B4LLS

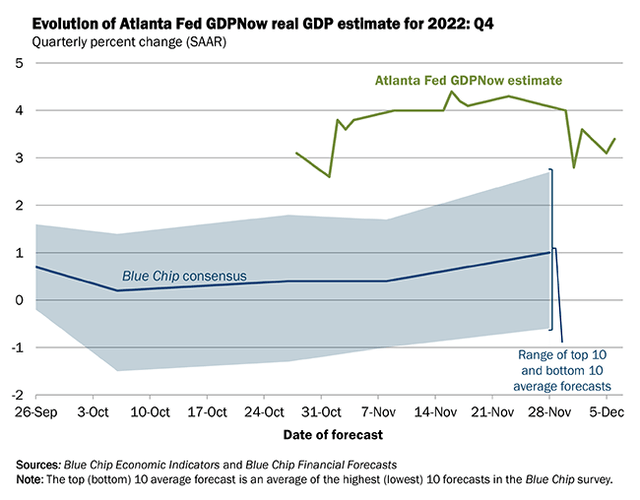

Electrical equipment stocks are usually sensitive to changes in the economy. While the current Atlanta Fed GDPnow reading shows robust real economic growth, there are fears of a technical recession during the first half of next year. One domestic stock in a cyclical space is upbeat, and earnings are seen as improving before too long.

US Real GDP Model Suggests A Strong 2H22

According to Bank of America Global Research, Vertiv (NYSE:VRT) is an electrical product manufacturer focused on data centers (70% of revenue) and telecom (20%) end markets. In 2019, Vertiv generated over $4 billion in revenue. Key product offerings include power & thermal management, IT management, and related services.

The Ohio-based $5.3 billion market cap Electrical Equipment industry company within the Industrials sector has negative trailing 12-month GAAP earnings and pays a small $0.01 quarterly dividend, according to The Wall Street Journal.

Back in late October, Vertiv reported a solid earnings beat and topped analysts’ estimates on the top line. Still, the numbers simply roughly matched the company’s pre-announcement, but VRT lowered its 2022 free cash flow guidance. Shares climbed into and after that Q3 report. Also boosting shares was the announcement of an activist stake taken on by Starboard Value on October 20.

Vertiv has near-term supply chain risks, but those could be on the mend now that there is a global reopening and commodity costs are easing. Still, cost pressure persists, which could hurt margins in the coming quarters. With a solid order backlog, the firm should be able to weather recession risks better than some of its peers. Downside risks include reduced demand for company-owned data centers, poor execution on cost-savings plans, and increasing industry competition.

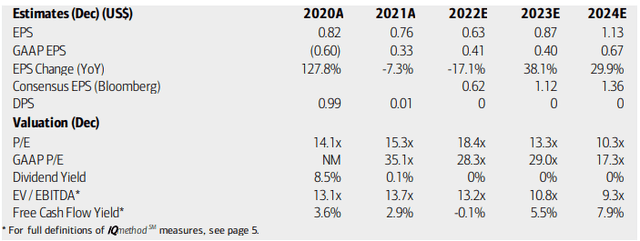

On valuation, analysts at BofA see earnings falling sharply this year but then recovering strongly in Vertiv’s FY 2023 and 2024. The Bloomberg consensus forecast is even more optimistic about future EPS growth prospects. Dividends are seen as going to zero, but that’s not a big drop. Moreover, free cash flow is flat now but should turn positive next year. Using 2022 operating earnings, the P/E is high, above 24 at last check, but that should retreat to attractive levels next year and beyond. Given that growth, I like the valuation here but acknowledge the risks.

Vertiv: Earnings, Valuation, Free Cash Flow Forecasts

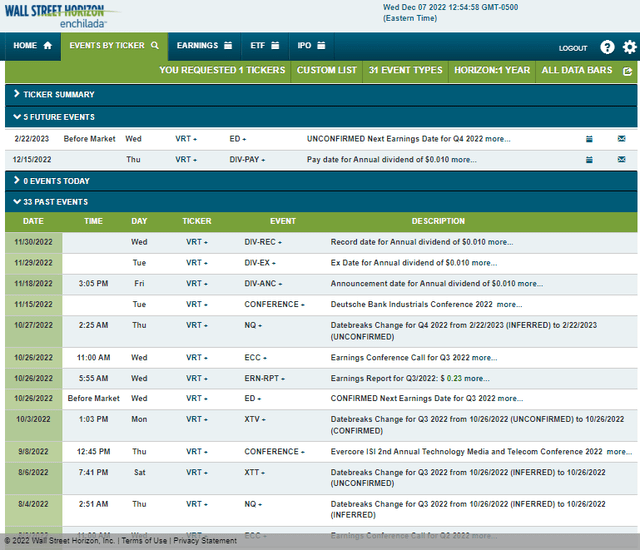

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Wednesday, February 22 before market open. Before that, a dividend pay date of December 15 is the only other notable event on the calendar.

Corporate Event Calendar

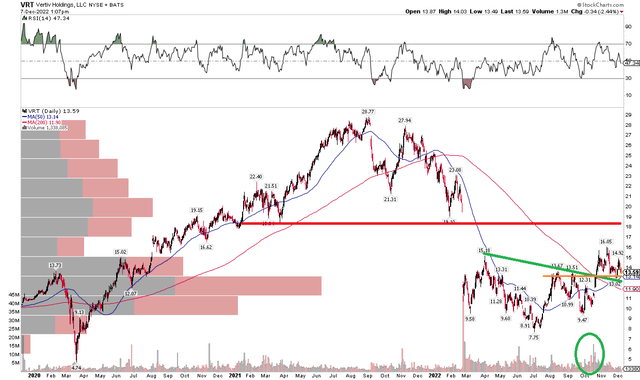

The Technical Take

VRT remains down big from its 2021 peak. I see resistance near $19, but the stock recently broke above a downtrend resistance line and has a confluence of support near the current price. Notice in the chart below that shares are above the 50-day moving average and the 200-day moving average, which should begin to flatten and even potentially turn positive. The stock’s volume profile is also interesting as there was an above-average amount of shares traded before its October earnings release when VRT was on the mend. I think being long here with a stop under the 200-day, currently near $12, makes sense. Gains should be taken on an approach of $19.

VRT: Shares Retest the August-September Highs, Eyeing More Upside

The Bottom Line

I like VRT’s valuation and its management team’s optimism for next year. Technically, the stock appears to have broken out. While macro risks are a concern, I think much of that negativity is priced in.

Be the first to comment