ronstik

Investment Thesis

Verde AgriTech Ltd (OTCPK:VNPKF)(TSX:NPK:CA) is a fertilizer producer company that is experiencing strong domestic demand due to many factors. The company has also entered into a strategic partnership with Lavoro, which can accelerate the growth of the company. I believe the rising demand for the products might be the primary growth factor, and a strategic partnership with Lavoro could be a supportive growth factor that might accelerate the company’s growth.

About Verde AgriTech

The company is a developer and manufacturer of fertilizer. It offers farmers chloride and salinity-free potassium fertilizers at the same price as traditional fertilizers. Every product of the company is made of glauconite, which is natural potassium. The company’s products are chloride-free, which is an advantage for it as chloride-free products keep the soil healthy for a longer period. The firm’s primary business is the production and distribution of multi-nutrient potassium fertilizers, which are sold under the trade names BAKS & K Forte in Brazil and Super Greensand globally. The largest part, 99% of the revenue, is generated from Brazil. The company also exports its products to the USA, Canada, Thailand, China, and Paraguay, which together generate only 1% of the total revenue. Currently, the company is still focusing on expansion in Brazil as it is experiencing a dramatic increase in product demand. Brazil is the second largest consumer and largest importer of potash in the world which shows that the company still has a huge market to address.

Robust Demand

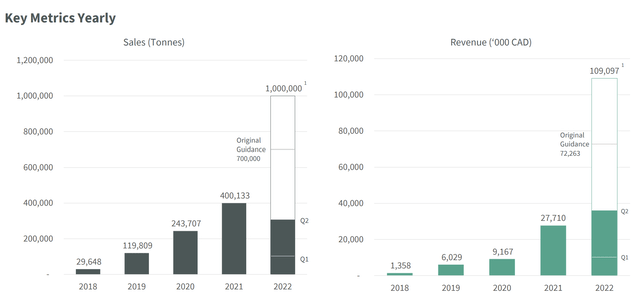

Yearly Sales (Verde AgriTech‘s Investor Presentation)

The company has been experiencing massive demand for the last four years. The quantity sold has increased by a 91.47% four-year CAGR, and the company’s revenue has grown by a 112.54% four-year CAGR. I think the growth spree of the company might continue, and the drivers could be these three main factors: A rise in overall crop demand, the Russia-Ukraine war, and the strong brand value of the company.

Soybean and corn are the major crops of Brazil, and both require potash for healthy production. According to Brazil’s National Supply Company, Conab, compared to 2021, the output of corn in 2022 is estimated to increase by 45.6%. The increase would be driven by a rise in planted area and productivity. The Conab also stated that soybean production in 2022 is expected to decrease by 10.2%, impacted by the La Niña storm. The U.S. Department of Agriculture believes soybean production could be 20% (149 million tonnes) higher in 2023 compared to Conab’s 2022 estimates of 124 million tons. I think the demand for the company’s products might increase in the coming periods with the rising production, as the management has confirmed in a recent conference call that the product sales and the country’s crop demand are strongly correlated. But I think this is not the only factor that can drive the company’s financial growth, as Brazil imports 85% of its fertilizers which indicates the scarcity of domestic production of fertilizers. The country has negotiated with Russia to obtain fertilizer shipments during supply uncertainties. After facing the severe fertilizer shortage due to the Russia-Ukraine war, I believe the government might decide to decrease its dependency on other countries to fulfill its fertilizer demand and encourage domestic players to increase production. The government can help agrochemical companies through tax benefits, loans at cheap interest rates, or other industry-specific benefits. I believe this imbalance of demand and supply shows that there is a huge market for domestic players, which is not addressed yet. According to my analysis, if the government decides to increase domestic production, the company is well positioned in the industry with a strong brand presence and customer trust. I believe rising organic demand since 2017, driven by positive word-of-mouth marketing and customer feedback, justifies the company’s strong position in the industry. The company’s current production capacity is 0.6 million tonnes per year (Mtpy). The company is currently targeting to start the production of plant 2, which will give an additional capacity of 2.4 Mtpy, and Plant 3, which is supposed to start production in 2023, will add 10Mtpy. After plant 3, the company can produce 16.4% of Brazil’s total potash demand, which I believe would be enough to cater to the rising demand and can help the government increase potash’s domestic production significantly.

I think the industry has a strong entry barrier, as creating a new agrochemical company from scratch requires enormous investment and research. After considering all opportunities and strengths, I believe the company might experience high growth in the coming years, which can lead to solid financial results and returns for the investors. The company has recently partnered with Lavoro, Latin America’s largest distributor, to reach maximum customers efficiently. I will explain this in detail in the next section.

Sales Partnership with Lavoro

The company has recently announced its strategic sales partnership with Grupo Lavoro. The company’s new partner is Latin America’s biggest agricultural product distributor. Lavoro offers an efficient distribution network that provides reach which is beyond its current sales team. Lavoro can also provide the path to expand the company’s business in other Latin American markets, and it also has a strong track record of promoting agricultural products in Brazil. I think this strategic partnership could be a significant supporting catalyst for the primary growth factor of rising demand because the availability of products at the right time and place can play an essential role in capturing demand in a growing market. Now let us discuss the recent financials of the company.

Financials of Verde

The company has recently announced solid 2Q22 results. The company has reported a revenue of C$24.9 million (US$19.29 million), which is a growth of 362% compared to the C$5.38 million (US$4.14 million) of 2Q21. The company has sold 202,255 tonnes of the product at an average price of C$123 (US$95.27) per tonne. The price and quantity of products have increased more than 100% compared to the previous year’s price and quantity. I believe the price can sustain at higher levels as the industry is experiencing robust demand. The production cost of the second quarter has increased by 256%. The rise was driven by an increase in production volume and a 68% increase in cost per tonne. The freight expense increased by 286%, and the sales & marketing expense increased by 104% in Q2 2022. The gross profit margin has increased by 700 basis points, and EBITDA before non-cash events has also risen by 782% and reached C$10.8 million (US$8.37 million). I believe the huge jump in gross profit margin and EBITDA despite the rise in production, freight, and sales & marketing expenses shows that the company has managed to pass on the significant part of inflation to its consumers. The company has reported a net profit of C$9.6 million (US$7.44 million), which is a growth of 3426% compared to the C$0.27 million (US$0.21 million) of the same period of the previous year.

The long-term borrowing of the company has increased by 63% compared to 6 months ago result. I believe rising borrowing is normal for growing companies as they have to spend funds on capital expenditure. Verde has borrowed most of the funds for the equipment. The company has revised its outlook after experiencing strong demand.

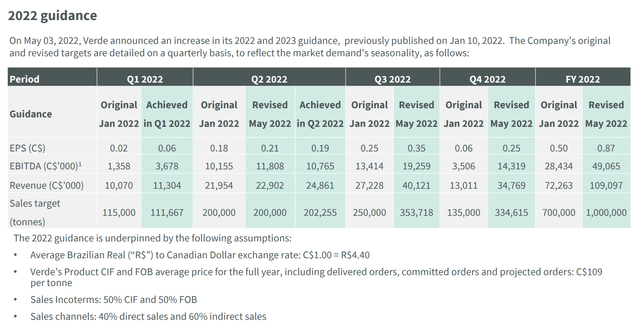

2022 Revised Outlook (Verde AgriTech‘s Investor Presentation)

The company estimates that by the end of FY2022, it can sell 1,000,000 tonnes with C$109.01 million (US$84.4 million) revenue. It has also estimated EPS to be C$0.87 (US$0.67), which is 1179% higher than the EPS of FY2021. The company also forecasts that after commissioning Plant 3, it might sell 2,000,000 by the end of FY2023. I believe the company outlook is accurate and aligns perfectly with my thesis.

What is the Main Risk Faced by Verde?

The Volatility of Commodity Prices

The firm’s future financial success and long-term sustainability can be significantly influenced by the price of generated minerals in the international market and the commercial viability of those minerals. Numerous outside factors may impact the commercialization of mineralized substances that the firm may buy or uncover. Consumption trends, inflation, speculative activity, economic & global political trends, interest rates, currency exchange swings, production costs, and production rates are a few of these variables. The company cannot forecast the impact of these factors, but all of them can hinder appropriate return on capital investment. Especially in recent years, the prices of some minerals have varied considerably. Suppose the company faces a significant drop in the price of a mineral it already produces or anticipates producing; in that case, it can have a materially adverse impact on its financial results.

Valuation

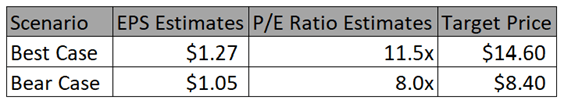

The rising demand and strong presence of the company are expected to drive the financial growth of the company in the coming years. I believe the company is on a growth spree due to rising market demand, and the strategic partnership with Lavoro can accelerate the company’s growth. The company estimates its EPS to be C$0.87 (US$0.67) for FY2022. It also assesses that sales can reach 2,000,000 tonnes for FY2023 which is twice as compared FY2022 estimates. I think the company’s estimates are correct, and after considering all these factors, I am estimating EPS of US$1.27 for FY2023 which gives the forward P/E ratio of 4.26x. After comparing the forward P/E ratio of 4.26x with the sector median of 11.01x, we can say that the company is undervalued. I believe the company might gain significant momentum and trade at a higher P/E ratio compared to the sector median P/E ratio in the coming years as it is a growth company. I estimate the company might trade at a P/E ratio of 11.5x, giving the target price of US$14.6, which is a 169.3% upside compared to the current share price of US$5.42. The volatile commodity prices can affect the financial performance of the company.

Target Price Chart (Author)

I believe even in that case, the company can achieve sales of 2,000,000 tonnes as it has huge domestic demand, but the high production cost due to volatile commodity prices can contract the profit margins and EPS of the company. I believe in the bear case scenario of volatile commodity prices, the EPS of FY2023 might be $1.05. I think the company might trade below its sector median in a bear case scenario. That’s why I estimate the P/E ratio of the bear case to be 8.0x, which gives a target price of $8.4, representing an upside of 55%.

Conclusion

The company has been experiencing massive demand. I believe it might continue for the coming periods as there are many economic tailwinds, such as rising crop demand and dependency on other countries for fertilizer supply. I think the company has a vast market in Brazil to capture with the efficient distribution channel of Lavoro. With its strong presence and new production capacities, the company is well positioned to benefit from the rising demand. After considering all these factors, I assign a buy rating for Verde.

Be the first to comment