HHakim/E+ via Getty Images

Vista Energy, S.A.B. de C.V. (NYSE:VIST) is an oil & gas producer with operations in Mexico and Argentina. It’s been a big year for the company, expanding output while also benefiting from strong energy prices. Vista recently reported its latest quarterly result, which went a long way to strengthen its bullish case through climbing profitability, positive free cash flow, and a solid balance sheet.

Shares are already up nearly 70% in 2022, but we see more upside going forward on continued operational and financial momentum. Vista appears undervalued relative to some other Latin American energy players, with the key distinction here that the company is independent and not state-owned. With a bullish view that energy prices have room to rally higher, we expect VIST to outperform.

VIST Earnings Recap

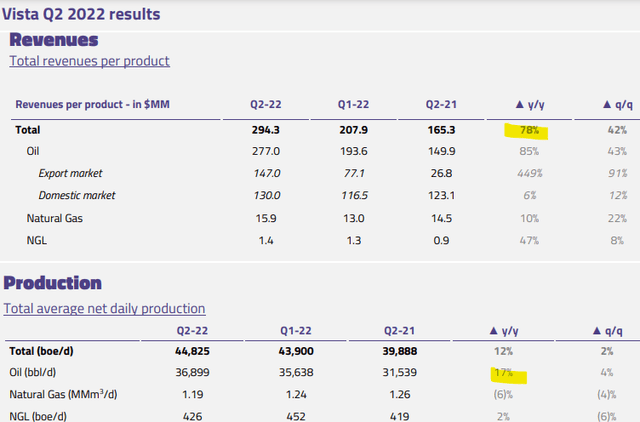

The company reported its Q2 earnings on July 26th with non-GAAP EPS of $0.93, up from $0.20 in the period last year. Revenue reached $294 million, up 78% year-over-year reflecting higher realized prices for oil and gas, with crude selling for 44% more than the average price in Q2 2021 and also up 22% from the first quarter.

Vista’s oil production averaging 37k barrels per day was up 17% y/y and 4% q/q as new shale drilling pads have come online in the Bajada del Palo concession in Western Argentina. This helped balance a -6% decline in natural gas production, which is a smaller part of the business, representing just 5% of total revenue.

An important theme for the company has been an effort at cost control to limit the lifting cost increase that reached $7.80 per barrel, from $7.30 in Q2 2021, but favorably flat from Q1. The trend here considers broader inflationary pressures but also a dynamic that the majority of the company’s operations are in Argentina, while the local Peso has been appreciated in real terms over the last several months. In essence, while oil is exported in Dollars, climbing Peso-denominated labor and supply contracts have added to expenses. Favorably, management believes the lifting cost has stabilized with room to trend lower.

Overall, the takeaway here is the strong profitability. Adjusted EBITDA in Q2 reached $202 million, more than double the $102 million result from the period last year. The adjusted EBITDA margin at 69% also climbed from 61% in the prior quarter. The company also generated $62.6 million in free cash flow during Q2, adding to its $252 million balance sheet cash position against $528 million in gross debt. Vista is reporting a net leverage ratio of 0.6x on a trailing twelve months EBITDA basis.

While Vista does not currently pay a regular dividend, the company did repurchase around $28 million in shares during the quarter. Management intends to distribute cash to shareholders either with a new dividend or more buybacks over time as earnings ramp up through scale over the next few years.

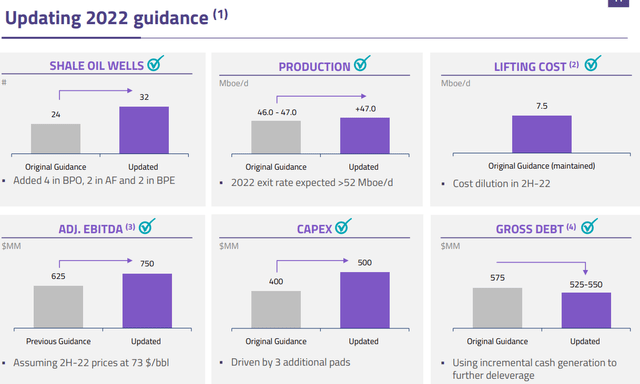

In terms of guidance, management hiked its full-year production target to “+47 Mboe/d” compared to a range between 46.0 and 47.0 announced at the end of 2021. The important point here is that the company expects to exit 2022 with a production run rate above 52 Mboe/d, representing an increase of 16% compared to Q2 realized levels. The full-year adjusted EBITDA estimate at $750 million, is updated from the previous guidance of $625 million.

Is VIST a Good Long-Term Investment?

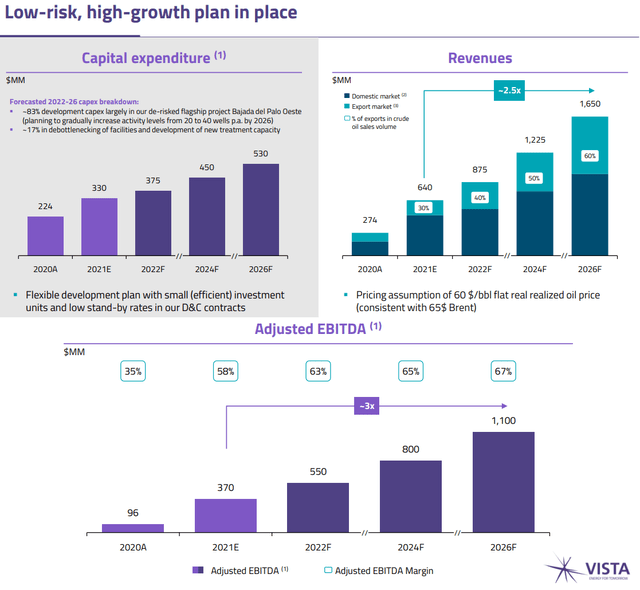

With a current market cap of just around $800 million and an enterprise value closer to $1.1 billion, Vista is making a name for itself as an emerging small-cap E&P leader in the region. With the bulk of its operations connected to the prolific “Vaca Muerta” shale formation in Argentina, the attraction here is a pure-play on this area that has attracted significant investments based on the favorable economics.

For context, Vista controls five concessions with 35-year terms covering more than 158k acres. The addition of new operating wells is driving production growth, which is expected to ramp up over the coming years. Management is targeting firm-wide total energy production to reach 80 Mboe/d, representing an average annual growth rate of around 14% per over the next four years. Through a higher proportion of export sales, revenues are projected to reach $1.65 billion by 2026, allowing adjusted EBITDA to triple from 2021 levels.

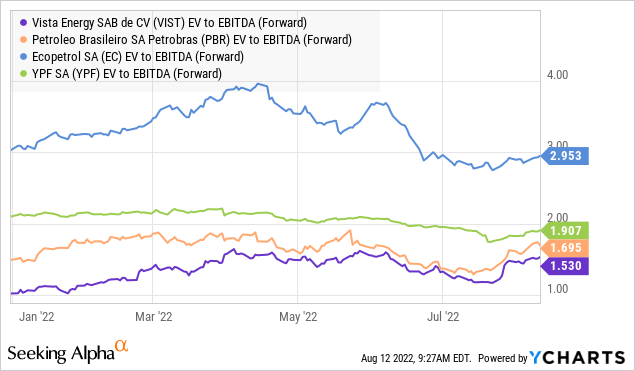

Beyond this strong growth outlook, we mentioned Vista’s independent profile stands out compared to LATAM energy giants like Petrobras S.A. (PBR), Ecopetrol S.A. (EC), and even Argentina’s YPF SA (YPF) which are all state-owned. While there will always be certain risks in operating in Latin America, including Argentina, the point here is to say that Vista avoids many of the political interference and governance risks that have plagued its peers historically.

We point out that Vista is currently trading at an EV to forward EBITDA multiple of just 1.5x, which represents a discount to PBR at 1.7x, YPF at 1.9x, and Ecopetrol at 3x. A contrast can be made with YPF which also operates in the same Argentine Vaca Muerta formation. In this case, YPF carries more debt with a leverage ratio closer to 2x while presenting softer growth, with energy production up just 8% in its last reported Q1 compared to VISTA which posted a 14% increase. While none of these companies make for an apples-to-apples comparison, we make the case that Vista is simply undervalued with its latest results possibly even justifying a premium.

VIST Stock Price Forecast

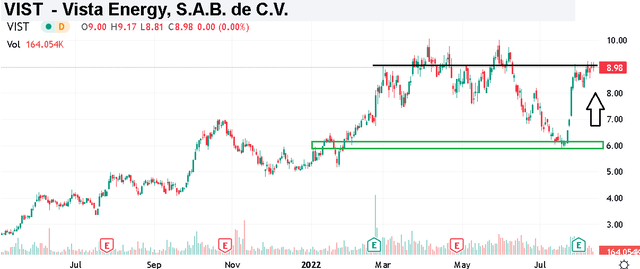

With the more volatile commodity price of crude oil in recent months, pulling back from its high, it’s encouraging to see VIST trading off just 10% from its cycle high near $10.00 reached in Q1.

Our call is that shares of VIST should lead the energy sector higher in a scenario where the price of crude oil rebounds. While global supply chain disruptions have eased, compared to fears earlier this year from the Russia-Ukraine war, the next catalyst for the market could be an improvement on the demand side outlook. The stock spiked on this latest quarterly earnings, and it appears the momentum has turned more positive. As long as shares can hold the ~$7.00 as an area of support, our recommendation is that investors should stay bullish.

Final Thoughts

We rate VIST as a buy with a price target for the year ahead at $12.00 representing a 2x EV to EBITDA which would work to narrow the valuation spread with YPF and ultimately open the door for the stock to trade at a small premium. We like the growth story and view Vista as high-quality small-cap offering exposure to this important market segment.

In terms of risks, we already mentioned the higher levels of uncertainty related to companies operating in Latin America. From a high level, a deterioration of the global macro outlook, accompanied by a drop in global trade with lower energy prices, would force a reassessment of the earnings outlook. For Vista, the operating margins and production levels will be key monitoring points over the next few quarters.

Be the first to comment