peepo/E+ via Getty Images

Overview

Vertical Aerospace Ltd. (NYSE:EVTL) is currently massively undervalued. EVTL is a strong contender in the emission-free electric vertical takeoff and landing [eVTOL] industry that has a large total addressable market (“TAM”) potential.

Because EVTL is not currently making any significant revenue or profits, and because the company has a lot to show the market (which translates to higher execution risk), I believe this has resulted in a significant value mismatch between the current market price and its intrinsic value. I think the market will react well if the company can show that its management’s advice is trustworthy.

Business description

EVTL is an international aerospace and technology company that focuses on emission-free flight. The company’s main business is developing, making, and selling eVTOL aircraft for the advanced air mobility [AAM] industry.

Investments thesis

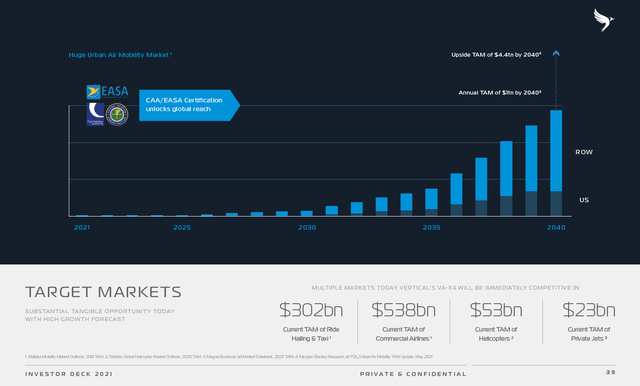

Huge market

I am a strong believer in the fact that with the deployment of the latest Ariel mobility network in the cities, EVTL will have an opportunity to expand its market. EVTL believes that they can capitalize on the untapped AAM market by avoiding the orthodox and obsolete travel methods that are not only impractical and inconvenient, but also unaffordable to a huge extent. The current projection of growth in the urban air mobility market is a whopping $1 trillion by 2040. I think that the AAM market will continue to grow over the next few years because both the population and the number of people who want to do things in transit are going up.

Using an analysis done by EVTL on Europe, there are 240 viable journeys in Europe between cities with a population of greater than 300,000 people. Their flagship eVTOL, VX4, represents a significant case to capitalize on intercity travel, such as from London to Bristol, etc. Also, Eurostar in 2019 had 11 million passengers annually, with EU rail having 8 billion passengers in 2018, which represented the maximum amount of transit opportunities that came among European cities. According to the internal survey by EVTL, reported in EVTL’s S-1, these 35 plus cities represent a population of 7.7 million people, excluding cities like London. While these statistics are only a small part of the world, they definitely show that there is a huge untapped space in this field.

EVTL sees potential in areas that aren’t directly related to its main business, such as transportation and logistics, first responder services, and military uses, as well as the distribution and maintenance of batteries for use in fields as different as transportation and logistics, first responder services, and power grid storage.

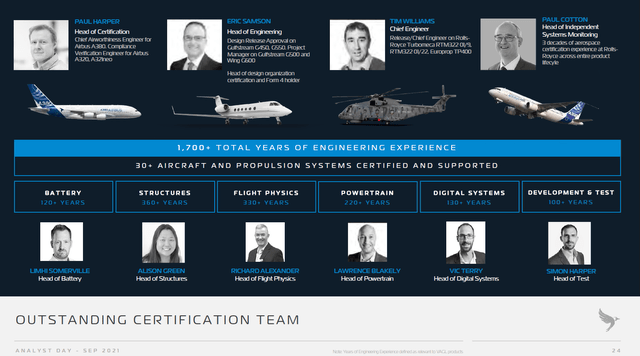

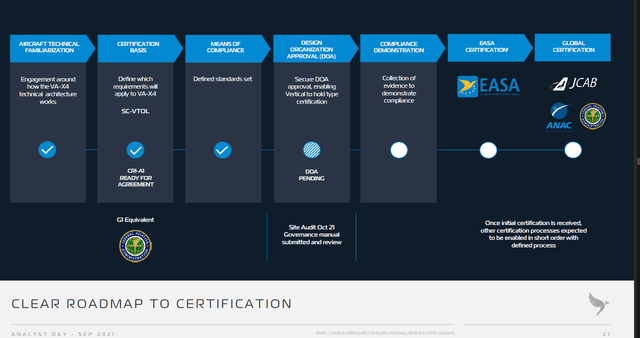

Certifications and successful prototype deployment de-risk investment case

EVTL is currently the only eVTOL designer and OEMS that is actively pursuing EASA or CASA certification. The same level of certification, along with FAA approval, is expected for their upcoming VX4 aircraft that is due in 2025.

It is never easy to get authorized certifications from reputed organizations. EVTL makes sure that it follows all the pre-requisites while manufacturing, and then it acquires certification from the local airworthiness certification authorities. It may take several years for these procedures to be completed. Two of their full-scale prototype eVOTL aircraft have already been dispatched to the UK, which includes the VA-X1 in 2018 and the VA-X2 in 2019. While VA-X1 was a single-seater, it was VA-X2, a two-seater, that broke the shackles, displaying the safe ‘motor-out’ feature. This is a major step forward towards achieving the coveted EASA certification.

Analyst day Sept 22 Analyst day Sept 22

Bespoke go-to-market approach to drive sales

EVTL recognizes the importance of commercial global presence in ensuring market and customer proximity. This is the reason EVTL depends hugely on their local regional teams to understand the local requirements and formulate plans accordingly.

As EVTL is not marketing a conventional aircraft, it understands the importance of getting local partnerships as well as customers very well and does make advancements in this direction proactively. They are also in constant touch with the local aviation authorities, mobility providers, and infrastructure developers, etc., to ensure that everything is correct in its place. They are always ready to listen and thus strike up a rapport with their ecosystem partners. This, in turn, makes people more open to the idea and helps make plans for the future.

Their mission and concepts of operation, coupled with their strategic partnerships across key markets, are the basic reasons that ensure effective integration of their aircraft and ecosystem with other existing transport means and networks.

Presence in after-market sales to further boost sales

Once it begins to sell its aircraft, EVTL also plans to provide “Aircraft Services” through its dedicated global network. These services will include services ranging from battery management to pilot training.

One of the most critical items in the latest VX4 is its battery. It has been designed in-house, keeping in mind all the intense requirements of the aircraft. As a part of the certification program, these batteries will get certification, too, which means that their OEM sales are bound to increase in the future as these batteries will be used by the customers as an upgrade or replacement. Furthermore, this battery is designed for re-use, taking out deteriorated cell packs for second-life use in grid energy storage while reusing the valuable aerospace grade electronics and composite battery packs. This is a key driver in achieving highly competitive vehicle operating costs and in the demand for aircraft services.

Also, because the planes are very digital, they can generate a lot of operational data that will bring in revenue for its Vertical Cloud Services, which were made in partnership with Microsoft.

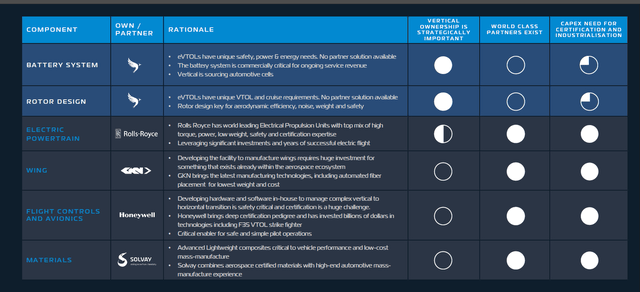

Strategic partnerships with industry leaders

EVTL emphasizes that their strategic partnerships create a sophisticated eVTOL ecosystem, allowing them to focus on creating value for their own customers throughout the process. They always sought out partnerships with industry leaders across the critical components required to successfully design, develop, and operate their aircraft. This way, they have been able to establish strong collaborations and relationships with industry giants like Rolls-Royce and Microsoft.

Using the case study with Rolls-Royce, EVTL plans to co-develop the much needed electrical propulsion units. These units are also known as power train systems. They are the world’s lightest and safest eVTOL power trains. Rolls-Royce has put in $14 million as an investor in the PIPE Financing for the Business Combination, which is part of EVTL’s partnership with Rolls-Royce.

Asset light business model sets EVTL apart from heavy CAPEX OEMs

The business model of EVTL is asset-light. They have always focused on creating an ecosystem that is a combination of key proprietary components that they themselves have developed internally and strong strategic partnerships with industry leaders in order to design and manufacture the best eVTOL aircraft. This model will give EVTL the ability to be more agile, flexible, and responsive to new technologies and opportunities. It will also give them competitive user economics, which will allow them to quickly scale up production once they get the necessary certifications.

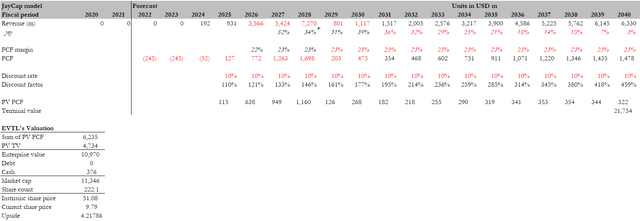

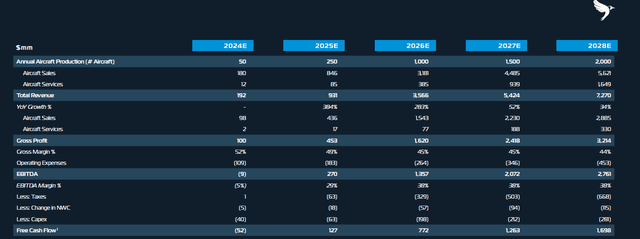

Forecast

I am stating upfront that my model is not accurate, and I don’t believe anyone can gain confidence in what would happen more than 10 years later. Nonetheless, it gives me a sense of what EVTL could be worth if it hits certain growth figures and margins, and my model’s primary goal is to demonstrate that. The basis of my assumptions is that eVOTL will take off and EVTL will meet management’s FY28 guidance. After that, growth will slow down over a 10-year period to a terminal growth rate of 3% (inflation-like rate).

The key variable in my model is free cash flow (“FCF”) margin, which I assume will not expand further after FY28. There is a good chance that this could expand further given its asset-light model, but I have no visibility into it, and it is best to be conservative considering this is an 18-year discounted cash flow (“DCF”).

Red flags

Major question mark if eVTOL can really take off

There is no doubt that the market for eVTOL aircraft is still in a relatively early stage, and its success in these markets is dependent upon its ability to effectively market and sell advanced air mobility as a substitute for conventional methods of transportation and effectiveness. If the public doesn’t see the benefits of advanced air mobility or chooses not to use it for safety or other reasons like cost, the market may not grow, grow more slowly than expected, or not grow as much as we expect. Any of these things could hurt EVTL’s business, financial condition, or results of operations.

Manufacturing at scale is still an unknown despite good prospects

The fact that EVTL has yet to develop a manufacturing facility is one of the major challenges it faces before going into mass production of its aircraft. Apart from the financial complications, the fact that it is not a traditional aircraft company makes it hard to get the much-needed clearances and certifications required for the production of eVTOL aircraft as well as lithium-ion batteries.

Conclusion

The one thing that investors need to have conviction that will work is for eVOTL to take off in the future and adoption to rise. If so, the upside from today’s stock price is incredibly huge. I believe the reason for such a big mismatch in value is largely due to EVTL not generating any meaningful revenue or profits today, and EVTL having a lot to show to the market – which means higher execution risk. So long as EVTL can show that management’s guidance is credible, I believe the market will react and EVTL’s stock price should go up accordingly.

Be the first to comment