lcva2

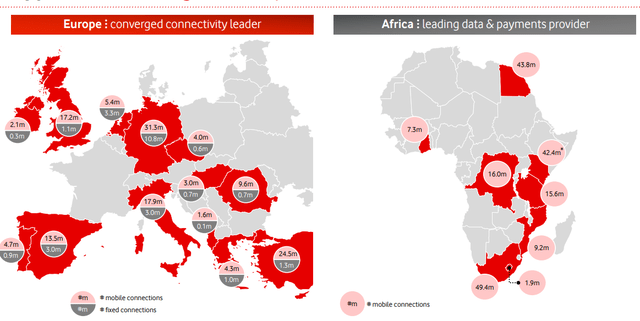

For the first time, today we are approaching Vodafone Group plc (NASDAQ:VOD) by combining a top-down analysis and a European sector overview. Vodafone engages in mobile communications operating in the Old Continent and internationally. The company provides various products & services such as voice, data, fixed line, television, IoT as well as payment services in the African area. It was incorporated in 1984 in the United Kingdom and currently, the British telecommunication player has more than 300 mobile million customers, including 20 million clients in the TV division and almost 30 million in fixed broadband.

Source: Vodafone Q1 Results

Our sector overview started with energy price evolution and how this will impact the company’s profitability. Among the companies at risk in 2023, we should include the European telecommunications sector, and according to our calculation, on average, we estimated an increase in energy costs of at least 50% in 2023 with a plus 20% this year with a consequent drop in EBITDA of 2-3%. The sector has experienced a median EBITDA growth rate of around 2% year-on-year over the past 18 months, implying that growth is expected to be flat in 2023. If we look at Wall Street analyst consensus, EBITDA is forecasted to decline in the next 12 months. At the aggregate level, we agreed. Looking to the details, there are companies with above-average risk such as Telenor (OTCPK:TELNY), Liberty Global (LBTYA), Orange (ORAN), and Telecom Italia (OTCPK:TIIAY). Conversely, there are others that we believe present a below-average risk such as Vodafone, Deutsche Telekom (OTCQX:DTEGY), and Swisscom (OTCPK:SCMWY). The telecommunications sector is not uniform and hedging policies vary a lot between operators. In fact, the telecommunication players use a combination of multi-year hedging strategies and 12-month strategies, through contracts with long-term suppliers and futures markets. In addition, the hedges were carried out at various times of the energy crisis. Going to the numbers – most operators have covered over 70% of the energy forecast for 2022 and dome operators have been lucky enough to be able to cover most of the demand expected for 2022 (and 2023), readopting the rates of 2021 or before 2021 such as Deutsche Telekom and Swisscom. Others progressively hedged themselves during the crisis with good timing, Vodafone was one of them. Here is the comment during the Q&A call to report:

“Our hedging has progressed as well. So, we are now 85% hedged. And if we were using the current spot prices, the year-on-year increase that was 200 million, two months ago is approaching now 300 million for us“. Adding also: “We have hedged almost 40% also into FY2024“.

Regarding Vodafone’s financial implications, we are estimating that energy costs will increase by around 20% in 2022 thanks to the hedge policy – a good result considering that average spot prices that have tripled year-over-year and will result in a 1% headwind at the EBITDA level.

Given the trend in energy prices in 2022, 2023 will be a more challenging year due to the rolling hedging policies. However, reporting the CEO’s words: “There is a substantial level of uncertainty surrounding the energy environment”, explaining that “the most important lever we have is to progress more long-term structural deals like PPAs“. The Power Purchase Agreements have now become an area of greater attention in attempting to decouple energy costs from current spot prices. However, even operators who have successfully raised PPAs such as Deutsche Telekom are aware that they will only begin to work off the increases in energy costs from 2024 onwards.

What’s next?

Starting from 2023, Vodafone Spain could index the prices of its services to inflation. The first to report the news was the Iberian newspaper, according to which the new tariffs will follow the trend of the average consumer price index of the previous year (in August 2022 at 10.4% year on year). The new pricing model would be updated every quarter and had already been notified to customers. For the moment, the indexation would only concern the Spanish subsidiary, but we do not exclude that Vodafone can replicate the strategy also in Italy, where the consumer price index reached 9.1% in July. Looking to the Spanish division, Vodafone is the third largest operator, and it will be interesting to see how the main competitors will behave. Indeed, the operator’s move could affect the commercial strategies of rivals and radically change the current deflationary dynamics of the telecommunications sector.

M&A in Europe

Despite the stalling dossier on Telecom Italia network, pending the national vote on the 25th of September, with a surprising move, Iliad founder Xavier Niel bought a 2.5% stake in Vodafone, rekindling the spotlight on M&A in the telecommunications sector. This was done through his investment vehicle, Atlas Investissement, and called Vodafone “an attractive investment opportunity, based on the quality of its asset portfolio and solid underlying trends in the global industry of telecommunications “.

Niel’s investment vehicle will support Vodafone’s already-stated willingness to pursue consolidation opportunities in selected geographic areas as well as infrastructure separation efforts. Atlas’s view consists in believing that there are opportunities to accelerate both the streamlining of Vodafone’s footprint and the separation of its infrastructure assets, further reduce costs, improve profitability, and accelerate broadband development in Germany and other areas. All in all, Xavier Niel has invested in the telecommunications sector in nine countries in Europe with nearly 50 million active subscribers and over €10 billion in revenues.

Conclusion and Valuation

There are many moving parts about Vodafone; however, after the Q2 results, the company left its outlook unchanged. Our internal team expects that the British telecommunication giant will hit the lower end of its 2023 EBITDA outlook at €15 billion. Looking at our internal model based on numbers, we derive an adjusted FCF yield of 8.5% versus peers that are currently trading at 7.8%. For the above reason, we value the telecommunication giant at £135 per share versus the current market price of £109. The next catalyst is the H1 company results plan for the 15th of November; however, the “top priority” is a potential tower deal. In recent years, Vodafone’s performance has been mixed, but the new revenue policy (in Spain and then Italy) could represent a turnaround from the deflationary trend of the sector in Europe driven by years of intense competition.

Be the first to comment