Marina_Skoropadskaya

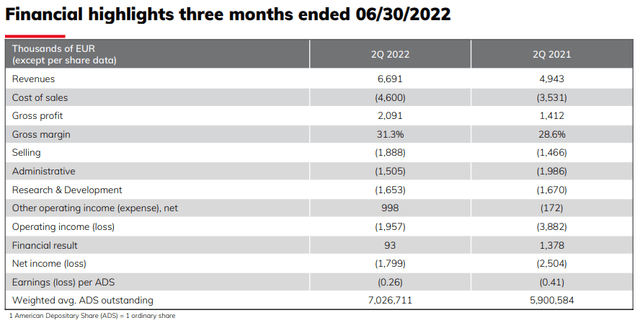

Last month, small Germany-based provider of large-format 3D printers and on-demand parts services voxeljet AG (NASDAQ:VJET) or “Voxeljet” reported improved Q2 results with revenues, margins and backlog all growing on a year-over-year basis:

Company Presentation

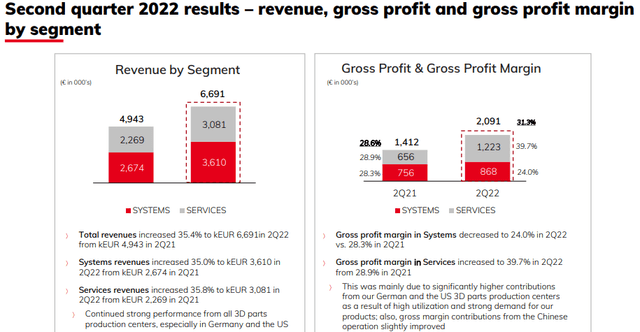

On the conference call, management highlighted increased contributions from the company’s services segment due to very high utilization of Voxeljet’s 3D parts production centers in Germany and the United States.

Company Presentation

Management also reaffirmed its previous full-year outlook for revenues to range between €25 and €30 million and gross profit margins to be above 32.5%. Adjusted EBITDA for Q4 is expected to be at break-even levels or slightly positive.

Unfortunately, the company continues to burn substantial amounts of cash from operations and, according to management’s statements in the press release, would have required additional funding by early 2023 at the latest point.

Given this issue, this week’s capital raise wasn’t exactly a surprise particularly given the fact that the proceeds from last month’s €26.5 million sale-and-leaseback of the company’s German headquarters have been mostly earmarked for debt repayments:

“As we continue on our path towards profitability, this sale-leaseback transaction aligns with our objective to source non-dilutive financing,” said Rudolf Franz, COO & CFO of voxeljet. “We plan to use the proceeds to repay our outstanding financial liabilities and focus on our main business, which is developing, manufacturing and selling high-tech, industrial 3D printers.”

Apparently, the transaction was required as a result of the company’s inability to successfully restructure debt facilities provided by the European Investment Bank (“EIB”) as evidenced by statements made in the company’s 2021 annual report on form 20-F (emphasis added by author):

(…) we have significant financial obligations, related to the repayment of tranche A including the performance participation interest from the loan received from the EIB. Tranche A will become due in December 2022 amounting to €14.6 million reduced or increased by fair value changes of the performance participation interest. (…)

We are taking several steps to mitigate the situation. Currently we are in discussion with the EIB in order to agree upon a drawn down of tranche B2 and tranche C of the loan amounting to €10.0 million and therefore restructure the debt. Moreover, we are taking further steps to raise further funds which may include debt or equity financing, not without mentioning that there can be no assurance that we will be able to raise further funds on terms favorable to us, if at all. (…)

However, while we assume of continuing as a going concern, the going concern is dependent upon we being successful in:

- successful negotiations with the EIB over the drawdown of tranche B2 and tranche C under the Finance Contract

- achievement of budgeted sales

- successful fund raising in the form of equity or debt

If these dependencies are not successfully achieved, management would consider the sale of voxeljet AG’s properties to raise sufficient funds for continuing the business as a going concern.

Basically all of the proceeds from the sale-and-leaseback transaction will be used to settle the company’s debt obligations with the EIB (€22.0 million) and a regional savings bank (€4.1 million).

While the debt repayments will release the company from all financial covenants including a minimum liquidity requirement, new lease obligations for the company’s corporate headquarters will put additional pressure on operating expenses and cash flows going forward.

At the end of Q2, the company reported €14.6 million in cash and cash equivalents. Even with the $4.4 million in gross proceeds from Wednesday’s capital raise, Voxeljet will likely require additional funding by the second half of next year.

Bottom Line

While the company’s recent Q2 report showed signs of improvements, Voxeljet’s elevated cash usage requires the company to raise additional capital on a more regular basis.

Following the above-discussed repayments, the company will be debt-free, but new lease obligations for the company’s German headquarters will put additional pressure on operating expenses and cash flows going forward.

Please note that Voxeljet will likely require additional funding in the second half of next year at the latest point.

Given the issues discussed above, investors should remain on the sidelines until the company moves closer to cash-flow break even.

Be the first to comment