PeopleImages/iStock via Getty Images

Not all electric vertical take-off companies are the same. Vertical Aerospace (NYSE:EVTL) aims to be an aircraft manufacturer, not an operator; it wants to build its VX4 and sell it to airlines. Joby (JOBY) wants to be an operator; they want to manufacture their aircraft and use it to operate an airline. Archer (ACHR) wants to both operate and sell the aircraft. Joby’s end customer will be the general public paying a few dollars per ride, and EVTL’s end customer will be an airline spending a few hundred thousand dollars per aircraft.

EVTL is building a team of companies that will cooperate to make the aircraft. Rolls-Royce (OTCPK:RYCEY) will build the engines, Molicel, a subsidiary of (OTCPK:TGBMF), the batteries; Honeywell (HON) the electronics; Leonardo (OTCPK:FINMF) the fuselage; and GKN, a subsidiary of (OTCPK:MLSPF) will assemble the parts into an airplane. Joby is trying to do it all themselves.

EVTL will coordinate all of this and get the aircraft approved to fly, it is a mammoth task, but everything in the aero industry is.

The evtol industry is a high-risk area for investors, the companies are years from revenue, and there are probably too many. It is unlikely they will all make it to revenue, so we must be careful where we put our money.

In this article, I will look at the people behind EVTL and the company’s finances and try to judge how it is doing concerning certification. Finally, I will consider its competitive strategy, which is the basis of my writing.

EVTL: The People

Stephen James Fitzpatrick owns more than 67% of EVTL, giving him complete control of the company he founded. Fitzpatrick is a highly successful UK-based entrepreneur. He built an energy company from virtually nothing and turned it into a top 6 supplier in the UK.

EVTL, incorporated in the Cayman Islands and listed in the US but based in the UK, is one element of a web of companies controlled by Fitzpatrick. According to Companies House, he is currently involved with eight companies, including Imagination Industries, OVO group, and EVTL. In total, he has recently been on the board of 14 companies. These companies are private UK-based limited companies where reporting transparency is not as strong as it is with the public US-based companies we usually deal with.

Earlier this year, Fitzpatrick was questioned by UK lawmakers regarding intercompany loans; EVTL received two loans from Imagination Industries in 2021 totaling £9 million.

Imagination also loaned £27 million to its directors last year, £4.4 million to Imagination Industries Incubator, £1.6 million to “Imagine Just 3 Things” and several million to Imagination Industries Aero. PricewaterhouseCoopers audited the 2021 accounts for Imagination, and in their report, they raise several points regarding the ability to continue as a going concern. See P21 of accounts. (imagination_2021_accounts.pdf)

The group is forecasting to breach financial covenants with trading creditors under the base case scenario.

The company relies on a royalty stream from its subsidiary OVO and has a loan facility repayable within the going concern period for which there is no confirmation of renewal.

There is a material uncertainty which may cast significant doubt about the groups and the company’s ability to continue as a going concern.

The subsidiary in question is OVO energy, a highly successful UK-based energy company that supplies gas and electricity to households. The UK energy industry is unique; energy companies buy wholesale and sell retail without owning the infrastructure. The National Grid owns the country’s gas and electricity networks that move energy around the UK. Much of the pricing is state-controlled by an ombudsman; the industry structure was formed when a previous government broke up a state-owned energy company.

The UK regulator fined OVO energy £8.9 million for overcharging customers in 2020. OVO made a combined loss of £300 million in the three years to 2020. However, soaring energy prices and great management gave it a profit of £337 million in 2021, turning net assets positive for the first time.

Fitzpatrick has developed a relatively poor press relationship; the generally business-friendly Daily Mail (a major UK national newspaper) has run a few negative articles about him. The Mail reported that Fitzpatrick was accused of being a fat cat making profits while ripping people off and describing him as controversial for taking money out of his company to buy a mansion when it was losing money and increasing debt.

The Web of Companies

Going through all 14 companies was time-consuming but revealed several facts worthy of note. If you follow the previous link to companies house, you can read the accounts of each company.

The web of companies controlled by Fitzpatrick is deep, and the shared names make it confusing. Jetty Technologies Ltd. (source: search of Jetty Technologies at Companies House) (active, but its counts are overdue) has previously been known as Imagination Industries Aero LTD, Vertical Aerospace LTD, Imagination Incubator LTD, Mylo App LTD, and OVO view Ltd. It has five officers, including Stephen James Fitzpatrick, Stephen Fitzpatrick, and Vincent Francis Casey. This is not illegal or sinister in any way; it is just unusual.

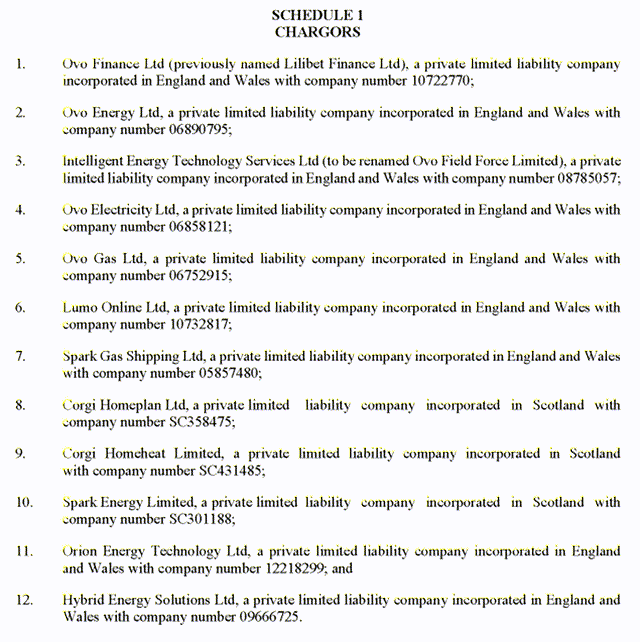

Many of the linked companies have charges against them (that is an official register of a debt). Below is the charger schedule from one such charge. (registered against OVO gas and one of 7 such charges).

Charge sheet (Companies House UK)

As is common in the UK, it is difficult to determine the size of the debt, who owes it, or what it was for.

Vincent Francis Casey is the CFO of EVTL and companies house have him being a director of 33 companies, generally the same companies as Fitzpatrick. The two men work together to build these businesses, and they have been very successful.

In October 2021, EVTL announced that Harry Holt had been appointed COO.

The press release contained the following few lines

Harry is joining Vertical from his current role as Chief People Officer at Rolls-Royce, one of the world’s leading industrial technology companies and which has decades of experience in powering the global aviation sector.

That is only half of the story. Companies House shows that Harry was a director of two companies. I have found this a recurring theme with EVTL, I think they want to be transparent, but as you will read in this article, their output is often overly positive.

Mr. Holt was a director of Rolls Royce Submarines Limited, which is the technical authority for the UK’s Nuclear Submarine fleet and a division of Rolls Royce holdings with a turnover of nearly 700 million GBP. Harry resigned on December 31st, 2021. Rolls-Royce has decades of experience in powering the global aviation sector, but Mr Holt does not.

Mr. Holt had previously been a soldier in the British Army for more than 20 years; he rose to the rank of colonel and was awarded a distinguished service order and the Order of the British Empire. That represents a highly impressive military career, and although I have never met him, I have had the pleasure of knowing several Irish guards. They have all been very impressive professionals.

The Go Ahead Group PLC was the second company Mr. Holt was a director of. He resigned as a director of this publicly traded company in October 2022 (10 months after he left Rolls Royce), having been appointed in 2017. This former public company operates as a passenger transport company. In 2021 the UK Government’s department for transport announced that it would terminate Go Ahead’s rail franchise after discovering financial errors, criticizing the company for its conduct. On December 9th, the company announced it would be unable to submit its accounts on time as its auditors needed more time to consider the implications of the errors made, in February the auditors reported that serious errors had been made since 2006, with more than £51 million being owed to the UK government, that £31 million was being set aside to pay a fine and a further £21 million was owed to the government due to a profit-sharing dispute. The errors began many years before Holt was appointed but continued throughout his tenure with the company.

To complement the entrepreneurial skill of Fitzpatrick and Casey, EVTL has appointed some industry veterans to key positions. One deserves mentioning as he has relevant high-level experience. Eduardo Dominguez was CEO of Airbus Urban Mobility and spent more than five years in senior management positions at Airbus.

The Company

Having looked at the individuals involved, I will now consider EVTL’s current situation and its competitive strategy.

EVTL order book

Much has been made of the EVTL order book. It is, without a doubt, the largest in the industry. However, I believe none of the orders are confirmed, and more than half are from related parties. Of the 1,400 orders, 500 are from Avolon and 350 from American Airlines.

During the first Half Year 2022 results, EVTL said

we have expanded our pre-order book to more than 1,400

In March, Avalon Aero, the Dublin-based aircraft leasing company, was said to have exceeded its 500 pre-orders of EVTLs aircraft and placed all of these aircraft plus an additional 50 units.

Domhnal Slattery is the founder of Avolon, and on January 1st, 2022, he was appointed Chairman of the board of directors at EVTL, one of 97 companies he is involved with.

Avolon is no longer publicly traded; it provides a quarterly update, and its Q1 2022 update confirmed that it had placed all 500 VX4 aircraft.

In the results, EVTL also announced

We have also secured an industry first with American Airlines’ commitment to place a pre-delivery payment for the delivery slots of their first 50 VX4s, out of a possible 350.

The announcement of pre-delivery payment for 50 of the aircraft resulted in a 72% gain in EVTL shares.

The wording around these orders is a concern; they are described as “initial conditional Pre-Orders,” and the pre-delivery payment is described as a “commitment.”

The 6K Q2 2022 adds some color to these orders.

all of the pre-orders Vertical has received for its aircraft are not legally binding, conditional and may be terminated without penalty at any time by either party,

A search of American Airlines (AAL) 10 Q filed October 2022 did not reveal any details about the prepayment but did show the losses associated with American Airlines Equity investment in EVTL. (page 57 shows a $57 million loss on investments from 3 companies, including Vertical Aerospace)

I do not think that AA has paid any money to EVTL for these orders, it just has the right to do so if it wishes to book delivery slots, but AA is not obligated to do so. Investors might not have gotten the complete picture from the word “commitment.” It appears to be an intention at best.

The conclusion of this section is just more caution. The orders are not firm and confirmed, no deposits have been paid nor committed to, and they can be canceled without penalty. At least 850 of the pre-orders are from related parties.

However, the pre-orders are from respected large-scale aircraft operators who would not have made them lightly. They are more of an intention to order than an order but they are the intention from large companies to buy the VX4 when and if it gets produced.

The VX4 aircraft

The VX4 (Vertical Aerospace web site)

This is another example of the overly positive messaging from EVTL, they describe the aircraft as

Our globally certified aircraft

That just is not true, the aircraft is not certified, and they are not applying for global certification.

The whole paragraph could be described as a marketing spin.

There appear to be two approaches adopted by the evtol companies. The first is to develop technology and build the aircraft yourself: this is the approach of Joby, EHang (EH), Eve (EVEX), Airbus (OTCPK:EADSF), and Boeing (BA). Several articles here on Seeking Alpha describe the second as an asset-light model. The asset-light model is to subcontract most, if not all, parts of the manufacturing process. The benefits, of course, are that you do not have to invest in manufacturing sites or R&D facilities. EVTL and Archer are pursuing this approach.

EVTL and Archer have similarities; founders from other industries (having already made significant fortunes) have not previously been involved with aerospace companies and choose to form partnerships with other organizations to do much of the development work for them. It is a lower-cost approach, but it is risky.

We have seen in the last couple of years how complex supply chains can break down and how the slow delivery of a single component can halt entire production lines. The third-party companies will not be as invested in the development and will have many other customers and areas they need to work on. The individual components from so many different suppliers might make the regulatory process far more complicated, and it means the evtol company will lack any intellectual property, severely limiting its value.

This quote from the 6K explains EVTL’s approach

Vertical’s top-tier partner ecosystem is expected to de-risk operational execution and its pathway to certification allows for a lean cost structure and enables production at scale.

The top tier partner ecosystem is a new term, and it comes with the following risk statement from the 6K

Vertical’s dependence on partners and suppliers for the components in its aircraft and for operational needs; the potential that certain of Vertical’s strategic partnerships may not materialize into long-term partnership arrangements;

I have real concerns about this approach. Key developments are needed, especially around battery technology. EVTL has subcontracted this area to Molicel, a subsidiary of Taiwan Cement Corporation, and they are a world leader in battery technology. Molicel focuses on the following areas: electric vehicles, electric storage systems, home appliances, power and garden tools, and aerospace. All those industries are already large and growing with large customers and ever-increasing needs. It worries me that Molicell may focus on the immediate potential of these current industries and may be unable to give the development time and money needed to get an evtol in the air. The entire EVTL aircraft is being built in this way, it is asset-light, but many cogs are working simultaneously, each with its own aims and needs that may not fully align with EVTL.

The recent shareholder letter amplified my concern. From page 7, the first prototype VX4 test vehicle has recently been constructed. 90% of the build was completed by GKN, who then dismantled it and shipped it in bits to the EVTL test center, where it was rebuilt and the final 10% completed.

The prototype made its first flight in September, it was brief, and the aircraft was tethered to the ground. No photos or videos were released. EVTL have said they expect approval for commercial operations in 2025; this seems extraordinarily unrealistic. Joby has completed over 1,000 test flights and flown 10,000 nautical miles with their aircraft, and Joby is guiding to 2025 for full regulatory approval. Volocopter, another European evtol company aiming for the same authorization as EVTL was flying more than 3 years ago and is targeting 2026 as the commercial launch.

EVTL are at least three years behind Joby and Volocopter, and assuming they follow a similar timeline; they will not be ready for regulatory approval before 2028. Could they do it faster? I don’t think so, they still have to get past the same rules and regulations (if they wish to fly in the US at least) with the same safety profiles and tests, plus they have to deal with the complexities of the partner ecosystem over the medium to long term.

The US and European regulatory bodies appear to be diverging on the way forward to evtol certification. The FDA recently significantly altered the way forward (causing Joby to add one year to its timeline) and is working with the individual evtol companies separately; the European regulators are applying more of a one size fits all approach and have not changed the rules in the way the US has.

EVTL remains committed to its timeline. However, we have all seen timelines drift in the electric car market, and electric cars are much easier to get approved than electric aircraft. We will have to wait and see.

The Competition

Joby wants to be an airborne taxi service in the US, so its competitors will be taxi companies, train operators, and airlines. EVTL wants to be an aircraft manufacturer in Europe, so its biggest competitor will likely be Airbus (OTCPK:EADSF) and its CityAirbus NextGen evtol aircraft, or perhaps Boeing (BA) with its Wisk aircraft, which is now in its sixth generation Volocopter will likely be the first evtol to take to the skies in Europe, but, like Joby, it intends to be an operator.

When Tesla (TSLA) entered the car market, It had a couple of years where it was the only premium EV and managed to build up a scale that turned it into a major car company. There is an argument that the current evtol situation is similar with EVTL about to break into and disrupt the industry. The problem is that it will not be first into the air and will not have the time to build its scale before the major manufacturers arrive. EVTL, Boeing, and Airbus will be targeting the same customers. EVTL will likely be the smaller unknown quantity fighting against established giants. It will be a very tough battle, and EVTL could get squeezed out completely if Boeing and Airbus start to bundle the evtol aircraft with their jet orders. It might be almost impossible for EVTL to compete.

EVTL Finances

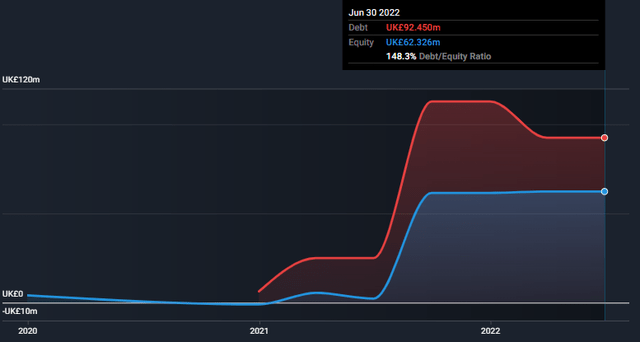

The most recent accounts released in October have not been audited. However, I will assume they are good. Unusually for new SPAC companies, EVTL has quite a high level of debt (although it does have more cash than debt).

EVTL Debt v Equity (SimplyWall.st.)

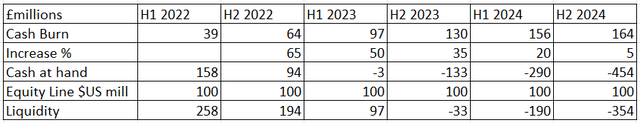

Relative to its main competitors, EVTL is low on cash and assets. It has $171 million in short-term assets and $16 million in short-term liabilities. Cash burn in the last six months was £39 million, up from £22m for the six months to June 2021, an increase of 77%. It is quite likely that these costs will continue to increase as EVTL begins its testing process. EVTL has an equity line arranged with Nomura for $100 million, giving the following approximate cash needs. (Here, liquidity has been used as the falling cash-at-hand balance + equity line.)

Liquidity with continued % increase in cash burn (author)

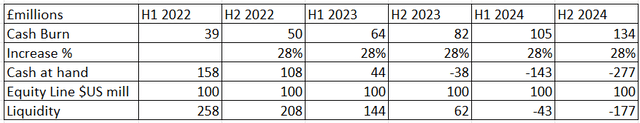

EVTL gave guidance in the last earnings report of a cash burn growth of 28%. If that is the case, we get

Liquidity using EVTL guidance (Author)

I have used $1 = £1 for this table. Increasing the value of the £ makes the cash situation worse.

The tables suggest that EVTL will run out of cash in either H2 2023 or H1 2024. Perhaps 3 to 4 years before they will likely be in the sky or generating revenue.

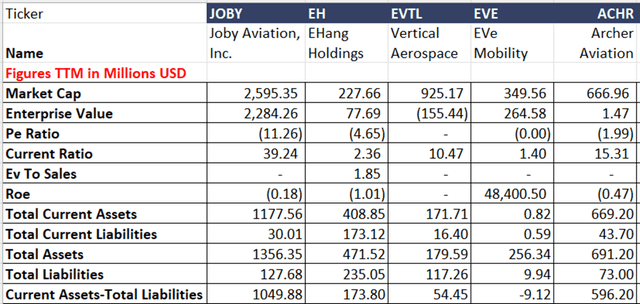

If we compare the main competitors in this field, we get the following table highlighting that EVTL is low on cash and will need to raise money, and quite a lot of it. I have not included Boeing and Airbus in this table.

EVTL v main competitors (Author)

Conclusion

EVTL is short on cash; it does not have registered patents and will rely on an echo system of suppliers to design and build its aircraft.

Much of the information coming from EVTL has a positive spin.

Its founders have limited experience in this industry.

The order book is large but filled with non-binding agreements from related parties that may never develop into actual orders.

If they get the aircraft in the sky close to the 2025 date they have indicated, then the order book could transform them into a hugely successful aircraft company.

If the 2025 timeline slips, they will likely enter the market behind Airbus and Boeing and compete with these two for the same orders. It will be a very difficult sell.

I will stay away from EVTL for the time being and will review my decision in 12 months.

Due Diligence

Although I do not make any allegations of misconduct against the directors of EVTL or suggest that they are misleading the public in any way, I decided that out of courtesy, I should contact them in advance of this article being published to ensure they had the opportunity to respond to the points I raise.

This is a quote from the email I sent to the EVTL investor and press departments on the 8th of November regarding my concerns.

1. More than 50% of the EVTL order book is from related parties (American Airlines as an investor and Avolon related through Domhnal Slattery.

2. The order book is not firm and can be canceled by either party without notice or penalty.

3. American Airlines has not paid a deposit on 50 aircraft but has the option to do so, again this is not legally binding.

4. Regulators fined Ovo energy and The GO Ahead Group whilst board members of EVTL were board members of these companies. No implication of wrongdoing by the directors is implied in the article.

5. I also discuss other companies with the same directors as EVTL using information from companies house. Including Jetty Technologies Ltd, OVO gas, and Kaluza ltd. Commenting on the different names of these companies, a charge registered against them, and quoting auditor reports in accounts.

I received a reply on November 9th and spoke with a representative of EVTL on the 10th. Both were off the record but the content was used in the final draft of this article. The response was shared with Seeking Alpha. It is worth noting that they are the first company I have contacted to reply to me and the representative was honest and open during our discussion.

Be the first to comment