asbe

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on July 23rd, 2022.

Shares of Verizon (NYSE:VZ) were slammed after releasing its latest earnings report. The actual numbers for the quarter weren’t the worst. It was the guidance that spooked investors to push shares down nearly 7% for the day. Throughout the day, shares had declined more than that 7% at times, too.

The guidance was cut across the board. EPS, revenue and EBITDA all saw reduced expectations for the year. The plunge in the stock price also is a good reminder of how volatile stocks can get, especially in this type of challenging environment.

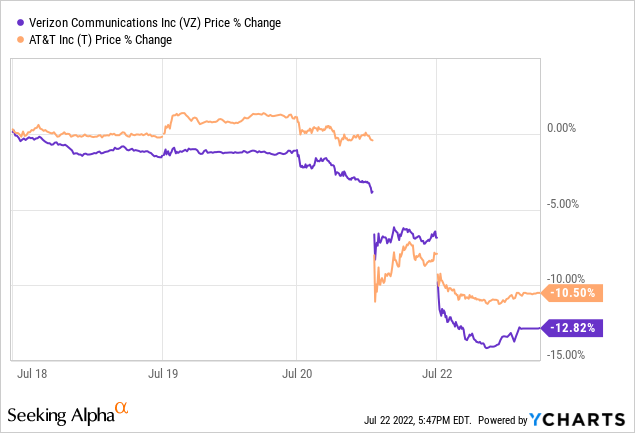

The declines for the day of earnings were only part of declines that had been building over the previous few days. The previous day, the stock was hit after telecom peer AT&T (T) also released its earnings. We saw similar results with T. Earnings numbers were fine but then guided for weaker cash flow. That sent shares significantly lower, and VZ fell along with them.

In fact, T had a strong number of postpaid adds of 813k. The best second quarter in over a decade. They warned that while people were paying their bills, there were delays in some subscribers making them. As an almost utility-like service, that can be a bit concerning. It highlights the difficulty some people are starting to experience in the high inflation environment. This is only set to get worse as the Fed tightens the economy.

Postpaid adds for VZ came in at just 12k. They had been raising prices on their plans, so the fear is that this is now starting to hurt growth. However, T had also put into place price hikes but had seemingly been able to avoid a slow subscriber quarter. Churn remained low, so the number of customers leaving was minimal.

Besides inflation for their consumers, inflation is also a problem for the company. Higher costs are showing up as higher expenses for the company.

Regarding inflation, we are seeing the pressures within our cost structure, most notably on labor costs, utilities and transportation and logistics expenses. We expect these pressures to accelerate in the second half of the year and have an impact on profitability and earnings. As Brady and Hans highlighted, adjusted EPS for the second quarter was $1.31, down 5.8% from the prior year. This primarily reflects the impact of our adjusted EBITDA results and higher D&A related to our C-Band rollout.

Over the last week, shares of both these telecom giants have seen significant downward pressure.

Ycharts

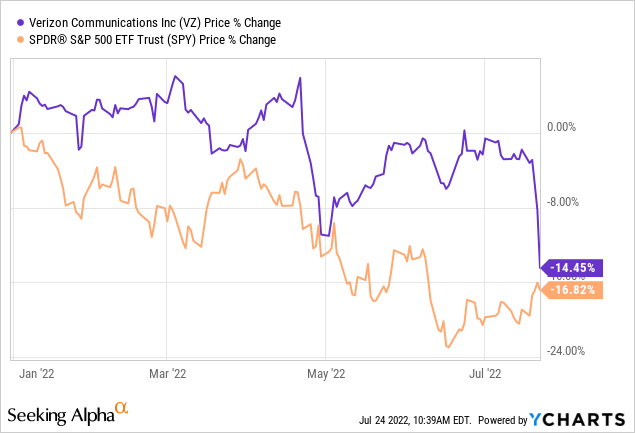

YTD VZ shares are down around 14.5%, not counting dividends. These latest declines came as VZ was making some ground up on their losses for the year. For some context, despite this massive drop, shares are still performing better than the broader market.

I’ve been closely watching VZ due to the options wheel strategy we’ve been rolling through this year after taking assignment of shares.

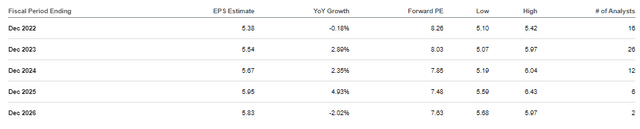

All this being said, it seems the latest sell-off was a bit of an overreaction. The growth expectation for VZ in EPS and revenue were almost nonexistent anyway. Even in the next several years, analysts are only expecting low single digits. This size of business just doesn’t equate to a lot of growth potential.

VZ Earnings Outlook (Seeking Alpha)

For this year, VZ’s expectations are for adjusted EPS of $5.10 to $5.25. The consensus is what we are seeing above at $5.38 for the year.

Even hitting the low end of $5.10 would result in a dividend payout ratio of around 50% based on its $0.64 quarterly dividend. For me, that seems as though it is a reasonable level that we still shouldn’t expect any cuts as it is well-covered. That’s something I highlighted in my last coverage; even if we get a slowdown and earnings decline, there is a cushion here.

I believe the dividend is very safe with VZ based on their historical commitment to the dividend. Based on the outlook for $5.40 in earnings, the current dividend works out to a payout ratio of 46.83%. It definitely leaves plenty of room with the coming recession in case things slow down even further. Since that is the outlook for next year, or that we could even currently be in a technical recession, this is good news. I continue to expect the dividend to be very safe at this time.

Dividend growth isn’t going to be something that we can boast about, but it hasn’t been for shares of VZ in a long while anyway. The CAGR over the last decade for the dividend has only been 2.5%.

Instead, it is the higher yield now that can be attractive to investors. The forward yield after these declines puts it at 5.76%. That doesn’t mean it couldn’t fall yet further. At a certain point, though, based on the strong coverage, there should be a floor eventually reached.

From the conference call, they also believe that these are more short-term challenges.

In summary, we view this quarter and second half challenges as short-term. We have a strong and resilient business model that is well suited to deliver favorable financial results, even in uncertain economic times. In this environment, we remain disciplined and focused on delivering long-term shareholder value through improved revenue and profitability, with healthy cash generation that supports our network investments and dividend policy as well as a strong balance sheet. We also have the best team in the industry, and I know they are ready to deliver.

Overall, shares are now quite attractively priced with a forward P/E of just 8.34x. For investors who don’t already hold a sizeable position, this could be presenting an attractive entry point for long-term investors.

The Trade

All this brings me to the latest covered call that expired on options expiration Friday. On a side note, we have puts on T that we sold at a strike price of $19. Those expire next month, so we have some time before seeing how that trade shakes out. At this point, it is looking like our telecom exposure will increase.

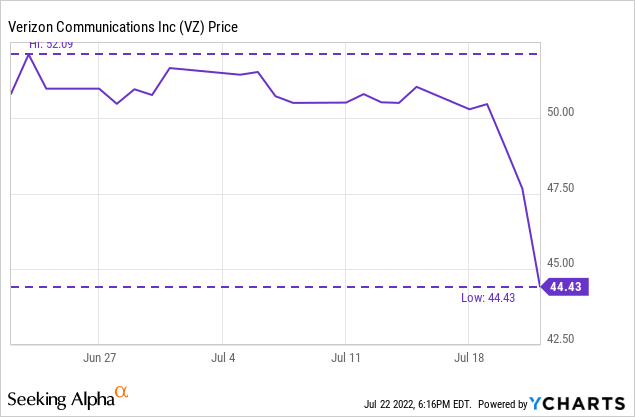

We were at very minimal “risk” for shares to be called away earlier in the week. This became almost guaranteed that the position wouldn’t be called away as the week progressed. We sold the calls at a $53 strike price. The trade was entered on June 22nd.

Ycharts

As I mentioned above, shares were actually starting to make some recovery from the lows reached earlier in the year. That allowed us to collect a premium of $0.37 at that significantly higher strike price relative to where shares are trading today.

Over the course of 30 days, that worked out to a potential annualized return of 8.5%. We were assigned shares at a price of $50 previously. The PAR based on that assigned price was then a bit more attractive at 9%.

Since this has been a series of trades now, we’ve collected a total of $1.09. It was the $0.42 we collected on the original trade of selling the puts. Then the previous covered call trade netted us $0.30. This brings our breakeven to $48.91. Unfortunately, the declines have been quite rapid lately, which still puts us at a sizeable unrealized loss for the shares.

What’s Next?

Ideally, I would like to see some rebounding before making the next covered call trade on shares of VZ. This isn’t too much unlike the previous covered call trades that we had done in May. We had to wait a little while after taking assignment of the shares originally because shares had also sold off. During that time, we did have some luck on our side, as it was less than a week later that we got the opportunity.

Luck was also on our side when entering this last trade, as we had the opportunity to do so at a $53 strike. That would have given us a significant upside bonus had the shares been called away. At this time, we will probably be looking much closer to the $50 or $51 strike prices. The ex-dividend date had also passed on July 7th, which entitles us to the quarterly $0.64. It makes it much easier to be patient with a dividend-paying stock.

There are some options for those that want to keep the train rolling without waiting for a potential rebound. One could go out much further and collect a decent amount of premium. The “yields” won’t be quite as attractive if you stick around the $50 strike but could be better than nothing for some investors.

- $50 strike for Nov 18 ’22 expiration has the bid at $0.37. That’s looking at around a 2.3% potential annualized return.

- Pushing it out even further to the Jan 20 ’23 expiration at the $50 strike could pull in $0.60. That would work out to 2.42% on an annualized basis.

Again, nothing too attractive as the price has plunged quite rapidly. The momentum is firmly on the downside. However, this would be in addition to the quarterly dividend that you would receive over this time. My arbitrary personal target is collecting a PAR that would result in a higher amount than the stock is yielding. For that, I will have to sit on the position at this time.

One could also write covered calls at less than the $50 assignment price that I’ve been playing with. With shares at $44.45 on Friday’s close, there is some room. If the stock begins to rebound, one would probably want to roll the position up and/or out if they have a higher breakeven. Preventing a person from not having the position called away below your breakeven. VZ’s options have plenty of liquidity where that shouldn’t be a problem.

Be the first to comment