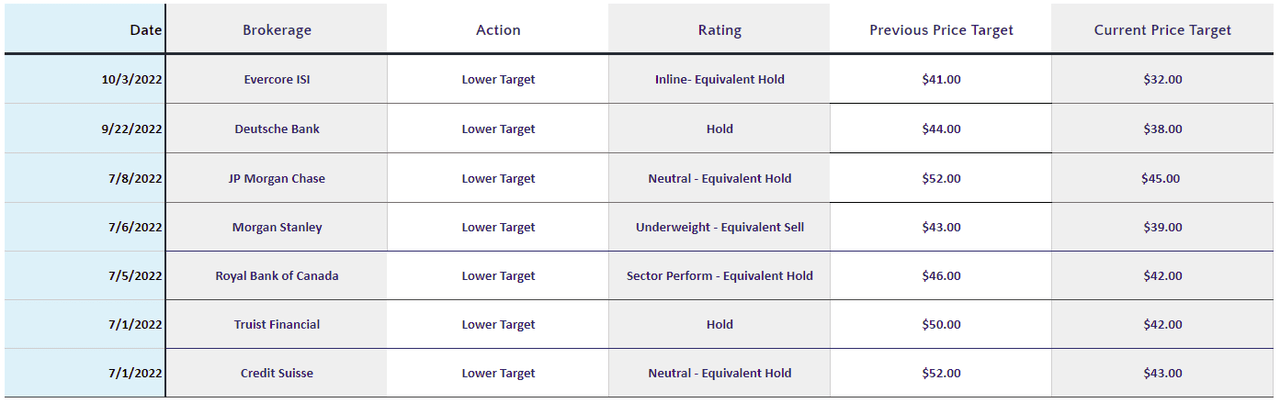

Figure 4: WBA Selected Analyst Ratings (MarketBeat)

I state the obvious by saying there is a lot of pessimism out there. But, is it well-founded, or driven by unreasonable fear?

How the Wheels Might Have Come Off: Potential Q4 Risks

I can’t say investors and analysts are pessimistic for no reason whatsoever. To that end, in this section I’d like to outline some key risks – as I see it – that could lead to a sales or earnings miss, or both – causing an already ugly-looking stock chart to become a lot uglier.

Figure 5: WBA 18-Month Stock Price Performance (Yves Sukhu)

Notes:

-

Data as of market close 10/7/22.

1. Headwinds came on even stronger than expected.

While they presumably attempted to provide investors accurate data, it is possible that management underestimated the earnings impact of certain headwinds mentioned in the previous section. For example, the firm had been struggling to return thousands of stores to normal operating hours following the height of the pandemic – a point evidenced by my recent visit to a Walgreens Photo Center only to learn that the particular store had no one available to staff it; at which point a Walgreens employee suggested that I go to the CVS (CVS) down the street. Pharmacy staffing had been particularly problematic with management noting that scripts volume in Q3 took a (190 bps) hit due to store operating hours. Hence, enduring labor-related headwinds could wind up eroding Q4 FY ‘22 earnings more than expected. On vaccinations, demand for the federally recommended 2nd COVID-19 booster and Omicron-variant booster may be somewhat muted.

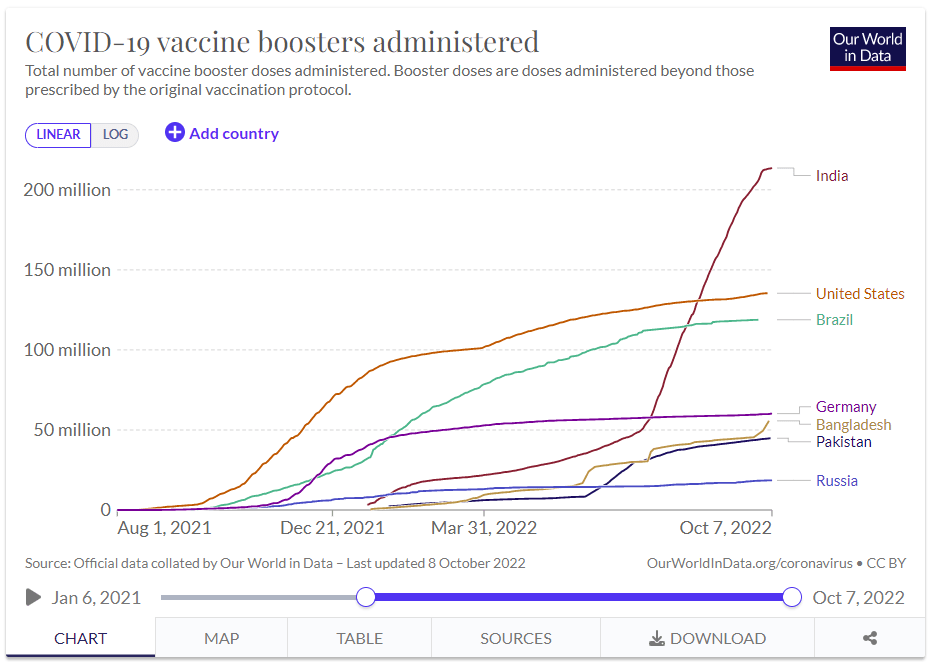

Figure 6: COVID-19 Vaccine Boosters Administered (Our World In Data)

The Q4 earnings impact due to the fall in COVID-19 vaccinations and testing could be more severe than what management originally had in mind, especially as they had “…called out COVID as the biggest headwind…[thinking] about fiscal ’23”. With respect to Walgreens Health, management was on track at the end of Q3 to expand its VillageMD footprint to 200 locations by the end of the calendar year. However, with each location generating losses during the first two years of operation, the nascent business is anticipated to add up to the (10%) to (12%) Q4 EPS headwind mentioned earlier. Recent labor and inflation challenges may have exacerbated VillageMD losses in Q4, potentially leading to a larger drag on Q4 earnings.

2. Boat-anchor AllianceRx sank deeper.

[Investors] will recall that when we gave guidance at the beginning of the year, [AllianceRx] was a material driver within the U.S. business. We called out that there would be a 7% decline in U.S. revenues as a result of roughly an $8 billion decline in the AllianceRx Walgreens [Pharmacy] business. – WBA CFO James Kehoe, Q1 FY ‘22 Earnings Call

AllianceRx, as expected, has dragged on performance all year. The sales decline in the business inflicted a (720 bps) impact on Q3 FY ‘22 net sales, which resulted in a related (11%) headwind against US Pharmacy sales in the quarter. Management is in the process of restructuring the business, believing that increasing their stake to 100% in Q1 FY ‘22 would make for a faster turn-around. But, it’s not clear those efforts will be reflected in Q4 results and therefore further decline in the business could drive a sales miss.

3. Inflation and the consumer.

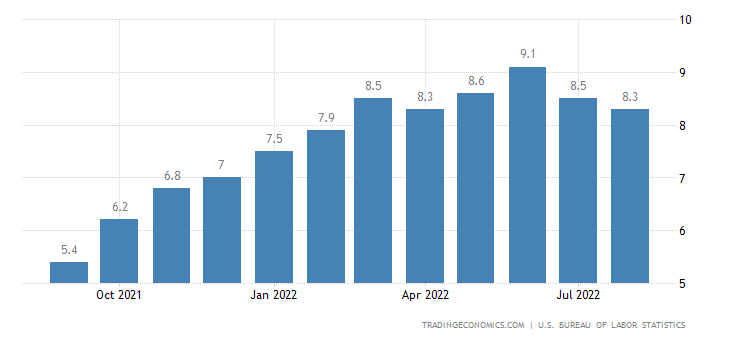

Again, I state the obvious by noting that the inflation rate has remained higher than what many may have thought it would be by now.

Figure 7: United States Inflation Rate (Trading Economics)

Management had expressed a certain confidence earlier in the fiscal year stating during the Q1 FY ‘22 Earnings Call that “…[they] have basically offset all the inflationary impacts, and that includes a massive increase in the cost of international ocean freight”; and they reaffirmed that “[they have]…been ahead of the curve in managing through inflation” during the Q3 FY ‘22 Earnings Call. However, also during the latter call, management acknowledged “…a shift in calculus due to food and fuel inflation” with respect to the consumer. Obviously, if the consumer is hurting to a greater extent than what management perceived just a few months ago, it’s just another reason why WBA may miss against an already tempered top-line estimate.

4. The United Kingdom is a mess and Boots UK might suffer as a result.

Boots UK (“Boots”), which grew comparable retail sales by 24% in Q3 FY ‘22, could reverse course in the fourth quarter due to the utter mess that is the United Kingdom at the moment. A weakened British pound coupled with high inflation could serve up a lousy Q4 sales performance, noting that footfall was still below pre-COVID-19 levels in Q3.

5. Stronger dollar.

With the dollar strengthening against the euro, British pound, and other currencies, this will obviously drag on WBA’s International segment results. And of course, it’s not too early to start worrying about Q1 FY ‘23 performance. If the dollar continues to strengthen, currency effects may weigh more heavily on those results when they are announced next year.

Obviously, any compound of the risks above could drive lower-than-expected results when the company announces Q4 results later this week.

Rethinking Q4 Risks

But, before you go and hit the “Sell” button for your WBA shares, I’d remind readers that management reconfirmed their FY ‘22 guide during the Q3 FY ‘22 Earnings Call.

We are maintaining our full year guidance of low single-digit growth in adjusted EPS. We have raised our [EPS] estimate for the base business slightly, from 6% to 8% growth, to 7% to 9% growth.

With that reassurance as a backdrop, let’s revisit the risks I posited in the previous section. I think there are reasonable counter-arguments to be made suggesting some of the risks, as I outlined them, may be overstated.

1. Headwinds came on even stronger than expected.

Let’s start with COVID-19. Headwinds related to the fall in COVID-19 vaccinations and testing certainly could have impacted Q4 EPS results, more so than originally anticipated. But, I think this may be less likely rather than more likely. For one thing, management explained that their confidence in raising the guide for the core business was due in part to “…increased testing and vaccinations…[and that they expect] 35 million vaccinations this year compared to 31 million previously.” Also, as I’ve noted before, WBA’s updated guidance following Q2 FY ‘22 earnings did not include a fourth COVID-19 shot (i.e. second booster shot). In other words, management chose to play it safe. So, it would seem reasonable to gamble that the realized COVID-19 headwind in Q4 wound up at the lower end of management’s range, i.e. (15%). With data from Figure 6 suggesting that uptake of the second COVID-19 booster shot has been growing steadily if slowly, WBA may even surprise investors with a weaker-than-anticipated COVID-19 headwind when they report Q4 results. Next, on labor, management also tied their guidance raise for the core business “…to reflect strong U.S. front-of-store performance.” One might infer that the labor picture was improving exiting Q3 and heading into Q4 based on retail performance; an inference that might find loose support with the most recent jobs report. That is to say if the US stores were woefully understaffed, one would not expect strong front-of-store performance. So, I’d say there’s a reasonable possibility that Q4 results will reflect lower-than-expected EPS erosion due to labor/staffing shortages. With respect to my speculation that Walgreens Health, and specifically VillageMD, may have operated with a higher-than-expected loss due to labor and inflation challenges, it is just that: speculation. I have no particular evidence to point to; it is a guess based on current economic conditions. To their credit, management seemed quite confident coming out of the third quarter that the full fiscal-year headwind from the operating segment should decrease from about (6%) in FY ‘22 to (1%) or (2%) at most in FY ‘23. My point is that WBA would appear to have the financial mechanics of Walgreens Health firmly within their grasp, which – if true – implies their Q4 forecast for the business was accurate. Therefore, we might deem it unlikely that the segment will generate an earnings headwind worse than the estimated (10%) to (12%) range.

2. Boat-anchor AllianceRx sank deeper.

Management has not offered much visibility into their progress restructuring the business. Unfortunately, then, it seems like a good possibility that AllianceRx will drag on sales again in Q4. Still, the proportion of the total prescription drugs market in the United States represented by specialty drugs has been growing steadily. Obviously, it is a key market for WBA, and WBA CFO James Kehoe remarked during the Q1 FY ‘22 Earnings Call that “[the market will] see us maybe in the next 6 months, come out with a more energized specialty strategy, which will be more integrated in how we surround potential partners with a series of integrated services.” Without more data, it’s impossible to say what investors can expect from the business when Q4 earnings are announced. However, maybe there is a sliver of hope that WBA’s restructuring efforts will, in fact, be reflected by overall Q4 revenues that include a flattish or, at least, “less-bad” AllianceRx sales result.

3. Inflation and the consumer.

Consider a couple points restated from one of my earlier WBA articles, but actually culled from CVS’ Q1 FY ‘22 Earnings Call:

-

“…[inflation] is a dynamic that can actually help frankly with our membership programs and also make our store brands more attractive relative to other products.”

-

Drug pricing is generally governed by multi-year contracts and is therefore resistant to inflationary effects.

As I suggested then and as I suggest now, both points should logically apply to WBA as well. Therefore, while inflation has remained stubbornly high, a business like WBA’s might paradoxically benefit from it. Perhaps we see evidence of that with the strong US front-of-store performance during Q3 as mentioned in Point 1 above. So, US consumer spending in Q4 may nonetheless turn out to be strong despite lingering inflation.

4. The United Kingdom is a mess and Boots UK might suffer as a result.

Remember that WBA’s International segment generates a minority proportion of WBA’s operating income; producing, for example, $227M in operating income in FY ‘21 versus $2,254M in operating income for the United States segment during the same fiscal period – i.e. about 9% of the total. So, even if it turns out that Boots laid an egg in Q4, the bottom-line impact might be readily absorbed by a strong performance in the United States, which may have a good chance of happening based on the preceding 3 points.

5. Stronger dollar.

Quite a bit of the dollar’s recent rise occurred in September. So, the timing of WBA’s Q4 works in the company’s favor.

If the risks to sales and earnings that I outlined capture you as reasonable, then perhaps my counter-arguments here also capture you as being reasonable. In that case, you might be willing to agree that there is a decent chance that the company could beat on the top-line; and, perhaps, a better chance that they could beat on the bottom.

Where Do We Go From Here? Is WBA Stock a Buy Heading Into the Earnings Call?

Since I started tracking and accumulating a position in WBA in late 2020, I have been consistently bullish on the company. While others have suggested that management should have been/should be more focused on the core business versus Walgreens Health, I have argued that their measured approach into an integrated pharmacy-primary care model is strategically sound and was executed in such a way as to minimize investor risk. I remind readers that the partnership with VillageMD began with a mere 5 store locations in 2019 to test the concept. With the concept having proved itself, WBA finished Q3 FY ‘22 with 120 locations, on pace for their target of 200 in CY ‘22, whilst increasing their stake in the company in late 2021 to 63%. This approach stands in contrast to, for example, CVS’ announcement last week of their intention to buy Cano Health (CANO) for $4.6B. As readers know, CVS shares plunged more than (10%) on the news.

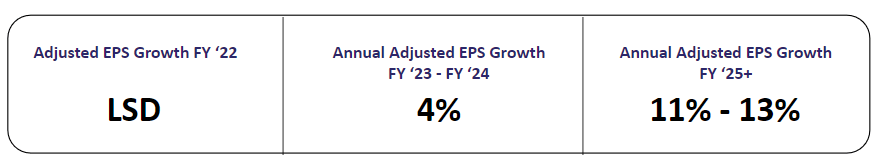

Unsurprisingly then, I remain bullish about the company and it is worthwhile noting that management left their long-term growth algorithm unchanged exiting Q3.

Figure 8: WBA Long-Term Growth Algorithm (Yves Sukhu)

I read another analysis on the company earlier this week (not on Seeking Alpha) suggesting the stock is likely to go nowhere anytime soon because there is no obvious catalyst to drive meaningful top-line growth. That may be so, but as implied by Figure 8, management is obviously working to alter the complexion of the company’s revenue stream, moving it toward a greater contribution from higher margin products/services that are going to drive their long-term double-digit EPS growth goal. I think most WBA investors would be quite satisfied to sacrifice top-line growth for higher “quality” revenue that is capable of driving steady, double-digit profit growth.

While the foregoing may paint a rosy picture with respect to the company’s long-term outlook, it doesn’t necessarily provide a clear indication of whether investors should buy shares heading into earnings, or if they should wait. I’ve clearly tried to argue that there are reasons to be bullish heading into the announcement. Moreover, Seeking Alpha reported that “options trading implies a move of 7% for Walgreens following the earnings release.” And if we can rely on the average analyst rating of $40.14 from Figure 4, then shares might have more than 30% upside based on where they closed on Friday.

I would also offer that there hasn’t been much selling by WBA insiders throughout the year, which also stands in contrast to CVS.

While the debate rages over whether WBA belongs in value-stock or value-trap territory, if you subscribe to the first camp as I do, you might review JPMorgan Chase’s Mid-Year Investment Outlook 2022. On page 14 of the report, you will note a chart detailing returns from various asset categories during the era of stagflation that was the 1970s. The performance from value stocks was second only to the energy sector.

I lean toward the stock as a buy heading into earnings. I temper my call from my prior strong buy recommendation noting Evercore ISI’s slashed price target of $32.00/share, as mentioned in the second section of this report. As I don’t have access to their research, it is unclear to me what Evercore ISI’s analyst team reacted to when making that decision. Of course, they likely have insights into the firm that I failed to analyze here. At the same time, investors may not want to over-react with respect to their recommendation. Some analysts, in my view, are sometimes guilty of taking too cautious a stance based on short-term market dynamics rather than a firm’s fundamentals and market outlook. That may not necessarily be the case with Evercore ISI’s analysis, but I think it is a point worth keeping in mind.

Naturally, I don’t know exactly what we will hear during WBA’s extended conference call this coming Thursday. But, I will probably be buying again on Monday.

Be the first to comment