visualspace

People tend to gravitate towards like-minded individuals, and studies have shown that people tend to view others who like them as having good taste. I believe this holds true in the investment world, too. For example, famed investor Peter Lynch found some of his best investment ideas from products that he and his family liked and used.

This brings me to Vista Outdoor (NYSE:VSTO), which produces products that have a loyal following, and if its consumers were investors too, they’d probably want to own the stock, too. This article brings me to why VSTO is looking attractive for value investors, so let’s get started.

Why VSTO?

Vista Outdoor is a global designer and manufacturer of consumer products in the outdoor sports and recreation markets. It has a broad portfolio of well-recognized brands that are sold by leading retailers and distributors across North America and worldwide. Among its array of brands include Bell (bicycle and motorcycle gear), CamelBak (water containers), Bushnell, and the ammunition names: Hevi-Shot (game ammunition), Federal, and Remington. In the trailing 12-months, Vista generated $3.2 billion in total revenue.

The company’s end-markets are somewhat recession resistant, as people will still buy recreational products, although they may trade down to lower-priced items. That said, consumer demand has remained strong despite macroeconomic headwinds showing up in the first half of the year.

This is reflected by an impressive 21% YoY sales growth to $803 million in VSTO’s fiscal first quarter (ended on June 26th). This was driven by strong double-digit growth in Sporting Products, partially offset by a 2% decline in Outdoor Product, driven by less accessories. Also encouraging, management has been able to manage expense well, as adjusted EBIT margins increased by 87 basis points, to 23%.

VSTO’s strong cash flows have enabled continued capital returns. While the company doesn’t pay a dividend, it did spend $14 million on share buybacks, which is not insignificant considering that VSTO currently has a sub-$2 billion equity market cap.

Looking forward, VSTO has plenty of opportunities to consolidate the fragmented outdoor sporting market through strategic acquisitions. This is supported by upcoming acquisitions, as noted by management during the recent conference call:

We’ve created a company with 39 coveted brands, and soon to be 41, as we continue to expand our addressable market through strategic acquisitions, such as the most recent planned acquisitions of Fox Racing and Simms Fishing. As a result, we will have amassed 12 power brands generating more than $100 million in annual revenue. We’re also maintaining our leading number one, number two category positions across multiple brands as you can see on slide five.

Both Fox Racing and Simms Fishing are iconic brands with cult-like following in their categories. Fox Racing, a global brand in performance motocross, mountain bike and lifestyle gear, is on a path that is expected to generate $350 million in revenue this calendar year. Simms Fishing, a premium fishing brand and leading manufacturer of waders, outerwear, footwear and technical apparel, is expected to generate $110 million in annual revenue this calendar year.

Also encouraging, VSTO has been able to grow externally without the use of excessive leverage. It had a low net debt leverage ratio of just 0.7x, and expects it to be a still reasonable 1.6x after its planned acquisitions. This is within management’s long-term targeted range of 1x to 2x.

Factors that could drive VSTO’s share price down could be continued macroeconomic pressures due to high inflation, with the potential for a recession. However, some market strategists and even President Biden expects a recession, if it happens, to be relatively mild.

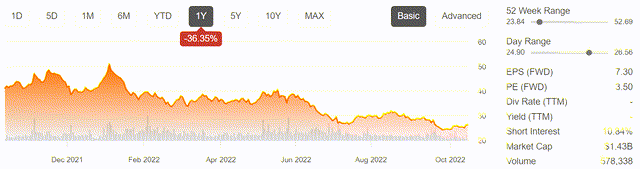

Meanwhile, it appears that the market has already baked in a very bad scenario for the company, as VSTO’s stock price is now trading at half of its 52-week high, as shown below.

VSTO Stock (Seeking Alpha)

At the current price of $26.19 and a forward PE of just 3.5, I believe the market is being overly-rotated on the negatives while ignoring the positives. This is reflective of bear market mentality, which is the opposite of bull market mentality, in which only positives are considered and negatives are ignored. Wall Street analysts have a consensus Strong Buy rating on VSTO stock with an average price target of $45, translating into potentially very strong double-digit returns.

VSTO Price Target (Seeking Alpha)

Investor Takeaway

Vista Outdoor has built up an impressive collection of strong outdoors brands, and it continues to grow its portfolio. This puts VSTO in a strong position as consumers have found renewed appreciation for the outdoors over the past couple of years. While VSTO isn’t a perfect company (if there is ever one) I believe the market is unduly bearish on it at the current time. This could present a very attractive opportunity for long-term investors with a higher risk tolerance.

Be the first to comment