David Ramos

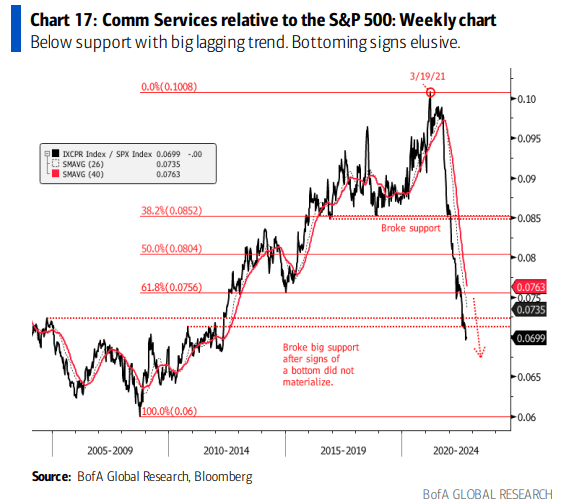

Netflix (NFLX) gave a much-needed boost to the beleaguered Communication Services sector. The group remains mired in a steep relative downtrend. Some of its blue-chip components are the culprit, and a behemoth telecom firm reports Friday morning.

Communication Services: Worst Recent SPX Sector

BofA Global Research

According to Bank of America Global Research, Verizon (NYSE:VZ) is one of the largest U.S. telecom companies. It offers voice, data, and video services and solutions. Its Consumer division includes wireless and wireline operations, with 114.6 million wireless connections and 7.3 million broadband connections. The Business division provides wireless and wireline services to business, government, and wholesale customers and has over 28 million connections.

The New York-based $156.2 billion market cap Integrated Telecommunication Services industry company within the Communication Services sector trades at a low 7.4 trailing 12-month GAAP price-to-earnings ratio and pays a high 7.0% dividend yield. While some competitors have cut their dividends, VZ’s payout has risen in each of the previous 16 years, according to The Wall Street Journal.

The company faces increasing competition as it attempts to leverage its premium network to build out a 5G system. More promo spending is needed, which could threaten its margins. Moreover, higher costs due to inflation could be a problem if the firm is unable to effectively pass those along to the consumer. Upside risks include strong apps on its network and a general valuation re-rating.

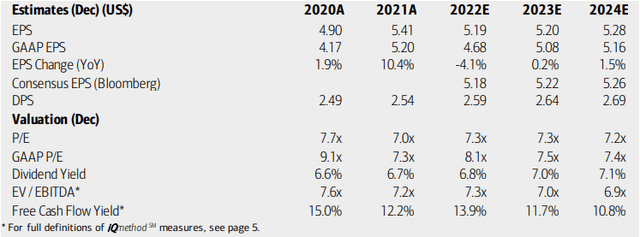

On valuation, BofA analysts expect earnings to fall by more than 4% this year while tepid EPS growth is seen in 2023 and 2024. The Bloomberg consensus forecast is about on par with that expectation. Still, strong free cash flow should warrant higher dividends in the coming years.

All the while, the firm’s operating and GAAP earnings multiples are incredibly low on an absolute basis, but relative to hardly any earnings growth, they aren’t overly compelling. Overall, the valuation seems about fair.

Verizon Earnings, Valuation, And Dividend Forecasts

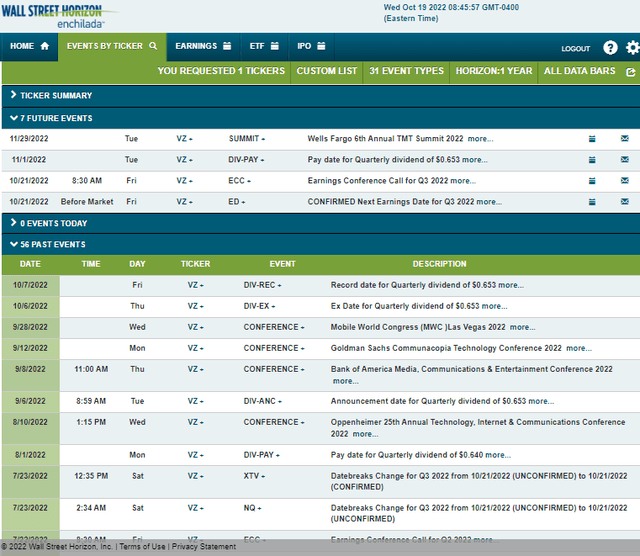

Looking ahead, corporate event data from Wall Street Horizon shows a confirmed earnings date of Friday, October 21 before market opens with a conference call immediately after results hit the tape. You can listen live here.

After Friday, investors can look forward to a dividend payment date of Tuesday, November 1. There could be some volatility late next month when Verizon’s management team speaks at the Wells Fargo 6th Annual TMT Summit 2022.

Corporate Event Calendar

The Options Angle

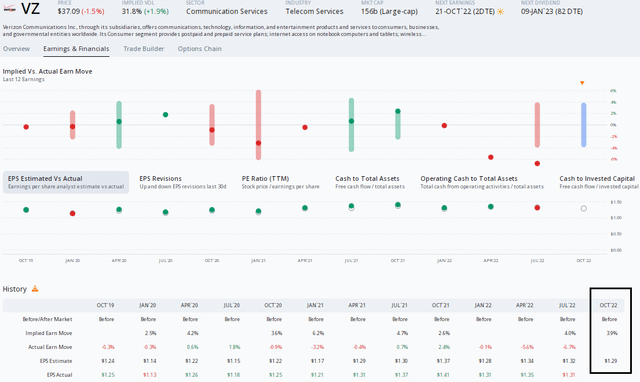

Data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $1.29 which would be an 8.5% drop from the same period a year ago. It’s remarkable to see how flat quarterly bottom-line figures have been over the last three years. Also, actual earnings tend to be very close to the consensus estimates. Verizon has a strong EPS beat rate history, per ORATS data, but it did miss on its July release.

Options traders expect a small 3.9% stock price swing post-earnings on Friday using the nearest-expiring at-the-money straddle. That’s within the historical range of past implied moves. Since the firm’s Q2 report, there have been five analyst upgrades and just a single downgrade of the company.

VZ: Solid EPS Beat History, Don’t Expect A Big Move Friday

The Technical Take

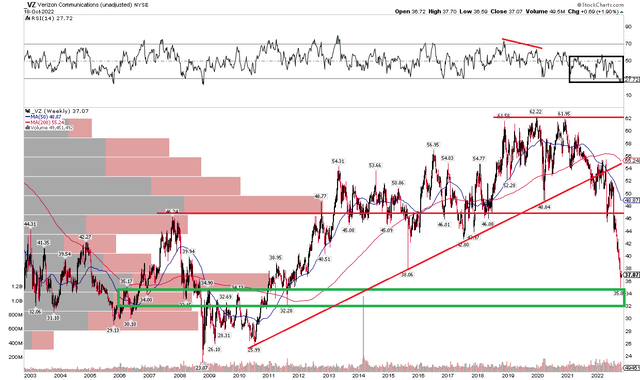

While the options look fairly priced based on history, the chart shows the bears are in control. Maybe I’m trying to be optimistic, but there could be some support in the $32 to $35 range. Also, there’s a decent number of shares traded in the mid-$30s as measured by the ‘volume-by-price’ indicator. On the upside $46 to $48 is the first major layer of bearish overhead supply.

The stock’s 50-week and 200-week moving averages are now negatively sloped, so this is a ‘sell the rip’ stock until the bulls prove otherwise. Moreover, the stock’s weekly RSI is confined to the bearish 20 to 60 range – a breakout above 60 would help support a more sustained recovery. Overall, buying on a dip into the low $30s is the play, so there could be more downside.

VZ: A 2022 Freefall to Old Support/Congestion

The Bottom Line

Verizon finally looks fairly valued based on its P/E multiple and growth outlook. The dividend should be safe based on solid free cash flow. Technically, there could be a bit more bearish room to run. Don’t be so quick to buy the stock ahead of earnings Friday.

Be the first to comment