Krystsina Yakubovich/iStock via Getty Images

Introduction

Following the global energy shortage rushing onto the scene early in 2022, the second half saw this optimism give way to fears of a recession coming but in the case of Vermilion Energy (NYSE:VET), they did not get the memo, metaphorically speaking, as my previous article discussed. The third quarter saw operating conditions strengthen given their direct exposure to European natural gas but sadly, this was a double-edged sword with a windfall tax now on the horizon. Despite being anything but positive for their shareholders, thankfully windfall tax or not, you can still win in the medium to long-term given their very desirable share price, as discussed within this follow-up analysis.

Coverage Summary & Ratings

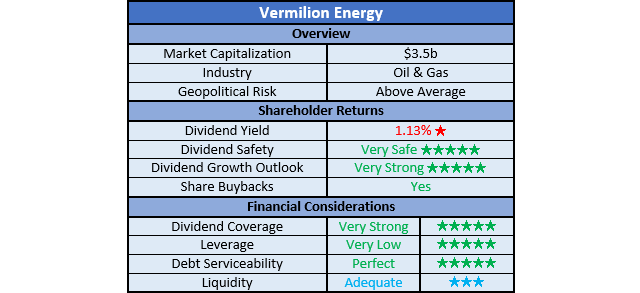

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

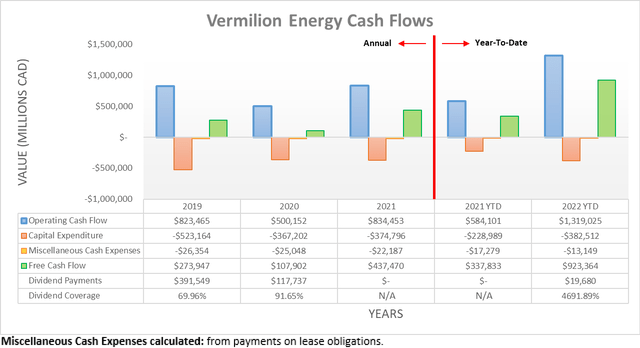

Upon watching the gas crisis in Europe only intensify during the third quarter of 2022 as the Nord Stream pipelines came under suspected sabotage, it was a foregone conclusion their booming cash flow performance would continue unabated. On this front, shareholders were not disappointed with their operating cash flow for the first nine months climbing to a massive C$1.319b, thereby far surpassing the C$1b mark for the first time in history, despite there being another quarter of the year remaining ahead.

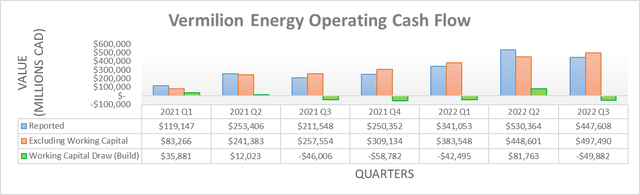

When viewed on a quarterly basis, their operating cash flow during the third quarter of 2022 landed at C$447.6m and despite being down materially from their second quarter result of C$530.4m, this was simply due to working capital movements. If these are excluded, their respective underlying results were C$497.5m and C$448.6m across these same two periods of time, as they continued to benefit from booming operating conditions. Notwithstanding this continued cash bonanza, sadly on another front, their shareholders were disappointed by the proposed windfall tax moving ahead in Europe with sizeable costs likely inbound, as per the commentary from management included below.

“We have provided an estimate for 2022 windfall tax impact of $250 million to $350 million within our Q3 release. There continues to be many unknown variables related to the final implementation of the tax. However, our current estimate of the potential two-year exposure for 2022 and 2023, if the tax was implemented as framed by the EU, would be approximately $650 million to $750 million, again, over two years based on the current strip pricing.”

-Vermilion Energy Q3 2022 Conference Call.

Even though this policy is not finalized, speaking from the perspective of shareholders, such an outcome would be disappointing as it hinders the immense upside from the natural gas crisis. Whilst this policy risks deterring further investment in domestic natural gas production, the focus of my analysis is not related to this broader economic nor political aspect but rather, the potential impacts for shareholders. As it stands right now, management expects to see a cost of C$300m at the midpoint attributable to 2022, which would wipe out about 25% of their free cash flow as they generated C$923.4m during the first nine months, which annualizes to circa C$1.2b. Despite clearly being a negative short-term catalyst, in the medium to long-term, returns are driven by acquiring investments that present desirable value Even if this reduced free cash flow is compared against their current market capitalization of approximately $3.5b, it sees a very high circa 19% free cash flow yield, given the current CAD to USD exchange rate of $0.75.

Needless to say, this is obviously still very desirable and provides ample scope for shareholder returns as they deleverage and ramp up their dividends and share buybacks, as outlined within my previous analysis. Furthermore, this does not include the benefits of their upcoming Corrib acquisition, thereby providing a margin of safety. Admittedly, their guidance for a total cost of C$650m to C$750m across both 2022 and 2023 implies that the latter year will see a higher cost from this windfall tax, this would obviously be tied to the price of natural gas remaining extraordinarily high and thus does not necessarily pose downside risk, rather it sadly hinders the upside potential.

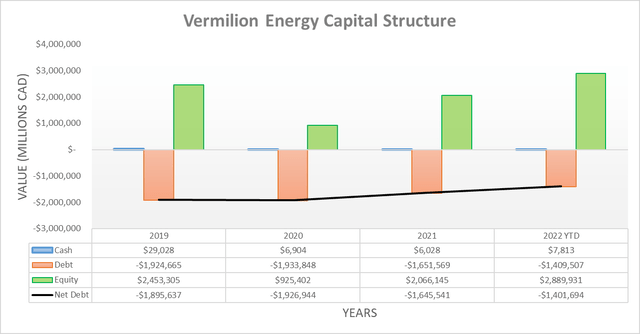

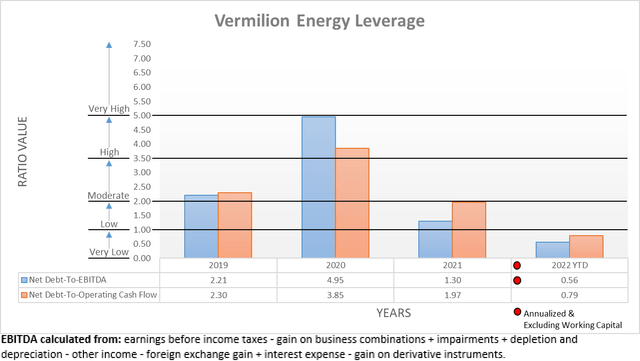

Thanks to their cash bonanza continuing during the third quarter of 2022, their net debt once again resumed its downward march after having temporarily bounced during the second quarter on the back of their Leucrotta acquisition. This now sees it landing at C$1.402b, which is down a solid C$125m from the second quarter that ended with net debt of C$1.527b and thus now sees their net debt within the C$1b to C$1.5b range that facilitates returning <50% of their free cash flow, as detailed within my previous analysis.

Before getting excited, due to the potential cost of the windfall tax, they now forecast 2022 ending with net debt of C$1.6b, including the relatively minor cost of their upcoming Corrib acquisition, as per slide seven of their previously linked third quarter of 2022 results presentation. This marks a sizeable C$400m increase versus their previous guidance following the second quarter that was included within my previous analysis, thereby slightly delaying ramping up their shareholder returns until early 2023 instead of late 2022. Despite these future moving parts, it would be redundant to reassess their leverage, debt serviceability and liquidity in detail because right now, not much is significantly different following only one quarter, especially as the impact of the proposed windfall tax was the main focus of this analysis.

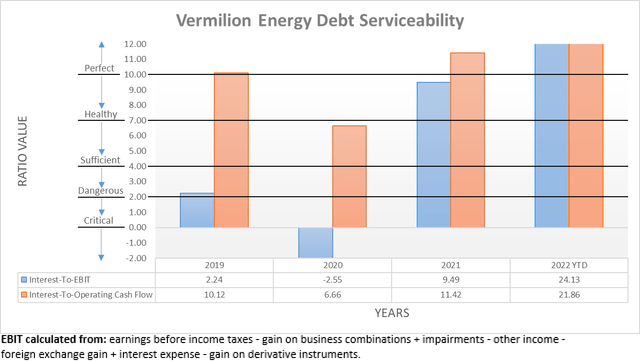

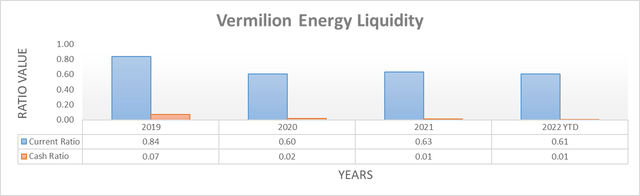

The three relevant graphs are still included below to provide context for any new readers, which shows their leverage is still very low with their respective net debt-to-EBITDA and net debt-to-operating cash flow of 0.56 and 0.79, which are comfortably beneath the applicable threshold of 1.00. Elsewhere, it sees perfect debt serviceability with their interest coverage of 24.13 and 21.86 when compared against their accrual-based EBIT and cash-based operating cash flow, respectively. Meanwhile, their liquidity remains adequate with a current ratio of 0.61, notwithstanding their otherwise almost non-existent cash ratio of 0.01. If interested in further details regarding these topics, please refer to my previously linked article.

Conclusion

Regardless of where a reader sits politically speaking, from the perspective of shareholders, it remains a disappointing outcome that clips their ability to capitalize upon these extraordinarily strong natural gas prices. Thankfully, their shares have consistently presented very desirable value and thus as a result, windfall tax or not, you can still win in the medium to long-term given their remaining very high almost 20% free cash flow yield and thus I am still maintaining my bullish stance. Although sadly, as it hinders their upside potential, I believe slightly downgrading my previous strong buy rating to a standalone buy rating is now appropriate until more clarity comes to light.

Notes: Unless specified otherwise, all figures in this article were taken from Vermilion Energy’s Quarterly Reports, all calculated figures were performed by the author.

Be the first to comment