tommaso79/iStock via Getty Images

Introduction

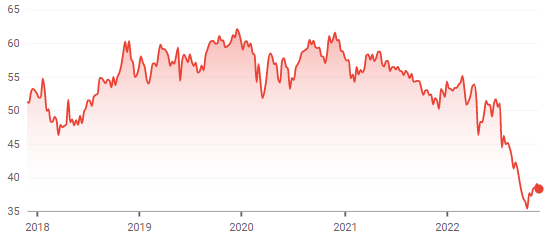

We review our Hold rating on Verizon Communications Inc. (NYSE:VZ) after shares remain near their 5-year low in October (just after Q3 results on October 21), and 37% below the level at the start of 2020:

|

Verizon Share Price (Last 5 Years)  Source: Google Finance (28-Nov-22). |

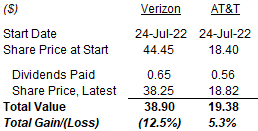

Verizon shares have lost 12.5% (after dividends) since our downgrade in July, an 18 ppt underperformance compared to shares in AT&T (T), Verizon’s main competitor:

|

Verizon vs. AT&T Performance  Source: Google Finance and company filings. |

Verizon’s EBITDA has grown less than AT&T’s in recent quarters, but partly because the latter had fallen more in 2021. AT&T’s recent EBITDA growth has largely been driven by its wireless business, which has had better net adds and Average Revenue Per User (“ARPU”) growth. However, this outperformance is built on past promotional activity, and Verizon is now following with its own promotions and cost cuts. Wireless is a commoditized sector, and the risk of a mutually-destructive price war is real. In the meantime, Verizon shares are now cheaper than AT&T’s, with a similar 7.4x P/E and a higher 6.8% Dividend Yield. We reiterate our Hold rating on Verizon stock. Avoid.

Verizon’s EBITDA Grew Less Than AT&T’s

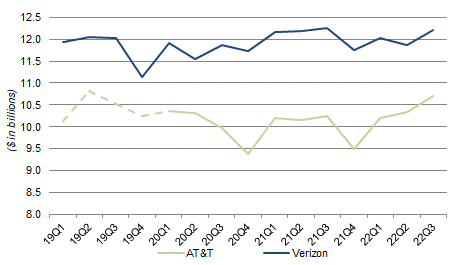

Verizon’s EBITDA has grown less than AT&T’s in recent quarters. As of Q3 2022, Verizon’s EBITDA has grown by just 4% since Q4 2021, while AT&T’s has grown by 13%. AT&T’s EBITDA growth is visibly steeper year-to-date:

|

Group Adjusted EBITDA – Verizon vs. AT&T (Since 2019)  Source: Company filings. NB. Verizon EBITDA includes Verizon Media (sold Sep-21) and Tracfone (acquired Nov-21). AT&T EBITDA on standalone basis; 2019 figures are estimated. |

However, AT&T’s steeper growth this year is on the back of a larger fall in 2021. Compared to Q1 2020, AT&T’s EBITDA has grown by just 3.4% as of the latest quarter, not much better than Verizon’s EBITDA having grown by 2.8%.

Verizon’s Slower Growth in Wireless

The gap between Verizon’s and AT&T’s recent EBITDA growth is largely driven by their wireless businesses.

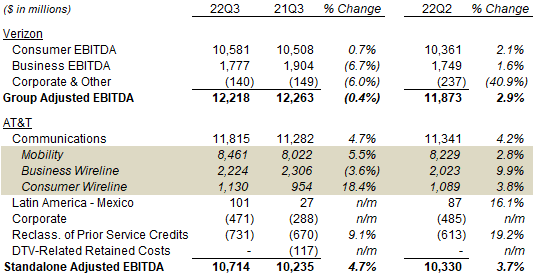

We can see this by looking at the two companies’ EBITDA by segment. In Q3 2022, Verizon’s EBITDA shrunk by 0.4% ($45m) year-on-year, while AT&T’s grew by 4.7% ($479m):

|

EBITDA by Segment – Verizon vs. AT&T (Q3 2022 vs. Prior Periods)  Source: Company filings. |

For AT&T, by far the biggest component of its year-on-year EBITDA growth was Mobility ($439m), which includes both consumer and business wireless customers. Growth was smaller in dollars in Consumer Wireline ($176m) and Mexico ($74m), and Business Wireline EBITDA fell $82m.

For Verizon, the Consumer segment was 86% of segmental EBITDA, and grew only 0.7% year-on-year. Wireless Service revenues accounted for 84% of the Service revenues in Consumer and are the main driver of Consumer EBITDA. While Verizon’s Business EBITDA fell 6.7% in Q3 2022, the decline in dollars was small ($127m) and similar in size to that at AT&T’s Business Wireline segment.

AT&T’s Better Wireless Net Adds & ARPU

AT&T has had better net adds and ARPU growth in its wireless businesses than Verizon in recent quarters.

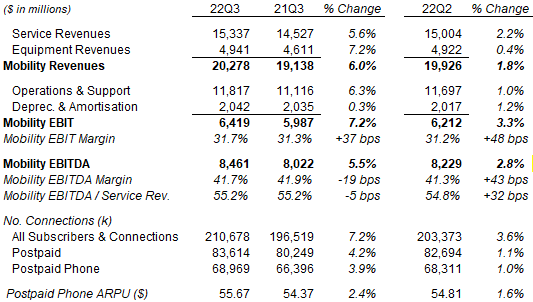

Q3’s 5.5% year-on-year EBITDA growth in AT&T Mobility was largely driven by Service revenues growing 5.6% (Equipment revenues are lower-margin), which in turn was driven by a 3.9% growth in Postpaid Phone connections and a 2.4% growth in Postpaid Phone ARPU:

|

AT&T Mobility P&L and KPIs (Q3 2022 vs. Prior Periods)  Source: AT&T results supplement (Q3 2022). |

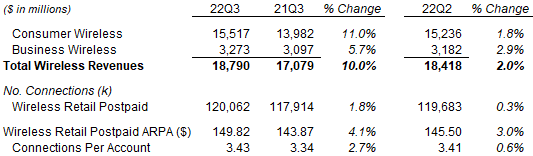

Verizon does not disclose its wireless-only EBITDA. Its wireless revenues were 10.0% higher year-on-year, but largely due to the acquisition of Tracfone in November 2021; excluding Tracfone, wireless revenues were only 3.5% year-on-year. Verizon’s Wireless Retail Postpaid connections grew just 1.8%; its Average Revenue Per Account (“ARPA”) grew 4.1%, but the number of connections per account also grew 2.7%, implying an ARPU growth of less than 1.5%:

|

Verizon Wireless Revenues and KPIs (Q3 2022 vs. Prior Periods)  Source: Verizon results supplement (Q3 2022). |

(Verizon Postpaid numbers are not distorted by the Tracfone acquisition because the latter was a prepaid business.)

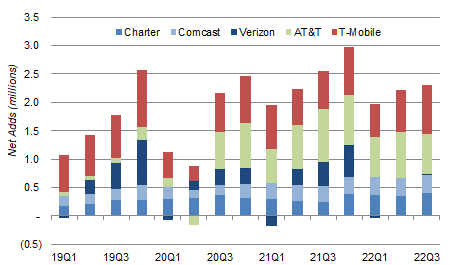

Verizon’s total wireless Retail Postpaid Phone subscriber net adds have dropped to almost zero in the past two quarters (after a seasonal Q1 dip), while AT&T’s remained substantial and were actually higher year-on-year:

|

Wireless Postpaid Phone Net Adds – Key Players (Since 2019)  Source: Company filings. |

Verizon’s negligible Retail Postpaid Phone net adds this year were the result of larger Business net adds being offset by even larger Consumer net losses. In Consumer, Verizon has lost 696k Retail Postpaid Phone subscribers in Q1-3 this year, compared to a gain of 239k in the same period last year. (In Business, Verizon has gained 680k Retail Postpaid Phone subscribers in Q1-3 this year, compared to 287k in 2021.)

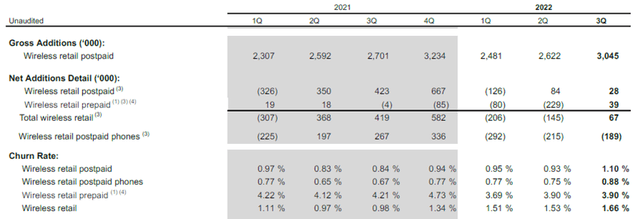

|

Verizon Consumer Wireless Selected Operating Statistics (Since 2021)  Source: Verizon results supplement (Q3 2022). |

Verizon’s Consumer churn rate has picked up this year (as has AT&T’s, both attributed to pricing actions); its gross additions have also gone up but not as much.

AT&T has undoubtedly gained at Verizon’s expense in consumer wireless in recent quarters.

AT&T Consumer Wireless Gains May Not Last

We believe AT&T’s recent gains in consumer wireless may not last.

These gains have been built on past promotional activity. CFO Pascal Desroches acknowledged this when he was asked about AT&T’s recent wireless subscriber gains at an investor conference in November:

“Here’s the way I would break it down. First of all, at the industry level, we’ve seen elevated industry growth in a variety of factors, small business formation small business gets started … And in 2019, ’20, we stepped up our investments and to match those peers … what that did is we offered the same exact promo to existing and new customers. It lowered our churn.”

This explanation is consistent with Verizon’s operational data, where it has also seen higher Business Postpaid Phone net adds this year but has lost far more in Consumer Postpaid Phone subscribers.

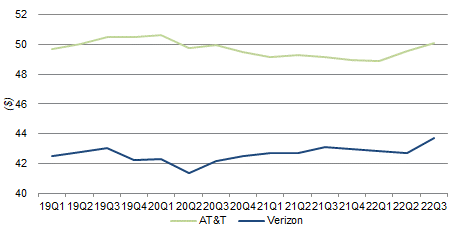

Also consistent with the explanation is the substantial decline in AT&T’s ARPU since 2019, before rebounding this year:

|

Wireless Retail Postpaid ARPU – AT&T vs. Verizon (Since 2019)  Source: Company filings. NB. Verizon ARPU figures estimated from ARPA and connections per account. |

AT&T management attributed its 2022 ARPU growth “largely” to price hikes, recovery in roaming revenues and customer upgrades, but we believe it has also benefited from lapping the last of its pre-2019, higher ARPU contracts. (AT&T had been offering 30-month plans since 2015 before moving to 36-month plans in 2021.)

AT&T executives have been repeatedly explicit about sacrificing ARPU for volume. For example, Desroches said at another investor conference in August 2021 that executives “felt that it would be perfectly fine to trade a few points of ARPU to maintain and grow our market share”.

AT&T’s promotions have had an impact on profit margins. As of Q2 2022, AT&T Mobility’s year-on-year EBITDA grew just 2.5%, 2 ppt less than the growth in its Mobility Service revenues (of 4.6%), leading to a margin contraction of about 1 ppt. AT&T has been funding its promotions partly by cost savings, which before Q3 2022 had largely been “reinvested” and not produced higher earnings.

Verizon is now matching AT&T with similar moves.

Verizon’s Cost Cuts and Potential Price War

Verizon is now following AT&T’s playbook of more promotions, lower prices and cost cuts.

The Welcome Unlimited wireless plan has been introduced in July to attract new postpaid customers. Described as Verizon’s “best Unlimited price ever”, it costs $30 per line per month for four lines, and comes with unlimited talk, text and data, 5G, as well as a $240 gift card for users who are bringing their own devices.

The Total By Verizon plan has been launched in September to attract new prepaid customers in the value segment. Monthly rate plans start at $30, while a $60 rate plan also comes with unlimited talk, text and data, as well as 5G and a Disney+ (DIS) subscription.

A new cost savings plan has been launched in Q3 2022, with the goal to save $2-$3bn annually by 2025. Verizon CFO Matt Ellis stated on the earnings call that, “while part of this will benefit the bottom line, a portion of these savings will be reinvested into the business to help accelerate opportunities”.

Verizon management stated on the Q3 call that there were “early indicators” that actions taken were “gaining traction”, and that they expected to achieve “positive Consumer phone net adds in the fourth quarter”.

There is a real risk of a mutually-destructive price war between Verizon and AT&T.

Wireless Is a Commoditized Sector

We believe wireless is a commoditized sector with relatively limited differentiation between competitors.

Wireless users on different networks use the same third-party mobile devices. Variations in service quality can be greater between different locales on the same network as between different networks. Switching costs for users are low, often funded by promotional offers. And each national carrier is obliged to provide coverage in every market, regardless of local Return on Investment Capital. Price appears to be the main area where networks compete.

We originally hoped that Verizon’s traditional premium positioning, more efficient operations as well as Mobile Virtual Network Operator agreements with Charter (CHTR) and Comcast (CMCSA) would give it a sufficiently large cost advantage to maintain its earnings even in a commoditized market. We realized we were wrong after Q2 2022 results.

Now we are cautious on wireless operators as a sector and have Hold ratings on both Verizon and AT&T. However, we do note that Verizon shares are now cheaper than AT&T shares on most standard metrics.

Verizon Shares Now Cheaper Than AT&T

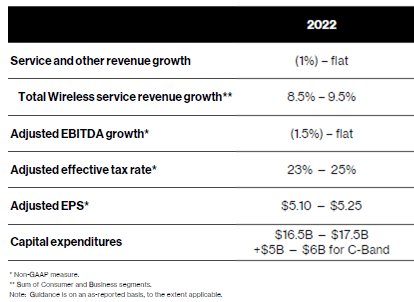

Verizon has kept its full-year guidance unchanged from July. Adjusted EBITDA is expected to be flat to down 1.5%, while Adjusted EPS of is expected to be $5.10-$5.25 (compared to $5.39 in 2021):

|

Verizon 2022 Guidance  Source: Verizon results presentation (Q3 2022). |

With VZ stock at $38.25, the mid-point of 2022 EPS guidance implies a P/E of 7.4x, slightly lower than AT&T’s 7.5x (based on 2022 guided continuing operations Adjusted EPS of “$2.50 or higher”)

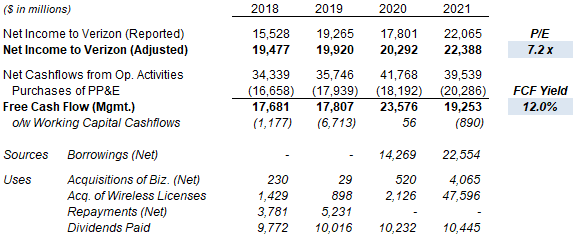

Relative to 2021 financials, VZ stock is at a P/E of 7.2x and a Free Cash Flow (“FCF”) Yield of 12.0%:

|

Verizon Earnings, Cashflows & Valuation (Since 2018)  Source: Verizon company filings. NB. 2020 benefited from a $2.2bn cash tax benefit related to the sale of shares in a foreign subsidiary and a $764m interest rate swap settlement (among others). |

Excluding $2.1bn of C-band CapEx in 2021, recurring FCF was $21.4bn FCF Yield would have been 13.3%.

Verizon stock’s FCF Yield is higher than that of AT&T, whose guided $14bn standalone FCF in 2022 implies an FCF Yield of 9.8%.

VZ stock pays a dividend of $0.6525 per quarter ($2.61 annualized), after a 2.0% raise in September. The dividend represents a Dividend Yield of 6.8%, higher than the 5.9% at AT&T.

Verizon shares are thus cheaper than AT&T shares on most standard valuation metrics.

Conclusion: Is Verizon Stock A Buy?

We reiterate our Hold rating on Verizon, meaning its stock should be avoided.

We are fundamentally uncomfortable with the commoditized nature of the wireless sector and the real possibility of mutually-destructive price wars. These fears outweigh telco stocks’ superficially cheap valuation in our view.

We also note that Verizon stock is cheaper than AT&T stock on most valuation metrics. While we would avoid both stocks, we would choose Verizon if we were forced to pick one, because of its lower valuation, better long-term track record and recent relative underperformance.

Be the first to comment