portishead1

Thesis

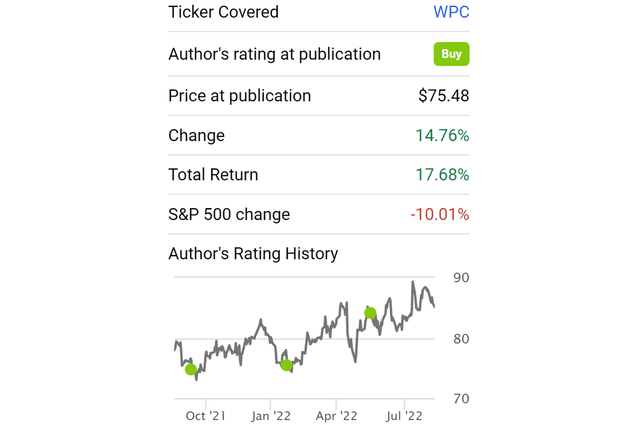

I have been publishing a bull thesis on W. P. Carey (NYSE:WPC) in the past years when the stock prices were in the $75 range. To me, that price represents a valuation discount too large to ignore (corresponding to a P/FFO around 14.5x only) for the premier properties it operates globally. Indeed, its stock prices have shown a strong climb against the backdrop of an overall market decline. To wit, as you can see from the following chart, the S&P 500 suffered a total loss of more than 10% since then. In contrast, WPC delivered a total return of more than 17%.

Therefore, despite the strong results it posted during Q2, such a large price appreciation has stretched the valuation by quite a bit. Currently, it is trading at about 16.2x forward Price/FFO multiple. However, in the remainder of this article, I will argue that such a valuation is still reasonable and there is still plenty of room for the price to further appreciate when such a fair valuation is combined with its robust investment activities and growth perspective. And the current valuation still implies an underestimate of its growth potential.

All told, I expect a target price of around $95 by 2023 based on a 17x P/FFO multiple and a projected FFO of $5.5 per share. Furthermore, its total return potential is further protected by its inflation-proof income, generous dividend yield, and strong balance sheet, as to be elaborated on next.

An inflation proof portfolio

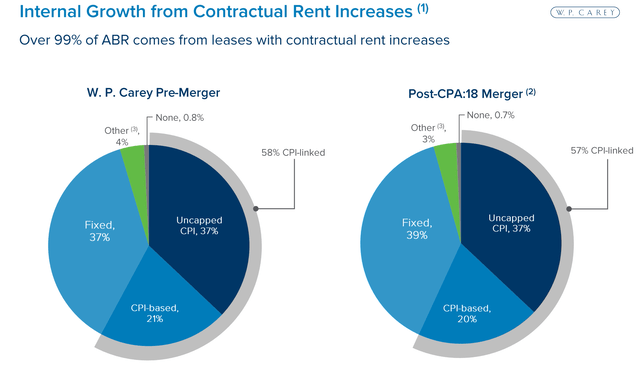

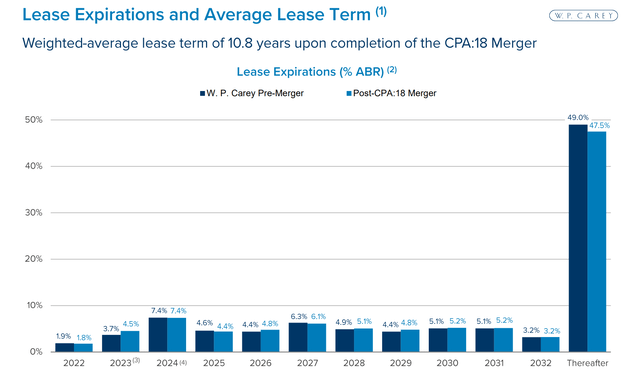

While the overall economy is struggling with high and persisting inflation, WPC’s income is largely shielded from these uncertainties due to its high-quality portfolio, well-diversified geography exposure, long duration of leases, and also contractual rental increases as you can see from the chart below.

Over 99% of its APR comes from leases with contractual rent increases. And after the CPA:10 merger (more on this in the next section), 57% of its rent would be CPI-linked as CEO Jason Fox commented (abridged and emphases added by me)

And because over 99% of our ABR comes from leases with embedded rent growth, the majority of which is tied to CPI. We continue to feel good about the all-in returns we are earning for our investors relative to our cost of capital. In fact, for investments with rent increases tied to CPI, higher expected rent growth in the near term may partly compensate for a higher cost of debt.

Strong investment activities and CPA:18

Besides the above contractual recent increases, I see a few other catalysts to support robust growth. I expect the strong investment momentum evident in the first two quarters to persist in the future. During its Q1 report, investment volume reached $415 million YTD. And during the Q2 report, the volume reached $1.1B, well on its way to the targeted range for 2022 of $3.5 billion to $4.0 billion.

In the meantime, its merger with the remaining captive REITs is well on track too. And the CPA:18 merger was one of the most impactful items as CEO Jason Fox commented during its Q1 earnings report. Since then, the merger has been progressing smoothly and I view it as a very positive move both in the short term and long term. Completion of the transaction is expected in the third quarter. After the merger is completed, the weighted average lease term is expected to be 10.8 years, providing stability to the rent income as aforementioned.

Consensus estimate for its FFO is in the range of $5.14 to $5.23 per share in 2023. However, I think these estimates are too low based on the following comments provided by CFO Toni Sanzone commented during the ER (abridged and emphases added by me). These ongoing investment and merger activities will not only be accretive to earnings but also could also potentially cut costs as the synergies progress.

…given the pace of our investment activity year-to-date and the visibility we have into our pipeline, we are raising our guidance assumption for investment volume by $250 million at the midpoint to between $1.75 billion and $2.25 billion, which of course is separate and in addition to the approximately $2 billion of assets we expect to add through our merger with CPA:18. Upon completion of the merger, we expect CPA:18’s net lease assets to add approximately $75 million of annualized base rent in addition the 65 self-storage operating properties we are acquiring from CPA:18 are expected to generate approximately $60 million of annualized operating NOI, with an estimated $26 million contribution to our 2022 guidance from the close of the merger through the end of the year…

Balance sheet strength

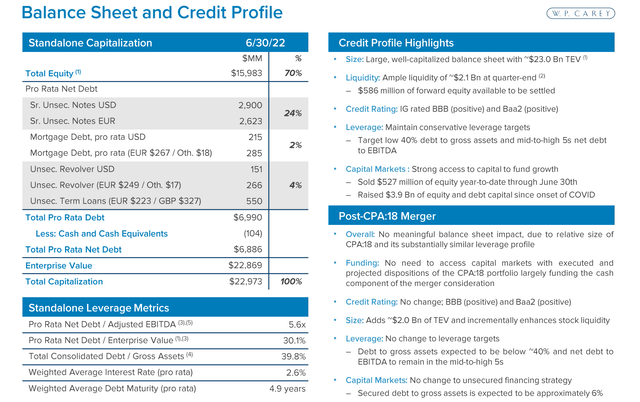

The balance sheet remains in strong shape despite the above activities thanks to its strong cash generation, and also the support from both debt and equity investors. As of Q2, its total equity stands at $15.9B and debt stands at $6.8B, leading to a total EV of $22.8B. Hence, the net debt to total EV ratio of 30.1% and the balance sheets is very conservatively leveraged at this point, as CFO Toni Sanzone commented during the ER (abridged and emphases added by me):

Turning to our key leverage metrics. At the end of the second quarter, debt to gross assets was 39.8% toward the low end of our target range, which is expected to be virtually unchanged with the closing of the merger. Similarly, net debt to EBITDA was 5.6 times at quarter end and expected to remain well within our target range with the closing of the merger…. Cash interest coverage ratio was 6.6 times over the second quarter, among the strongest in the net lease peer group.

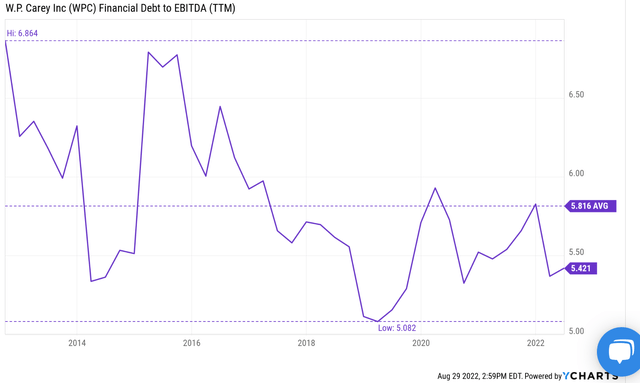

To put the above comments under a broader perspective, the second chart below shows the debt to EBITA ratios over the past decade. As you can see, the business has been in general deleveraging its balance sheet over the years. The ratio fluctuated between a peak level of 6.8x in the earlier part of the decade to a bottom level of 5.1x in 2019. The long-term average is 5.8x. And currently, its leverage ratio of 5.6x as of the end of Q2 is not only below the historical average but also towards the lowest level in a decade.

WPC Q2 Earnings Presentation Seeking Alpha

Valuation and dividend

Despite the growth potential and the strong balance sheet as discussed above, its valuation remains reasonable.

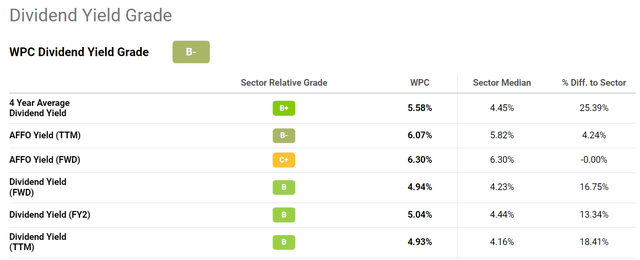

In terms of dividend yield, it is currently yielding 4.94% on a forward basis. Admittedly, the current yield is below its four-year average of 5.58% by about 12%. As aforementioned, the large price appreciation in the past year or so has stretched its valuation. However, a 12% premium is not that large and could be well within the margin of error. And next, we will see that the premium is even lower in terms of P/FFO multiple. Finally, note that WPC’s FW dividend of 4.94% is above the sector’s average dividend yield of 4.23% by 16.7%, providing further support to total shareholder returns.

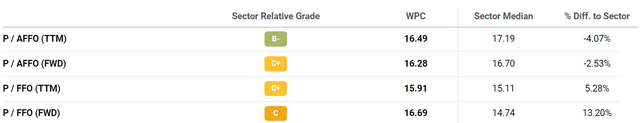

In terms of P/FFO multiples, the valuation premium (if there is any) is totally within the margin of error in my view. As you can see from the first chart below, its P/AFFO ratio (16.4x on a TTM basis and 16.2x on an FW basis) is actually below the sector average by 4% and 2.5% respectively. To me, this signals a mispricing considering the growth potential, quality of its assets, and the financial position discussed above.

Final thoughts and risks

All told, the thesis is that WPC’s growth potential is undervalued. The consensus estimate for its FFO is in the range of $5.14 to $5.23 per share in 2023. However, I think these estimates are too low and my estimate is around $5.5. Its ongoing investment and merger activities will not only be accretive to earnings but also could also potentially cut costs as the synergies progress. In terms of valuation, its current P/FFO multiples (16.3x to 16.5x) are actually below the sector average. Assuming its multiple expand to 17x to be on par with the sector would lead to a PT of around $95 by 2023.

Finally, risks. There are certainly macroeconomic risks ahead. Both the U.S. and the rest of the world are facing the possibility of a recession, which could impact WPC’s income. At the same time, as a global business, WPC’s profit could also be negatively impacted by currency fluctuations, both the U.S. dollar and the Euro as CFO Toni Sanzone commented during the ER (abridged and emphases added by me):

…as a reminder, we hedge the impact of foreign currency movements on our cash flows in two principal ways. First, by overweighting debt denominated in foreign currencies, primarily the euro, creating a natural hedge through interest expense. Our foreign denominated operating expenses also add to that natural hedge.

Be the first to comment