Dzmitry Dzemidovich

Thesis

We cautioned investors in our previous article on leading net lease REIT operator W. P. Carey Inc. (NYSE:WPC) that it was too late for investors to buy aggressively at those levels in July. Even though WPC had outperformed the market in 2022, we believe it neared the peak of its buying surge.

Accordingly, WPC has underperformed the SPDR S&P 500 ETF (SPY) significantly since our caution, down more than 15%, compared to the SPY’s 5% decline. Moreover, WPC has also given back all its gains for 2022 in a few weeks, as the market sent fearful investors rushing for the exit. Notably, the massive selloff has digested WPC gains massively, sending it back close to the lows last seen in May 2021.

We believe the de-rating is justified, as WPC couldn’t sustain its valuations at those levels in July, given its exposure to worsening macro headwinds in Europe and the US. Moreover, despite its robust AFFO visibility, the market is increasingly concerned about its ability to continue its investment cadence without seeing a marked impact from forex headwinds since the massive collapse of the euros in recent weeks.

Notwithstanding, we gleaned that WPC’s valuations are more palatable now but still not undervalued. However, we believe it should be supported robustly at the current levels, given the steep selloff akin to a capitulation move.

Therefore, we believe it’s appropriate to revise our rating from Hold to Buy.

The Selloff In WPC Is Justified

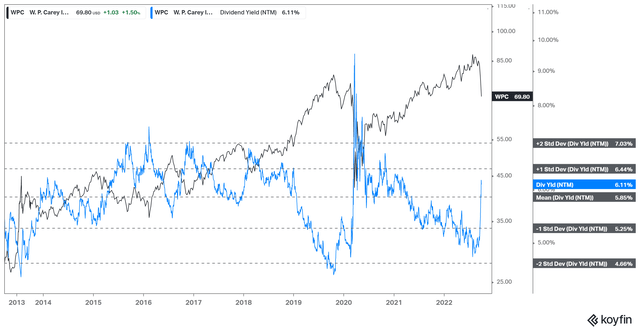

WPC NTM Dividend yields % valuation trend (koyfin)

As seen above, WPC’s NTM dividend yields nearly reached the two standard deviation zone under its 10Y mean at its July highs. Therefore, we believe it’s clear that WPC was overvalued, despite its highly consistent AFFO visibility and highly secure tenant base.

We urge investors to pay attention to valuations as no company or REIT is immune to business cycle headwinds. Therefore, it proved that WPC’s outperformance in 2022 was ultimately unsustainable. In addition, investors must consider that its underlying growth metrics are unlikely to continue its previous growth cadence as we head into a recession.

Notwithstanding, the steep pummeling has improved its valuation tremendously, sending its NTM dividend yield of 6.1%, slightly above its 10Y mean of 5.85%.

However, we deduce that WPC is still not undervalued, and could face further headwinds if its hedging activities from its euro exposure proved more challenging than anticipated. However, we don’t attribute the recent fall mainly to its forex headwinds, given its ability to hedge (even though there’s some likely impact as the euros have fallen below parity to the USD).

Our assessment indicates that the market de-risked WPC in anticipation of more challenges in finding accretive investment opportunities as the business cycle turns down decisively.

Investors Need To Be Ready For Tepid Growth

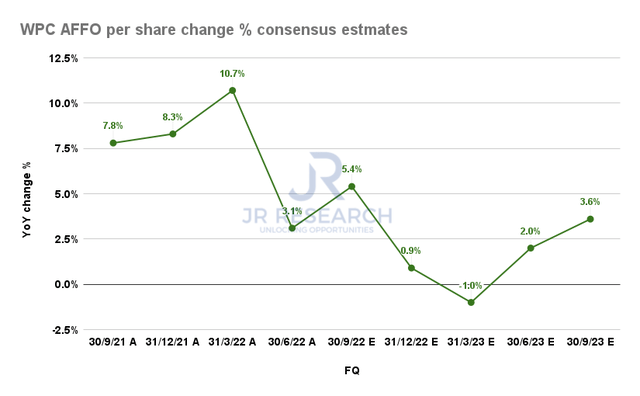

WPC AFFO per share change % consensus estimates (S&P Cap IQ)

As seen above, the consensus estimates (bullish) suggest that WPC’s AFFO per share growth would continue to moderate through FQ1’23 before recovering further.

However, we believe these estimates could be at risk, given the worsening macroeconomic conditions hampering its ability to add accretive investments. Despite that, management has improved its balance sheet astutely with its high share price through 2022, raising additional forward equity before its recent collapse.

As a result, WPC had nearly $600M in undrawn equity forwards in Q2, proffering its ample liquidity to fund appropriate investments. Hence, we believe it demonstrates the management’s foresight and execution capability bolstering its ability to invest through the cycle.

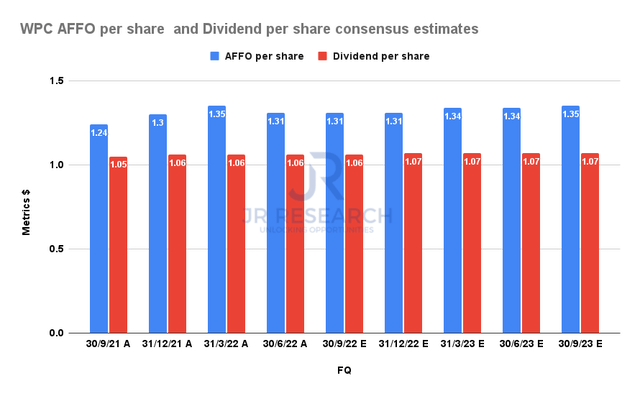

WPC AFFO per share and Dividend per share consensus estimates (S&P Cap IQ)

Accordingly, we are confident that its AFFO per share visibility would continue to support its distribution through the cycle. Therefore, it should help provide robust valuation support as WPC yields more than 6% at the current levels.

Is WPC Stock A Buy, Sell, Or Hold?

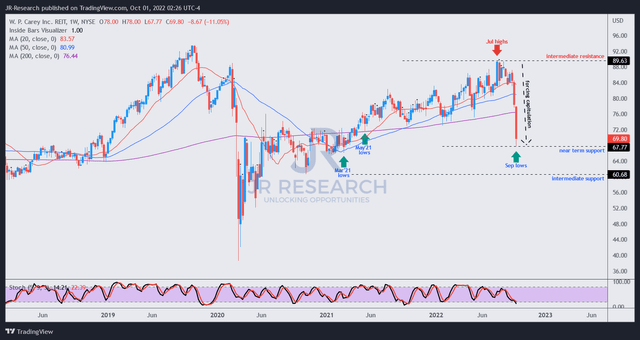

WPC price chart (weekly) (TradingView)

As seen above, the capitulation move over the past three weeks sent WPC re-testing its May 2021 lows, forcing investors who added exposure since then into the red.

However, such price structures are often emblematic of steep moves to force out weak hands. As such, we expect to see basing price action, subsequently leading to a relief rally. Hence, we urge investors not to panic now.

Instead, we encourage investors who have been patiently waiting to capitalize on the massive selloff and add exposure over time. However, as we deduce that WPC is not undervalued, further near-term downside volatility cannot be ruled out to de-risk its execution risks further, with its intermediate support as the next drop zone.

We revise our rating on WPC from Hold to Buy.

Be the first to comment