Thomas Barwick

I have been hesitant to buy W. P. Carey (NYSE:WPC) stock for quite some time due to the stock trading at unreasonable relative valuations to peers. While some of that was perhaps justifiable due to the strong same store sales growth, I viewed the high disposition activity as being more than offsetting those benefits. After a recent slide, WPC stock is now trading at a yield in excess of 6% which in turn has eased my concerns. The stock is now priced for significant outperformance potential as multiple expansion can complement the high dividend yield.

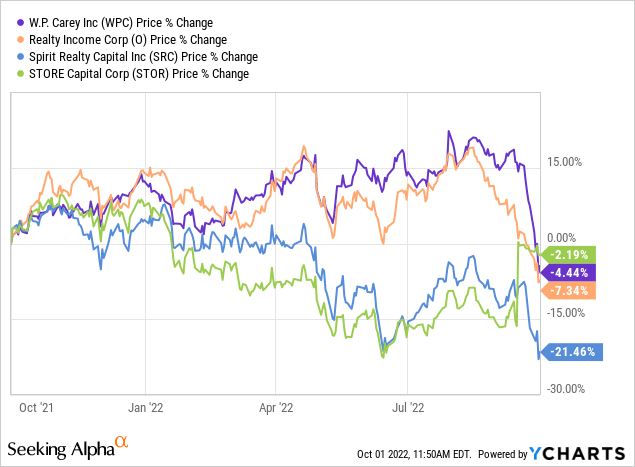

WPC Stock Price

For much of the year, WPC dramatically outperformed peers like Realty Income (O), Spirit Realty (SRC), and STORE Capital (STOR). That has changed in recent weeks with the stock price falling to $70 per share.

I last covered WPC in July where I recommended avoiding the stock due to its relative valuation to peers. The stock has since fallen 15%, creating an attractive entry point.

WPC Stock Key Metrics

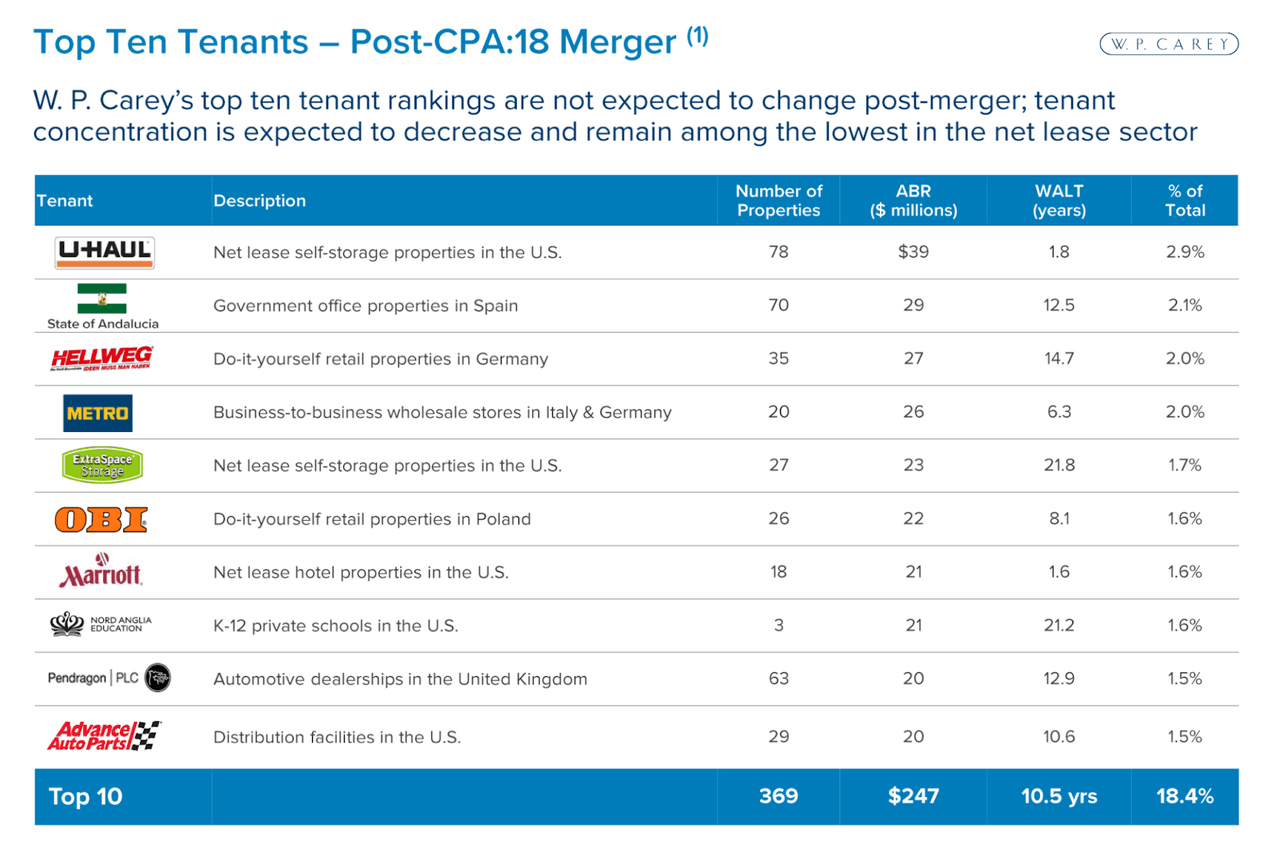

WPC is a net lease REIT which means that its tenants are responsible for real estate taxes, insurance, and maintenance costs. WPC has finally completed its merger of CPA:18. WPC had previously served as the management advisor for CPA:18. After the merger, its top ten tenant list includes many well-known brands.

2022 Q2 Presentation

As disclosed on the conference call, 30% of tenants are investment-grade and only 1% are on the credit watch list (compare that with the 4% during the pandemic peak).

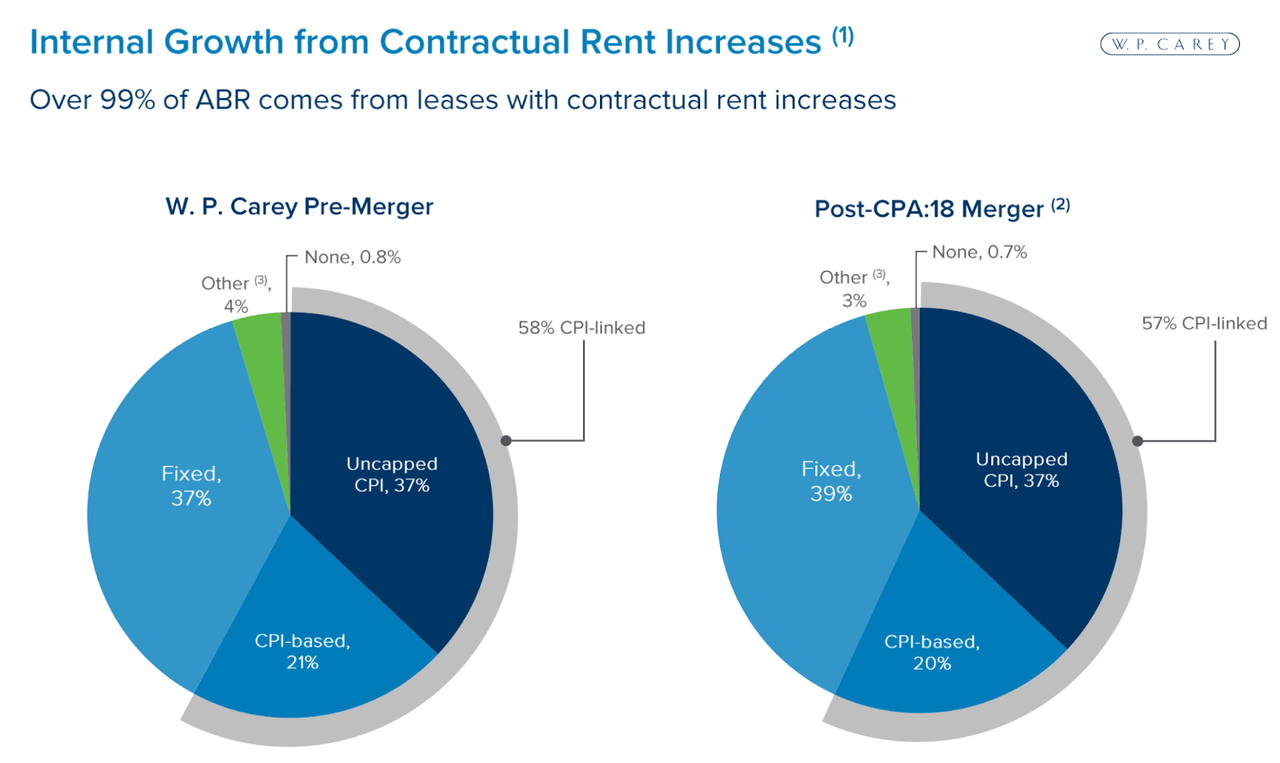

WPC has become popular among dividend investors as of late in large part due to its exposure to inflation, as 57% of its leases are linked to CPI.

2022 Q2 Presentation

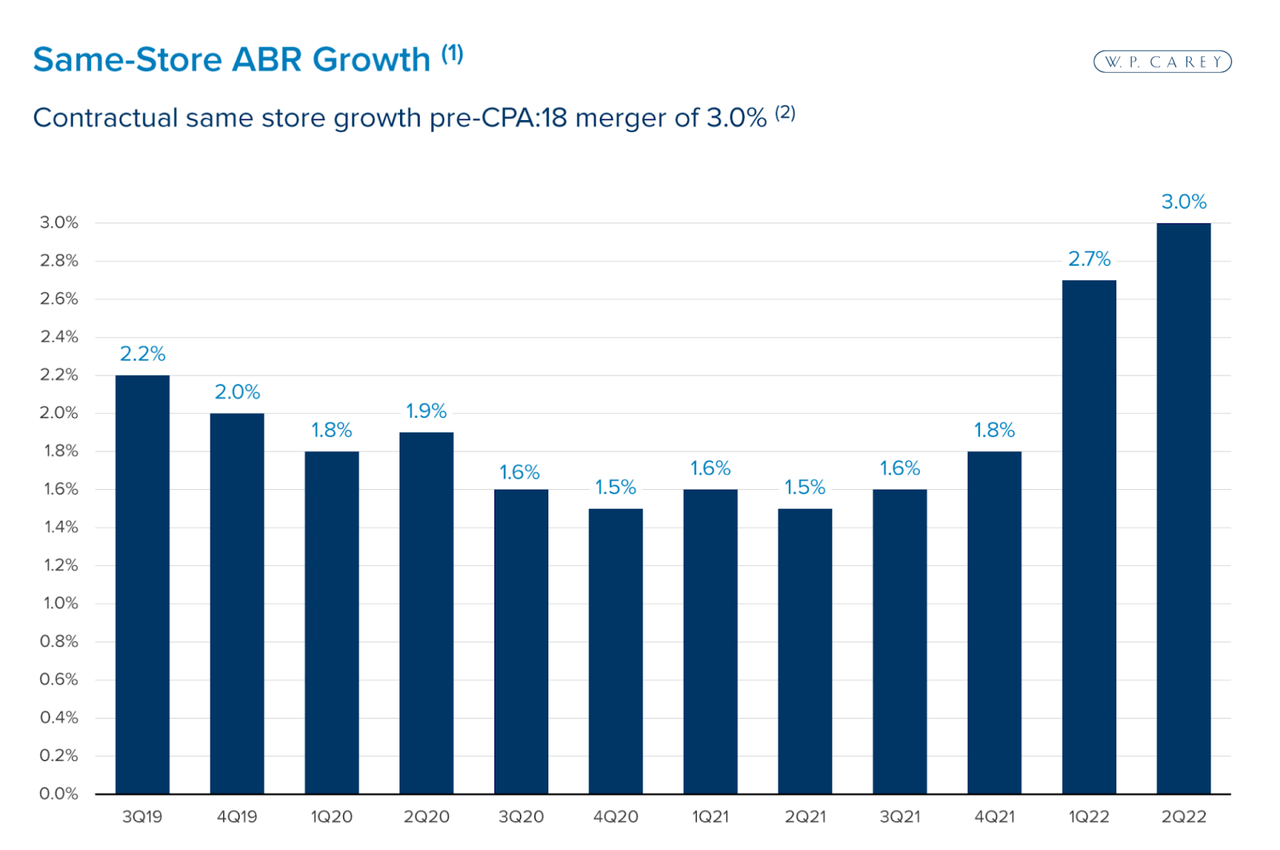

That has helped it generate 3% same-store average base rent growth in the latest quarter. We can see that same-store rent growth has accelerated significantly due to inflation.

2022 Q2 Presentation

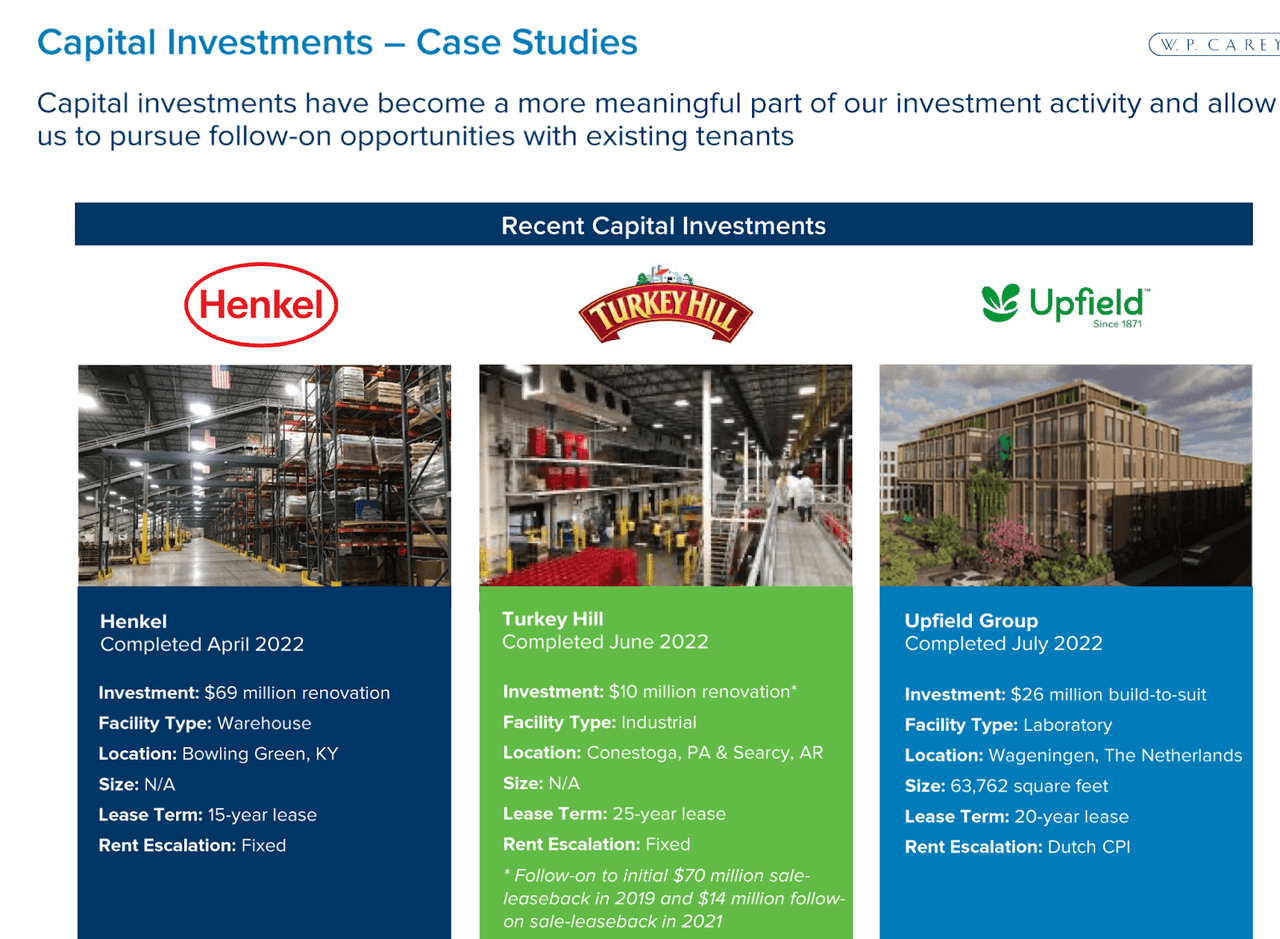

In comparison with other NNN REITs, one differentiating factor at WPC is its ability (and willingness) to invest additional capital at existing properties. In this manner WPC is able to help its tenants grow while profiting from that growth as well. This investment option is valuable considering that competition is heating up in the net lease sector.

2022 Q2 Presentation

Yet in spite of the best-in-class same store sales growth, WPC is still guiding for only 5.4% adjusted funds from operations (‘AFFO’) per share growth this year. It is also worth noting that the $1.31 AFFO per share posted in the latest quarter is the same as the $1.31 in AFFO per share reported in the first quarter of 2016. The reason is due to the high amount of capital recycling.

Year to date, WPC has disposed of $119.4 million of properties (cap rate undisclosed) versus $785.5 million in investment volume (at a 6.1% average cap rate). That 15% ratio is high and WPC has historically generated high ratios as evidenced by the 46% ratio in 2020. Dispositions can be a big drag on cash flow growth because they offset the benefit of acquisitions. The best NNN REITs – like Realty Income – typically see that ratio hover in the low single-digits. NNN REITs often try to ease the pain of dispositions by including the sale of some properties at a profit, but in general high disposition activity is an indication of weaker credit underwriting processes.

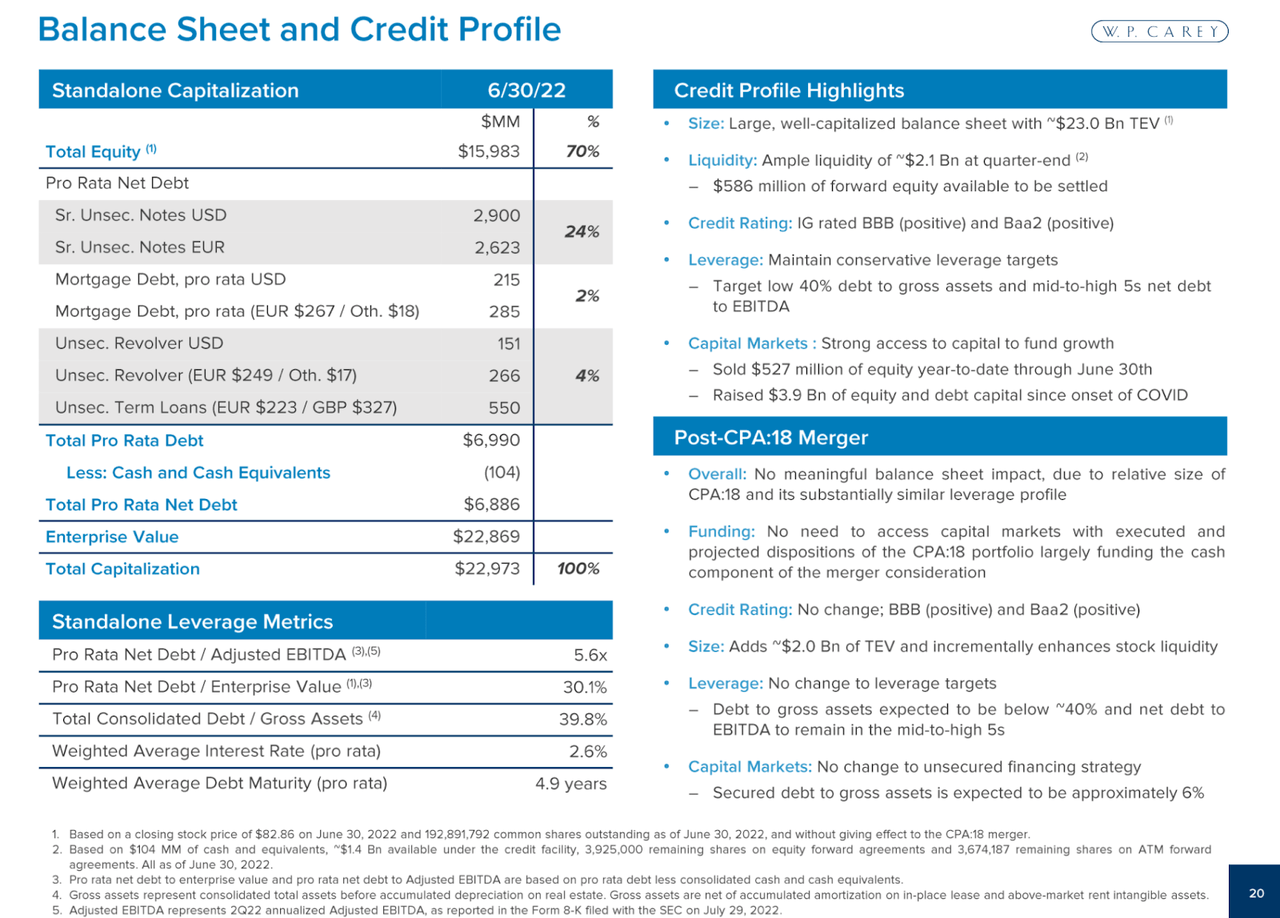

WPC ended the quarter with a solid balance sheet as evidenced by the 5.6x debt to EBITDA ratio and BBB (or equivalent) credit rating.

2022 Q2 Presentation

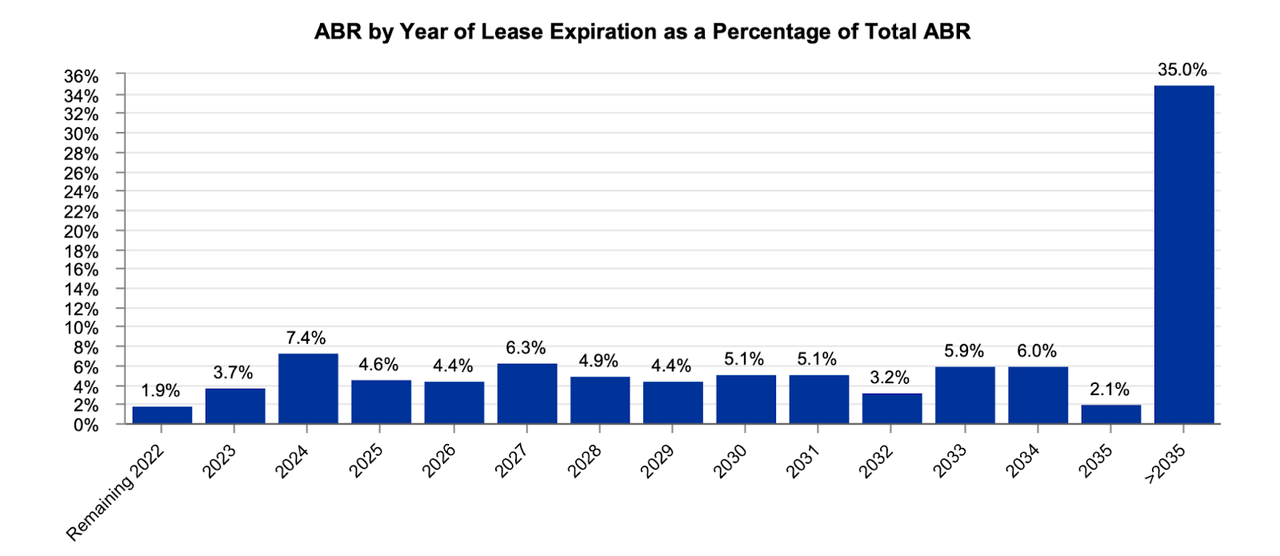

WPC has a weighted average 10.5-year lease term.

2022 Q2 Presentation

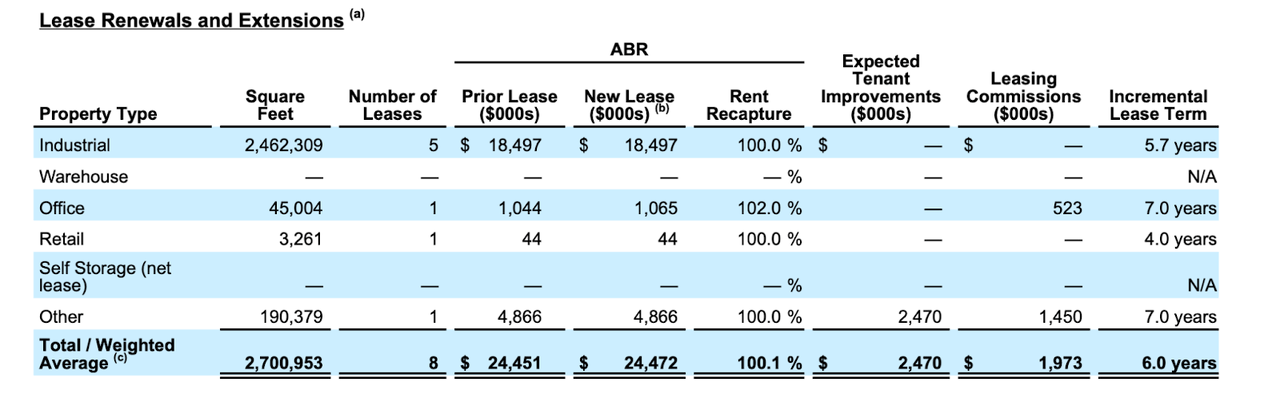

That is a little shorter than peers, which is worth noting because lease renewals can also be a source of drag on growth. WPC did generate a solid 100.1% rent recapture on renewals and extensions in the quarter.

2022 Q2 Presentation

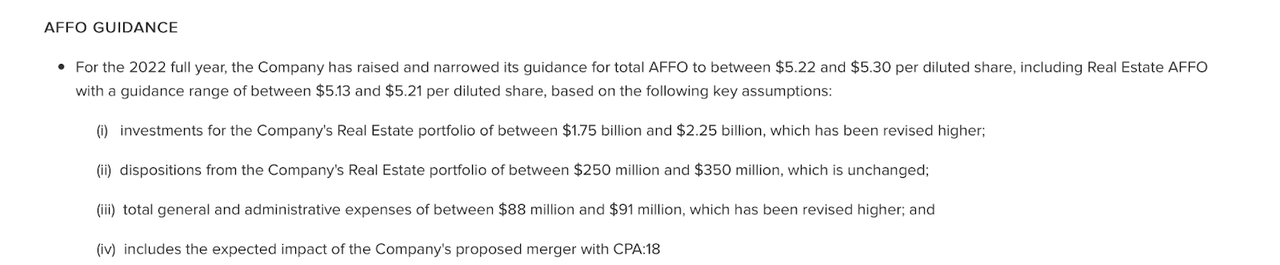

For the full year, WPC is guiding for up to $5.30 in AFFO per share, representing 5.4% year over year growth.

2022 Q2 Press Release

Is WPC Stock A Buy, Sell, or Hold?

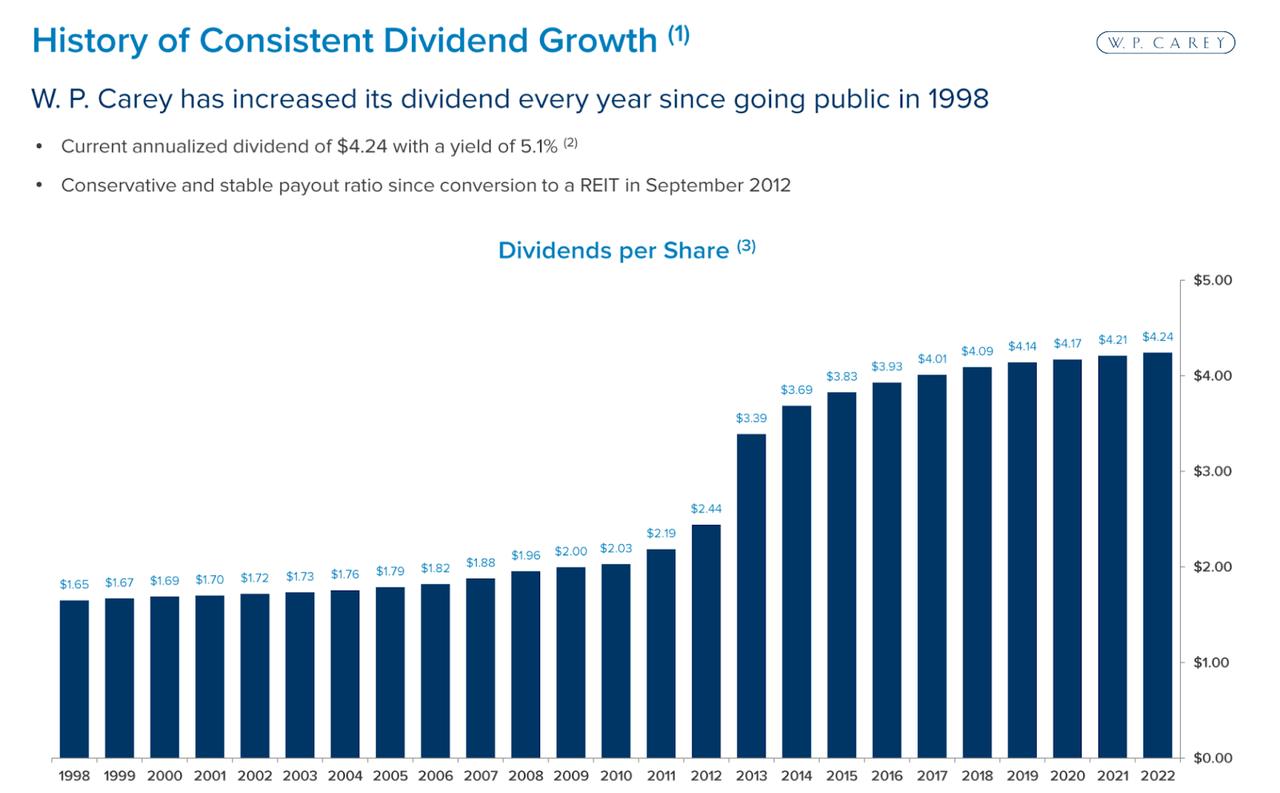

Many dividend investors may be attracted to WPC due to the 24-year dividend growth history.

2022 Q2 Presentation

I caution against such reasoning. Such a track record can help validate a business model but there are many alternatives in the net lease REIT sector. Instead, one might look at the minimal dividend increases of recent years to be more relevant. The true potential of WPC stock has been held back due to the low growth rates. I can see the stock achieving significant multiple expansion if it can bring dispositions down even lower. I can see the stock trading higher than even O due to the strong same store rent growth. But when will disposition activity dissipate? That is a difficult prediction to make.

I could see WPC trading up to a 5% yield over time, representing 16% potential upside from multiple expansion. Combined with a 2% to 3% growth rate, that may suggest around 9% to 10% annual return potential from current levels. If WPC can reduce disposition activity and keep it low, leading to stronger growth rates in the 4% to 5% range, then I can see WPC trading up to a 4.5% yield, representing 25% potential upside from multiple expansion. That would increase the annual return potential to around 12% to 14%.

What are the key risks? The most obvious risk is that disposition activity does not dissipate, and WPC eventually trades back to historical norms. The stock after all traded at yields around 6.5% to 7% prior to the pandemic. With interest rates rising rapidly, it is reasonable to assume that WPC can trade at comparable yields if not higher. The higher interest rates may also steadily increase cost of capital, as WPC may need to refinance maturing debt at higher interest rates (but this impact should be smaller due to the staggered debt maturities). WPC has been acquiring properties at a slim 6.1% cap rate – while that may be a positive for overall portfolio credit quality, it may put pressure on forward growth rates. WPC will need cap rates to expand even for higher credit tenants in order to maintain previous investment spreads. My buy rating for WPC is solely due to the high dividend yield and potential for a relative re-rating.

Be the first to comment