Getty Images/Getty Images News

Introduction

Former Volkswagen Group (OTCPK:VWAGY) (OTCPK:VWAPY) (OTCPK:VLKAF) CEO Herbert Diess was known for pushing software and electric vehicles. It was announced in numerous articles on July 22nd that he would be leaving the company after reported clashes with unions and questions about his communication methods. Long-time Volkswagen veteran Oliver Blume took over as CEO on September 1st and reports say that he is less inclined than former CEO Diess to have Volkswagen Group develop all their software themselves. My thesis is that Volkswagen Group continues to be strong with battery electric vehicles (“BEVs”) despite the CEO change.

The Numbers

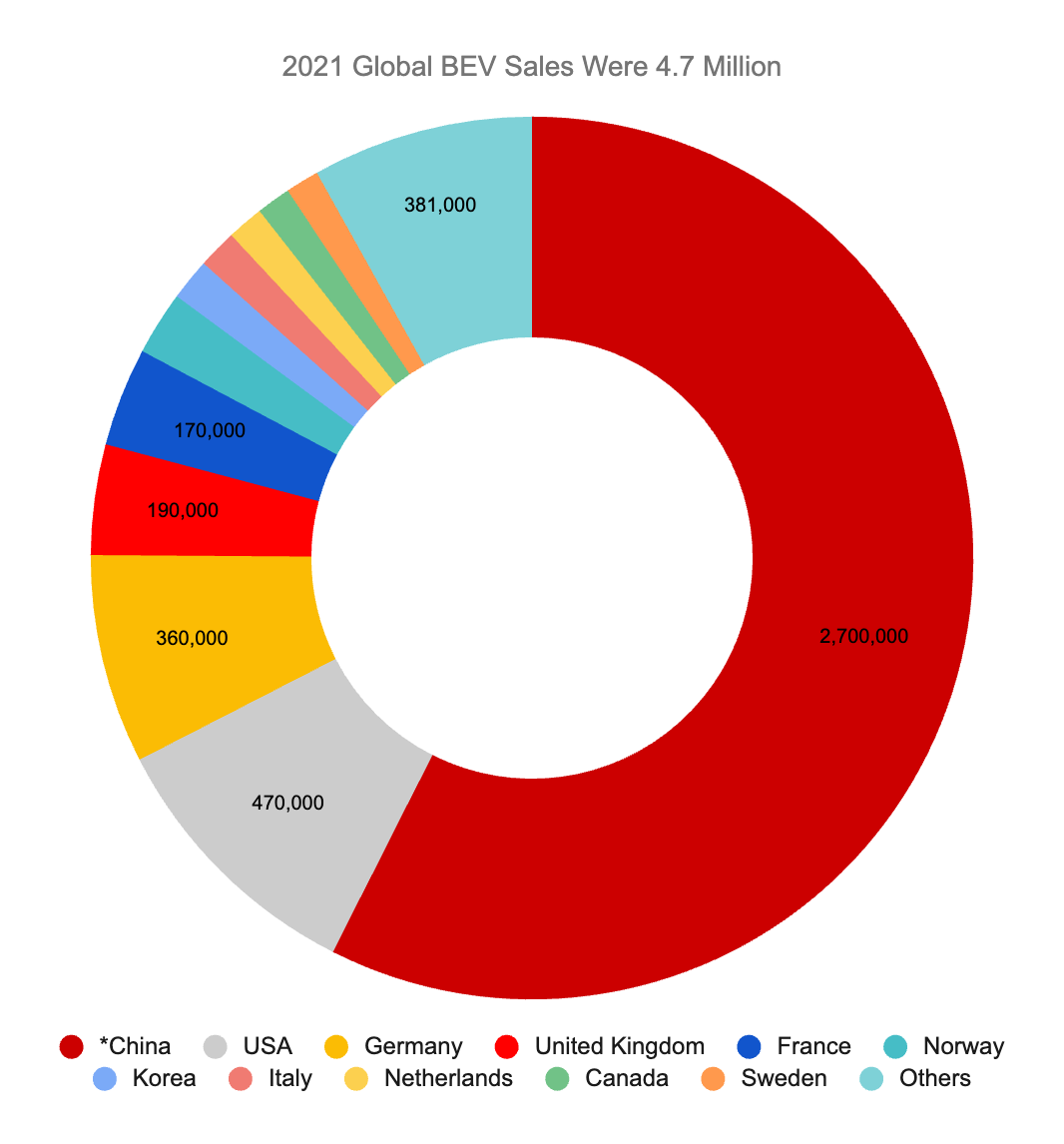

The IEA shows global BEV sales are rising prodigiously, going from 2 million in 2020 up to 4.7 million in 2021. The Volkswagen Group has strong BEV sales in some of the biggest BEV markets in the world, such as Germany and the UK:

2021 BEV Sales (author’s spreadsheet based on IEA numbers)

*Many BEVs sold in China are mini-cars such that the China numbers are not apples to apples.

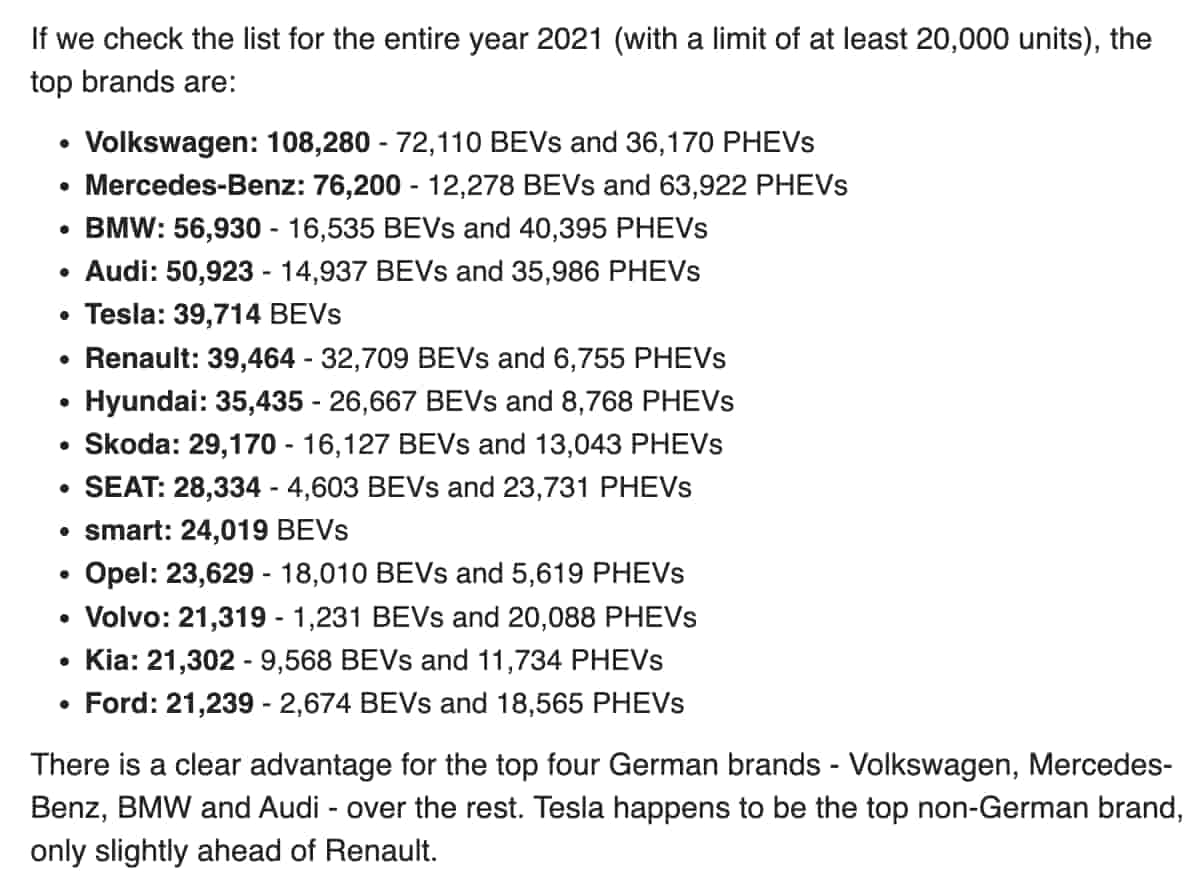

InsideEVs shows that Volkswagen Group including Audi had by far the most BEV sales in Germany for 2021:

Germany BEV Sales (InsideEVs)

The headlines show that Mercedes (DMLRY) (DDAIF) and BMW (OTCPK:BMWYY) are not far behind with electric sales in Germany, but there is a big difference between BEVs and plug-in hybrids (“PHEVs”). Unlike PHEVs, BEVs have no internal combustion engine, so they have far fewer moving parts which means much less maintenance; BEVs are the future and PHEVs are a stepping stone. Looking at BEVs only in Germany for 2021, the combination of Volkswagen and Audi had sales of 87,047 while BMW only had 16,535 and Mercedes had a mere 12,278.

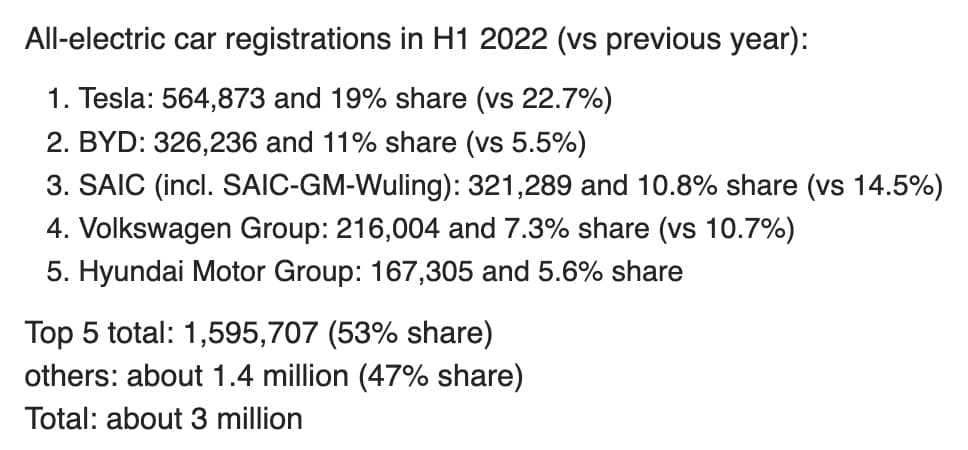

The Volkswagen Group isn’t just strong with BEVs in Germany, they have a large share globally, as shown by InsideEVs registration numbers for the first half of 2022:

1H22 BEV Sales (InsideEVs)

Again, SAIC/GM had 321,289 units but many of these were mini-cars such that they’re not apples to apples. BYD (OTCPK:BYDDY) (OTCPK:BYDDF) is another strong company inside China. Outside of China, most BEV sales come from Tesla (TSLA), Volkswagen Group and Hyundai (OTCPK:HYMTF) (OTCPK:HYMLF).

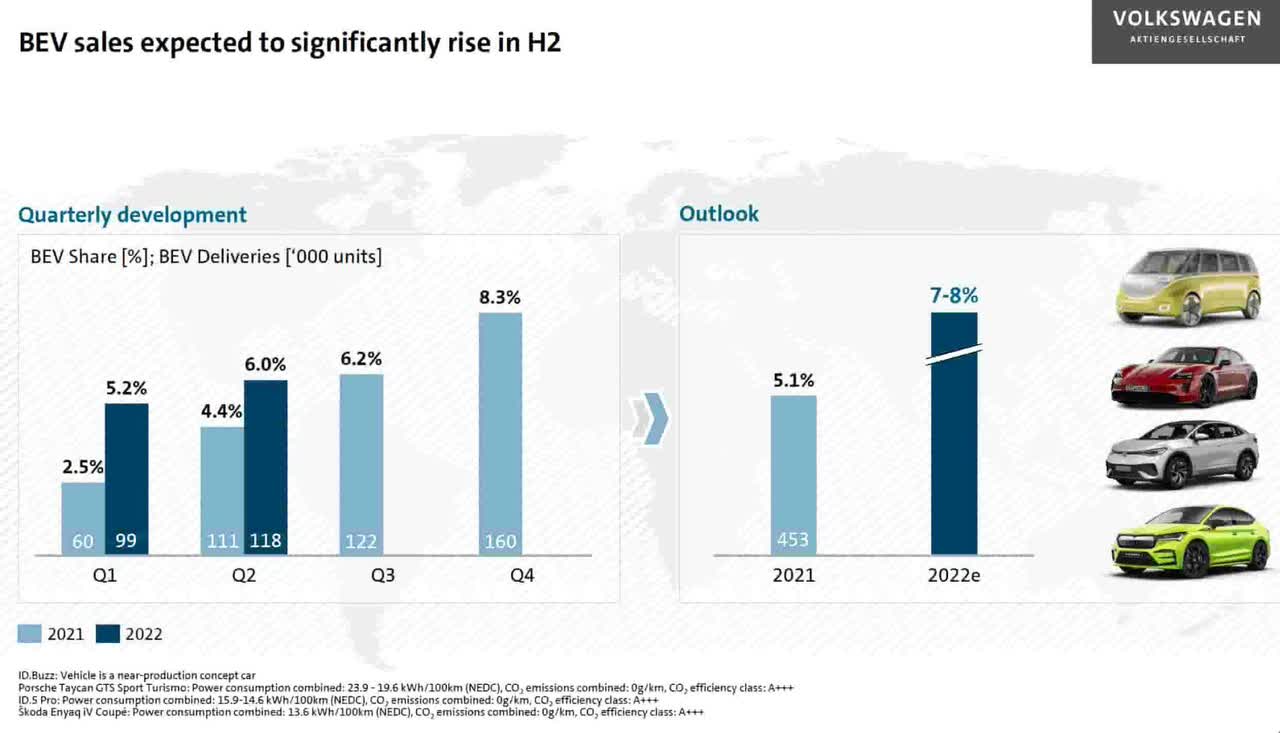

The July 28th 1H22 presentation from Volkswagen Group came after the reports of former CEO Diess stepping down, and it shows that they delivered 453,000 BEVs in 2021 for 5.1% share. 1H22 BEV deliveries were 217,000, up from the 171,000 in 1H21. Full year 2022 BEV share is expected to be higher than it was in 2021:

1H22 BEVs (1H22 presentation)

The 2Q22 earnings call shows that BEV expectations are still strong despite the CEO change. CFO Arno Antlitz said they anticipate a constantly growing BEV volume in the second half of 2022. Joe Miller from the FT asked about strategy changes given the new leadership, especially with CARIAD, their automotive software company. CFO Arno Antlitz answered by saying that they earn their money today with combustion engine cars, but that this will change significantly. He explained thoughts on future revenue sources:

One is still basically combustion engine 50%, but then 50% [of] the revenues will come from BEVs. And the third revenue will emerge based on software-based business. And so you see like Porsche is well underway in that direction. Electrification of Porsche works very well. Volkswagen is underway, the whole group is underway. So the total picture where the industry is heading and what we need to do is pretty clear. There will be continuity.

On September 29th, Reuters reported that CFO Antlitz noted they are in good shape to fund their electrification strategy after raising money with the Porsche (OTCPK:POAHF) (OTCPK:POAHY) IPO:

We are well set-up financially [and] have strong cash flows to fund our electromobility strategy ourselves.

Closing Thoughts

Forward-looking investors should see how things develop as other parts of Volkswagen Group follow the Porsche model. Automotive News Europe reports that brands are doing training exercises as if they were preparing for IPOs. This should help communicate the value of the group’s Audi, Bentley and Lamborghini brands. Investors should look to see if the results of these exercises are presented at a capital markets day. It will be interesting to see if the enormous gap in post-retirement liabilities vs assets is broken down among the various brands.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment