Alex Wong/Getty Images News

The last two weeks saw bank stocks outperform as a string of better-than-expected earnings releases triggered a significant rally. Both JPMorgan (JPM) and Bank of America (BAC) beat expectations, and the entire banking sector rallied when their releases came out. The highlight of the banks’ third quarter was Bank of America’s net interest income, which increased 24% despite the persistently inverted yield curve observed in the period.

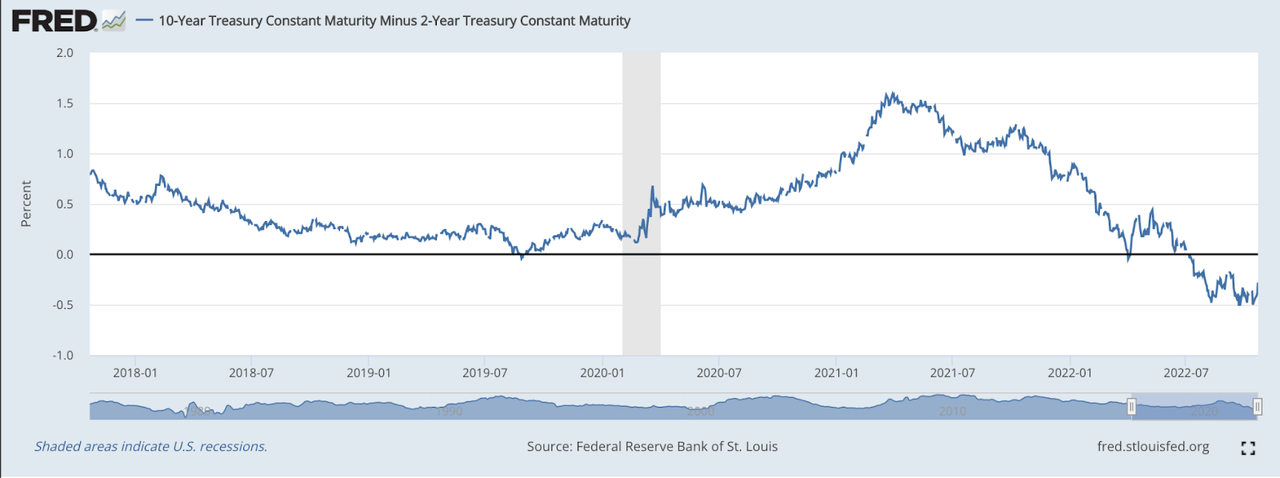

2/10 year treasury spread (FRED)

Many people were surprised to see banks showing relative strength last week. It is well known that inverted yield curves are not good for banks. They borrow on the short end of the yield curve and lend on the long end, so long term interest rates being lower than short term rates should squeeze their margins.

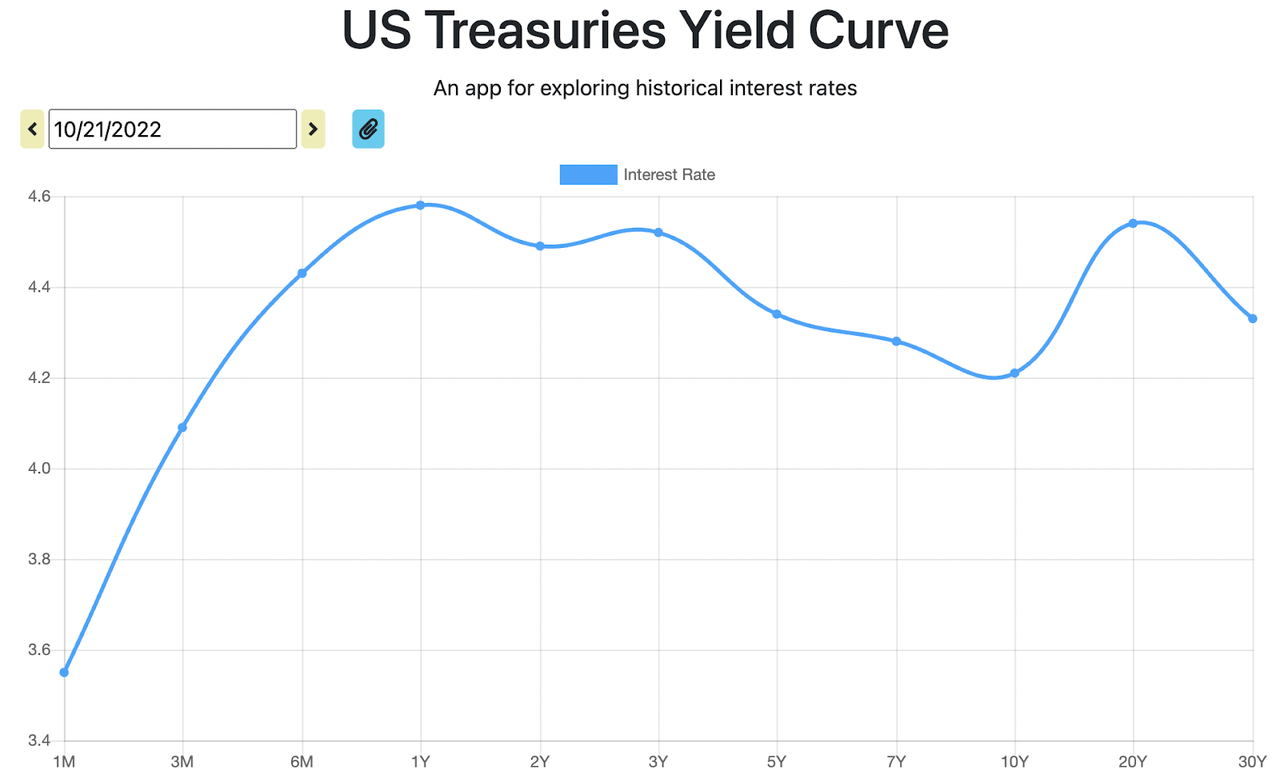

One reason why banks are beating expectations is because the yield curve is not as “inverted” as many people believe it is. The curve that’s currently inverted is the 2-year/10-year treasury yield spread, which plots the 10-year yield minus the 2-year yield over time. That was inverted by 28 basis points as of this writing and had been inverted for most of the year. The true yield curve–the one with maturities on the X axis and yield on the Y axis–still has an upward slope. Extremely short-term bonds have lower yields than long term bonds; the inversion starts at the one-year maturity.

Yield curve (US Treasury Yield Curve)

Given that interest rates are rising and the yield curve is not THAT inverted, this is a good environment for lenders. High interest rates in themselves are good for banks, as they allow banks to charge higher interest rates. It’s only when the yield curve inverts that this ceases to be the case, and today’s yield curve is only partially inverted.

What’s a good way to play this increasingly bullish environment for banks?

You could try finding banks that you think are better positioned than their peers–I happen to like Bank of America and TD Bank (TD) personally. However, you can just skip all that and buy the Vanguard Financials ETF (NYSEARCA:VFH), which gives you exposure to all the big banks, credit card companies, and Berkshire Hathaway (BRK.B).

I bought VFH this year knowing that I wanted more exposure to U.S. financials. I saw that bank stocks were going down while their interest income was going up. Their earnings were declining, but that was in very large part due to higher provisions for credit losses (“PCLs”), which is more a precaution than a true loss. If the current recession risks are overstated, then banks will be able to lower those PCLs later. I happen to believe that that’s the case. Media scare stories have trained people to equate “recession” with “catastrophe.” This leads to binary thinking whereby there can only be a raging expansion or an impending apocalypse. In reality, there is such a thing as a “mild contraction,” and we’re in one today: jobs are being added, unemployment is low, and retail sales are stable. If we are in fact in a recession, it is a mild one, not a 2008-style meltdown. For this reason, banks are still well positioned to out-perform compared to investors’ relatively low expectations. VFH is a great way to get exposure to this undervalued sector, particularly for investors who don’t have the time or risk tolerance to entertain individual bank positions.

Why VFH is a Great Alternative to Individual Bank Stocks

There are many reasons why a person would prefer a sector fund over a collection of individual stocks. Diversification is the main reason, a lack of expertise in the sector is another. Any investor can benefit from diversifying their portfolio, most investors would benefit from diversifying the portion of their portfolio that is invested in financials. The reason for this is that financial stocks, especially bank stocks, are notoriously different from other stocks, particularly in the way they are analysed. If you don’t have particular expertise in the banking sector, you might want to skip picking individual bank stocks.

First things first, banks are analyzed using a host of ratios that are not applicable to other kinds of companies. Capital ratios, for example. To begin with, you’ve got the risk based capital ratio, which is capital over risk weighted assets. Then you’ve got other ratios that break down capital into different levels of quality, like the CET1 ratio and the Tier 1 ratio. Finally, there are loss absorption targets, stress tests, and other various things related to the capital ratios. The regulations regarding banks’ capital ratios are quite complex, and you need to know all of them to understand how risky an individual bank is.

Second, banks interact with macro factors in a rather unusual way. Chiefly, they respond to interest rates differently from other companies. Higher interest rates reduce the present value of growth companies’ future earnings, and increase the expenses of capital-intensive companies like utilities. Banks are unique in that they can potentially gain from rising interest rates. Provided that rates rise in parallel across the yield curve, and the yield curve remains upward sloping, banks usually gain from interest rate hikes. However, if the yield curve inverts, that might not happen. In the third quarter, the U.S. banks’ interest income increased, which is consistent with the theory that banks gain from high interest rates. However, it was not consistent with the theory that an inverted yield curve diminishes banks’ gains from high interest rates. Ultimately, I think that the banks’ strong performance in Q3 is explained by the fact that the yield curve was not “truly” inverted; the 2/10-year spread was negative, but not shorter maturities’. The point is that in order to pick individual bank stocks you need to know how different banks respond to interest rates, as some are far more rate-sensitive than others.

Between capital adequacy and interest rate sensitivity, banking stocks have a lot of unique factors that can be a real challenge to understand. In light of this, funds like VFH offer a great way to get started with banking and financial stocks that does not require deep expertise in the sector to get started with.

First off, you get diversified exposure to U.S. banks, including JPMorgan, Bank of America, Citigroup (C) and Wells Fargo (WFC). So, your risk is spread across various banks with varying degrees of capital adequacy and interest rate sensitivity, resulting in a portfolio that can do well in various different economic conditions.

Second, you get significant exposure to non-bank financials. In addition to banks, you also get holding companies like Berkshire Hathaway, brokers like Charles Schwab (SCHW) and credit card companies like Visa (V). Some of these companies are doing much better than your average bank this year. For example, Charles Schwab is down only 7.3% for the year, while Visa is down only 6.6%. This makes perfect sense, because most of the big banks have heavy investment banking exposure, and i-banking is taking a hit from the collapse of tech IPO underwriting business. Brokers like Schwab on the other hand profit from volatility whether the market is bullish or bearish, and capture higher interest income in their lending operations. So, through VFH, you get heavy exposure to non-bank financials, which are doing much better than large, diversified banks this year.

VFH is Pretty Cheap

Another attractive thing about VFH is that the fund is pretty cheap. VFH is not a broad market index fund: it is a sector fund that tracks the MSCI U.S. Financials Index. Nevertheless, it has expenses that are typical of broad market index funds, including:

-

A 0.10 MER.

-

Decent tracking (the fund’s NAV trails the benchmark by only 0.8% cumulative over 18 years).

-

A 0.02% bid-ask spread.

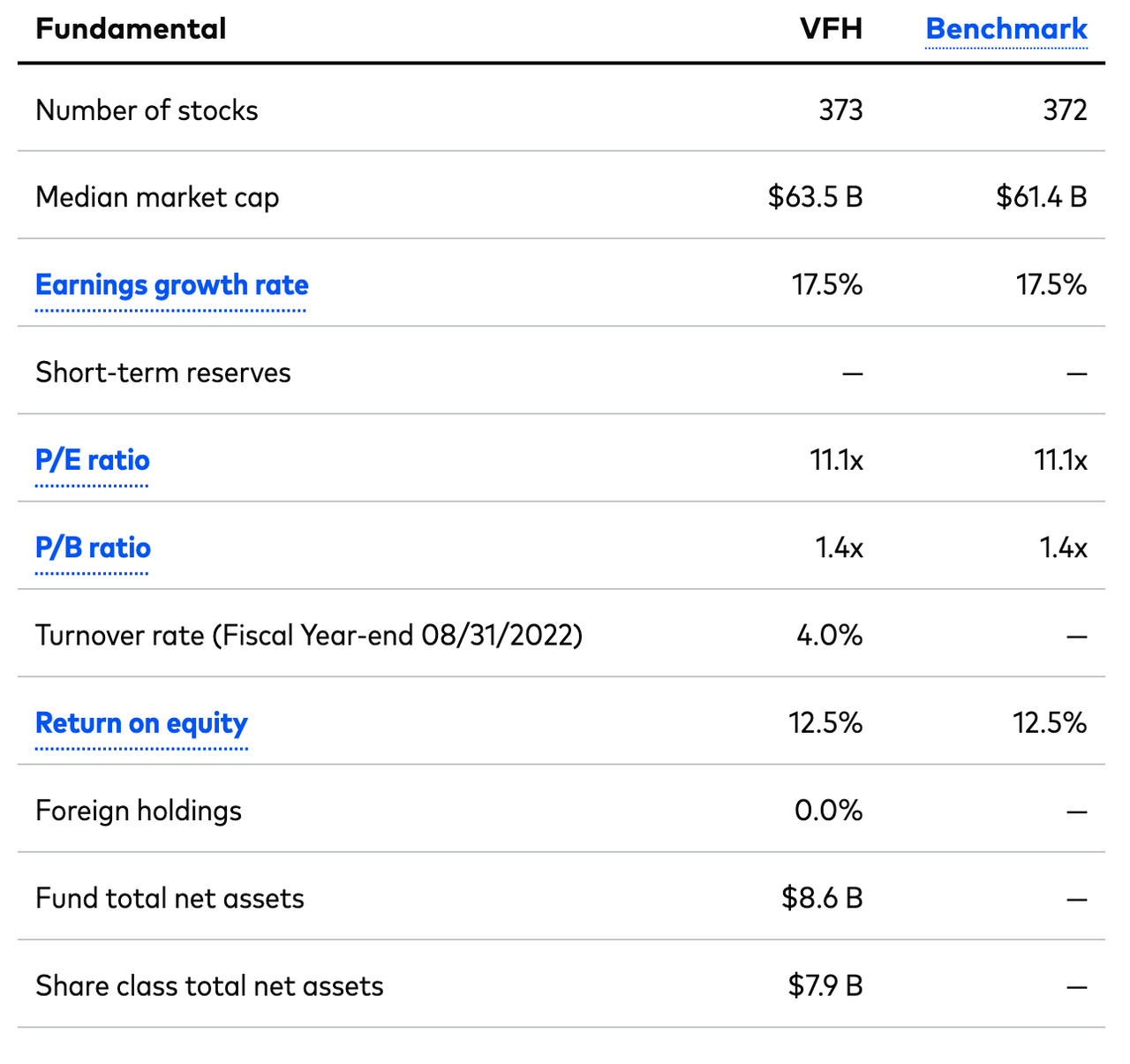

These characteristics collectively indicate that VFH is a cheap fund. There is another form of “cheapness” you can speak of with respect to VFH: the cheapness of the holdings. Because financials are out of favour right now, VFH’s underlying portfolio is rather cheap, with an 11.1 P/E ratio and a 1.4 price/book ratio. These low multiples are currently available despite the fact that VFH has a 12.5% average return on equity and a 17.5% earnings growth rate. So, not only are you not paying out much for VFH in terms of fees, spreads, and tracking error, you’re also not paying too much for the underlying stocks.

VFH portfolio valuation (Vanguard Group)

The Bottom Line

The bottom line on VFH is that it is an inexpensive fund invested in an industry that’s currently out of favour for no particular reason. Sure, bank earnings are down this year, but that’s largely due to PCL build. Many credit card companies and brokerages are doing quite well. With VFH, you get not just the banks, which could see their earnings surge as PCLs come down in the next economic recovery, but also non-bank financials, which in many cases are doing quite well already.

To be sure, VFH is exposed to many risk factors. Inverted yield curves are not good for banks, and recessions tend to increase credit risks. Nevertheless, all signs indicate that, if we are in a recession right now, it is a mild recession, not a 2008-style meltdown. Taking the pros and cons of financials together, we can make a strong case that financials are likely to rise in the ensuing months, much like oil stocks did earlier this year. Personally, I’m quite content being overweight banks, both individually and through my position in VFH.

Be the first to comment