omersukrugoksu

Investment thesis

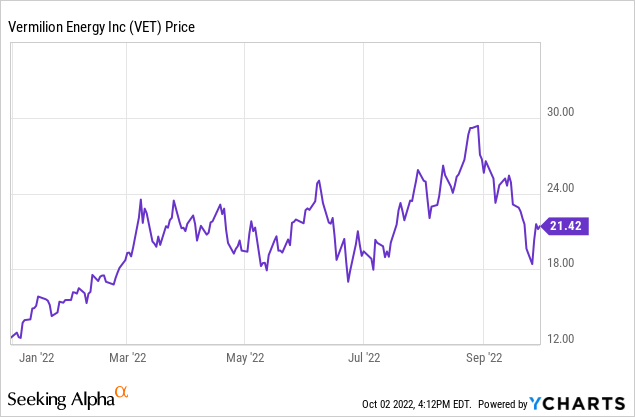

Vermillion Energy (NYSE:VET) sold off sharply in the last couple weeks:

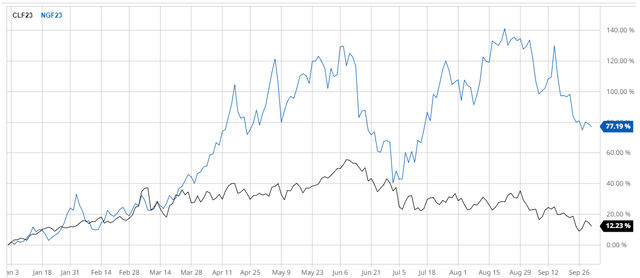

Justified or not, the macro recession fears are pressuring down oil and gas prices; the WTI crude oil (CL1:COM) contract topped in June while U.S. Henry Hub natural gas (NG1:COM) is down from a double top:

Jan. 2023 WTI (CLF23) and Henry Hub (NGF23) contracts price change (barchart.com)

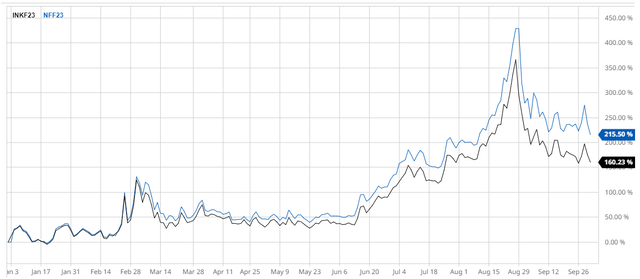

However, the two European natural gas markers relevant to Vermillion, the UK National Balancing Point (or NBP) and the Dutch Title Transfer Facility (or TTF) have held up better:

Jan. 23 NBP (NFF23) and TTF (INKF23) contracts price change (barchart.com)

The European markers received a boost last week from the detected Nord Stream 1 and 2 leaks, presumably due to sabotage.

It is also important to emphasize the vast pricing arbitrage between European and North American gas; the LNG infrastructure is quite limited relative to Europe’s current needs. Right now, the Jan. 2023 TTF is around $57 per mmbtu. Henry Hub for delivery in the same month is about $7.

Since Vermillion’s value proposition has been mostly about its European gas production, the stock probably shouldn’t have fallen so much when the North American gas indices corrected. However, it was also expected that the EU would implement some type of windfall tax on energy companies.

This tax is now a fact as the European Council agreed on it last Friday. As anticipated, the windfall tax will apply at a minimum rate of 33% on “excess profits” in 2022-2023. Excess profits are defined as taxable profits above a 20% increase on the average taxable profits during 2018-2021.

When all is said and done, the windfall tax may reduce VET’s 2022-2023 cash flow by 25%. It isn’t a small hit, but the valuation remains attractive. The risks are probably that European countries go above the EU’s minimum 33% threshold or that the tax gets extended past 2023.

Company background

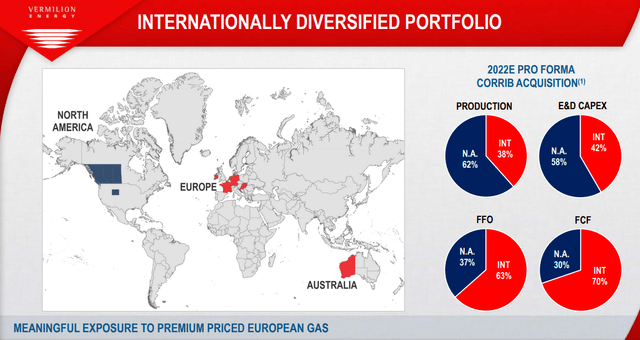

Vermillion doesn’t need much introduction on SA, but, as quick summary, it is a Canadian-based oil and gas exploration and production company with a broad international footprint:

Vermillion Energy October 2022 Presentation

The company currently guides towards 86,000 – 88,000 boe/d production for 2022. Most production is from North America, but most free cash flow for 2022-2023 is from the international operations.

In fact, most cash flow comes from the natural gas production in Ireland, the Netherlands and Germany, and this is also Vermillion’s main selling point. In the midst of the European energy crisis, Vermillion is one of the few domestic (to Europe) producers who can benefit from the exorbitant TTF and NBP prices whereas overseas producers are constrained by the LNG infrastructure. Vermillion boasts netbacks of $200+ per barrel of oil equivalent.

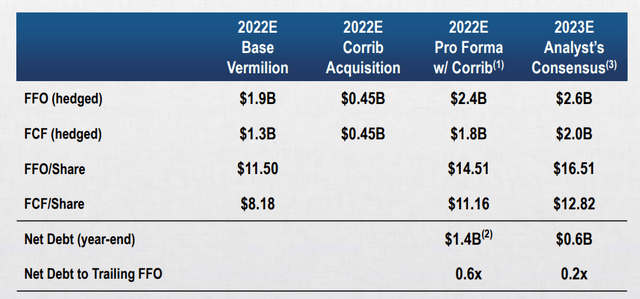

The reason why VET has gathered much attention among energy investors is the eye-catching cash flow multiple. The company’s latest projection is for $1.8 billion (Canadian) of 2022 FCF:

Vermillion Energy October Presentation

With an enterprise value of $6.2 billion (also Canadian), the implied EV / FCF multiple is 3.4x on hedged 2022 FCF, including VET’s expansion of its stake in the Corrib asset offshore Ireland.

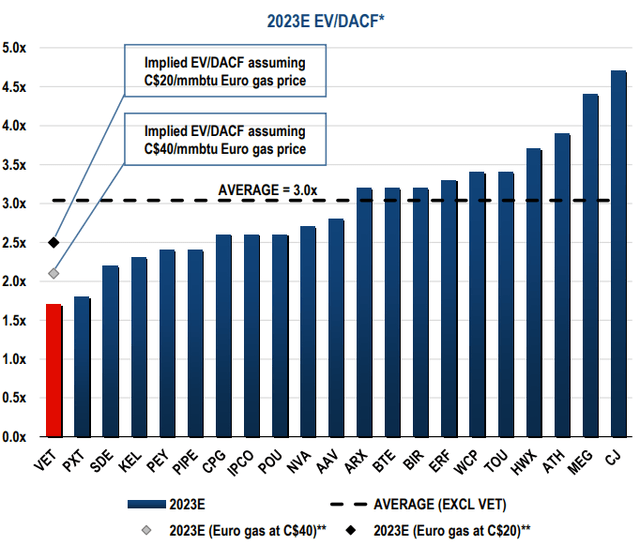

On 2023 estimates, the valuations look even better:

Vermillion Energy October Presentation

The windfall tax

One reason VET has been cheap is probably the short expected horizon for its abnormal cash flows. Even if Europe never again imports gas from Russia, a significant buildup in LNG capacity is expected around 2025-2026. Competing projects such as the EastMed pipeline may also come online. Ultimately, the TTF/NBP pricing only benefits about 14,000 boe/d (with Corrib) of VET’s production while the majority is sold at much lower North American prices.

The elephant in the room though was probably the speculation over a European windfall tax, which is now a fact. The implementation details aren’t fully clear, but the EU Council Regulation lays out the main parameters relevant to hydrocarbons production.

The tax, dubbed “temporary solidarity contribution” will apply to EU companies and permanent establishments generating at least 75 % of revenue in the crude petroleum, natural gas, coal and refinery sector. VET’s European operations fall within this perimeter.

The tax will apply for the two fiscal years starting on or after January 1, 2022 and 2023.

The tax will apply to “excess” profits:

Only profits in 2022 and/or 2023 above a 20% increase of the average taxable profits generated in the four fiscal years starting on or after 1 January 2018 should be subject to the solidarity contribution.

The 2018-2021 “reference period” includes the COVID demand destruction period when likely many oil and gas companies were in the red. However, Article 14 of the Regulation clarifies:

If the average of the taxable profits in those four fiscal years is negative, the average taxable profits shall be zero for the purpose of calculating the temporary solidarity contribution.

It looks that for loss-making companies in 2018-2021, the “normal” profit threshold will be zero, so their entire 2022-2023 profit may be treated as excess profit.

The minimum tax rate on the excess profit will be 33%, but EU member states are free to apply a higher tax rate. It is also made clear that the “solidarity contribution” will be separate and in addition to any tax owed under the regular taxation regime.

Since Vermillion will be taxed on a country basis, let’s take a look at the three European jurisdictions where it produces significant gas quantities.

Ireland

Ireland is the largest cash flow contributor, especially after the Corrib acquisition which will expand VET’s stake in the project from 20% to 56.5%. Ireland produced 4,655 boe/d (all gas) in Q2, so, with the 7,700 boe/d from the newly acquired stake, this will jump to 12,355 boe/d. In the recent quarters, realizations on this gas hovered around 100% of NBP.

At the prices projected in VET’s latest deck, Ireland (including Corrib) should generate about $964 million (Canadian) in FFO during 2022 (north of $1 billion in revenue). This is a big chunk of the $2.4 billion total FFO that VET projects for the year, especially considering that Ireland contributes only 12,000 boe/d of VET’s total 90,000+ boe/d (with the added Corrib stake).

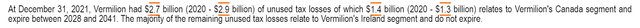

In theory, Ireland taxes oil and gas using an R-factor formula which caps at 40% of income. However, in reality VET doesn’t pay any Irish tax due to accumulated losses:

The FFO for Ireland won’t of course match the profit reported for Irish tax purposes. However, given that 2022 revenue is close to $1 billion while 2021 revenue was about $200 million and 2020 only $58 million, I find it reasonable to assume that for Ireland the 2018-2021 average taxable profit would be close to zero.

How has Ireland reacted to the EU decision? It looks the prime minister is supportive:

Taoiseach Micheál Martin said funds from the EU’s windfall tax would be “substantial” and would help to meet further energy supports if they were required next year.

Ireland government officials assume that 1-2 billion Euro will be collected in total, but that won’t be Vermillion alone as the tax also applies downstream.

The Netherlands

The Netherlands also seems on board with the tax and was already planning its own measure before the EU decision.

VET’s Dutch gas production was 5,870 boe/d in Q2 and the realization is close to 100% of TTF. This should lead to $662 million in FFO for the full 2022 year. In Q2 VET paid tax equal to about 46% of its FFO generated. The taxation is a combination of regular corporate tax and a state profit share; the combined effect should cap out at 50% which is probably what VET would pay over the next quarters. VET doesn’t report royalties paid to the government, likely due to the low production volume.

Dutch revenue should be about $721 million in 2022 at VET’s price deck; in 2021 it was $295 million and only $65 million in 2020. So similarly to Ireland, I would think not much windfall tax will be saved due to high average 2018-2021 profits.

Germany

Gas production was about 4,220 boe/d in Q2. This translates into $519 million of revenue for 2022 and $428 million in FFO. In the last quarters, VET has consistently paid royalties around 5% so this would probably stay the same. VET has also been paying income tax although at much lower rates than the statutory rate, so there is potential for the regular tax to rise too.

Germany was talking about windfall taxes as back as August, so it would be reasonable to assume they will gladly implement the EU regulation.

Takeaways

Vermillion’s unique position as a European gas producer allows it to benefit from the energy crisis and sky-high NBP and TTF prices, but at the same time it makes it vulnerable to the EU legislation.

The company’s October presentation projects 2022 FFO of $2.4 billion and FCF of $1.8 billion with the Corrib acquisition. These are after-tax numbers, but not accounting for the windfall tax which technically hasn’t been enacted yet.

I estimate that gas production from Ireland (with Corrib), the Netherlands and Germany will generate about $2.0 billion of pre-tax FFO for the year based on VET’s pricing deck. I am guessing $400-$500 million of it could be paid in regular royalties and taxes, but this outflow should already have been captured in the company’s $2.4 billion FFO/$1.8 billion FCF estimates.

We could make two quite conservative assumptions about the windfall tax:

- The average 2018-2021 taxable profit is zero or less; and

- There are no significant offsets against the pre-tax FFO (in reality some of the current or past years’ capex spend will be deductible; VET also has hedging losses, but it isn’t clear to me if those were incurred in Ireland/the Netherlands/Germany or are held at the corporate level in Canada).

So applying 33% to the $2 billion pre-tax FFO means about $660 million/year in cash outlay due to the windfall tax. This is about 25% reduction in the FFO estimate and 33% in the FCF estimate.

This a significant cut, but VET would still be priced at less than 5x hedged FCF. That is why I feel the recent stock price fall from $30 to $20 is perhaps more due to the broader selloff in energy and not so much about the specific effects of the EU windfall tax on VET.

With the Nord Stream incidents (alleged sabotage), I think NBP and TTF will enjoy a solid price floor for a while. The biggest risk for VET likely will be that EU governments decide to make the “temporary solidarity contribution” more permanent in nature.

Be the first to comment