Guido Mieth

Thesis

Investors in leading single-tenant net-lease commercial REIT W. P. Carey Inc. (NYSE:WPC), who added exposure at its September/October lows, have seen a remarkable recovery from the panic selloff.

Accordingly, WPC has gained nearly 13% since our previous article urging investors to buy the capitulation, outperforming the S&P 500’s (SPX) (SP500) 9.8% uptick. Relative to its 10Y total return CAGR of 11.7%, it has proved to be an astute move for investors who picked those lows and didn’t fall into the bear trap.

WPC’s robust performance is secured by high occupancy rates (FQ3: 98.9% of net-lease portfolio), bolstering its resilience and consistency over the years. In addition, its market leadership, coupled with a solid balance sheet, has helped the REIT raise equity/debt financing at attractive rates despite the recent market volatility.

Therefore, it has provided WPC with significant firepower to leverage opportunities resulting from the market dislocation spurred by the Fed’s rate hikes cadence. While management has turned in a more conservative investment cadence in Q4, it remains confident in its internal rental accretion, driven by robust same-store annualized base rent (ABR), protected by contractual CPI-linked escalators (capped: 18.4% of ABR, uncapped: 36.8% of ABR).

As such, WPC has consistently traded at a premium against its broad REIT peers, given its market leadership and competitive advantage. However, with the rapid recovery from its September lows, we gleaned that WPC’s valuation is less attractive for investors to consider adding more positions now.

We also parsed that a pullback seems likely, with WPC’s price action possibly facing resistance at the current levels. Hence, we encourage investors to pause from adding exposure and wait patiently for a retracement to digest some of its recent momentum.

Revising from Buy to Hold for now.

Management Raised FY22 AFFO Per Share Guidance

Management saw a robust FQ3 performance with same-store ABR up by 3.4%, above Q2’s 3%. However, its same-store rental income crept up by just 1.5%. Notwithstanding, management remains confident that its contractual rental accretion would continue to drive “overall comprehensive same-store growth, but there will be some variability.”

Moreover, management telegraphed its confidence in seeing more robust same-store ABR metrics in FY23, as CEO Jason Fox accentuated:

I would suspect that we’ll continue to see same-store growth. That’s the one item that we have kind of a clear picture on in terms of more certainty given where we are right now and the time lag and how things flow through to our leases. We would continue to see that trend upward above the 4% to 4.5% range. (WPC FQ3’22 earnings call)

Therefore, we believe its resilient operating performance and ABR growth visibility bolstered management’s ability to lift its outlook. Accordingly, WPC increased its AFFO per share guidance to $5.28 (midpoint) from $5.26 previously. It also narrowed its guidance range, seeing lesser earnings dispersion.

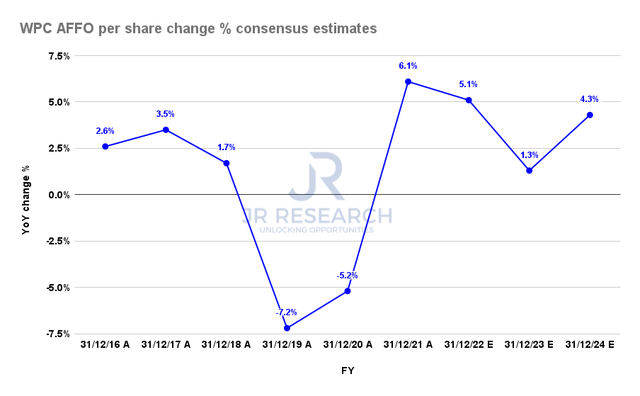

WPC AFFO per share change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) have also been lifted to reflect management’s revised outlook. Analysts penciled in an AFFO per share estimate of $5.29 for FY22 (up 5.1% YoY), slightly ahead of WPC’s midpoint guidance.

However, management also cautioned that its investment activity would slow down into Q4, downgrading its FY22 outlook to $1.75B (midpoint). Therefore, it implies an investment volume estimate of $450M for FQ4, down from FQ3’s $474.8M. In addition, management highlighted it continues to see challenges in negotiations with sellers as cap rates have moved up more slowly than the cost of capital, which has surged.

Despite that, WPC was confident that it remains well-positioned to capture opportunities moving forward despite the widening of spreads. Therefore, we believe there’s potential upside to WPC’s forward AFFO estimates if the investment environment improves further in FY23, allowing the REIT to leverage its dry powder accordingly.

Is WPC Stock A Buy, Sell, Or Hold?

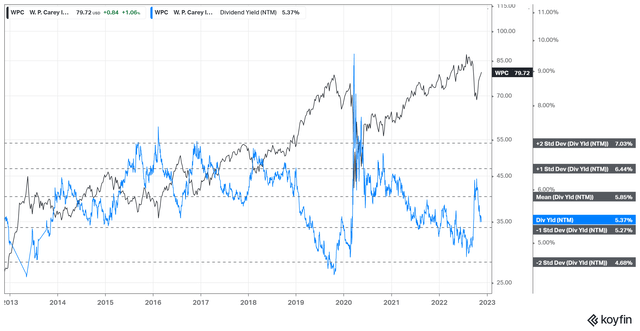

WPC NTM Dividend yields % valuation trend (koyfin)

With the sharp recovery from its September lows, WPC’s NTM dividend yield has moved away from its September/October highs of 6.2% down to 5.37%. It’s also closing in on the one standard deviation zone under its 10Y mean.

Also, WPC’s NTM AFFO per share multiple of 15.1x has moved ahead of its 10Y mean of 14.1x. Furthermore, it remains priced at a premium against its REIT peers’ median of 13.7x (according to S&P Cap IQ data). Therefore, we gleaned that WPC’s near- and medium-term upside has likely been reflected in the recovery.

With the economy likely heading into a recession, we don’t expect WPC to be re-rated materially higher from here.

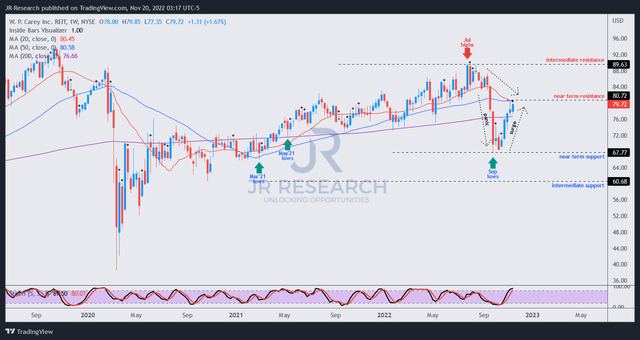

WPC price chart (weekly) (TradingView)

We observed that WPC had recovered rapidly from its panic selloff leading into its September lows.

We also noted that WPC had lost its medium-term bullish bias, with sellers likely resisting further buying upside from the current levels. Hence, we don’t consider the reward/risk attractive at these levels.

Revising from Buy to Hold for now.

Be the first to comment