metamorworks/iStock via Getty Images

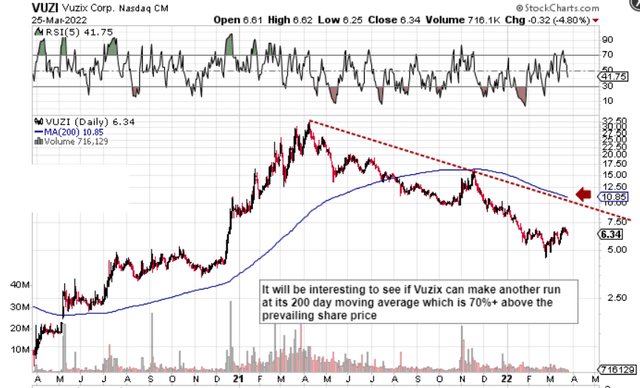

If we look at a technical chart of Vuzix Corporation (NASDAQ:VUZI), we can see that overhead resistance by means of the multi-month downcycle trend line is located at practically the same level as the stock’s 200-day moving average of $10.85 per share. Suffice it to say, overhead resistance in Vuzix is located 70%+ north of where shares are trading at present ($6.34 a share). This really is the trading opportunity at present in Vuzix, which essentially is a potential bear market rally. For an actual fresh bull market to ensue in Vuzix, shares would need to get back above their 200-day moving average and begin a pattern of higher highs. The chart at present, however, remains bearish especially given the fact the shares have already failed to take out overhead resistance just 4 months ago (November 2021).

Technical chart of Vuzix (VUZI) (Stockcharts.com)

Furthermore, the company’s short-interest ratio remains above 30%, and although inside buying continues to take place, they are only of a token nature. In this present month of March, for example, 4,250 shares have been bought thus far by insiders, which came to an investment of just over $25k. Vuzix’s present market cap is over $400 million. The company did state recently that a $25 million share buyback program had been approved, so it will be interesting to see when shares will actually be bought back.

Furthermore, the fundamental areas of concern for long-term investors are Vuzix’s valuation as well as its clear lack of profitability. Despite the fact that the company’s top-line growth is expected to top 34% in fiscal 2022, Vuzix remains unprofitable and consensus estimates with respect to projected EPS numbers do not forecast any meaningful growth in years to come.

Management actually alluded to this on the recent fourth quarter earnings call when the CEO stated that there was still 5+ years of cash available to fund the cash flow burn rate every year. This is essentially the problem with growing industries such as the augmented reality smart glasses space in that heavy investment will most likely be needed for a sustained period of time to stay at the forefront. There are several tech companies in the market for example itching to get a piece of this growing market, but it is fair to say that Vuzix has an advantage here with respect to how it has improved its waveguide technology to name but one.

In 2021, for example, on the technology side, the company continued to double down its investments in waveguides, optical solutions, and display engines. Considering what management believes this industry will eventually be worth, you can bet that related investments will continue and that bottom-line profitability will continue to come in a distant second in terms of priority. In saying this, the durable M400 once more in the fourth quarter was the main seller, but recurring orders from existing customers is a theme that is beginning to gain traction.

From an investor’s standpoint, it would be interesting to know how many orders or initial pilot schemes have been issued to date. The reason being is that these pilot orders are usually only to test the water so to speak especially among really large corporations. On the product side, Vuzix recently added the M400c & the Shield to its portfolio. Suffice it to say, if value can continue to be added on the product side, and these trial companies really see the benefit of the improving technology on offer, then sales growth could undoubtedly increase significantly.

As a potential investor, R&D and the patented protected products are where I would like to see that $120 million of war chest funds being used. Why? Because competitors with deeper products will have no problem on the marketing side to expand their operations if indeed they see an opportunity to pounce. Investing in sales personnel, marketing initiatives, and third-party networks (which Vuzix is undergoing) should all continue to be lagging factors. Why? Because if the quality is there (which will drive the demand), customers will find the necessary channels to get their hands on the products over time.

Therefore, to sum up, although Vuzix continues to fail to make a real imprint on its bottom-line profitability, sales are expected to grow by up to 35% in fiscal 2022. There are two ways to view Vuzix from an investor’s standpoint. A value investor for example would most likely be disinterested due to the very high sales multiple. On the other hand, the growth investor may state that this valuation is indeed a sign of the potential in this stock (and industry). If the company can hit its estimates in Q1 and beyond, we continue to believe the 200-day moving average at a minimum is a viable target here for a swing play in the short term. We look forward to continued coverage.

Be the first to comment