dima_zel

Some of the hardest investments to predict the outcomes of are those that have poor fundamental performance but strong catalysts for the future. A great example of this can be seen by looking at Virgin Orbit (NASDAQ:VORB), a company that specializes in launch services for companies and governments that are interested in placing satellites in orbit. Even today, there really is no true fundamental argument in favor of the company. Instead, all of its perceived value is based on what’s coming through the pipeline moving forward. This, combined with tremendous volatility in the broader market, has led to volatility in its stock as well. For those who don’t mind this kind of risk, the upside potential could be significant. But anybody who is a value-oriented investor would be wise to steer clear for the moment.

Virgin Orbit – Crash and burn

The last time I wrote an article about Virgin Orbit was in early April of this year. At that time, I acknowledged that the company was not faring well from a fundamental perspective. Having said that, I also said that it was important to view the company from a growth perspective with significant backlog and a forecast for strong growth in the near future. Ultimately, I felt like the catalysts driving the company more or less made up for the lack of a fundamental story here. And because of that, I ended up rating the business a ‘hold’. Since then, volatility has reared its ugly head. While the S&P 500 is down by 5.4%, shares of Virgin Orbit have plummeted by 41.2%.

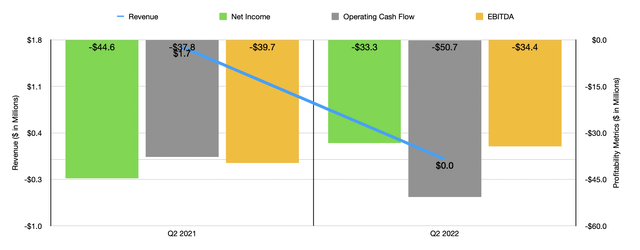

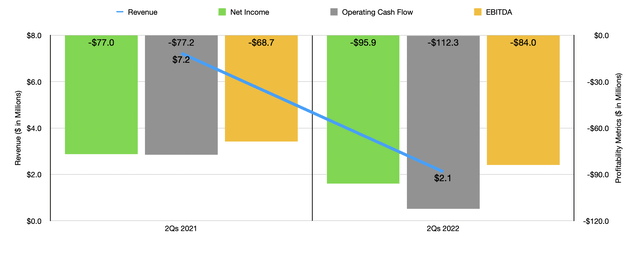

Based on this return disparity, it might be tempting to think that there was some catastrophe affecting the business. But that’s not the case. Of course, it’s also wrong to think that everything is going well either. As has always been the case, there really is not much revenue for the business. In the second quarter of its 2022 fiscal year, which management just reported on, the firm generated sales of just $5,000. This compares to the $1.69 million in revenue generated the same quarter last year. Other profitability metrics were rather disappointing as well. The company generated a loss for the quarter in the amount of $33.29 million. Although this was better than the $44.65 million loss generated the same quarter last year, it does not mean that every profitability metric improved. Operating cash flow, for instance, went from negative $37.78 million to negative $50.69 million. Though on the other hand, EBITDA did improve slightly, going from negative $39.71 million to negative $34.36 million.

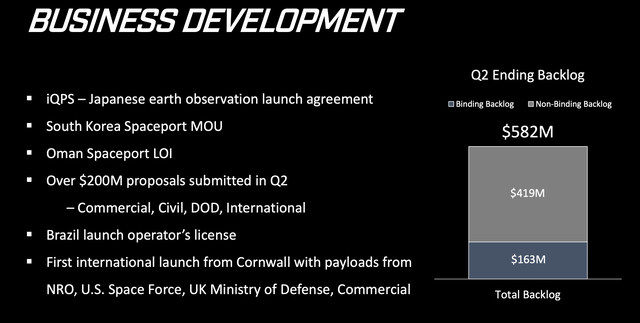

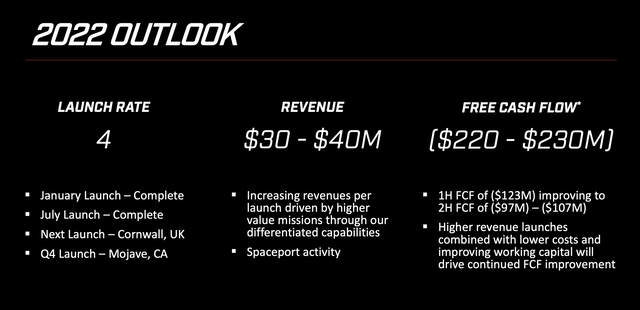

At first glance, investors would be right to ask why anybody would buy into a business with virtually no revenue and significant losses and cash outflows. Simply put, it’s because of what the future holds for the business. As an early-stage company, Virgin Orbit has been focused on getting its operations in gear. This would become most readily visible when the company reports financial results for the third quarter later this year. That’s because, during that quarter, the company achieved the fourth launch of satellites in its history, delivering 7 satellites to low earth orbit for the United States Space Force. This brings the company’s history of successful satellites deployed up to 33, with customers including the Department of Defense, NASA, and more. Thanks to this latest launch, which took place on July 1st, the company will recognize over $12 million in revenue when it reports third quarter earnings.

This is not to say that everything is going to get better overnight. Yes, the company does now have backlog of $581.9 million, $163.2 million of which is binding by contract. In addition to that, the firm is now forecasting revenue for this year as a whole in the amount of between $30 million and $40 million, with pricing per launch ranging between $6 million and $12 million. On the other hand, it’s still expected to generate significant cash outflows this year. Due in part to continue capital expenditures, free cash flow should be negative by between $220 million and $230 million. This does prove slightly problematic because the company only has cash on hand of $122.9 million. Debt stands at $50 million, but it is convertible in nature. Based on this, it’s highly probable that the company will either issue additional shares, take on debt, or do something else to help cover some of its expenses. Pessimism around dilution or high-interest debt could be a driver behind the company’s falling share price recently.

At the end of the day, what will really determine the success of the company will be two factors. First will be the company’s ability to grow into its costs without massively diluting shareholders. And the second will be capturing a sizable portion of the space economy. Some estimates peg the market space at around $400 billion with the market eventually climbing to $1 trillion or more by 2040. Launching satellites will prove to be incredibly valuable, but expanding into other avenues that are related to this will also be important if the company wants to truly thrive.

Takeaway

At this point in time, Virgin Orbit is an interesting company in a fascinating space. Long term, I believe that the space economy will prove to be incredibly valuable for the players that can operate in it well. Having said that, this is a steep hill to climb and it is fraught with risks. As things stand today, the company will likely have to dilute shareholders more and/or will have to take on debt. But if management can continue to lockdown backlog while delivering on the contracts they do receive, the upside for shareholders could be material. Because of this, I have decided to retain my ‘hold’ rating on the company, with the understanding that this is a highly risky prospect with a high amount of upside potential if things go well. In short, I view this as almost like a binary play that investors should be comfortable with if they decide to buy in.

Be the first to comment