FotoDuets/iStock via Getty Images

Investment Thesis

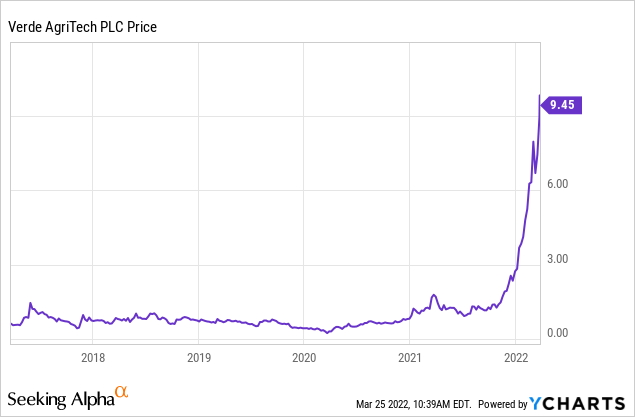

In the context of the global fertilizer crisis, Verde Agritech PLC (OTCQB:AMHPF, TSE: NPK), a company operating in Brazil, is gaining more and more attention. The share price has already exploded, but in my opinion, it is still a great opportunity, as pretty much everything points in a positive direction: strong growth, rising sales prices due to the global crises, locality, and thus independence in supplying Brazilian customers. The CEO holds 19% of the shares, and the company would also be a welcome guest in any ESG ETF, as its product is significantly better for the soil than conventional fertilizer.

Note: all figures in this article are in Canadian dollars as all documents in the Company’s investor relations are in CAD.

What distinguishes Verde from other fertilizer producers

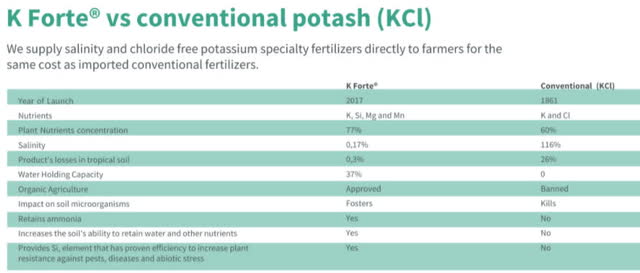

We supply salinity and chloride free potassium specialty fertilizers directly to farmers for the same costs as conventional fertilizers.

In a video on its YouTube channel, it was stated that the hunger for growth of the company is also fed by the fact that they are so convinced of their products and want to contribute something positive to the preservation of soil biodiversity. According to the company, fertilizers containing chloride and salt are the main enemy of microorganisms in the soil. In the long run, current fertilizers kill the life in the soil, reducing the overall diversity high up the food chain.

corporate presentation Corporate presentation

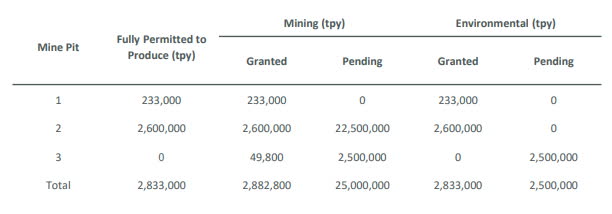

The company is very convinced of its positive effects on soil quality. The main product of Verde is Kforte, which is a direct replacement of KCL (potassium chloride) containing fertilizers. Kforte consists mainly of glauconite. And this glauconite is mined in the company´s mines. Recently, on February 10, 2022, Brazil granted a permit for further mining of 2.5 million tons per year, which represents a tenfold increase from the previous production volume. Permits for up to 25 million tons are still pending.

corporate presentation

Glauconite is extracted from ancient rocks and the mines have a total capacity of 777 million tons, enough for decades. No chemicals are used in the mining process. When a mine pit reaches the end of its life, it can simply be filled in and forest will grow on it again as if nothing had ever happened.

Verde is independent of the current crises

Especially in the context of the current crisis in Eastern Europe and the split between East and West, independence is very important at the moment. Everything the company needs for its products can be found in its own country. It is therefore independent of Belarus as one of the largest suppliers of potash, independent of gas from abroad, and independent of all trade restrictions. This localness and security of supply should be an argument for farmers to switch to Verde, because given the current world situation, global supply chains and prices, especially for fertilizers, are very uncertain.

Explosive Growth

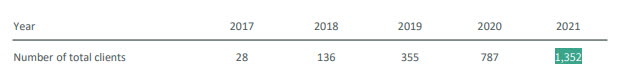

Kforte has been available since 2017 and has seen very rapid growth since then. According to the company, the average order quantity per customer is also improving. In addition, surveys of new customers have shown that some became aware of Kforte through word of mouth, indicating high levels of satisfaction among previous customers.

January Newsletter

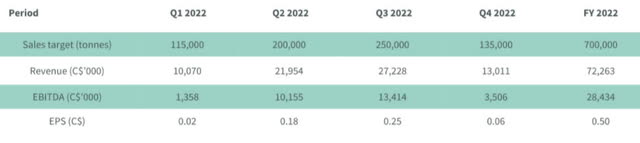

Sales also have developed very strongly. In 2020, revenue was C$9.1M, in 2021 already C$27M and for 2022 revenue of C$72M is expected. From 2022 to 2023, the company wants to double production again to a total of 1.4M tons. Here is a table that reflects the seasonality in sales.

I don’t know exactly how accurate the company’s projections are. However, one has to keep in mind that we are already in March 2022 and farmers have to plan very far ahead in their business, so I rather assume that orders for 2022 have already been received. Therefore, Verde should have a near-perfect view of its revenue and this year’s selling price.

Are the shares overvalued?

The share price has exploded. Normally, when you see such graphs, you think of a bubble formation or completely exaggerated valuations. Is that the case here? 2021 EPS were C$0.06 which would equate to a P/E of 157 at the current price. According to the last table above, Verde expects EPS of C$0.50 for 2022, which would mean a forward P/E of 19. So if this comes true, the stock would be significantly undervalued given this growth.

This estimate of C$0.50 is based on several factors. Since the company bills entirely in Brazilian reals, but is listed in Canada, the exchange rate plays a role. For this estimate, the company assumes an average exchange rate of C$1.00 = R$4.40 (at the moment it is R$3.82 for one C$). Also important is the price per ton of KCL fertilizers, which is the competitor’s product. The C$0.50 is based on 500USD per ton. At the moment, futures for the rest of 2022 are trading between $800 and $1000, so overall it could be even better than C$0.50 EPS.

Profit from scarcity without being scarce itself

Verde bases its sales price on the prices of the classic fertilizer producers. This means that Verde could profit permanently from the scarcity of fertilizers and the resulting high prices, although its product has not become scarcer. This development can already be seen to some extent. In 2020, for example, the sales price per ton sold was C$38 and the production cost per ton was C$14. In 2021, it was already a sales price of C$69, with production costs of C$18. Thus, the gross margin in 2021 was 74%.

Risks

I have already touched on some of the risks. The exchange rate, of course, but also the price development of KCL fertilizers, to which Verde is oriented. Another risk is that the production capacity will be expanded, but there will not be enough demand on the market. The number of users is increasing rapidly, but there is no guarantee that this will continue in the future. Another risk is that Brazil will not provide further mining permits for glauconite. At the moment it is allowed to mine about 2.8 million tons and in 2023 the production of Kforte should be 1.4 million tons. So this allowed capacity should be enough until about 2024.

What else to know?

One important thing I would like to mention is that the CEO Christiano Veloso owns 19% of the shares. The number of shares outstanding has increased from approximately 37M in 2014 to 52M now. So the dilution is not extremely high and should slow down as the company is making profits from last year. And last but not least, the company has hardly any debt (about C$5M).

Conclusion

There is a lot to like about this company. Virtually all figures point in a positive direction. The number of customers along with increasing revenue per customer as the selling price increases. In addition, there is the locality, which represents independence from global supply chains. The high number of shares held by the CEO and little debt. Even after this explosive growth of the share price, it remains a very good investment for me.

Be the first to comment