ipopba

A Quick Take On Voxtur Analytics

Voxtur Analytics Corp. (OTCQB:VXTRF) recently reported its Q1 2022 financial results on May 31, 2022, as revenue and gross profit grew sequentially.

The company provides a suite of software as a service (“SaaS”) real estate assessment, valuation, settlement, and other related software functionalities to businesses worldwide.

VXTRF faces risks as it appears the U.S. economy is nearing or already in a recession, which may slow sales cycles for some of its offerings.

With these macroeconomic risks and increasing operating losses, I’m on Hold for VXTRF for the near term, although the stock is worth putting on a watch list.

Voxtur Analytics Overview

London, Canada-based Voxtur was founded as iLOOKABOUT to provide real estate software technologies to investors, lenders, government agencies and mortgage servicers.

The firm is headed by Chief Executive Officer Jim Albertelli, who was previously founder of ALAW, a legal services provider to financial services and mortgage banking firms in North America.

The company’s primary offerings include:

-

Tax assessment

-

Property valuation

-

Settlement services

-

Data & Insights

-

Attorney Opinion Letter [AOL]

-

Wealth

Voxtur’s Market

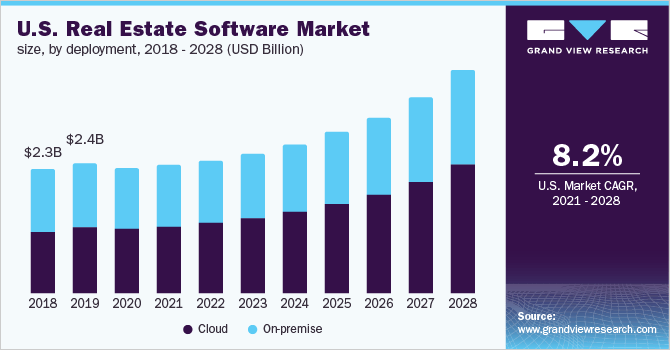

According to a 2021 market research report by Grand View Research, the global market for real estate related software was an estimated $9.34 billion in 2020 and is forecast to reach $19.6 billion by 2028.

This represents a forecast CAGR of 9.7% from 2021 to 2028.

The main drivers for this expected growth are a recovery of the market after the 2020-2021 pandemic and increasing demand for digitization of real estate functionalities.

Also, the chart below shows the historical and projected U.S. real estate software market, from 2018 to 2028:

U.S. Real Estate Software Market (Grand View Research)

Notably, cloud-based systems were dominant in 2020 versus on-premise deployments and are expected to expand at greater than an 11% CAGR from 2021 to 2028.

Also, N. America accounted for nearly a 35% market share by region although the Asia Pacific region is expected to grow at the fastest rate of growth through 2028.

Voxtur’s Recent Financial Performance

-

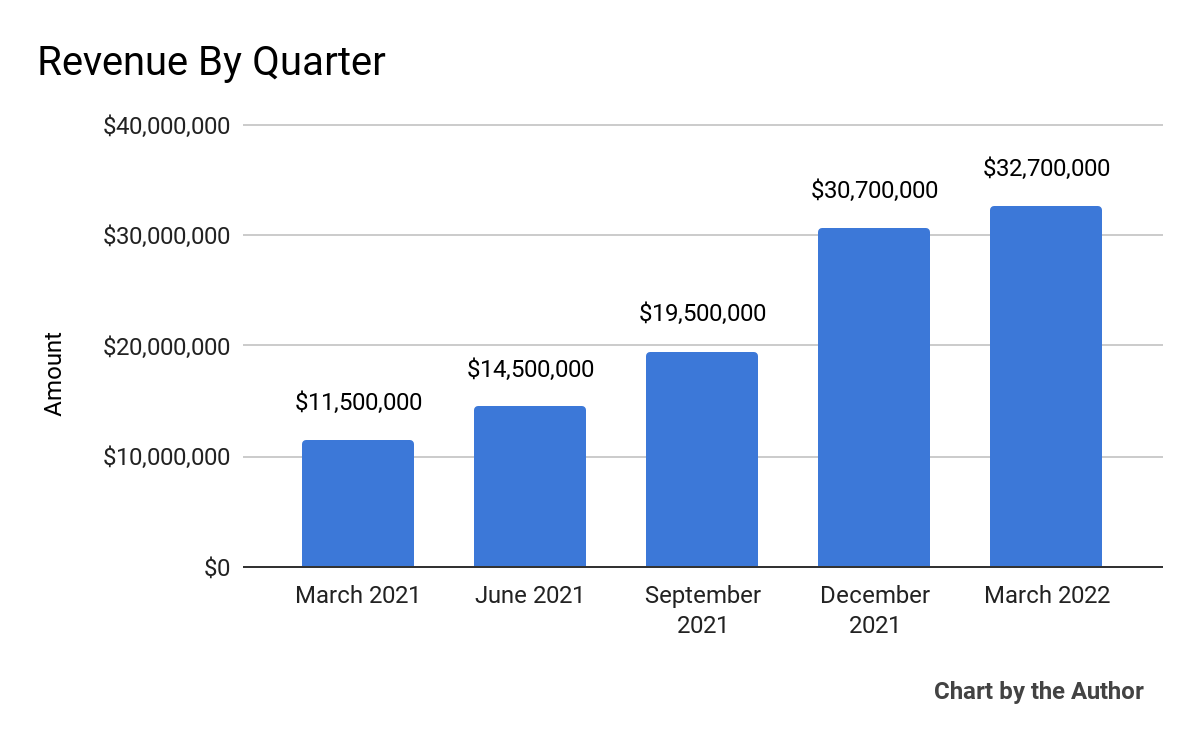

Total revenue by quarter has risen considerably over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

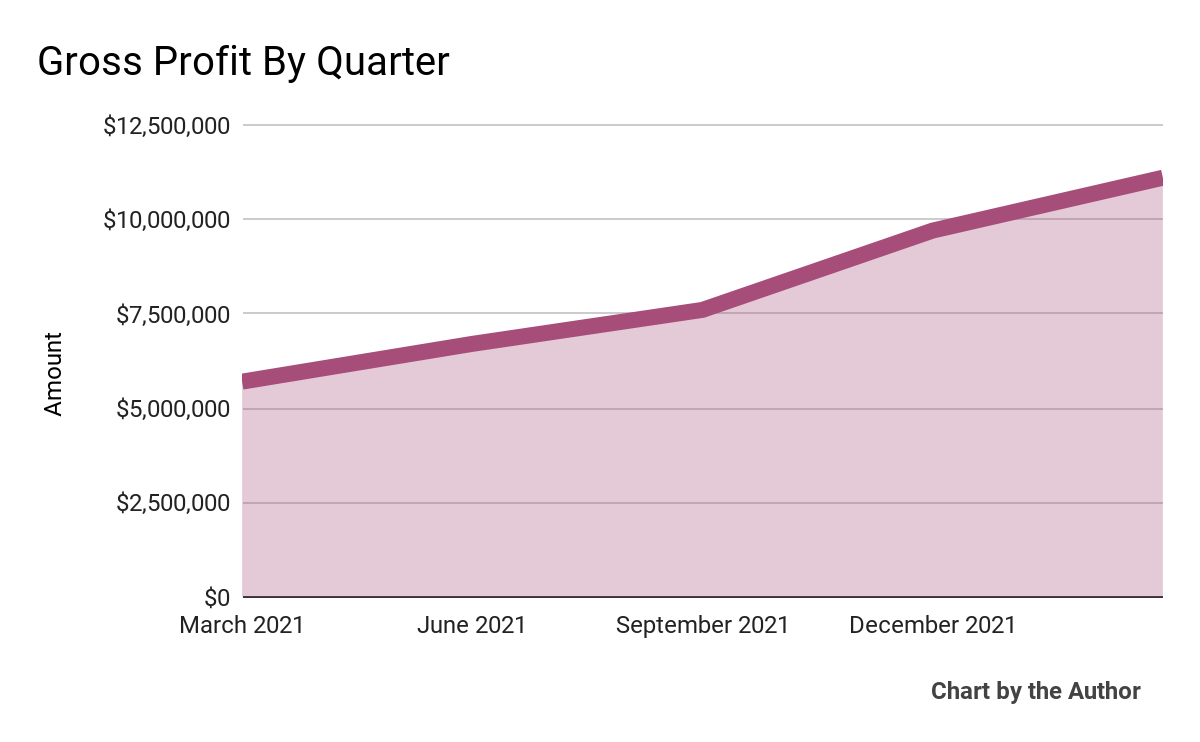

Gross profit by quarter has also risen in step with total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

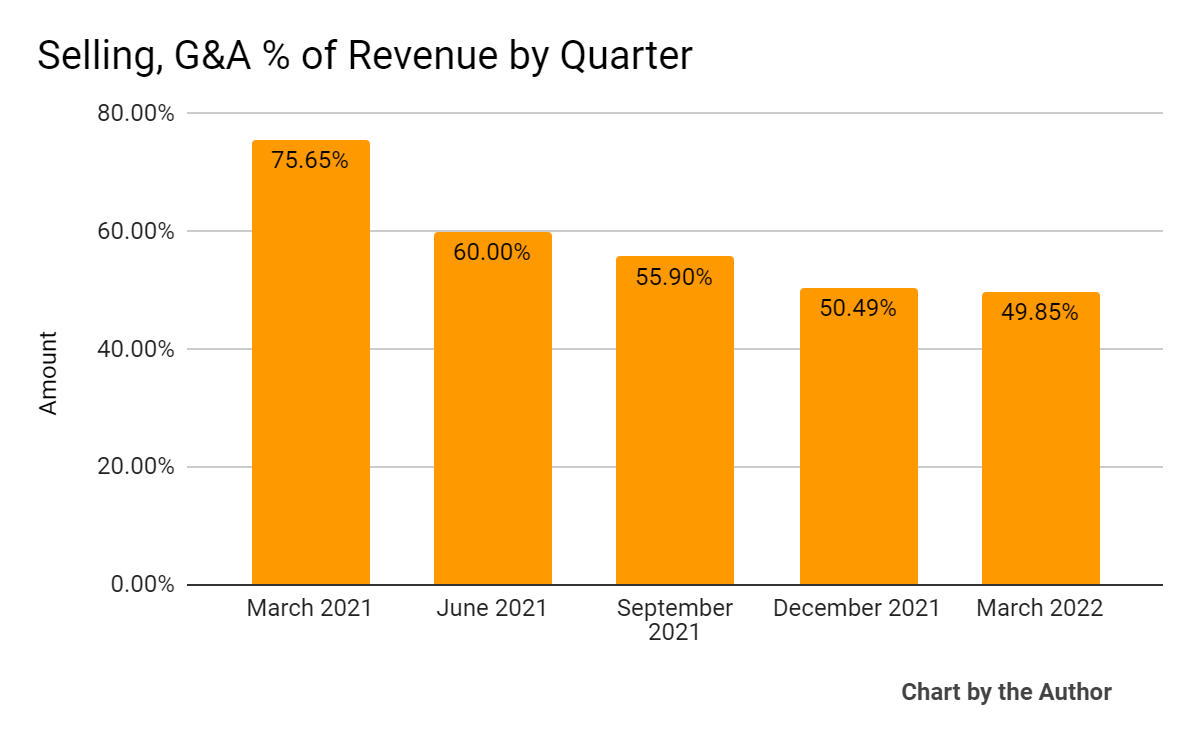

Selling, G&A expenses as a percentage of total revenue by quarter have dropped as revenue has increased:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

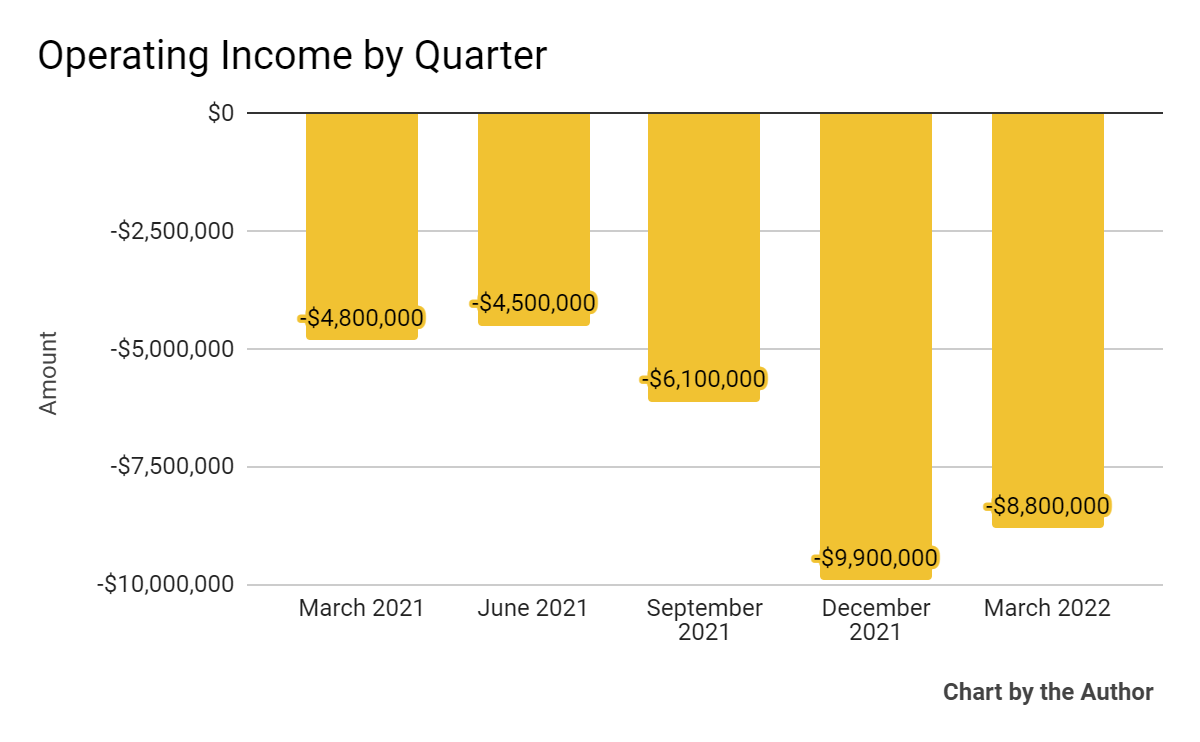

Operating losses by quarter have worsened in recent quarters:

5 Quarter Operating Income (Seeking Alpha)

-

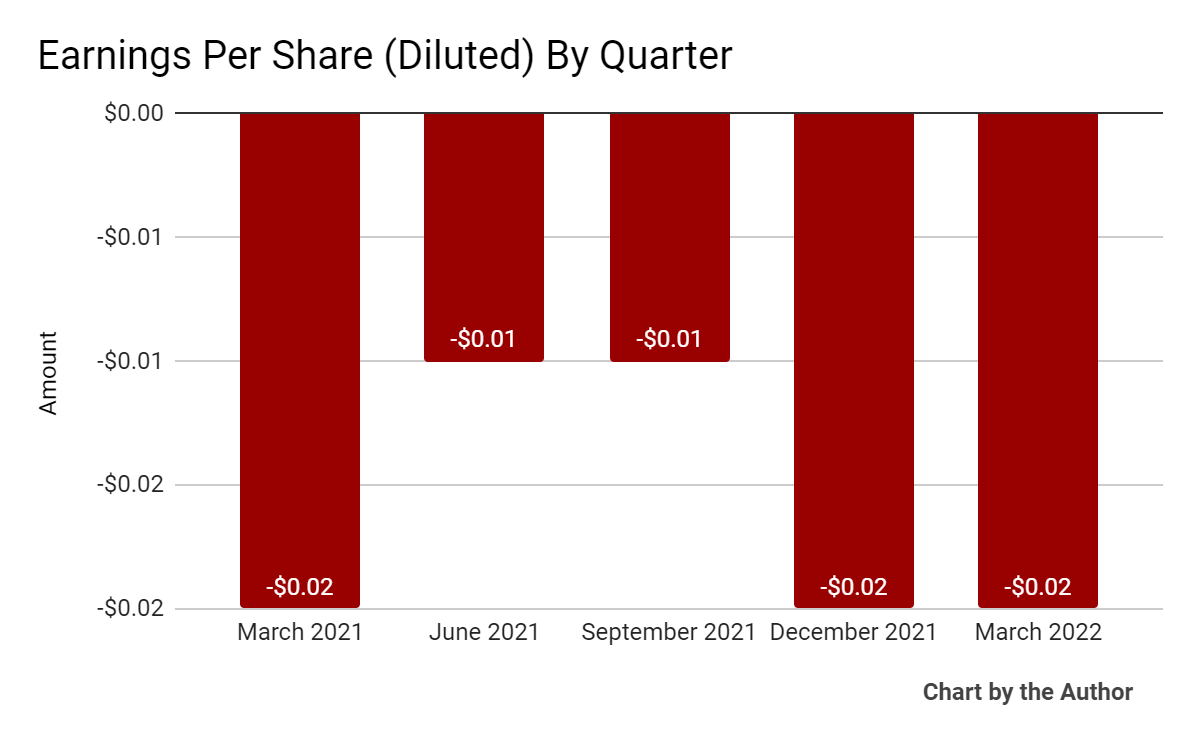

Earnings per share (Diluted) have remained negative as the chart shows below:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP.)

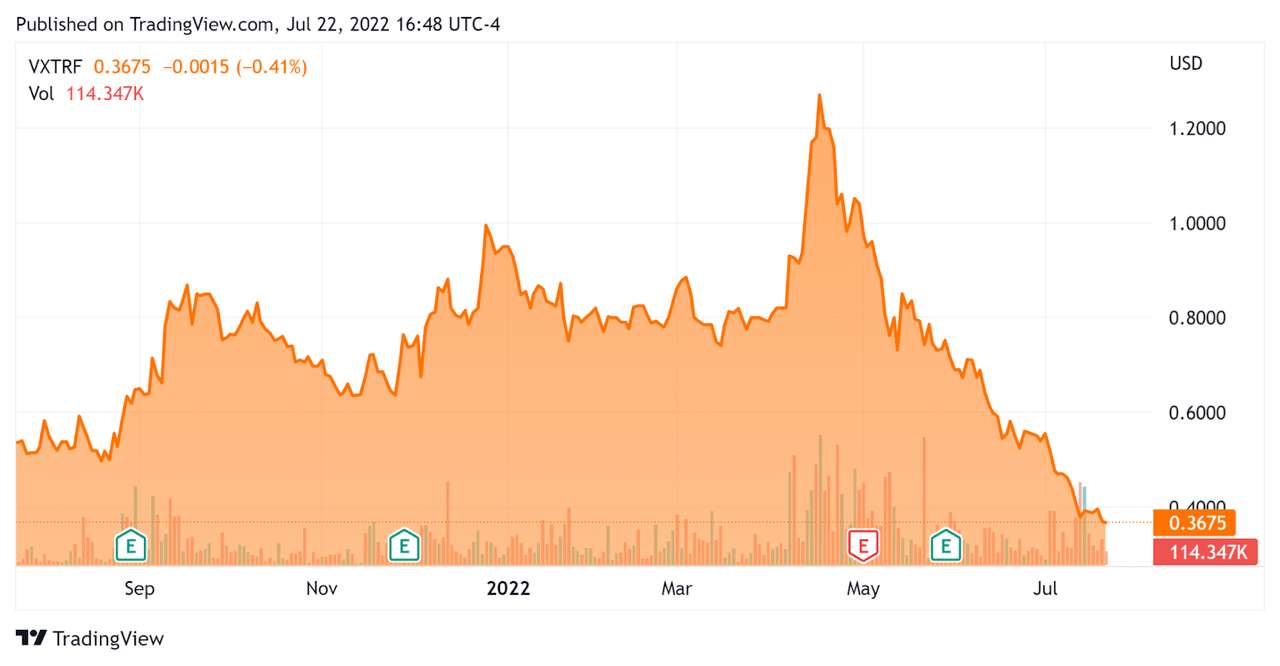

In the past 12 months, VXTRF’s stock price has dropped 31.5 percent vs. the U.S. S&P 500 index’ fall of around 9.2 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Voxtur

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$210,910,000 |

|

Market Capitalization |

$198,380,000 |

|

Enterprise Value / Sales [TTM] |

2.16 |

|

Price / Sales [TTM] |

1.81 |

|

Revenue Growth Rate [TTM] |

309.66% |

|

Operating Cash Flow [TTM] |

-$17,830,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.06 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

Voxtur’s most recent GAAP Rule of 40 calculation was 287% as of Q1 2022, so the firm has performed quite well in this regard, per the table below:

|

GAAP Rule of 40 |

Calculation |

|

Recent Rev. Growth % |

310% |

|

GAAP EBITDA % |

-23% |

|

Total |

287% |

(Source – Seeking Alpha)

Commentary On Voxtur

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the anti-cyclical nature of some of its SaaS offerings which are priced individually.

Its Real Property Tax Analytics offering and programmatic asset management system appear to have no pro-cyclical characteristics.

Additionally, management believes its Attorney Opinion Letter and valuation software have counter-cyclical aspects that may offset revenue declines in other segments.

As to its financial results, revenue grew 182% year-over-year, while gross profit rose by 93% over Q1 2021.

However, operating losses have worsened markedly in the last 2 quarters, a concern for tech stocks which have been beaten down by the current market as the cost of capital has risen.

For the balance sheet, the firm finished the quarter with $32 million in cash but used $4.9 million in cash so needs to reduce its cash burn in subsequent quarters lest it run low on cash.

Looking ahead, management reiterated 2022 full year guidance for revenue of $180 million at the midpoint of the range and gross profit of $92 million at the midpoint. It believes the firm will generate ‘positive EBITDA during the latter part of 2022.’

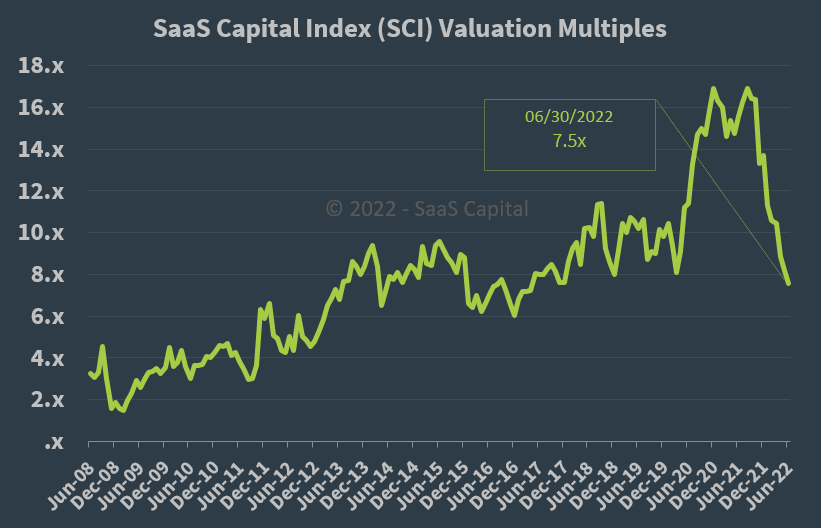

Regarding valuation, the market is valuing VXTRF at an EV/Sales multiple of around 2.2x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, VXTRF is currently valued by the market at a large discount to the SaaS Capital Index, as of June 30, 2022.

The primary risk to the company’s outlook would be a North America recession which would lower customer demand for or slow its sales cycles for some of its offerings.

A potential upside catalyst to the stock could include a pause in interest rate hikes, which may have the effect of increasing its valuation multiple as the cost of capital would cease rising and may indeed drop.

However, the firm faces uncertainties as it appears the U.S. economy is nearing or already in a recession.

With these macroeconomic risks and increasing operating losses, I’m on Hold for VXTRF for the near term, although the stock is worth putting on a watch list.

Be the first to comment