imaginima

Overview & Investment Thesis

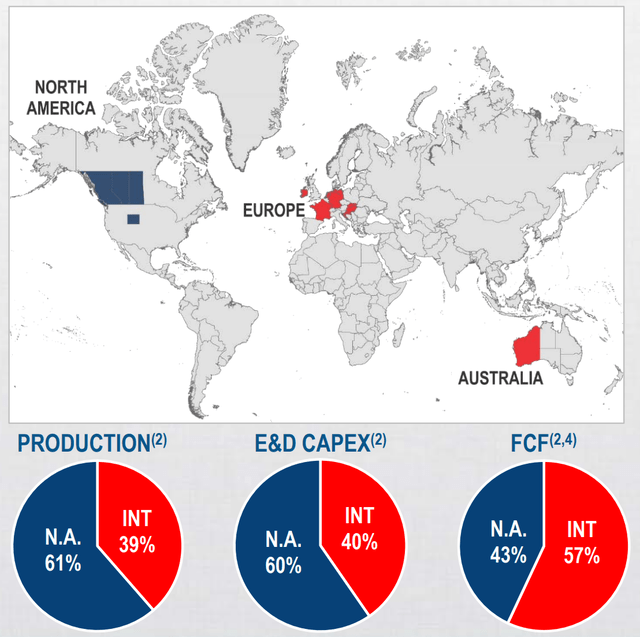

Vermilion Energy (NYSE:VET) is a global oil, natural gas, and natural gas liquids producer with 2022 estimated production of 86,000 – 88,000 boe/d. The company is listed in both the U.S. and Canada (TSX:VET:CA). It has operations in Europe, North America, and some offshore oil production in Australia. Most of the North American assets are in Canada, while the company also has some production in the United States.

Figure 1 – Source: Vermilion December 2022 Presentation

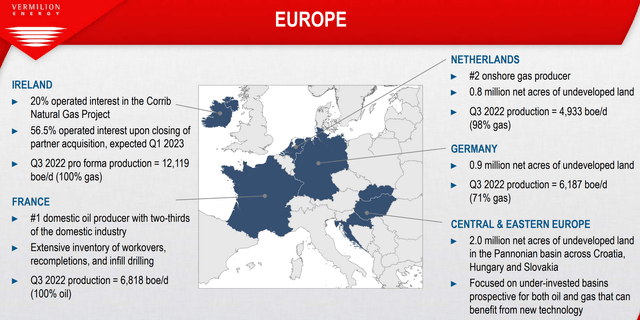

In Europe, the company has exploration and development projects in Slovakia, Hungary, and Croatia while the current European production comes from France, Ireland, Germany, and the Netherlands.

Figure 2 – Source: Vermilion December 2022 Presentation

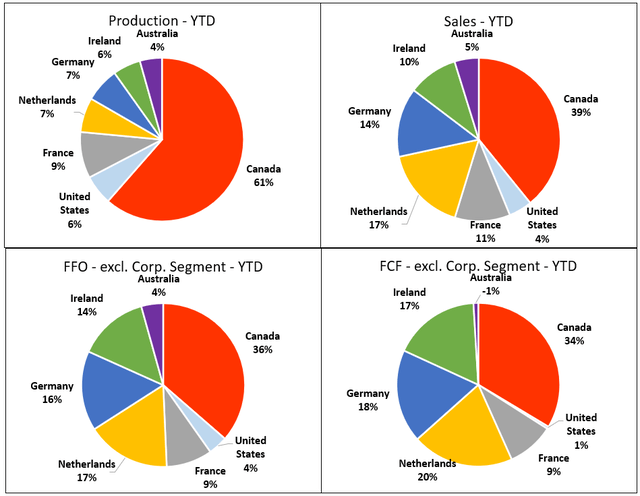

The company is well-diversified when it comes to production, but a disproportionate amount of funds from operations and free cash flow comes from the natural gas production in Ireland, Germany, and the Netherlands due to the very elevated energy prices there. Note that the charts below do not include the pending Corrib acquisition in Ireland.

Figure 3 – Source: Data from Vermilion Q3-22 MDA

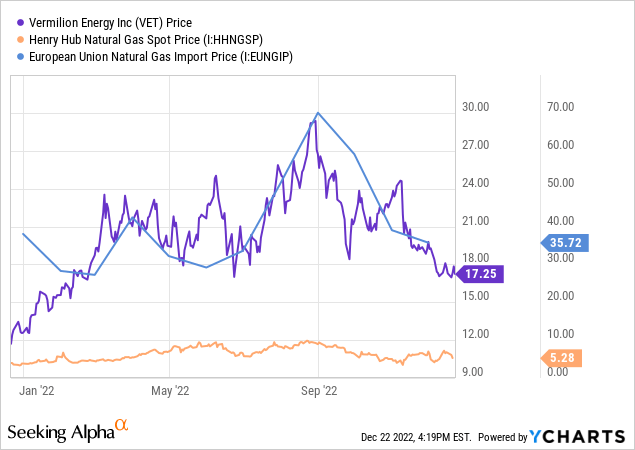

Vermilion has taken a beating lately and is down more than 40% from the peak earlier this year. Part of that is naturally due to lower oil and natural gas prices in general, especially lower natural gas prices in Europe. However, the proposed windfall tax (“WFT” henceforth) by the European Union has also had a significant impact. Judging by comments in various forums, investors are also very disappointed with the temporary pause in buybacks from Q4-22.

I would argue the sell-off has gone too far, the company now offers an excellent valuation even when the WFT is taken into account, and the stock is one of my favorite investments for the coming year.

Figure 4 – Source: YCharts

Windfall Tax & Capital Allocation

While the WFT looks set to be implemented for 2022 and 2023 in the European Union, the exact levels in all countries and the precise impact for Vermilion are not yet 100% clear. So, there is a lot of uncertainty now, which the market typically detests. However, with a stock price of $17.25 at time of this writing, the market has priced in an extremely dire outcome in most European countries, which I don’t think is likely.

The minimal level of the WFT in the European Union looks to be a 33% windfall tax made by oil, coal and gas companies whose profits for 2022-2023 exceed by 20% or more the 2018-2021 average.

As far as I can tell, France is still debating the level of the WFT. However, the outcome in France is much less important to Vermilion. This is because 100% of the production in France is oil, where the price differential between 2022 at least and 2018-2021 is much less than for natural gas. So, I am not overly concerned with the outcome there.

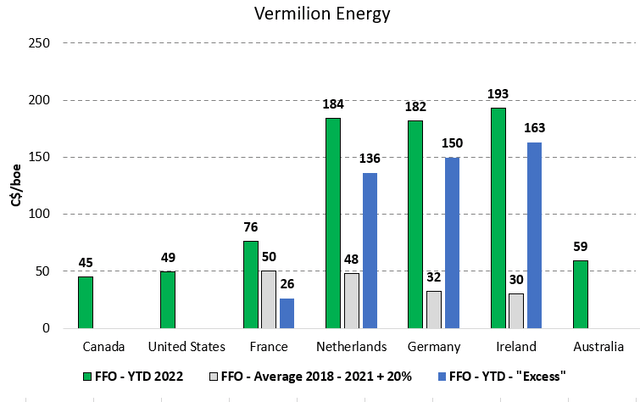

In the chart below I have plotted YTD 2022 funds from operations, the average FFO in the European countries during 2018-2021 +20%, and what “Excess” there is that might be affected by a WFT. Please note that I have used FFO as a proxy for earnings as the company reports it on C$/boe for all countries. Actual earnings will naturally differ somewhat in reality, but the figures below provide a good indication on the profitability in the various countries.

Figure 5 – Source: Data from Vermilion Quarterly Reports

The Netherlands and Germany look to be implementing the European Union minimum of a 33% tax on the “Excess”. While it is certainly painful to have to pay a WFT retroactively for 2022, Vermilion would still have a very elevated profit margin in these countries during 2022 and likely 2023. I would also argue that provided Vermilion can get reassurances from the Netherlands and Germany of at the very least no further hikes (and preferably a confirmation of the roll-back of the WFT), it would still make sense to continue to invest further in those countries. That is provided any reassurances can be trusted.

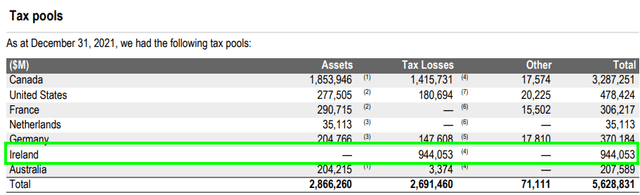

Ireland is presently more of a concern, where there are at least talks of a 75% WFT on the “Excess” in 2022 and 2023. It remains to be seen if this is exactly what is implemented as it would be very punitive. This will have an even larger impact on Vermilion following the Corrib acquisition, which is now expected to close in Q1-23 and would more than double Vermilion’s natural gas contribution from Ireland starting on the 1st of January 2022. It also doesn’t look like prior year’s tax losses can be used to offset the tax payments. That would otherwise have been very beneficial in Ireland specifically where the company has a large tax loss.

Figure 6 – Source: Vermilion 2021 Annual Report

It is fair to say the situation with the WFT is not straight forward and might take another quarter or two get finalized. The company has so far estimated the WFT in 2022 to be somewhere around C$300M and something similar for 2023. I have tried to get further clarification on the calculations made by the company without any luck, but even if we were to double or even triple the WFT figure, the FCF yield for Vermilion is still above many peers in 2022.

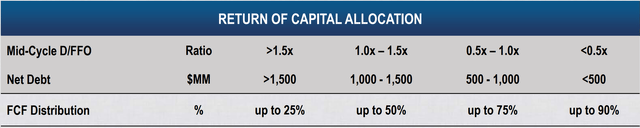

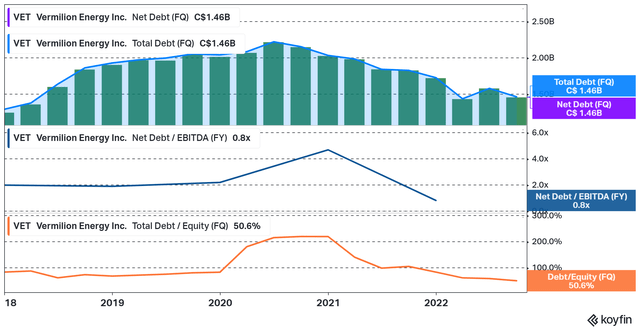

As mentioned earlier, investors seem very disappointed with the pause in buybacks, which the company announced in the Q3-22 conference call. This was done to focus on deleveraging for a couple of quarters and because of the uncertainty with some large WFT payments in the next 6-9 months. While buybacks are always welcomed when the stock price is depressed, the estimated net debt will in the end of the year now be around C$1.6B and earnings will likely not be pretty in Q4-22 if the full year’s WFT gets booked then. So, it looks more to me like the shareholder distributions have been delayed rather than removed, and for a good reason to get clarity on the WFT.

Figure 7 – Source: Vermilion December 2022 Presentation

Valuation

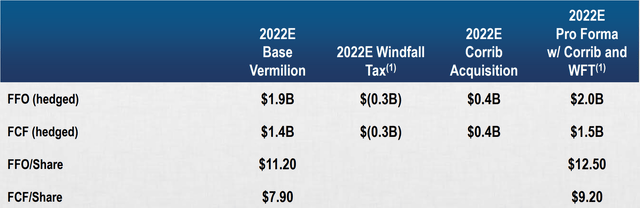

The below figures for Vermilion Energy provides a good overview of the estimated cash flows for 2022. Where we are now looking at about C$2B in funds from operations and C$1.5B in free cash flow. Note that these figures include the very healthy cash flows following the Corrib acquisition and the company’s latest C$300M estimate for the WFT in the European Union during 2022.

Figure 8 – Source: Vermilion December 2022 Presentation

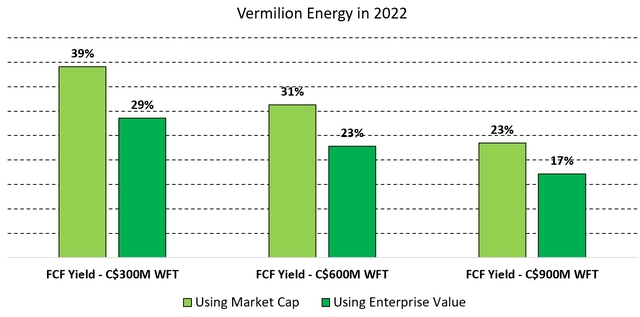

With the latest share price of $17.25 or C$23.53, Vermilion trades with a very attractive FCF yield as illustrated in the chart below. That applies even if we were to double or even triple the estimated WFT in 2022. While the outcome in Ireland will no doubt have a large impact on the final level of the WFT, I would still be somewhat surprised if the company was off by that much in their estimates. Regardless, if we just focus on the market cap, a FCF yield in the range of 24% to 39% is nothing short of an extremely attractive valuation for Vermilion.

Figure 9 – Source: My Calculations – Company’s December 2022 Estimates

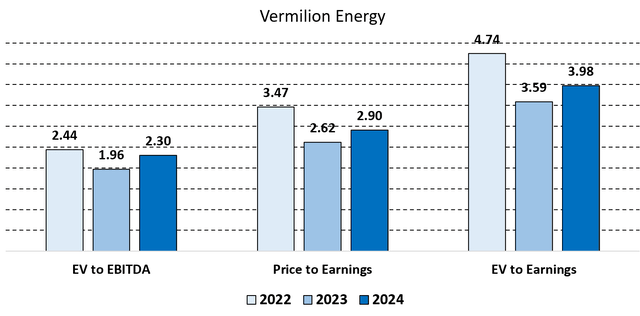

Longer term, I think it is safe to assume that European energy prices will decrease some, but at least I don’t think the energy problems in Europe will be solved in the next year, especially with Nord Stream 1 & 2 now out of commission. The brokers covering the stock is estimating even higher EBITDA and Earnings for both 2023 and 2024 compared to 2022, which further verifies the attractive valuation.

Figure 10 – Source: My Calculations – Koyfin Estimates

Risks & Conclusion

Despite an extremely attractive valuation, an investment in Vermillion is far from risk-free. While I will always be against a windfall tax on principle, I am not overly concerned with a temporary 33% windfall tax given how elevated energy prices are in Europe, how profitable it has been for Vermilion, and because it looks to be more than priced in at the current stock price. However, it is a lot easier to make a temporary government policy permanent once it has been implemented in the first place. So, that is certainly something to consider.

Another concern is that the windfall tax goes higher over time, or it goes as far as outright nationalization of some assets. Now, the higher a windfall tax goes, the worse the problem will become for the governments over time. I do think at least some parts of the governments are aware of this, even if one can easily doubt that based on comments made by many politicians. It is also worth remembering that Vermilion has a reasonably good diversification after all, as illustrated in figure 1-3 in the overview section.

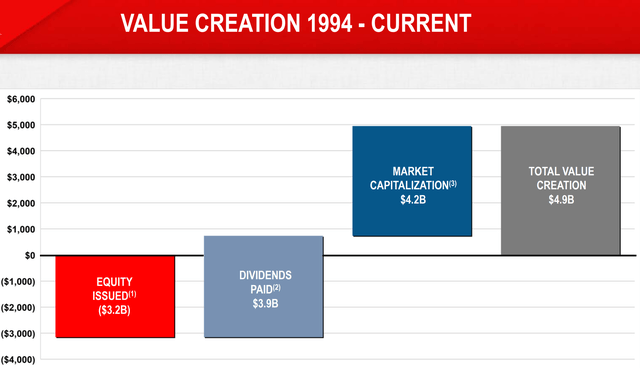

The dividend yield of Vermilion is relatively low at 1.4%, so another potential risk would be that the company focuses on more acquisitions rather than returning cash flows to shareholders via higher dividends and/or a restart of the buybacks in 2023. The company has done a good job returning cash flows to shareholders in the long run and the elevated net debt should be lowered in 2-3 quarters, so that is not a major concern for me.

Figure 11 – Source: Vermilion December 2022 Presentation

Apart from an excellent valuation, Vermilion has improved the leverage ratios over the last few years, and further deleveraging is expected over the coming year. The company has also boosted reserves where the 1P and 2P reserve life increased to 9.7 years and 15.4 years in 2021.

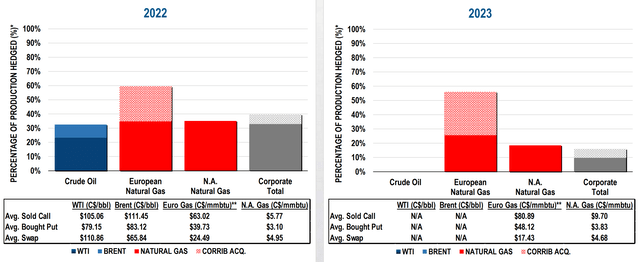

For 2023, Vermilion has a relatively small part of the overall production hedged, even if just above 50% of European natural gas production is hedged at healthy levels.

Figure 13 – Source: Vermilion December 2022 Presentation

All-in-all, Vermilion is a relatively high-risk investment in the oil & gas industry due to political uncertainties, but the stock carries an acceptable risk in my view given the extremely attractive valuation. The company also provides somewhat diversified exposure and natural gas exposure in Europe, which is not easily found.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment