Justin Sullivan

Investment Thesis

Visa Inc. (NYSE:V) continues to improve its own financial results, and it seems that the overall economic slowdown is not an obstacle for the company. Visa looks like a safe harbor against the backdrop of global challenges such as supply chain crisis, inflationary pressure, and declining demand. However, the company’s market valuation is fair, so we maintain confident HOLD status and cannot yet recommend buying the stock due to a very modest upside.

Visa is a safe harbor in the time of uncertainty

2022FY was successful for Visa. The company significantly increased the volume of payments and managed to recover lagging business lines. Unlike many other industries, transactional services performed quite well throughout the year. The general proliferation of payment systems, lack of direct monetization systems in the B2C segment and expansion of the ecosystem helps the company avoid problems with demand from retail customers.

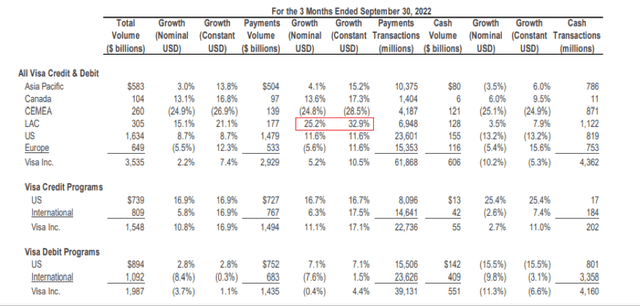

The inflation spiral is a global concern in 2022, but has not caused problems for Visa. Payment volumes, as well as the number of transactions continued to grow along with the company’s withdrawal from the Russian market, strong currency exchange rates and volatility in the cryptocurrency market, where Visa cooperates with more than 70 platforms.

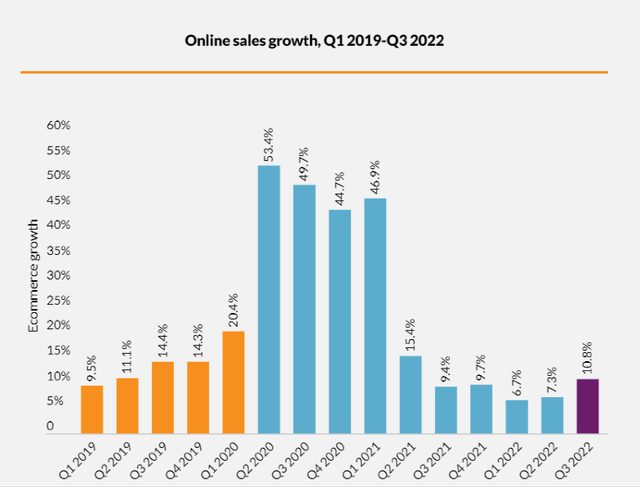

E-commerce is still an important payment volume driver, and in Q3 (Q4 FY22 for Visa) its YoY growth accelerated again after a slowdown in 1H, according to the U.S. Department of Commerce.

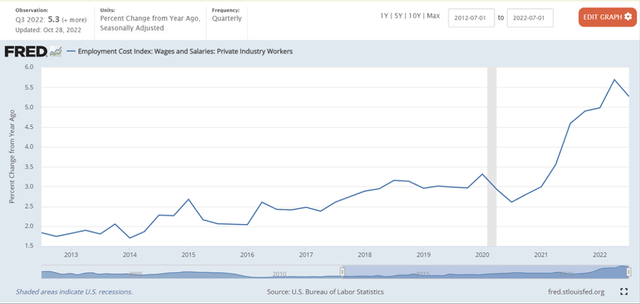

Despite problems with increasing prices, consumer activity has remained strong so far, according to FRED, and we believe this is due to record growth in wages. Even with elevated prices for basic commodities and energy, consumers are still willing to increase spending on cyclical goods, although they allocate less weight to them in the overall basket.

In addition, Visa continues to enter foreign markets. Latin America is an important region now, where transaction services are not yet so advanced, and consumer behavior differs from that in the developed countries. According to the company’s management, the growth of the total volume of payments in constant currency in Latin America was +33% YoY in Q4. Going forward, Visa retains high potential in Africa and some Asian countries.

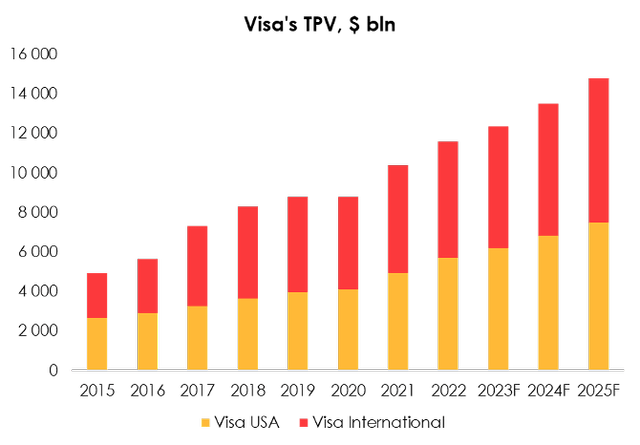

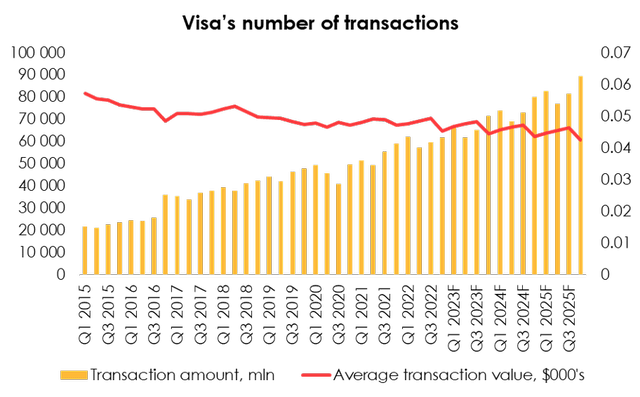

We have quite a conservative view on future TPV growth, given that the average ticket per transaction continues to decline steadily and share of digital payments remains high in the key markets. We expect Visa TPV to total $14 852 bn (+5.41% YoY) in 2023 and $15 495 bn (+4.33% YoY) in 2024, subject to further negative exchange rate effects, but we allow the TPV forecast to improve depending on the scale of Visa’s service offerings and expansion activity into new markets.

The growth in the number of transactions and increased ways to monetize users are crucial for Visa. Historically, the average transaction volume always declined due to more frequent use of the service for everyday small purchases, but TPV compensated for this by increasing the number of transactions.

Such a trend creates a positive base for Visa to increase revenue from the Data Processing segment, so revenue growth will outpace TPV growth.

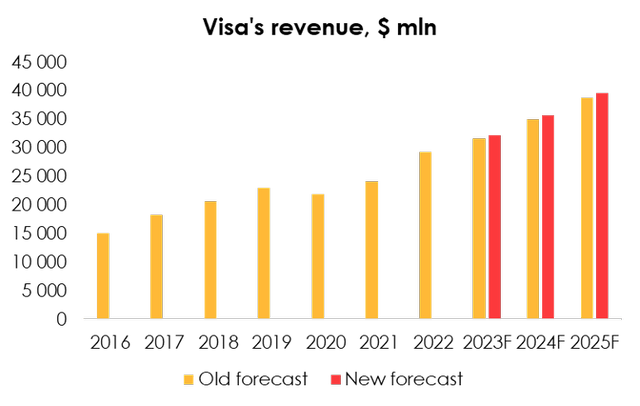

Following the FY22 report, we have revised our revenue forecast for Visa upwards from $31 661 mln (+9.0% YoY) to $32 170 mln (+9.8% YoY) in 2023 and from $35 069 mln (+10.8% YoY) to $35 751 mln (+11.1% YoY) in 2024. The revenue forecast was influenced by minor adjustments to the total payment forecast and monetization rate.

High yields are systematic – Visa is a natural cash generating machine

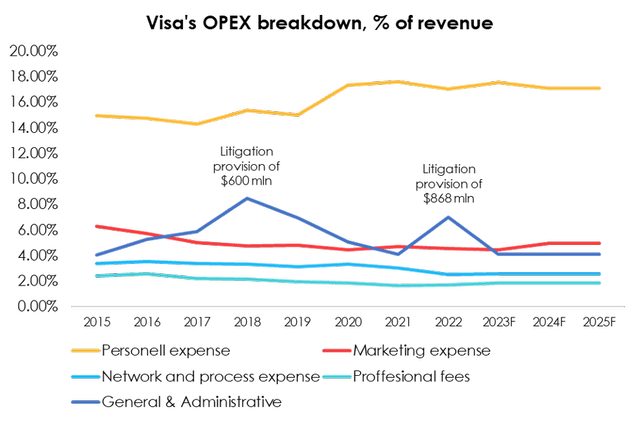

Comfortable cost structure and high margin are also positive factors for Visa. In 2022 operating margin was 64.19% including litigation costs and was up by 1.58% YoY excluding litigation costs despite a premature wage hike in Q4.

Meanwhile, costs for most items except labor and one-time items have increased at a slower pace than revenue since 2015. We expect Visa to be very conservative in increasing future spendings. The company does not require large investments in advertising, and the infrastructure is efficient and unlikely to require significant cash expenditures over the foreseeable time horizon.

We expect spending growth of 11.74% in 2023, which would be equivalent to 66.55% of operating margin.

Visa offers an attractive yield, and a sharp increase in costs on any expense item, except for potential legal expenses are yet unlikely to arise. The company has no problems with cost inflation, as payment monetization remains stable, and the business is barely dependent on global supply chains or other noncontrollable factors.

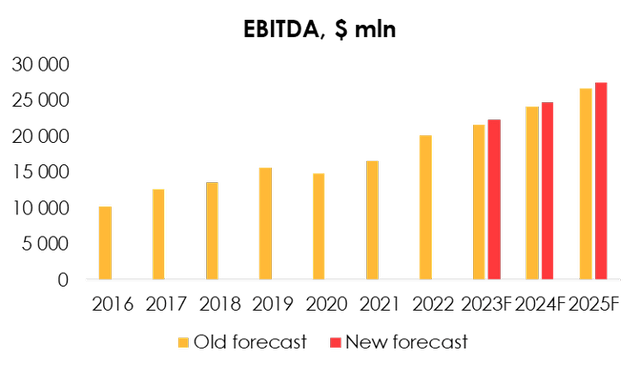

We have revised our EBITDA forecast from $21 676 mln (+7% YoY) to $22 350 mln (+9% YoY) for 2023 and from $24 184 mln (+12% YoY) to $24 829 mln (+11% YoY) for 2024 due to the following factors:

- Upward revision of revenue forecast due to expectations of higher growth and monetization levels of total payment volume.

- Slight reduction in Visa’s operating expense growth forecast due to more conservative investment plans of the company’s management for 2023FY.

Valuation

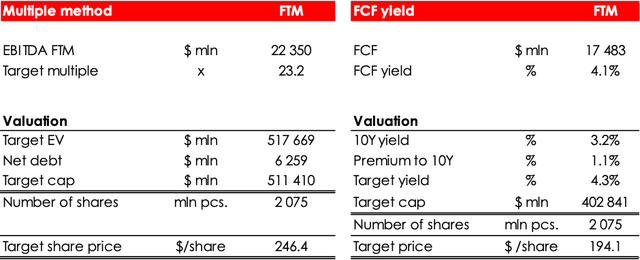

We are evaluating V target price based on FTM EV/EBITDA multiples & FCF Yield methods (average price between methods are taken).

The fair value price for the shares is $220. Based on the new assumptions, we are maintaining the rating at HOLD. The upside is +6%.

Conclusion

We have a positive view on Visa in terms of its operating results, but we would not recommend buying the stock right now. Under current conditions, Visa looks like a great instrument with positive prospects, but current prices suggest insignificant upside. Since the stock generally follows the patterns of the major indices, we would wait for a general market decline to buy.

To manage the position, we recommend keeping an eye on financial statements of Visa and Mastercard (MA), and on key economic indicators (e.g., the expenditure of the population and the situation in the labor market).

Be the first to comment