MaboHH

I recently wrote an article on Broadcom Inc. (AVGO) detailing my generally positive views of the company and management’s ability to acquire, raise margins, and de-lever to add long-term value. One of the key catalysts for Broadcom is its pending acquisition for VMware, Inc. (NYSE:VMW).

This article looks at the merits of the Broadcom/VMware transaction and key points VMware shareholders should consider. On the positive side, Broadcom has a long history of successful acquisitions and shareholder value creation. However, there are some leverage and business mix concerns. Finally, market implied probability of the deal completing is surprisingly low. Investors should closely monitor regulatory developments, as that seems to be the key hurdle.

Broadcom Takeover

On May 26th, 2022, Broadcom announced an agreement in which Broadcom will acquire all of the outstanding shares of VMware for approximately $61 billion, plus assume VMware’s $8 billion in net debt.

Under the terms of the deal, VMware shareholders can elect to receive either $142.50 in cash or 0.252 shares of Broadcom stock for each share of VMware. The cash option will be subject to proration, resulting in approximately 50% of VMware’s shares being exchanged for cash and 50% being exchanged for stock.

In connection with the transaction, Broadcom has obtained commitments from a consortium of banks to provide $32 billion in debt financing.

The transaction is expected to be completed in Broadcom’s fiscal year 2023. Note, Broadcom has an October 31st year-end, so the companies are expecting the transaction to complete prior to October 31, 2023. Michael Dell and Silver Lake, who own 40% and 10% of VMware respectively, have signed agreements in support of the offer.

VMware had a “go-shop” provision under which it was allowed to solicit and evaluate potentially superior transactions to the offer. As the “go-shop” provision expired on July 5th, 2022 without a superior bid emerging, VMware shareholders should consider the Broadcom offer the best and final bid on the table.

Who Is Broadcom?

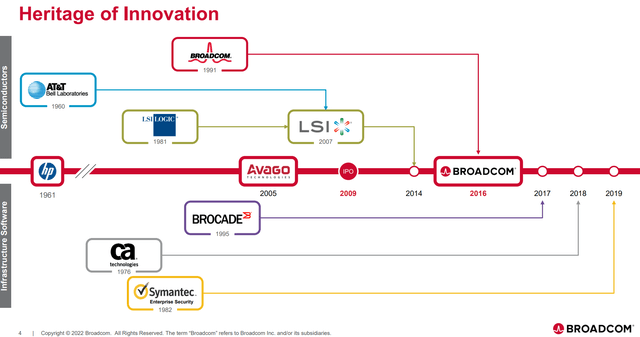

For those unfamiliar, Broadcom was created in 2005 from the spinout of Hewlett Packard’s semiconductor business (“Agilent’s Semiconductor Products Group”) into a private equity-backed company called Avago. Through years of acquisitive growth, including the 2016 acquisition of Broadcom (following which the company adopted the Broadcom name post merger), Broadcom/Avago had grown into a semiconductor giant (Figure 1).

Figure 1 – Broadcom grew through acquisitions (AVGO investor presentation)

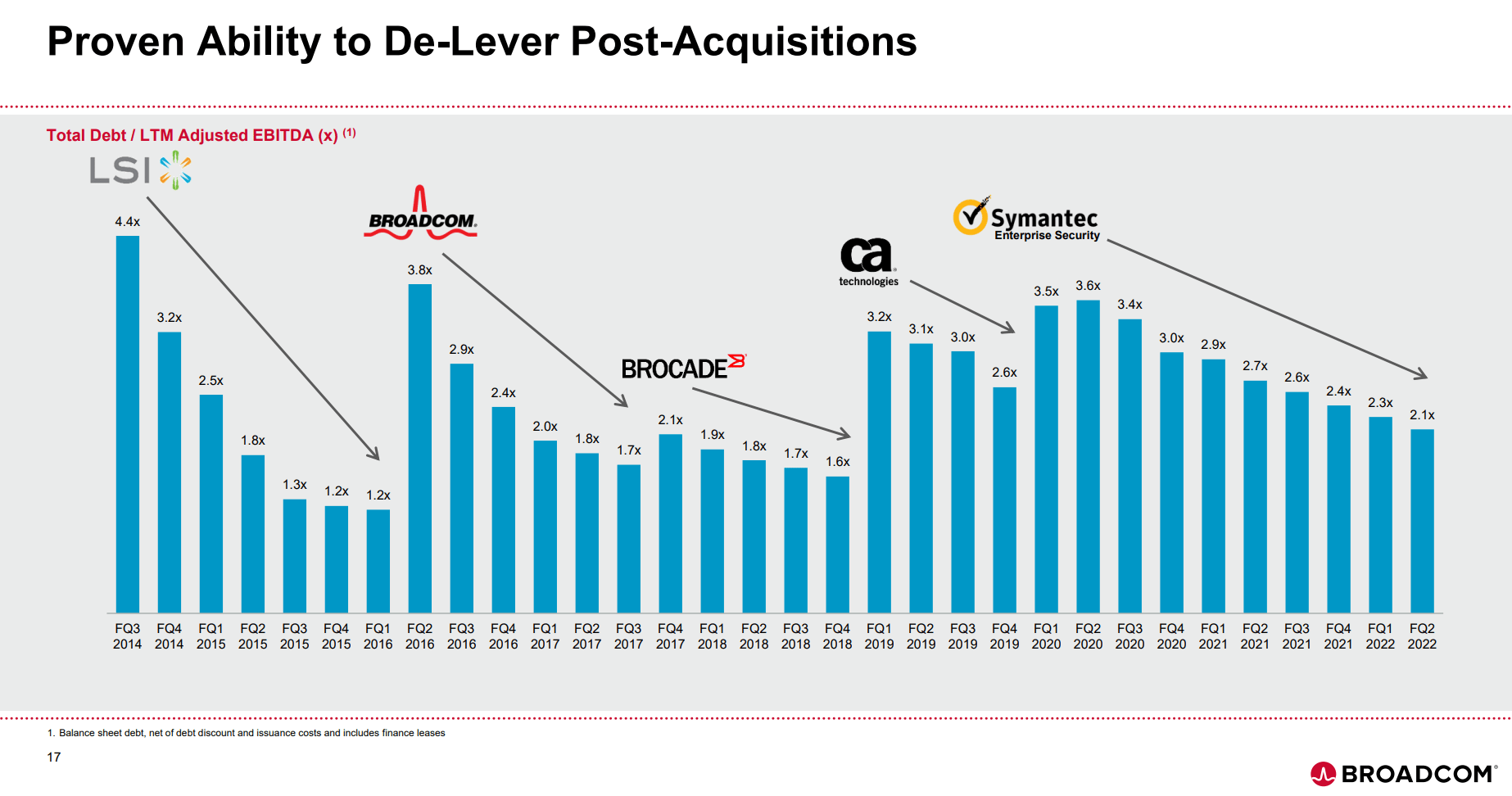

The basic business model for Broadcom is fairly simple. It acquires maturing technology businesses, improves margins, pays off the transaction debt, and repeats (Figure 2).

Figure 2 – AVGO PE-like Business Model (AVGO investor presentation)

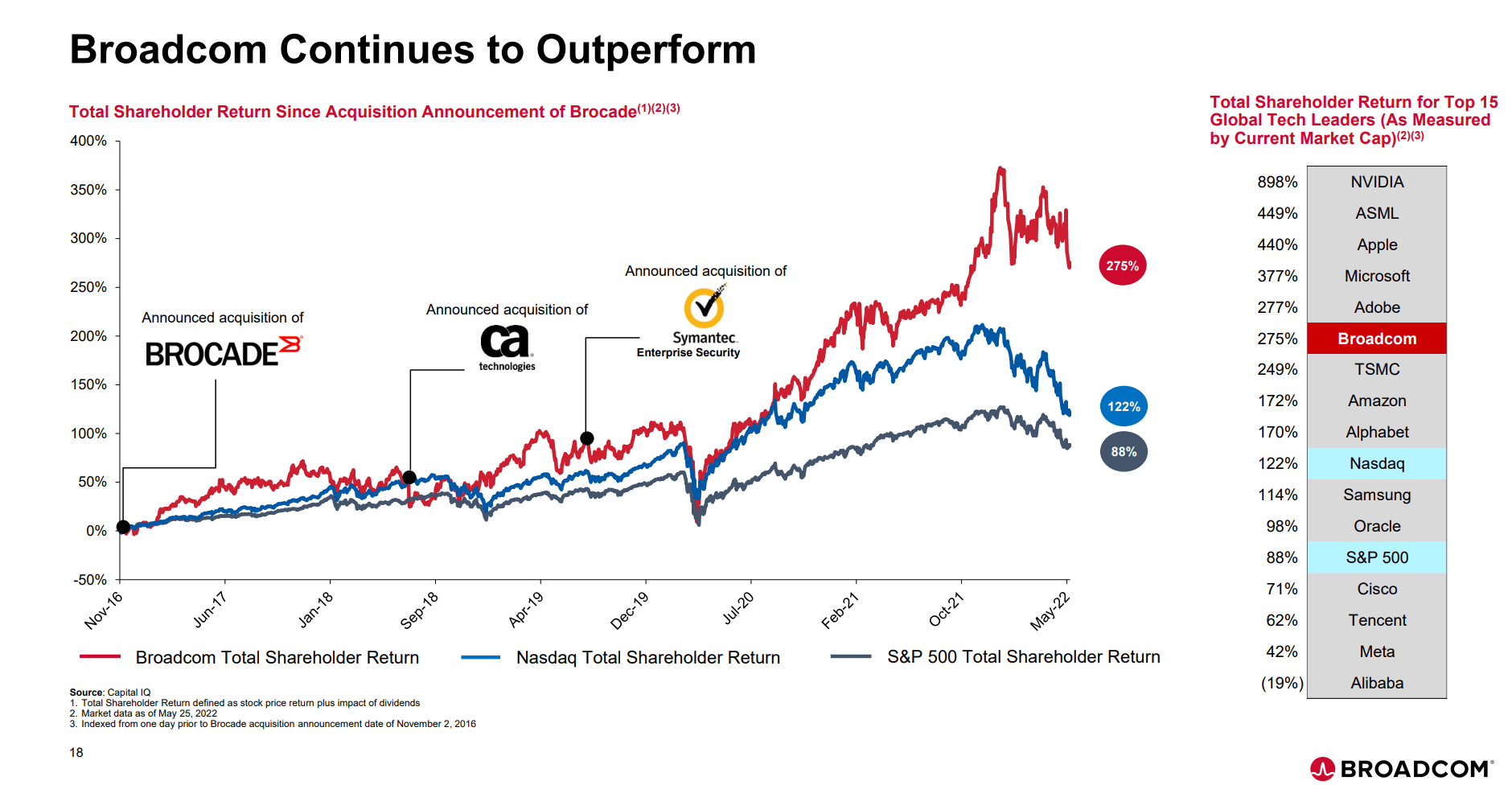

By following this simple business model, however, Broadcom has been able to deliver some spectacular long-term results. Since 2016, Broadcom has delivered 275% total return, outpacing the Nasdaq and S&P 500 indices, and only trailing a handful of top stocks like Nvidia (NVDA), ASML Holding (ASML), and Apple (AAPL) (Figure 3).

Figure 3 – AVGO has outperformed long-term (AVGO investor presentation)

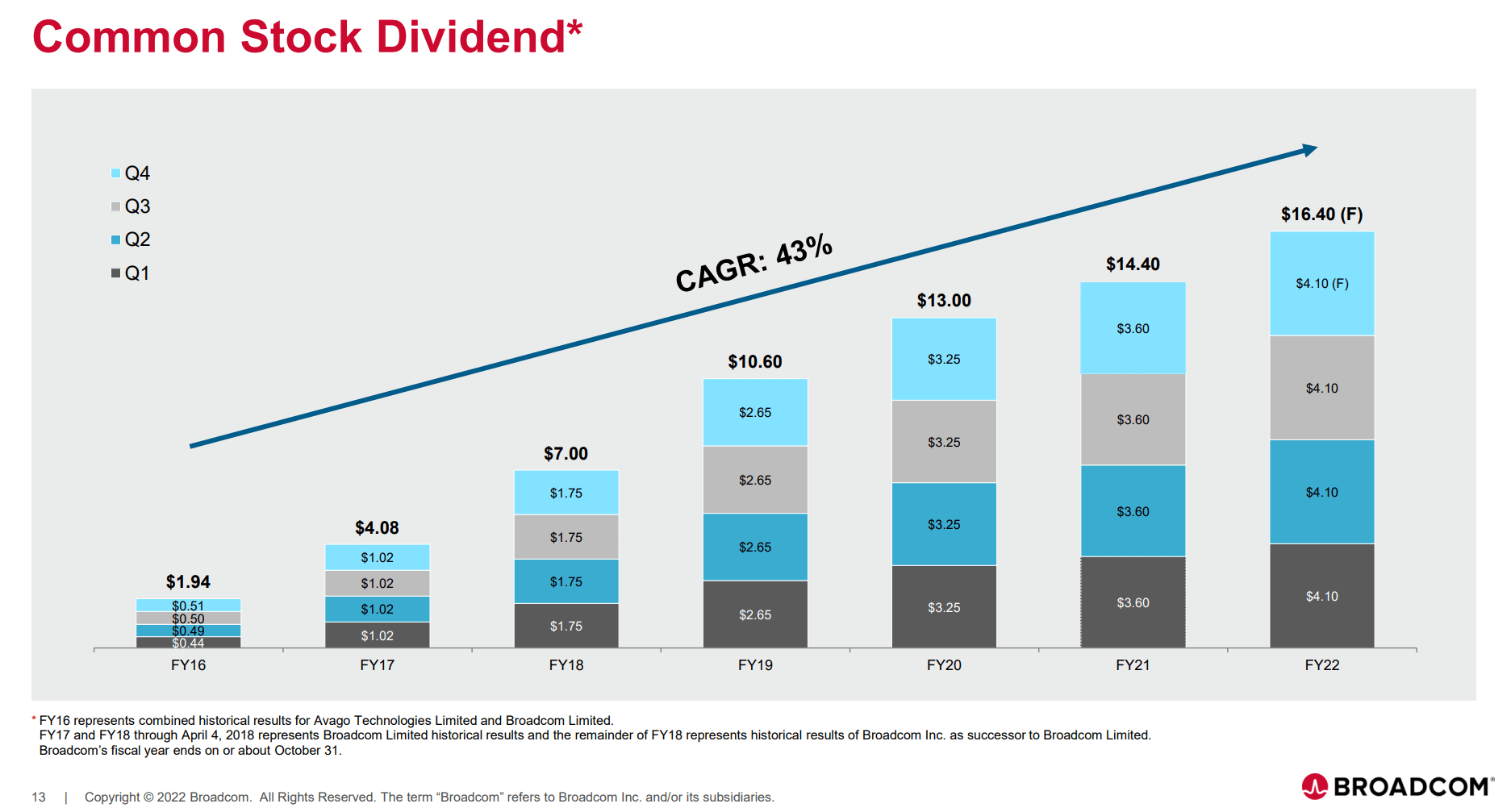

AVGO shareholders have been richly rewarded in the process, with per share dividends increasing from $1.94 in 2016 to a forecasted $16.40 in 2022 as part of the total return (Figure 4).

Figure 4 – AVGO dividend has increased at 43% CAGR. (AVGO investor presentation)

4 Key Things To Consider As A VMware Shareholder

In the coming months, VMware shareholders should expect to receive a formal proxy solicitation for the Broadcom/VMware transaction. How should shareholders view the transaction?

First, as we mentioned above, Broadcom has a long history of successfully acquiring businesses, improving margins, deleveraging, and creating shareholder value. There is no indication that this process will not be repeated with the VMware transaction. So based on Broadcom’s track record, shareholders could consider voting in favor of the transaction.

Next, let’s consider leverage and the slowing economy. Broadcom currently has $9 billion in cash and $39 billion in debt. In order to complete the acquisition, Broadcom is expected to add $32 billion in debt and assume VMware’s $8 billion in net debt. Pro-forma, the company will have over $70 billion in net debt, versus a pro-forma $21 billion in EBITDA, pre-synergies. This will raise the pro-forma Broadcom’s Net Debt / EBITDA to over 3.3x, amongst the highest in the technology sector.

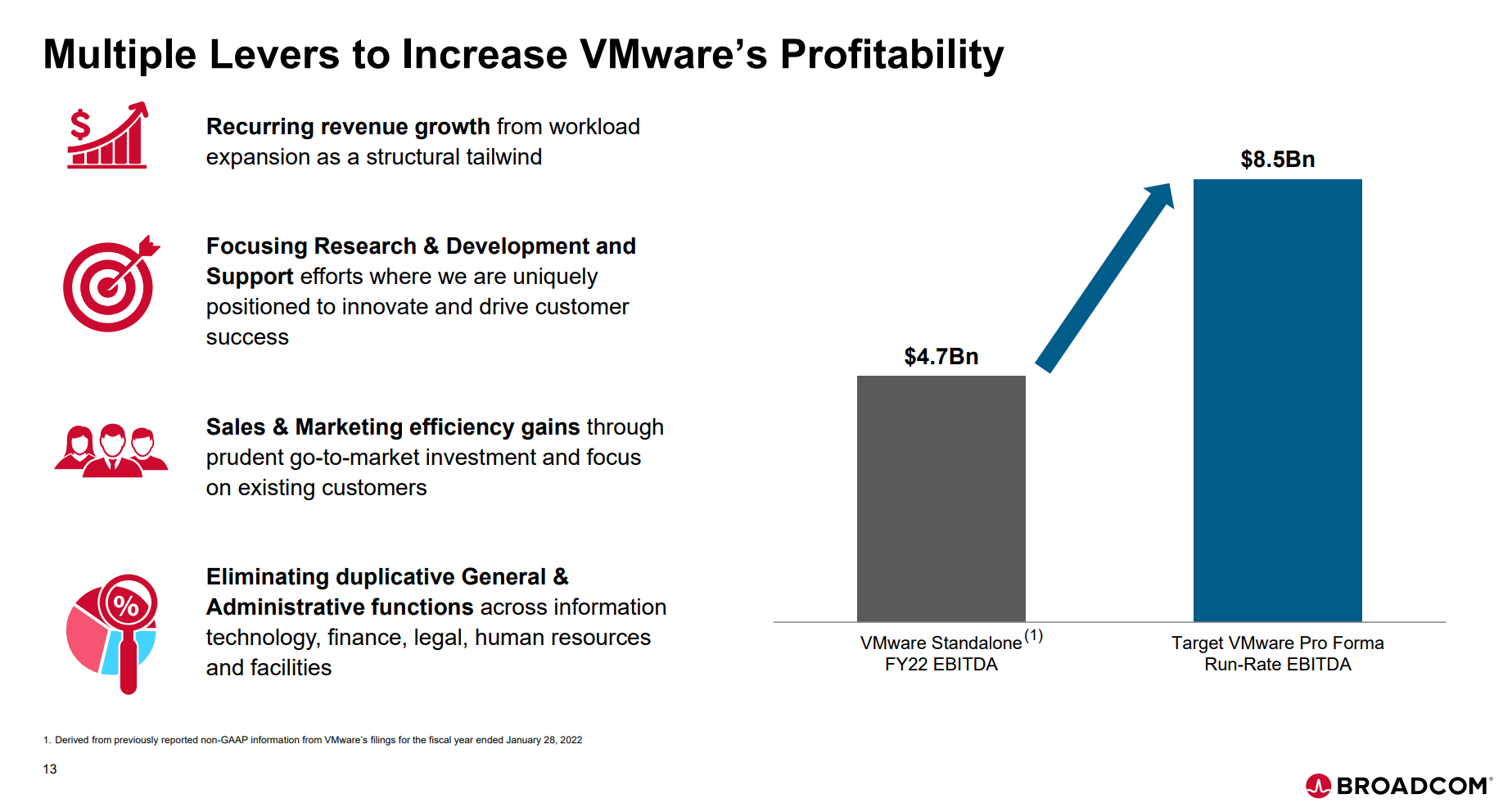

While the company is targeting almost $4 billion in synergies that should bring leverage down to 2.8x over time, this is still a pretty elevated leverage level, especially versus VMware’s current Net Debt / EBITDA ratio of 1.7x (Figure 5). Into a slowing economy, this could increase operating risk.

Figure 5 – VMware synergies (AVGO investor presentation)

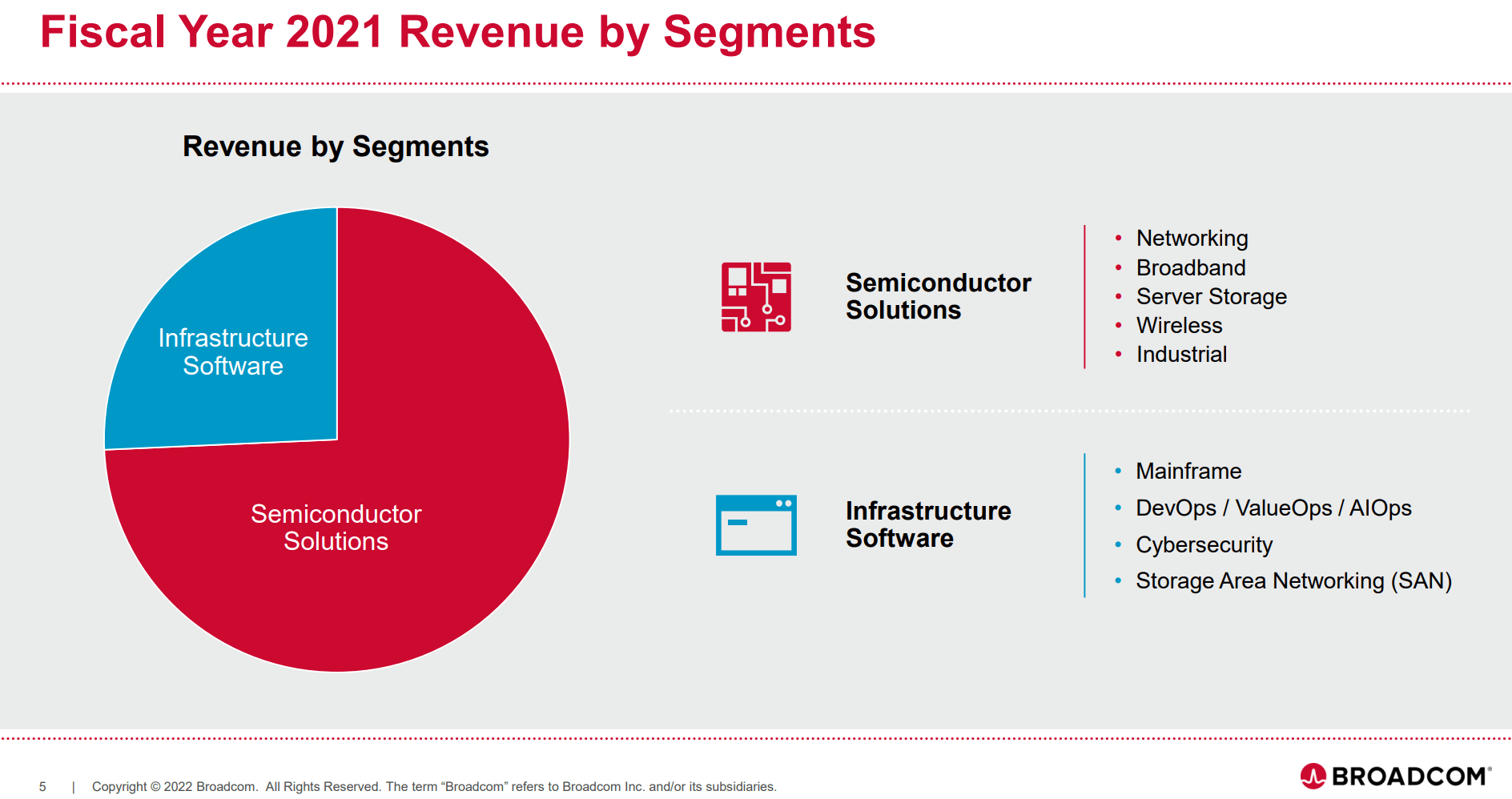

Third, VMware shareholders should consider the pro-forma business mix. Broadcom’s business mix is currently ~25% infrastructure software on $30 billion in revenues (Figure 6). Pro-forma, with the addition of VMware’s $13 billion in revenues, the business mix will shift towards roughly 50/50 infrastructure software versus semiconductors.

Figure 6 – AVGO F2021 Business Mix (AVGO investor presentation)

Infrastructure software is typically stickier and less cyclical, especially for revenues following the Software-as-a-Service (“SaaS”) or subscription model. VMware’s business mix was approximately 67% SaaS and maintenance service revenues in the latest fiscal year, whereas Broadcom’s revenues from services and subscriptions was 24% in the latest fiscal year. This means that on a pro-forma basis, VMware shareholders exposure to SaaS and subscription revenues will fall from roughly 2/3 of revenues to 1/3 of revenues.

On the other hand, VMware, under existing management (VMware was privately managed by Dell Technologies until 2021, had not been on the leading edge of technology for a while. It’s F2022 and F2021 YoY revenue growth rates were only 9%. So merging with Broadcom may actually give VMware investors a higher revenue growth rate, as Broadcom’s revenues grew 15% YoY in fiscal 2021.

Finally, VMware shareholders should be aware of the regulatory risks that remain. Recall in 2017, Broadcom tried to acquire Qualcomm (QCOM) but was rebuffed by American regulators on national security and anticompetition concerns. Already, there are rumblings from international regulators and VMware customers regarding anticompetition concerns.

Markets Pricing In Significant Doubts On Deal

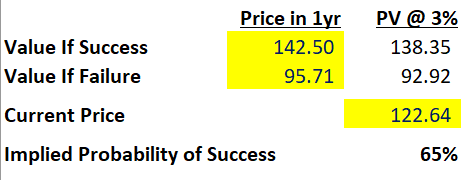

At a current price of $122.64, VMware is trading at a 14% discount to the cash tender offer of $142.50. This is a significant discount. AVGO share-exchange at 0.252 AVGO share / VMW share imply $139 / share.

Assuming a closing time of approximately 1 year, discount rate of 3%, and that VMware will revert back to its pre-deal speculation price of $95.71 on May 20th if the deal falls through, the implied probability of the deal being successful is only 65%.

Figure 7 – Implied probability of transaction completion (Author created)

Furthermore, if we consider that equity markets have rebounded significantly post late-May, so if the deal falls through, VMware’s value could be higher, then the implied probability of success is even lower. Note VMware traded at $130 as recently as February.

Conclusion

On the one hand, as no superior bids came forth during the ‘go shop’ period, it’s probably safe to say that VMware’s valuation is capped at ~$142 / share or 14.7x trailing EV/EBITDA, at least in the short-to medium term. At the same time, trading at $123 per share, markets are assigning a relatively low probability of the deal succeeding.

Even if the deal were to fall apart, one would expect a stand-alone VMware to trade above the pre-deal speculation price of $96 / share, as the company is ‘in play’ and equity markets have recovered significantly since May. Also, a standalone VMware can pursue similar kinds of revenue and cost synergies to increase shareholder value.

The low deal probability is surprising as over 50% of VMware shareholders (Michael Dell and Silver Lake) are supportive of the deal and there are no other bidders. So the uncertainty must lie on the regulatory front. As I am not an expert on anti-competitive regulations, I would suggest VMware shareholders keep a close eye on developments on this front. VMware shareholders could be comforted by the fact that downside at current valuations (12x forward EV/EBITDA) is fairly limited as it is a discount to software peers.

Be the first to comment