Cylonphoto/iStock Editorial via Getty Images

The pursuit of stable dividend income has quickly come to form a critical and near-visceral objective of my post-pandemic investment strategy as mass layoffs loom over what was once a strong economy. Inflation has significantly eroded previously strong discretionary income, with the specter of a protracted period of negative economic growth rendering a dependency on a singular income source via a salary as not prudent. This was the backdrop that led me to take an investment position in VICI Properties (NYSE:VICI), an S&P 500-listed REIT that owns one of the largest portfolios of casino properties in the US. This consists of 43 properties comprised of over 122 million square feet and with approximately 58,700 hotel rooms and more than 450 restaurants, bars, nightclubs, and sportsbooks. Its portfolio includes some of the most iconic buildings in Las Vegas, like the Venetian Resort and MGM Grand.

Dividend investing is not an easy endeavor, with the need for stability and growth set against the volatility and inherent entropy of the stock market and economy. VICI has a diversified client base with its properties triple-net leased to several companies including Caesars Entertainment (CZR), MGM Resorts (MGM), and Penn Entertainment (PENN). My reasons for making an investment in VICI are mainly concentrated on its dividend history and strong financials.

A Strong And Near Recession-Proof Financial Base

I’m taking defensive measures ahead of what is sure to be a global recession next year. Academic research is mixed on whether casinos are recession-proof. Indeed, a 2011 academic paper from Oklahoma State and Purdue University came to an empirical conclusion that there was a generally negative relationship between the 2008 economic recession and Las Vegas casino revenues. This relationship was significantly influenced by an increase in exposure and reliance of the sector on lodging. But this is countered by previous academic research showing casino revenues rising in previous periods of negative economic growth, including in 2001.

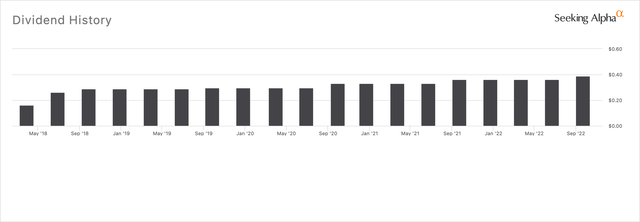

Fundamentally, casinos should be less-sensitive to market downturns on the back of several factors, including repetitive gamblers and a lack of competition due to heavy regulation. And the coming recession is also likely not going to be as structural and severe as 2008 with employment still relatively strong and inflation already peaking. This provides some confidence that VICI will be able to maintain its financial health. Indeed, the cash dividend payout was recently raised by 8% to $0.39 per share. This would mean an annual yield of 4.86% with the company’s commons currently trading at just over $32.

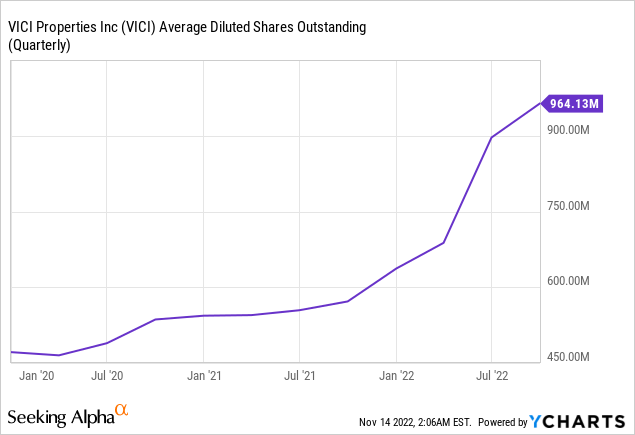

Stability and growth are both important tenets for dividend investors, and VICI has been consistent with maintaining and growing its dividend since it went public. The company has now grown its dividend by a compound annual growth rate of 8.2% since October 2017 with its leases coming inbuilt with annual rent escalators pegged to inflation. This creates certainty for rental income against financing costs split between fixed-rate debt and equity offerings. The company recently offered 16.5 million common shares at an implied price of $30.90 for gross proceeds of $510 million. This was a relatively small dilution event at less than 2% of its average diluted shares outstanding, with proceeds likely to be invested at a high single-digit cap rate.

Revenue Growth Wins As FFO Moves Higher

The sustained increase in average diluted shares outstanding did provide a reason for pause, but VICI has been able to invest this well. A more than 2x increase in share count is a dilution of common shareholders, but it has meant less dependency on debt and came with a positive return on equity for the same shareholders over the same time period.

The company recently reported its fiscal 2022 third quarter earnings, which saw revenue come in at $751.5 million, a 100% increase from the year-ago quarter and a $13.27 million beat on consensus estimates. This growth reflected the full impact of VICI’s acquisition of the Venetian Resort and MGP. The company also closed an acquisition of Rocky Gap Casino Resort in Maryland, which will see their master lease with existing tenant Century (CNTY) increase by $15.5 million for a 7.6% acquisition cap rate.

Adjusted FFO per share was $0.49 during the third quarter, outperforming consensus for $0.48. This was also a sequential increase from $0.48 in the second quarter and grew by $0.04 from the year-ago period. This of course meant its dividend was covered and helped support a balance sheet with cash and equivalents that stood at $518.4 million.

While the fate of REITs has always been tied to the financial viability of its tenants, triple net-lease REITs like VICI provide a significant cushion to this. Further, recession fears for next year will likely materialize but not to the extent of 2008 and casinos probably stand to perform well in this environment. I’m comfortable buying the commons at a 16.77x price to forward AFFO. Whilst this is around 10% higher than its sector median, VICI comes with a strong growth profile and an impressive dividend history.

Be the first to comment