teddyleung/iStock Editorial via Getty Images

Published on the Value Lab 6/4/22

AB Volvo (OTCPK:VOLVY)(OTCPK:VOLAF) is a company we haven’t given much thought to. We all knew automotive was struggling these years due to semiconductor shortages (although Volvo doesn’t manufacture its brand of cars anymore only trucks and equipment), so we gave the sector a berth on account of those shortages having difficult to map horizons. Indeed, our thoughts on Volvo center on the weaker guidance for 2022 as a consequence of these shortages, backtracking on more rosy expectations given at the FY conference. Moreover, Volvo is dealing with issues related to China’s economic woes. Nonetheless, we have noticed its valuation coming down substantially, and we are beginning to think about whether Volvo might be an attractive exposure with prices having retraced to pre-COVID levels.

A Look At the FY

Volvo did really well on an FY basis. The environment has shown strong demand for freight vehicles with freight rates being so high, of course contributing to that demand being ahead of supply thus the shortages. However, due to the evolving commodity environment, the FY results are a bit of a red herring. We are more interested in the Q4 results, which are beginning to show the gross margin impacts of higher prices, and the topline growth being stymied by supply shortages compared to a strong 2020 Q4 when demand was picking up for cars.

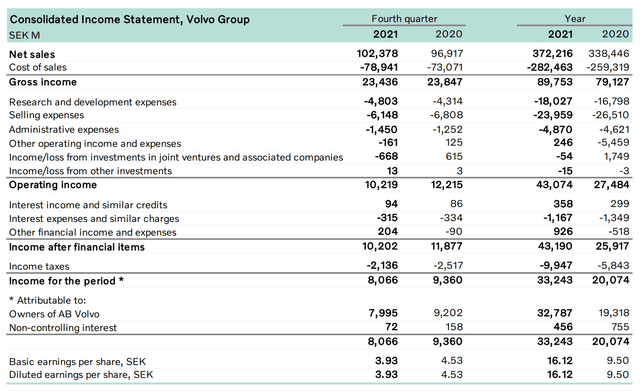

Income Statement (Volvo Annual PR)

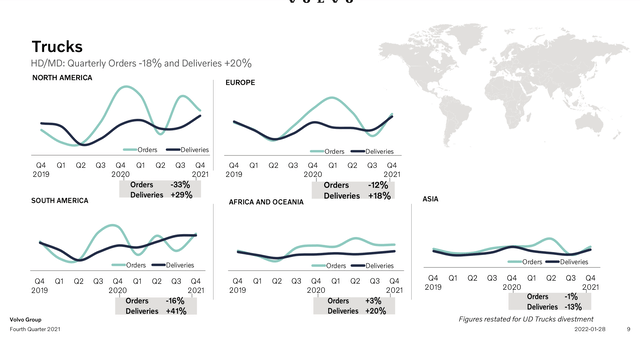

On the FY, marketing dollars were better spent thanks to the exogenous growth in the car market, contributing to a higher operating profit. While that decline in marketing spend was seen in the Q4 evolution YoY as well, gross margins started to let profitability down to the extent that operating profit and gross profit had fallen. While trucks have been in higher demand due to freight, supply shortages have caused industrial inefficiencies affecting gross margins and have also caused declines in orders.

Trucks Segment (Q4 2021 Pres Volvo)

Moreover, there have been increases in prices of nickel, affecting stainless steel components, in aluminum, and we are also worried about the situation in rubber markets, which could be the next source of shortages.

China Exposure

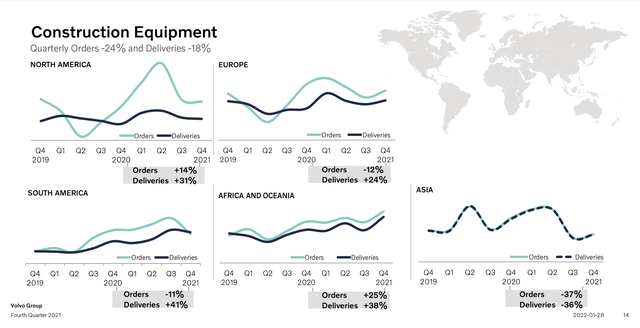

Further on the profit matter, the JV with Dongfeng Motor (OTCPK:DNFGF) had also reversed its profits into losses thanks to Chinese economic woes, affecting the performance of the JV and associate line in the income statement. In fact, China was an important theme for this quarter. While a decline in truck demand was evident as the cycle is turning there, in part related to the massive property bubble that is bursting there, there was also a decline in demand in construction equipment, which despite being the only geography in which such declines were occurring, brought the entire segment down.

Equipment Segment (Q4 2021 Pres Volvo)

For construction equipment, while China is the main source of issues now, we also highlight order declines YoY in Europe and LatAm as well, as governments start to take their feet off the fiscal pedal.

Valuation Discussion

So Volvo is exposed to construction equipment, mainly in China, and to Trucks. Moreover, supply shortages have caused a 22% drop in sales in March, and are the reason why the company is guiding towards flat sales growth in 2022 compared to 2021, and inflation is affecting margins. What are the puts and takes here with respect to the valuation?

Upsides

- Freight is in high demand, and trucks are valuable products. While long lead times is creating lag, price increases are possible to preserve margins from cost inflation. This demand should endure, and is enterprise exposed unlike the demand for cars, which could be more sensitive to economic woes associated with inflation including retail fuel costs.

- Service revenue is also increasing, and is about 20% of the revenue mix. Here inflation is very quickly passed on, and this revenue is essential and recurring. It is also less affected by supply side issues, and it will likely grow in the mix due to the guidance for production increases being flat despite demand, which should improve margins for the business as service is a higher margin business.

- China is getting a pledge from its government to clean up the economic mess. The disaster of Evergrande (OTCPK:EGRNF) and the consequences it is having on the property market and the general economic outlook will be part of the area that China is going to have to address. Perhaps they’ll eliminate caps on steel mill production as part of the stimulus, making steel prices lower for Volvo as well, and they’ll also be supporting the markets upon which the equipment business relies. Equipment is 20% of revenue against 69% for trucks.

- Bus segment should get stronger as reopening occurs, but this is only 4% of revenue.

Downsides

- Despite stimulus, the end markets for equipment are going to be worse in the coming years in China, and probably in the rest of the world as fiscal stimulus subsides, seen by falling deliveries in Europe and LatAm.

- Inflation is going to put margin pressure with price increases lagging those input increases, so the Q4 results are the best estimate of the run-rate situation for Volvo now.

Taking all this into consideration, we use Q4 financial data for calculating the run-rate figures. Let’s work with P/E figures to consider valuation. On a TTM basis, the P/E for Volvo is about 10x, which is very low considering its nice end markets, relatively resilient margin profile thanks to pricing flex and services likely to increase in the mix. In reality though, a run-rate P/E is better estimated at annualising the Q4 EPS, so let’s call it 12 SEK per share. That puts us at a 14x P/E, and it is based on the conservative assumption that the JV continues to make losses in China, and that price increases don’t really occur with margins suffering at the current levels. Moreover, it is a P/E multiple that preempts margin improvements and resilience related to service revenue which will increase in the mix associated with lower production rates due to semiconductor shortages.

Conclusions

A 14x P/E implies still a pretty high earnings yield despite conservative assumptions. Moreover, Volvo offers a nice 3.8% dividend on an ordinary basis for shareholders that has been proposed to the board. While a change in guidance from growth to flat evolutions is a disappointment, markets have reacted to it appropriately with prices back to pre-COVID levels.

Volvo Retraces (Google Finance)

Overall, we like the end markets, and we think China will do what it can to restore its economy as its zero COVID policy among other things begins to collapse around them. This should help the JV as well as the equipment business. In trucks, while semiconductor shortages are a persistent problem, we like the odds on the market as demand for goods will remain enduringly high. We should also see a little contribution from buses as well as reopening takes better hold. The service business provides margin resilience when units sold becomes less relevant to the mix, and we like the economics of service and the value provided by trucks in the current environment of freight. Overall, a 14x conservative multiple gives a nice margin of safety despite the headline risks, and we look favourably on Volvo as a buy.

Be the first to comment