halbergman

Ever since the pandemic broke out and started to rattle stock markets 2 years ago, I have become an ardent supporter of W. P. Carey (NYSE:WPC). Back then, REITs across the board had seen massive selling and W. P. Carey dropped as low as $38.62. That was the time when I started doing my due diligence on the company and subsequently started to invest into the stock with the goal to make this one of my core holdings.

I haven’t regretted that decision at all with the only regret being not having bought more. W. P. Carey’s rent collection has been in beast mode throughout the pandemic and as the company gained more visibility into its virtual insulation from COVID-19 management refocused attention on ongoing investments and buying assets at distressed prices.

More than 2 years later, the company is at its strongest ever, boasting a superior dividend and guiding for much better than expected adjusted funds from operations for 2022. Dividend growth has been anemic over the past couple of years, but with 2022 poised to be very strong, W. P. Carey’s payout ratio will finally come down meaningfully and should provide the company with ample opportunity for faster dividend growth going forward.

What is going on at W. P. Carey?

W.P. Carey started the year with an initial bullish 2022 AFFO guidance between $5.18 to $5.30 representing between 3% to 5.4%. Over the course of two quarters that guidance narrowed to a range between $5.22 to $5.30 driven by soaring inflation as a large portion of W.P. Carey’s rent contracts are CPI-linked.

The REIT generated FFO per share of $1.31 for the most recent Q2 quarter representing an improvement of $0.04 vs. the same quarter a year ago. Portfolio occupancy reached its highest level since 2017 at 99.1%. Impressively, the last time portfolio occupancy dipped below 98% on a full-year basis was more than 10 years ago in 2011 when it was recorded at 97.3%. That is testament to W.P. Carey’s strong tenants and management’s smart portfolio allocation. Similarly, rent collection, which had been of vital importance during the peak of the COVID crisis, is well above 99%.

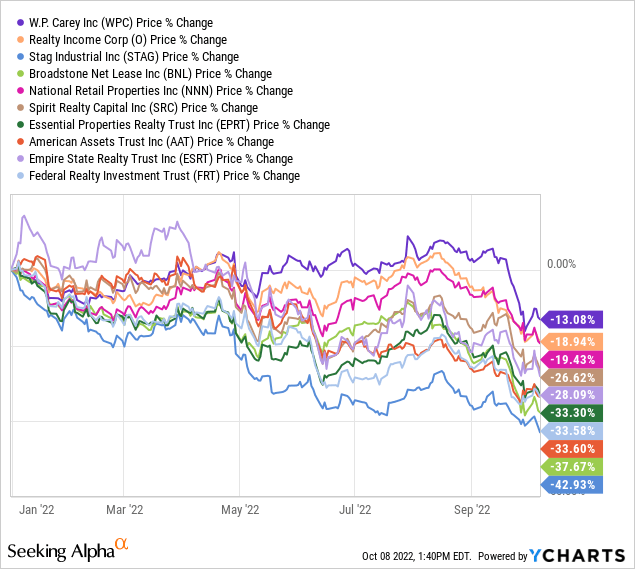

Contrary to many REITs W.P. Carey’s stock performance in 2022 has been very solid with the REIT outperforming all its peers.

One can certainly argue whether the stocks selected in the chart above constitute all of WPC’s peers but at the end of the day I believe that this is a representative collection of similar companies and it becomes blatantly obvious that W.P. Carey has reigned supreme. In fact, most of its 13% YTD decline is attributable to the last two to three weeks when the entire REIT and BDC sector found itself in the midst of an indiscriminate and relentless selloff.

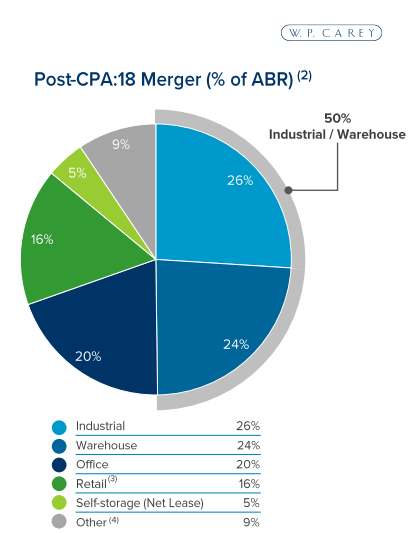

In my view, W. P. Carey is the most diversified landlord on the market with an almost perfectly balanced portfolio. W. P. Carey has been constantly expanding its property portfolio which currently consists of 1,390 net lease properties, which is up from 1,261 5 quarters ago. In terms of diversification, W. P. Carey’s portfolio has almost been equally split among four key property types: Industrial (26%), Warehouse (24%), Office (20%) and Retail (16%). Over the last year, W. P. Carey has made some key strategic decisions regarding its portfolio by focusing on growing its industrial and warehouse divisions.

W.P. Carey Property Diversification (Investor Relations)

The Industrial/Warehouse cluster sits at 50% of annualized base rent and is the main reason why W.P. Carey mastered the pandemic almost unscathed. Now the upcoming recession will be different from COVID as it will likely lead to a significant decline in consumer spending and while that may impact the expansion in the Industrial and Warehouse segment, this does not mean that W.P. Carey won’t continue to collect rent.

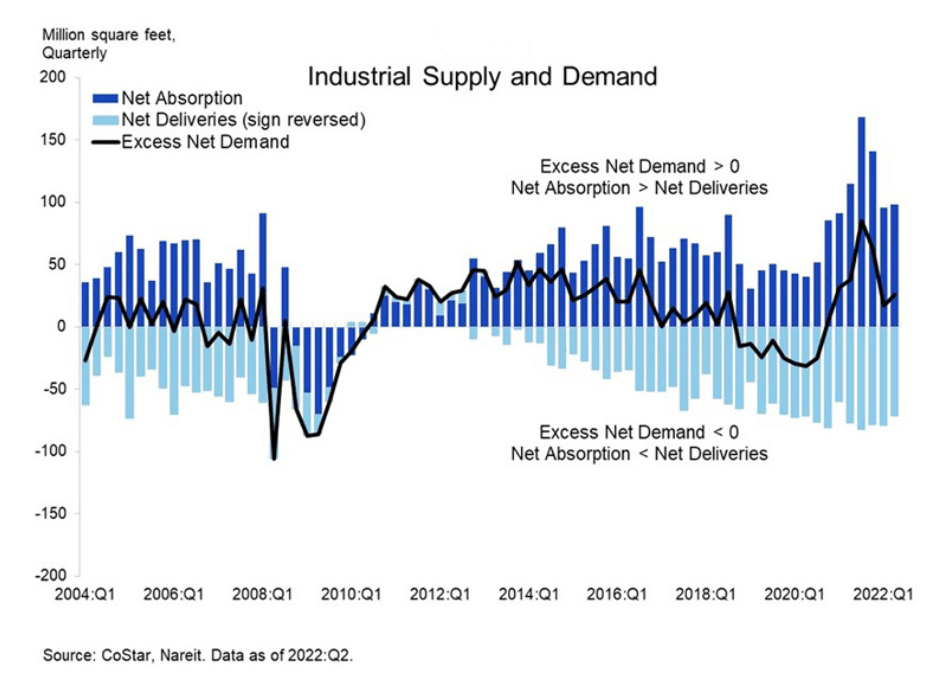

What’s more, according to a report by the National Association of Real Estate Investment Trusts (Nareit), Q2 industrial demand exceeded industrial supply which shows that despite dramatic headlines like Amazon scaling back on its warehouse operations the broad market continues to grow and continues to offer attractive opportunities for REITs at least those operating in the industrial sector.

Industrial Supply and Demand (Nareit)

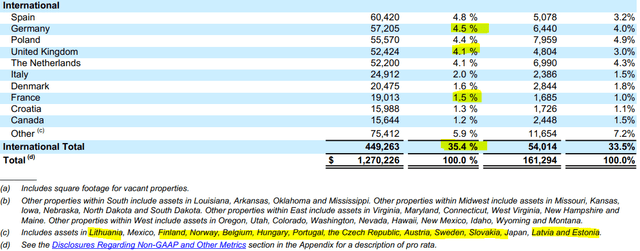

The REIT is not only diversified by property but also by geography, with roughly 2/3 of annualized base rent coming from the U.S. and another third from Europe, Canada, Mexico and Japan. Especially as a German investor who relies on the Euro as the main currency, it is assuring to see that with W. P. Carey I am not 100% exposed to EUR/USD exchange rates but that at least a third of that is indirectly embed into the business and its stock price.

That has always been my line of argumentation in the past when it came to W.P. Carey and the question is if that is still valid against the background of the current energy crisis plaguing the European continent. Following the outbreak of the war in Ukraine energy exports from Russia to Europe have been declining month after month and with the recent escalation in the Baltic Sea where Nord Stream 1 and Nord Stream 2 got hit there is little hope that any gas will be flowing through these pipelines for the remainder of the year. While Europe and especially Germany have been scrambling to get off Russian gas by sourcing American LNG and increasing gas exports from Norway as well as trying to forge new energy partnerships in the Middle East and North Africa, the current situation as we are approaching the winter remains uncertain. Inflation is approaching double-digit territory in the euro area and national as well as European initiatives are seeking to cap off the increase in gas and electricity prices. Establishing price gaps will be a very costly endeavor with anybody’s guess as to how successful and how expensive they eventually will turn out to be.

That said, while the situation looks grim, it is manageable and unprecedented government support will likely help to cushion the worst of rising energy prices which remain the main inflation driver and the main driver for declining consumer demand.

W.P. Carey’s exposure in Europe amounts to 35.4% of annualized base rent with the following country breakdown:

W.P. Carey International Portfolio (W.P. Carey 10-Q)

Germany, which is the euro area’s largest economy, and France (number 2), account for a mere 6% of W.P. Carey’s annualized base rent. These two countries are in my view ironically also the two most likely to encounter any type of energy shortage during the winter, albeit for different reasons. Germany had been overly dependent on Russian gas and gradually phased out nuclear energy and is now unfortunately ideologically scrambling to even decide on a temporary and vital operating extension for the 3 remaining nuclear power plants that are otherwise scheduled to go offline by the beginning of 2023. France meanwhile is overly reliant on its own nuclear energy but due to maintenance overhangs, structural concerns and low water levels in the rivers preventing effective cooling it currently has to import electricity from Germany and is facing an uncertain winter.

That is certainly not a pleasant outlook but the good news for investors is that W.P. Carey’s tenants in Germany are mainly home improvement chain Hellweg and wholesale stores from Metro which are very large businesses that will continue to pay rent even if their own business is facing margin pressure.

It should be noted that every crisis also boasts opportunities and with WPC’s rock solid balance sheet and ample liquidity of $2.1B at the end of Q2 the REIT is in a great position to selectively benefit from these opportunities both in terms of accretive acquisitions as well as using its financial prowess as bargaining power to foster its relations with its tenants and leverage that for lease extensions:

Yeah, it’s an opportunity both to invest in capital, but may be equally important. It allows us to kind of have these conversations with tenants get lease extensions kind of further embed our properties within their operations. So I think that’s all positive. But yeah, in the short term it’s going to provide a little bit of pressure on some tenant margins certainly.

Source: W.P. Carey Q2/2022 Earnings Call

In my view, the most crucial thing right now is to take a good look at the debt profile of REITs and BDCs in order to assess their relative strength in this high-interest environment which we haven’t been confronted with for decades. And it is not only the expected peak interest level of around 5% in 2023 which is concerning but also the immense pace at which the Federal Reserve is hiking rates. The Fed caused that situation all by itself as it deemed inflation transitory for many months and was significantly too slow to react to the outbreak of the war and soaring energy prices.

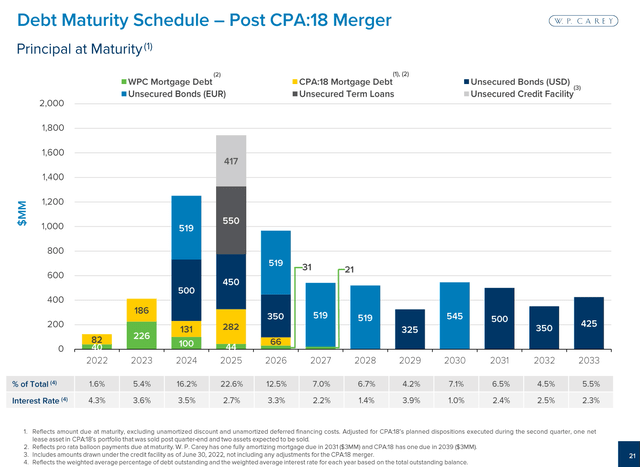

W.P. Carey sports a solid and conservative balance sheet with a manageable debt maturity ladder. Especially in the near term until 2024 only 7% of total debt is maturing. Given the rapid pace of the Fed’s interest rate hikes we can currently expect that interest rates may peak towards the end of 2023. That means that theoretically interest rates could start declining from 2024 onwards but that outcome is very uncertain and subject to a lot of external factors most notably inflation, the state of the economy and the stability of financial markets. With almost 40% of total debt maturing in 2024 and 2025 W.P. Carey will have to prepare for that in time.

W.P. Carey Debt Maturities (Investor Relations)

I have full confidence in W.P. Carey to master the crisis due to high internal growth and its favorable cost of equity since unlike all of its peers W.P. Carey’s stock price has been very resilient and thus offers attractive opportunities to raise capital. The last time W.P. Carey did raise capital was in early September before the recent market selloff impacted its stock price. It raised $350M of debt at attractive interest rates over a 7Y and 10Y period of 3.41% and 3.7%.

W.P. Carey is equipped with sufficient liquidity, a rock-solid balance sheet and a resilient stock price to benefit and navigate the slowing economy and potential recession.

What’s in WPC Stock for Dividend Investors?

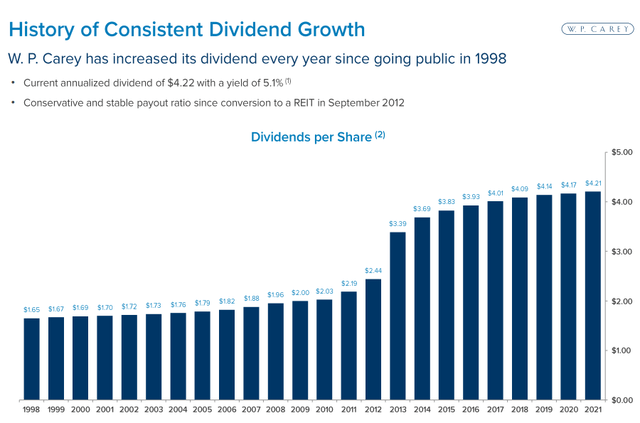

W. P. Carey has a long and strong dividend track record with over 20 years of annual dividend growth and year-long series of quarterly, even if mediocre, dividend hikes since its IPO in the late ’90s and is thus closing on joining the illustrious Dividend Aristocrat cycle.

It is one of a very few REITs that was able to maintain its dividend growth streak amid the pandemic. While these dividend raises can only be described as anemic or as a tiny snowflake (it is just 0.2% per quarter), for an investor with many years or decades of investing ahead, even a tiny snowflake can turn into a big snowball, especially when that initial snowflake, the current dividend yield, already starts at above 5.9%.

W.P. Carey Dividend Track Record (Investor Relations) Right now, the yield is very close at 6%, and there is no real reason why the stock should be yielding that much, despite the fact that the market is either massively discounting the stock or significantly underestimating the resilience of W. P. Carey’s tenants and that of the portfolio overall.

I started my position in W. P. Carey in March 2020 and have been running it on bi-weekly investment plans ever since, as well as opportunistically adding more shares when I have some money left.

The main reason for that anemic dividend growth over the last couple of years is W. P. Carey’s relatively high payout ratio which was consistently above 80%. Based on its current dividend, the 2021 AFFO payout ratio came in at 83.7%. Factoring in the company’s 2022 guidance, the year-end AFFO payout ratio would drop below 80%. And although management hasn’t explicitly communicated any target payout ratio, a level below 80% is certainly more sustainable than what the REIT had managed to achieve the last couple of years.

This is a great development and inspires some confidence in me that dividend growth will reaccelerate next year and provide a better safety cushion against inflation. Since 2014, the annual dividend only increased by a meager 14% in total, but for investors looking for a safe and high income, this is an attractive stock. As mentioned above, going forward, higher inflation is more likely to be a tailwind for the company than a headwind and there aren’t many dividend paying companies out there who can claim that.

What’s really fascinating about W. P. Carey, however, is how well it puts its diversification to work for investors. For example, it has avoided U.S. retail assets in favor of European retail, because it believes the U.S. has too many stores. And early in the pandemic, it announced plans to buy industrial and warehouse assets. It saw an opportunity to invest in an increasingly important property type while companies were trying to bolster their liquidity in the face of the health scare.

Investor Takeaway

W.P. Carey is best of breed in the triple net lease sector and its 2022 stock performance despite numerous headwinds speaks for itself. Its YTD performance is also negative but that applies to virtually every stock especially REITs and BDCs and W.P. Carey is clearly outperforming its peers thanks to its strong balance sheet, CPI-linked contracts and a strong and diversified portfolio.

W.P. Carey is equipped with ample liquidity that it can cautiously and selectively leverage to take advantage of the numerous opportunities that will emerge. The stock is not as cheap as other REITs, for good reason, but with a 6% yield I am a happy investor and will continue with my bi-weekly savings plans.

Be the first to comment