Sean Gallup/Getty Images News

Background

Vonovia SE (OTCPK:VONOY) (OTCPK:VNNVF) is Germany’s leading residential real estate company. Vonovia currently owns and manages ~550K residential units, mostly in Germany, but with some apartments also in Austria and Sweden.

Whilst rental income from holding residential apartments is its main business, Vonovia also has additional segments that include:

- Property development segment

- Recurring sales (disposal of non-core apartments)

- Value-add services (e.g., craftsmen, media, etc.)

I have recently written an article summarising the key catalysts for the stock which I recommend readers review to obtain a fuller context. Since then, the company released its third quarter earnings report which was well received by the market and the stock climbed up ~8% on the day.

This article is an update on my thesis in light of the positive Q3 earnings report. But before I dive into the 3rd quarter results and what it means, it is important to understand what has caused the precipitous share price decline and what Mr. Market is really concerned about when it comes to this stock.

The problem statement

The stock has declined (in Euro terms) ~51% year-to-date. Vonovia is supposedly a defensive, recession-resistant stock and this is the deepest drawdown it experienced since its IPO in 2013.

The culprit is the rapidly rising interest rates in the eurozone which impacted Vonovia directly (via cost of debt) as well as indirectly (downward pressure on the prices of property). Specifically, for the real estate sector in Germany, the bond spreads have widened to 350 basis points which in the current yield curve translates to a ~6% rate for a 10-year fixed borrowing rate in the capital markets.

Given the yield on Vonovia’s underlying assets is in the range of ~3%, this is clearly not sustainable. As such, this renders its previous business model of debt-funded inorganic M&A not tenable any longer. It is also no longer economical for Vonovia to refinance its debt at such costs, and it is effectively forced to deleverage. Fortunately, bank lending is cheaper currently (in the range of 4% to 4.5% all-in cost), so that’s a much better option compared with bond issuance.

So it is clear to everyone involved, that Vonovia has to deleverage somewhat and that’s exactly what the management team has communicated to the markets in the last 6 months. It has then earmarked a EUR13 billion portfolio that is marked for sale where the proceeds are expected to be utilized in paying down debt as it becomes due. It is also exploring selling a Nursing portfolio (1 to 1.2 billion euros) and a tax-efficient JV partnership with institutional players (as capital providers), the proceeds should be used for share buybacks and/or additional deleveraging.

The Bear Case

The bear case is simple, Mr. Market currently does not believe Vonovia is going to be able to deleverage without massively destroying book value. The share price currently factors in a price decline of ~35%-40% of German properties which to me seems rather implausible. The reality is that the German property market is currently stable to low single-digit down price-wise, but it is also near a stand-still where transaction volumes are extremely low. So Vonovia has to be quite deliberately cautious in the pace of any sell-downs so it doesn’t flood the market with “for sale” signs and creates a downward price spiral due to temporary “over-supply”.

Vonovia, on its part, highlights the secular demand-supply chronic shortage in the urban German markets where supply for the next few years is 200k units short of what is needed per annum. The release valve for such a scenario in most property markets is higher rental prices but the German residential rental market is highly-regulated and rents are well below market rates and only rise gradually with a lag in accordance with the unique “mietspiegel” rental index system.

Currently, Mr. Market is punishing the stock for the uncertainty and perceived inability to leverage without destroying shareholders’ value. The only way for the management team to deal with this uncertainty is to prove to the market that it can deleverage with minimal damage to the intrinsic value of the company.

The Q3 earnings released yesterday were a very good first step in the right direction.

Q3 Earnings

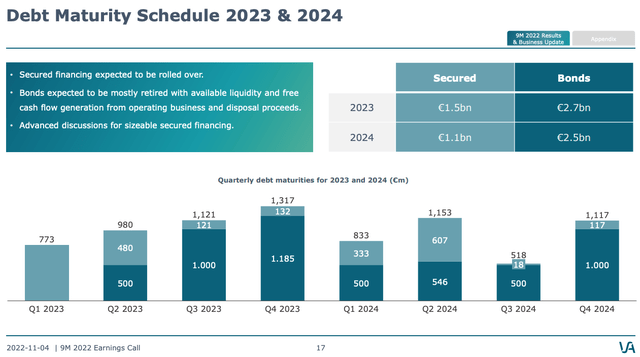

Vonovia has started to provide details and specific numbers on the planned deleverage. Firstly, it clarified how it will deal with debt maturities that will come due in 2023 and 2024:

The management team has made a commitment to retire all the bonds that come due (EUR5.2 billion) whereas bank debts will be rolled over at an expected interest rate of between 4% and 4.5% (based on current pricing).

Vonovia will fund this from disposals of its EUR13 billion portfolio earmarked for sale. The management team made it clear in the earnings call that this is a hard commitment, as highlighted by the following exchange:

So that’s probably because this question is coming very often. So we are given you slides, where we are saying that this management team is committed to have under the explanation that Philip is doing a cash free cash flow of EUR 2.8 billion after dividend payments. So this was a commitment, like our commitment over rental cost like our commitment on offer if all, or normally, you know that we as a management team, are normally doing guidance, which we can fulfill. So and of course, some players feel that they’re playing, we can do a little bit more this non-core, you can do a little bit more multifamily home. So there’s a lot of pillars which we have to play, but in the end, we will feel very comfortable that we will deliver the EUR 2.8 billion free cash flow and assumptions laid out in page 18. So please, we will not give you more disclosure, and especially breaking it down because this gives us also limited flexibility to react. Because keep in mind the idea in a business-to-business relationship, we are discussing the people, which probably are probably on this call. So to discuss myself strategy with the public will harm my price. It’s not a b2c business. It’s a b2b business. And that’s why please, and I apologize for not being so precise. But this, I think, is the interests of all our shareholders. But there is a firm commitment of this management team that we will deliver EUR 2.8 billion in cash flow at the end of’ 23, which will be used for as Philip has said in early.

The management team also indicated that they are in advanced discussions on the secured lending facility.

Additionally, there are ongoing discussions with JV partners as well as the sale of the Nursing portfolio. Management was confident both will happen and it is just a matter of time. Any capital generated from these incremental disposals is likely to be utilized toward share buybacks and/or additional deleveraging.

Other items to note

In the recurring sales segment of condos, the volume of sales was lower than expected ~1.7k units but units were sold at an average premium of 44% to book value (which is a very good sign). Management reaffirmed that it will sell ~3000 units by year-end and the pace will be increased in Q4.

Management also indicated that organic rental growth is set to accelerate in the coming periods as rental prices increase in line with the Mietspiegel indexing methodology. As such, despite the disposal program, rental EBITDA will continue to grow in coming years as the rental market rate increases more than just compensating for the reduction in portfolio size.

Final thoughts

Vonovia is both a short-term and a long-term generational buy in my view. You get an 8% yield to wait and several catalysts are likely to play out in the next 12 months. Longer term, the rental price growth will catch up with recent years’ inflation quite mechanically. The German property market is chronically under-supplied and the current valuation of Vonovia’s apartments is a fraction (5%) of its replacement cost given high construction costs.

If Vonovia is able to execute the sale of the Nursing portfolio (high probability) and/or JV partnerships (medium probability), then share buybacks are likely to be on the table.

The main risk is a cataclysmic decline in the German property market (~20%- 40% decline) which I see as a remote possibility. Given that it also trades a bond proxy, if longer-term rates continue to climb rapidly, the share price will likely suffer temporarily.

Otherwise, at 0.35x net assets value, Vonovia is a generational bargain that I expect to hold for many years to come.

Be the first to comment