sommart/iStock via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on May 29th, 2022.

W. P. Carey (NYSE:WPC) is quite the popular REIT on Seeking Alpha, getting brought up in many discussions. This is for a good reason too. This REIT keeps on delivering the dividends to investors as they raise quarter after quarter, rather than the usual annual increase. These increases have been rather slow lately but might be due to pick up the pace in the future.

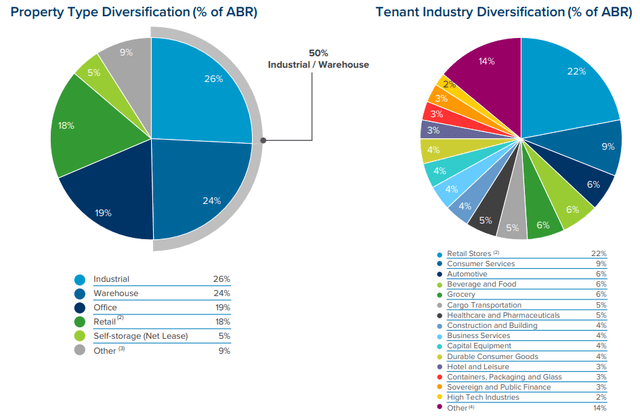

It’s also a diversified REIT, meaning it shouldn’t have too much concentration risk across its 1336 properties with 157 million square feet. They aren’t only diversified through the tenants and industries that they provide these square feet for, but through geography too. They have properties in the U.S. and Northern and Western Europe.

WPC Property Diversification (Investor Presentation)

Their latest earnings showed us a collection rate of 99.7% for Q1 and a portfolio occupancy of 98.5%. The weighted average lease terms of 10.8 years mean they have their tenants locked in for a while. AFFO was up 10.7% year-over-year ($1.35 vs $1.22.) These are all strong metrics, in my opinion, that make WPC worth a look.

Defying Gravity In 2022

Despite this diversification, during the COVID market crash, this REIT wasn’t insulated. Its price had declined quite substantially – along with the rest of the market. WPC still hasn’t reached its pre-COVID high of $88 it touched in February 2020.

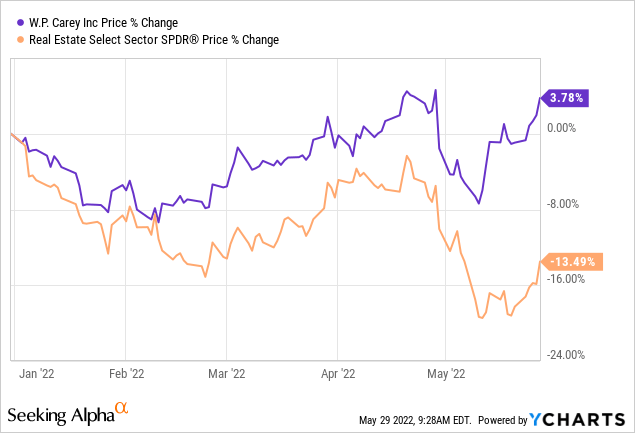

However, for this year, WPC has been bucking the trend of mostly being down. This is especially interesting considering the real estate sector isn’t holding up any better during this inflationary and interest rate Fed-driven decline.

Ycharts

This is where the rent escalations come in for this REIT. Most REITs have some way of increasing rents automatically based on a percentage. Several of the REITs I follow have it around 1% (thinking Realty Income (O) and Agree Realty (ADC).) For WPC, they have it tied to CPI. With inflation being so high, their rent escalations are certainly paying dividends!

Here are the remarks on the latest conference call:

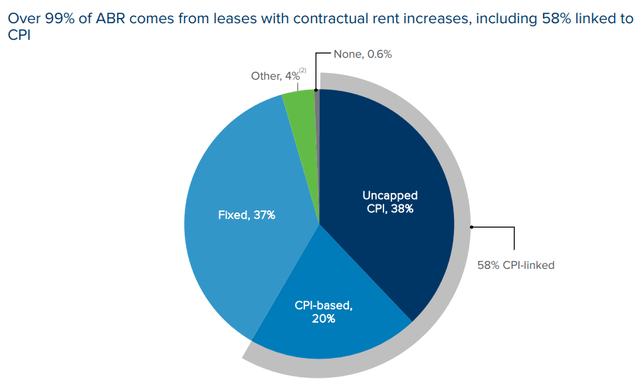

Turning now to the more meaningful impact that inflation is having on our rents. We continue to believe we’re better positioned than any other net lease REIT to capture higher inflation through rent growth. is 58% of our ABR having rent escalations tied to CPI. On an ABR basis, 40% of our assets with rent increases tied to CPI went through scheduled rent increases during the first quarter with an average increase of 4.5%.

It’s important to keep in mind that the 4.5% is capturing the year-over-year impact of fourth quarter CPI. And with inflation currently running at around 8% in both the U.S. and Europe, we’d expect to see significantly higher rent growth in 2022 and even more significant impact in 2023. We view this as especially valuable in the current environment, perhaps underappreciated by REIT investors, given that it has no cost of capital associated with it and has the potential to provide a prolonged tailwind to earnings even after inflation begins to decline.

WPC Rent Increase Breakdown (Investor Presentation)

That’s certainly great news for investors of WPC. They have a natural hedge against inflation because properties tend to rise in value through inflation. Now, they also have these embedded rent increases. These increases can keep pace better with inflation relative to other popular REITs.

This is obviously the positive angle of investing in WPC in this current environment. The bear argument would be that every investor seems to have realized this by now. Thus, the price of WPC remains elevated amongst this overall broad decline.

There have also been hints now that inflation could be peaking. Even if it isn’t, we know at some point it will diminish. That will happen eventually as the Fed tempers the economy down and/or we hit the next recession.

Is WPC Still Worth Investing?

The forward P/FFO of WPC comes in at 16.57 based on the expected $5.14 in FFO from analysts and the last closing price of $85.15. WPC actually guides for a bit higher AFFO range of $5.18 to $5.30. They’ve also announced a potential merger with Corporate Property Associates 18. That guidance doesn’t include the impacts of that merger.

Given the forward P/FFO of 16.57, we are elevated relative to where WPC has traded in the past. In 2018, we saw a P/FFO of 11.89. 2019 showed us an elevated 15.86, but still below where we are now. 2020 gave us an ending P/FFO of 13.85. Even at the end of 2021, the P/FFO was 15.96, below where we are now as shares continued higher.

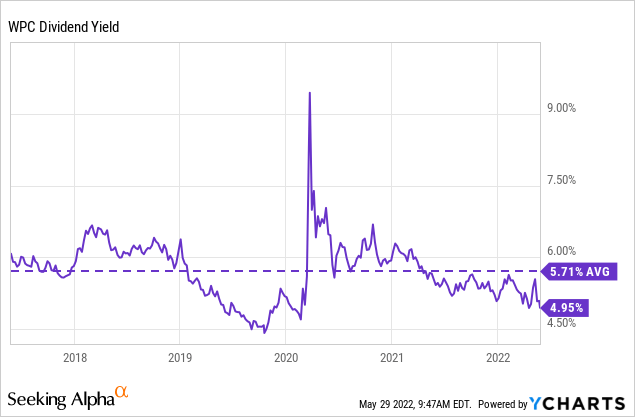

We can also give it the yield test and see that we are elevated. REITs are income-oriented investments. The yields can tell us much about what is going on and where they have historically paid. It isn’t perfect, but it is another quick way to see where we are. Historically, WPC has yielded around 5.71% when looking over the last five years.

Ycharts

Given the latest annualized dividend payout of $4.228, getting back to that yield would bring us to $74 a share.

All this being said, despite it being elevated compared to where it has been trading historically can make sense. Again, we are expecting better earnings growth going forward due to the strong CPI-tied rent increases.

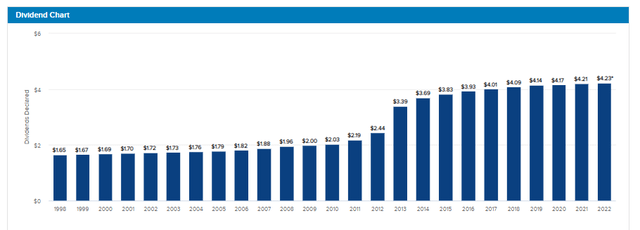

That brings us to the other point, where a long-term investor is probably more concerned. That is the dividend growth. They have increased every quarter for years. In fact, before they were even structured as a REIT, they were raising every quarter. It appears that this trend went back all the way to 2001. That includes straight through 2008/09. In 2007, 2009 and 2013, they had paid special dividends that could throw some dividend charts off.

WPC Dividend History (WP Carey)

Even before they were increasing the dividend every quarter, they were doing the typical annual increases since they went public.

These increases have been slow, particularly over the last several years have slowed to a snail’s pace. However, given the fact that they should be picking up in AFFO growth, that could lead to higher dividend growth going forward.

Based on their midpoint of AFFO guidance for the next fiscal year at $5.24, that puts the current payout ratio around 81%. That isn’t overly elevated for a REIT, but it is higher than some of its peers. STORE Capital (STOR), as an example of another diversified REIT, comes in at a payout ratio near 72%.

The midpoint AFFO guidance means they expect a 4.17% increase in AFFO above the 2021 fiscal year of $5.03. In the last several years, they have increased the annual dividend by just 0.79%, 0.77% and 1.22%. Meaning that based on their guidance, either the payout ratio will come down, or we could see some larger increases.

All this being said, the dividend yield is still incredibly attractive at nearly 5%.

Conclusion

WPC is expensive, but it is also better sheltered for the current environment. I’m not an investor to invest based on the next six months to a year though. While it certainly helps and makes it a bonus for the short term, I’m a long-term investor looking at WPC.

What is more pressing for me as a long-term investor (looking out 5 to 10 or even 50 years) is the sustainability of the investment and how it fits into my overall portfolio. For WPC, I think it makes a great long-term investment choice based on bringing greater diversification. In particular, owning rental properties outside of the U.S. brings a lot to the table for my currently U.S.-based portfolio.

What I would be looking for to initiate a position would be to see shares come down. Just a few weeks ago, shares were trading at around $76 a share. Today, we are pushing near the 52-week high of $86.48. Morningstar assigns a fair value of $80.74 based on an algorithm.

A 10% decline from the current trading level would indicate a price near $78. Overall, I think that is where I’d want to be picking up shares in that $75 to $78 range to make it feel like I’m getting a good deal. Based on their guidance, this would put the P/FFO range at 14.30 to 14.90.

Therefore, I’m a few days late to this party, but it is a perfect name for my watchlist. The problem with this is we could be in the beginnings of a reversal in the overall market. So it could be sitting on the watchlist for quite some time.

Be the first to comment