hh5800/iStock via Getty Images

This past week saw another significant selloff on Wall Street. As a consequence, I only found four new selections from my quant sorting formulas to quickly discuss for next week’s trading.

This is the second issue of the VBR. So, here’s a brief description again of what I am trying to accomplish for readers. Wall Street has an old saying – volume precedes price. The idea is major investors and insiders quietly try to acquire shares before a breakout in price. The VBR is essentially a starting point for individual investors, who may not have access to quant sorting technology and databases. Stocks are included using a specific set of formulas regarding positive momentum characteristics I have developed over many years, in conjunction with high-volume days on short-term price uptrends. My proprietary formulas include as many as 15 different technical trading indicators analyzed daily on a computer database of 4,000+ stocks.

Week in Review

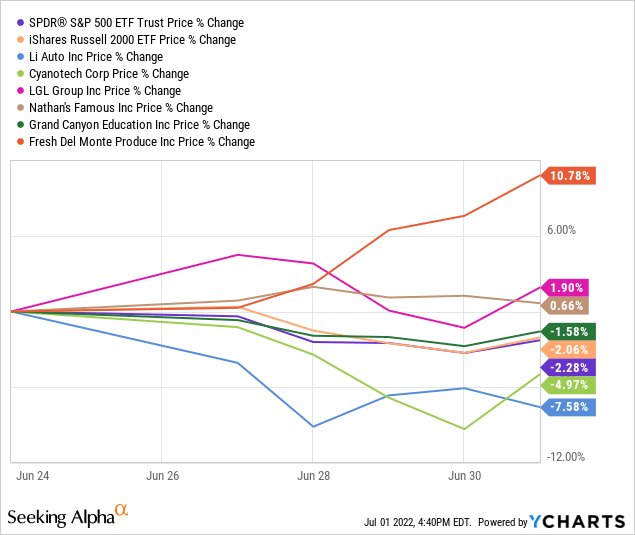

The first list of six stock picks made on June 25, 2022, here performed in a respectable manner over five trading days. Four out of six “outperformed” the market decline. Equally weighted, the group survived better than the large-cap SPDR S&P 500 ETF (SPY) slide of -2.28% or small-cap iShares Russell 2000 ETF (IWM) drop of -2.06%. On the week, the VBR list declined a slight -0.13% in price for a mean average return, measured from Friday-to-Friday closing values. This loss was substantially less than the major Wall Street indexes.

The biggest winners were Fresh Del Monte Produce (FDP), LGL Group (LGL) and Nathan’s Famous (NATH), two food companies and a cash-rich manufacturer seeing more defensive demand by investors. The main losers were Li Auto (LI), which announced a $2 billion stock offering, and Cyanotech (CYAN). To repeat, this week’s action does not tell me with any real statistical predictive certainty what will happen next week. But it is entirely possible this initial group of six will outperform the market again in early July, to what extent, I cannot know. Often, one big winner carries the whole list to decent gains.

YCharts

My trading experience and research has not been much different for returns over the years. High-volume breakouts have been able to regularly beat the market by varying margins for 6-week to 8-week spans. After that, individual stories take over, with some picks coming back down or even slipping lower than when high-volume interest appeared. Others start to perform like the general market. And still others continue streaks of strong “relative” gains. If I could figure out which ones would be the huge winners, I would be a trading billionaire by now. But that is not the case. My research simply serves to increase the odds of short-term success.

New Buy Signals

During bull markets on Wall Street, I may have ten or more strong accumulation patterns to present. However, the weak market direction in June is not the best environment to find aggressive buying outstripping liquidation pressure. Below are the most interesting setups my formulas have discovered/suggested for additional research.

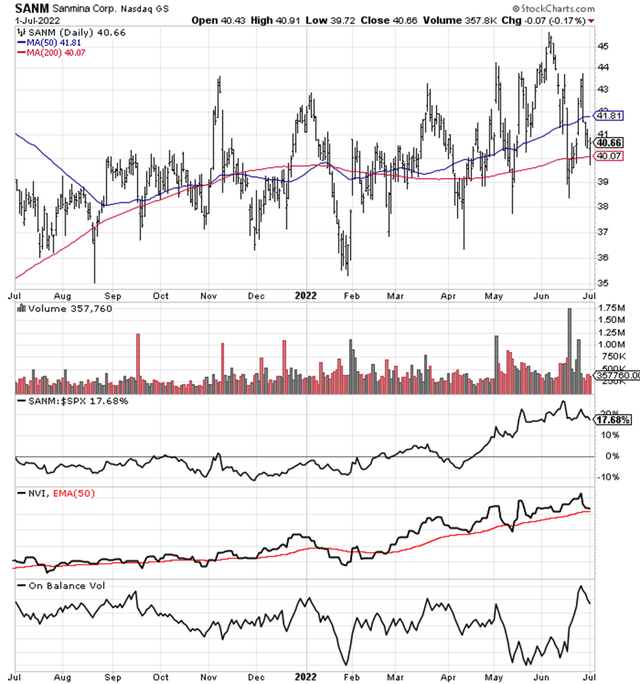

Sanmina

An interesting pick with underappreciated hard asset value is Sanmina (SANM). The company is a provider of integrated manufacturing solutions, components, products, repair, logistics and after-market services. Sanmina provides these offerings to OEMs in the industrial, medical, defense/aerospace, automotive, communication network and cloud-server industries. The valuation story: 9x EPS, 10x free cash flow, trading close to tangible book value (after adjusting property and land values held for decades, using mark to market pricing vs. cost accounting). Conservative finances are present, with more cash on the balance sheet than debt.

Resources Connection

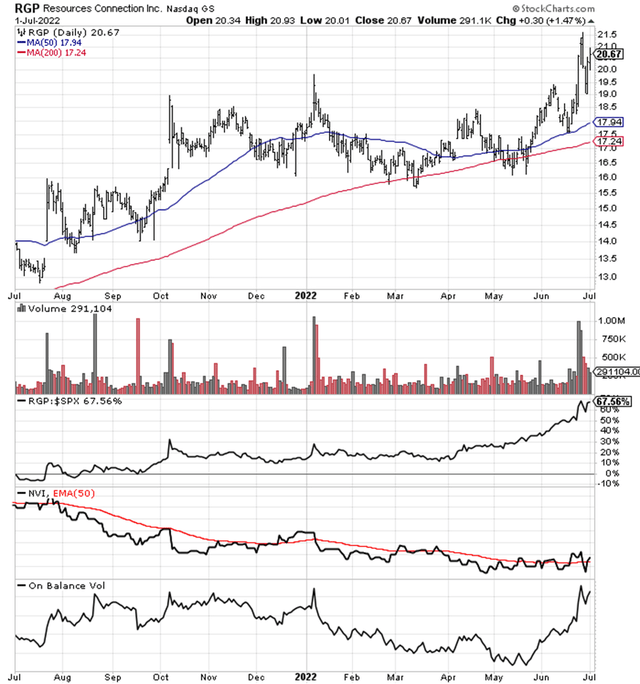

Resources Global Professionals, taskforce, and Sitrick are the main business names used by Resources Connection (RGP). It’s basically a business consulting enterprise with interests in public relations, employee staffing, project management and crisis oversight. Bullish Seeking Alpha Quant score…

Seeking Alpha Quant Rank – July 1st, 2022

This name has been a steady performer the last 12 months, showing up on my top momentum/accumulation screens several times. The VBR buy signal in June is perhaps the strongest to date. Fundamental value: 12x forward estimated earnings (10x trailing), 2.8% dividend yield. Desirable balance sheet with more cash and current assets than total liabilities.

Kelly Services

A slower economy might bring a more competitive labor market, where employee placement outfits like Kelly Services (KELYA) (KELYB) could see better demand/pricing for their work. Priced at 70% of tangible book value, with a solid balance sheet owning more cash and current assets than total liabilities. Trading at low multiples of 10x projected 2022 EPS, 7x for 2023. $16 per share in working capital vs. $19 equity quote. Serious turnaround potential for investors after years of stagnation. Top 10% Quant Rank by Seeking Alpha computer model for building upside momentum.

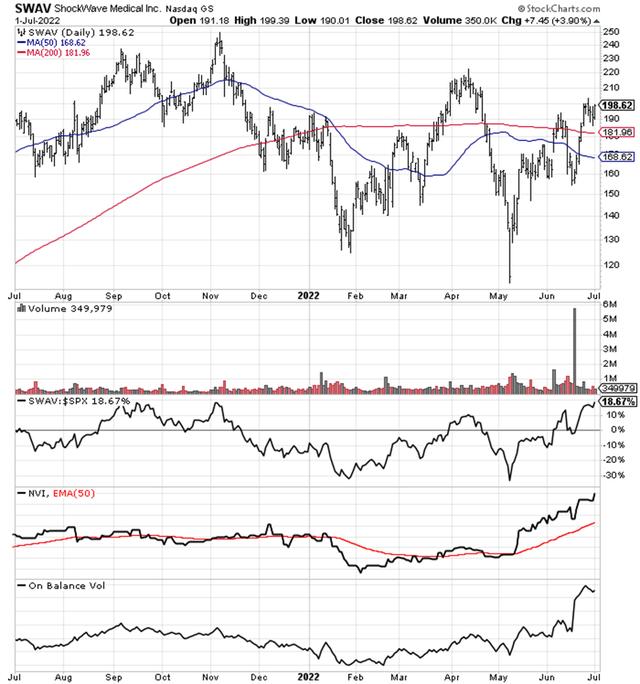

ShockWave Medical

A high-growth pick experiencing massive sales and income expansion in 2022. ShockWave Medical (SWAV) doesn’t have the usual low valuation on trailing results I like to find. However, trading momentum stats in June are super-positive, and robust business growth rates during a recession are rare.

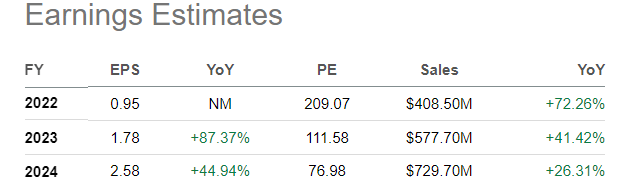

Seeking Alpha Table, Consensus Estimates – July 1st, 2022

SWAV is a medical device company engaged in the development and commercialization of a revolutionary intravascular lithotripsy technology for the treatment of calcified plaque in patients with peripheral vascular, coronary vascular, and heart valve diseases worldwide. Wide earnings “beats” the last 4 quarters are part of the bullish argument.

Final Thoughts

I suggest readers make an effort to do further research into any of the selections that appeal to you, a function of your risk appetite or sector exposure needs in portfolio construction. Please understand small-cap picks should be a limited portion of portfolio design. Holding a diversified number of stocks is the smartest, risk-adjusted way to play them. Volatile price swings are part of the investing process for smaller companies on Wall Street. Please consider using preplaced stop-loss sell orders to reduce downside potential in individual names. Depending on your risk tolerance, 10% to 30% stop levels are recommended.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment