Mohammed Haneefa Nizamudeen

Shares of Vera Therapeutics (NASDAQ:VERA) have risen by 67% since IPO priced at $11 back in May of 2021. So far in 2022, share price has fallen by almost 30%.

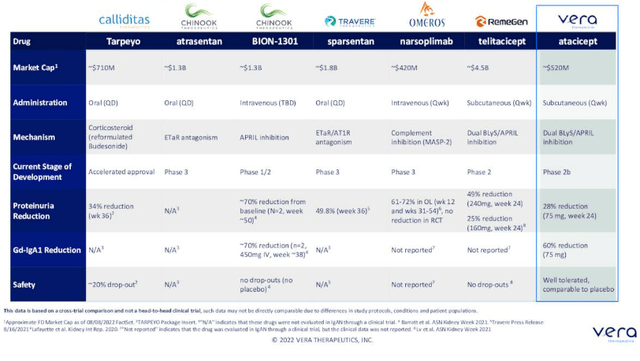

I grew interested in this early-stage player in immunological disease space as I researched multiple Iga nephropathy (IgAN) contenders in what I consider to be an increasingly lucrative area with multiple tailwinds (see my recent article on Chinook Therapeutics which also provides a view of the overall landscape). Specifically, the FDA’s willingness to accept surrogate endpoints such as proteinuria reduction for regulatory approval is speeding up development timelines and several promising drugs could improve outcomes for these patients in the next few years.

Vera’s dual inhibitor of BLyS and APRIL, atacicept, could have best-in-class potential for IgAN and has an important readout coming up in Q1 2023. Couple that with additional shots on goal in lupus nephritis and other indications of high unmet need, at a current enterprise value of just $400M, and it’s clear why I wanted to dig deeper and see if there’s a near term opportunity for my readers.

Chart

Figure 1: VERA weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares bounce around in the $15 to $30 range for much of the past year. After bottoming in mid-teens this summer, they’ve again rebounded just south of $20 and appear to be consolidating for a move higher still. My initial take is that, given tailwinds to the IgAN space and presence of a near term catalyst coming up, investors interested in this story would do well to establish a pilot position and from there accumulate dips in Q3 for the potential run-up into data in 2023.

Overview

Founded in 2016 with headquarters in San Francisco (just 17 full-time employees), Vera Therapeutics currently sports enterprise value of ~$400M and Q2 cash position of $131M providing them operational runway for roughly 1.5 years (conservatively).

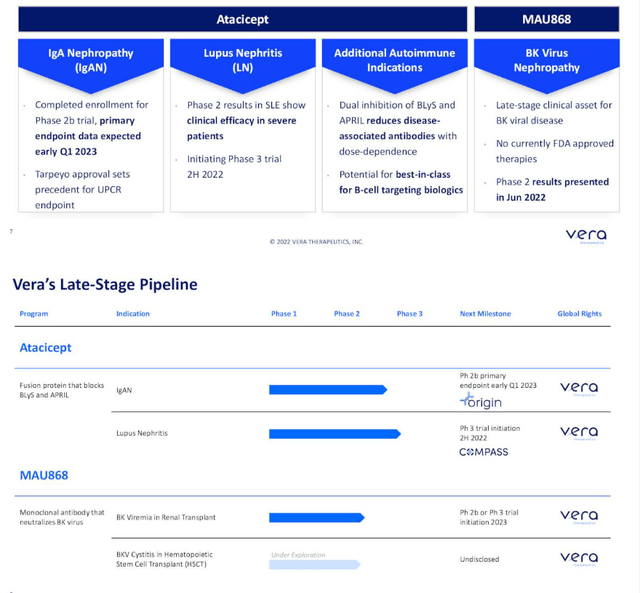

At Wedbush PacGrow Healthcare Conference presentation, CEO Marshall Fordyce describes the company as developing novel medicines in the area of immune-related kidney disease where there is large unmet need and market opportunity with recent favorable regulatory conditions. Vera has 3 programs in late-stage clinical development (impressive for a small company).

Figure 2: Pipeline & milestones (Source: corporate presentation)

Atacicept is their lead candidate, a fusion protein that is dosed once per week subcutaneously and previously has been in over a thousand patients in clinical studies (well-characterized safety and manufacturing profile). Atacicept was actually phase 3-ready when Vera licensed the drug in from Merck KGaA. Vera is developing it for two immune-driven kidney diseases, IgAN and lupus nephritis.

IgAN is an autoimmune disease of the kidney affecting young people (average age of diagnosis at age 30). It’s now getting attention from developers but has no disease-modifying drugs. They estimate the market to be at least in the high single digit billions in the US alone and there is emerging evidence that targeting the source of the disease (B cells which produce bad-acting auto antibodies in IgAN) could be disease-modifying and substantially improve kidney function as measured by protein in the urine and GFR. No one has shown this mechanism leads to improved kidney function in multi-national, randomized controlled studies yet and Vera hopes to be the first.

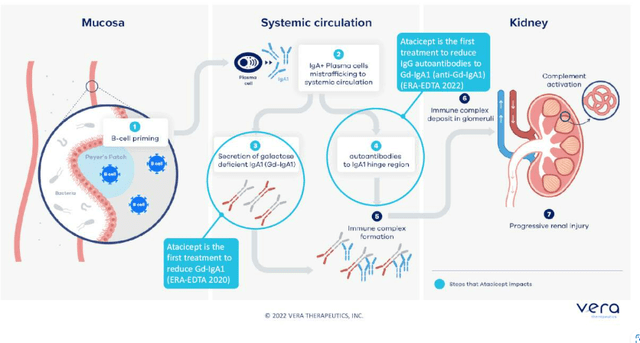

Figure 3: Atacicept hits two steps in the pathogenesis of IgAN (Source: corporate presentation)

Atacicept targets B cell lineage through dual inhibition of APRIL and BLyS which potentially makes it more potent and confers dosing advantages versus APRIL only approach. Readout of phase 2b ORIGIN study is due in early Q1 of 2023 and will demonstrate the effect of atacicept on kidney function as measured by proteinuria as primary endpoint. These results could be very meaningful for the field.

Second upcoming milestone is for lupus nephritis, as they have agreement with FDA to advance the higher dose (150mg) into a phase 3 study to be initiated this year.

Third, they are developing a second molecule, MAU868, for BK virus which is a leading cause of kidney failure in transplant patients. There are no approved drugs here and they have the first results of a randomized, controlled-study showing that this neutralizing antibody can reduce BK virus in the blood versus placebo.

Company has lean operating model, completely focused on clinical development and leadership team comes from Gilead and Genentech (highly experienced with drug approvals that led to blockbuster sales).

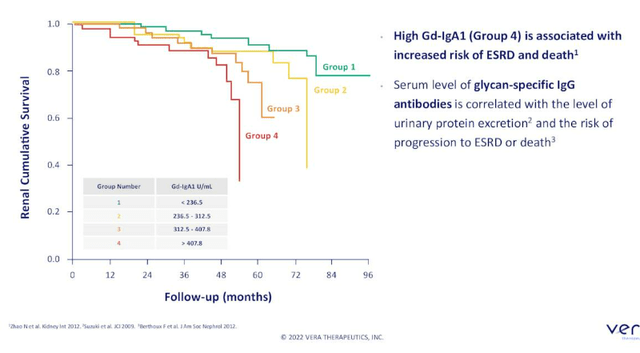

Returning to IgAN, the market is quickly evolving with much more interest coming into the space. Diagnosis is done by kidney biopsy and there is reason to believe IgAN is underdiagnosed. Prior, physicians knew with diagnosis they would just give patients an angiotensin receptor blocker or ACE inhibitor if they know the patient does not have diabetes or high blood pressure driving kidney failure. Diagnosis as a kidney biopsy is still a hurdle. There are two biomarkers that track with disease severity, the bad-acting auto-antibodies (GD-IgA1) which can be assayed and IgG. Together the two may have strong specificity for diagnosis and there are efforts to bring those forward as a non-invasive approach to diagnosis. Atacicept is the first and only molecule in development to show reduction in these biomarkers in randomized, controlled trials. Hepatitis C market was a great example of how when effective therapies come along, diagnosis goes up. IgAN patients traditionally have had no treatments available except ACE inhibitors or steroids, and randomized studies for the latter have been stopped early due to known acute and chronic side effects. Tarpeyo is now approved in IgAN and it is a reformulated steroid that provides a marginal improvement. Natural history data shows that 30% reduction in proteinuria leads to improved kidney outcomes over time, and that’s why Tarpeyo received accelerated approval (and potentially provides tailwind for all IgAN developers). CEO views upcoming approvals of endothelial receptor antagonists Chinook Therapeutics’ (KDNY) atrasentan and Travere Therapeutics’ (TVTX) sparsentan as potential improvements on ACE inhibitors or ARBs (protecting the kidney through hemodynamic change). Again, none of these approaches are disease-modifying and work downstream of this disease process. As it stands, there is strong observational data linking lowering Gd-IgA1 to improve proteinuria and leads to improved clinical outcomes including mortality and time to dialysis. However, how this translates into regulatory handling of specific programs is all conjecture at this point (too premature).

Figure 4: High Gd-IgA1 associated with reduced time to dialysis, transplant and death (Source: corporate presentation)

For the ORIGIN phase 2b study in IgAN, they are looking for data in early 2023 (24-week assessment). Atacicept prior has been studied in a small, randomized controlled study of about 15 patients (similar population) where it showed clear reduction (60%) in Gd-IgA1 at the middle dose (75 mg). CEO considered that to be pretty compelling and they will see whether they can meet or exceed that reduction in the ORIGIN study. They did see reduction in proteinuria, but again with wide error bars because numbers were small (27.7% reduction in proteinuria at 24 weeks). ORIGIN was designed for that reason, to get a better idea of the true reduction in proteinuria they can achieve including at high dose of 150mg. Study is powered for at least a 28% reduction in proteinuria (threshold is 30%, which led to accelerated approval for Tarpeyo).

Figure 5: Competitor landscape in IgAN (Source: corporate presentation)

They will be showing delta from placebo (prior trial had outlier that created increase in proteinuria in placebo, whereas placebo arm in ORIGIN study is expected to have no change in proteinuria at 24 weeks). 150mg dose will also be used in the lupus nephritis study. Merck was looking at taking the asset originally into systemic lupus, then they decided to focus pipeline elsewhere. Formerly, exposure safety analysis run by Merck was given a thumbs up to take 150mg dose into LN. However, dosing higher does not make sense as they do see a plateau in other disease sets (appear to be on the plateau when they go from 75mg to 150mg). Target product profile is appealing and simple, one mL subcutaneously once per week (what Humira is, for example). They are in a unique position as they know safety data in over 1000 patients. Base case is that they will have to run a phase 3 study after this phase 2b trial. ORIGIN study will be followed out to 96 weeks as long-term results are important (want to push possibility of dialysis further out into the future for these patients who are 30 years old on average at diagnosis). The hypothesis is that this drug is having a broader renal impact (removing the bad-acting auto-antibody so that downstream effects may be lessened). Mechanism will be key and again it depends on what alternatives are available (down to efficacy, safety and tolerability). They anticipate atacicept being used as a chronic, maintenance therapy (envision other mechanisms that have shorter duration, like Tarpeyo label which includes 9 months).

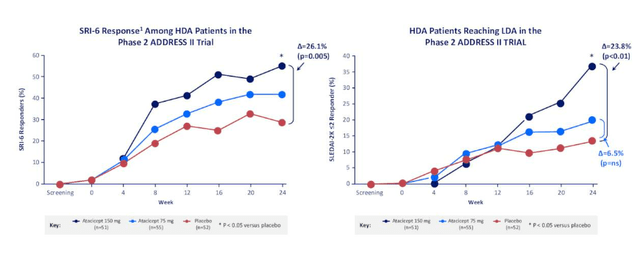

Moving on to lupus nephritis, there were no approved drugs 2 years ago and it is a terrible disease with huge unmet need. It can have a form where it causes rash, affects joints and can also be organ-threatening (lead to stroke or kidney failure). Brain fog, fatigue and other symptoms are quite difficult to measure in a multi-national study. There are now two approved drugs in LN (voclosporin from Aurinia and Benylsta from GSK) on basis of complete renal response endpoint (lab measures of protein in urine and GFR stability). Now, there is a precedent for approvals with this endpoint and nice correlation between phase 2 and phase 3. Vera wants to see this for indications they choose for development. It looks like atacicept can be efficacious in LN, and data in subset of patients with severe disease looks promising. Primary endpoint is 52 weeks (mimics voclosporin program). BLyS only is an approved drug for LN and systemic lupus (Benlysta), and we can think of atacicept as BLyS plus X (think adding APRIL to that mechanism can perform better in a randomized, controlled study). Prior data for atacicept has shown it reduced disease-associated auto-antibodies (dose-responsive) and suggest it potentially could work.

Figure 6: Phase 2 evidence of clinical efficacy in SLE (Source: corporate presentation)

As for MAU868 in BK virus, I remind readers that the company acquired this asset from Amplyx Pharmaceuticals (subsidiary of Pfizer) in December of last year for a mere $5M upfront payment in addition to $7M in certain regulatory milestones and low single digit percentage royalties on net sales. Vera is also obligated to make certain milestone payments in an aggregate amount of up to $69M to Amplyx’ partner Novartis as well as mid-to-high single-digit percentage royalties. At the time, Vera also entered into a credit facility with Oxford Finance of up to $50M (drew the $5M upfront payment at closing) and debt facility provides for at least 48-months of interest only payments.

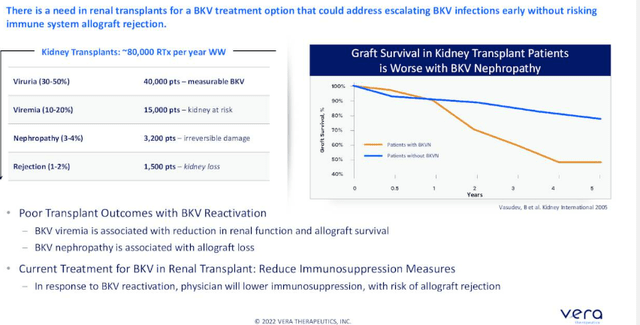

MAU868 has the potential to neutralize infection by blocking BKV virions from binding to host cells. CEO Marshall Fordyce notes that BK is a leading cause of kidney transplant loss and transplant-associated morbidity, with no currently available antiviral treatments in the US and potential to significantly impact outcomes for these kidney transplant patients (provide a new standard of care). Up to 90 percent of healthy adults are infected with BKV, but it remains latent in kidney and bladder tissues. Reactivation occurs in the setting of immune suppression, and causes clinical disease in the transplant setting. BKV is a significant cause of complications in immunocompromised patients, including in kidney transplant and hematopoietic stem cell transplant (HSCT) recipients. In kidney transplant recipients, BKV is a leading cause of allograft loss and poor outcomes, while in HSCT recipients, the virus significantly increases the risk of severe hemorrhagic cystitis, which causes bladder damage.

Figure 7: BKV is a leading cause of allograft loss (Source: corporate presentation)

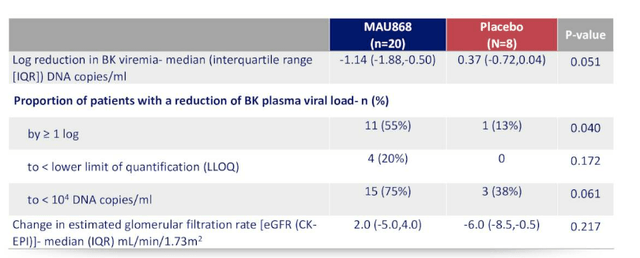

Positive interim phase 2 data was reported in June, showing that MAU868 was well tolerated and demonstrated significant BK antiviral activity in kidney transplant recipients with BK viremia.

Figure 8: Antiviral and renal effect versus placebo at week 12 (Source: corporate presentation)

Playing devil’s advocate, I think given details of the deal including low upfront payment, perhaps the market assigns little to no value to this asset until a phase 3 win is achieved or even a regulatory green light.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $131.9M (along with access to $45M credit facility) as contrasted to net cash used in operating activities for past six months of $28M (nearing triple the prior year). Quarterly net loss was $14.9M. My estimation is that the company (conservatively) has operational runway of 2 years with current resources at its disposal, so I would not be surprised to see further dilution via secondary offering by mid 2023 or so. Accumulated deficit so far is a reasonable $124.1M.

As for prior financings, I consider it a green flag that February’s upsized offering took place at $15/share (nearly 30% lower than current levels).

For those wanting to learn more about the value proposition behind MAU868, the March webinar was quite helpful for me. Here are a few nuggets:

- Patients undergo kidney transplant and then put under immune suppression can have reactivation of BK virus that threatens survival of their transplanted kidney. This is a major clinical problem (risk to their new kidney), although BK Virus nephropathy is not a well-known disease.

- Dr. Jordan, the Director of Nephrology and Transplant Immunology at Cedars-Sinai, states that BK Virus is an opportunistic infection associated with significant morbidity and mortality in transplant patients. Virus finds a home, is dormant and in immuno-suppressed patients is reactivated, starts killing the graft cells and eventually kills the kidney. Main risk factor is overall degree of immunosuppression. Mainstay of management at this time is reducing immunosuppression which has deleterious side effect of increasing risk for rejection.

- 100,000 kidney transplants are done worldwide each year. Reactivation occurs in about 40% of these patients (virus starts appearing in the urine and if it persists, it appears in the blood). If it persists, you know you are going to get damage to the kidney (kidney function can deteriorate rapidly). If physician resorts to lowering immunosuppression (current standard of care), 12% of patients have rejection of organ (KOL thinks in his experience it’s much more than 12%). Devil’s advocate, again 12% would seem like a low percent overall and I’m still not sure the market potential for such an asset, not to mention adoption that would occur IF it is approved. On the other hand, data shows that standard of care (immunosuppression reduction) is not a good idea in many cases as it could allow patient’s kidney to be rejected by the immune system.

- MAU868 neutralizes all four genotypes of BK Virus at subnanomolar concentrations. This mechanism of neutralization is proven and effective as seen in other approved monoclonal antibody therapies. In vitro it has been shown to be more potent than IVIG. Administration could be to patients before evidence of BKV replication in plasma as prophylaxis, preemptively at early stages of BKV infection or after disease diagnosis in treatment perspective. Optimal positioning may be in prophylactic high-risk patient or preemptively.

As for institutional investors of note, Longitude Capital Partner owns a 12.7% stake and RA Capital owns a 7.5% stake.

As for insiders, CEO Marshall Fordyce owns 181,500 shares but constant insider sells over the past few months are not inspiring confidence.

As for relevant leadership experience, Chief Medical Officer Celia Lin served prior as Senior Medical Director at Genentech (responsible for phase 3 global study execution and regulatory filing in orphan disease). Chief Development Officer Joane Curley prior led Project and Portfolio Management at Gilead Sciences. Similarly, SVP Development Operations Tom Doan also came from Gilead where he served as Executive Director, Clinical Operations Head of the Inflammation/Respiratory Therapeutic Area.

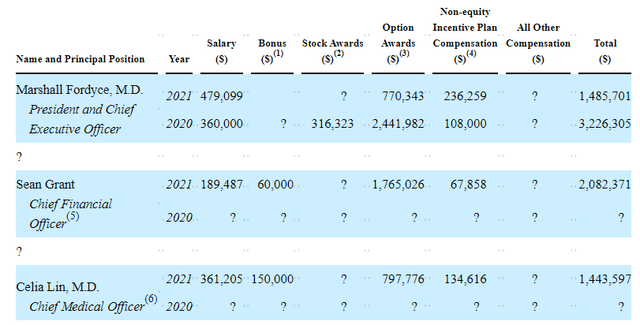

Moving on to executive compensation, I am pleased that on the whole cash portion of salaries is on the lower end of my expectations, as are stock and options awards.

Figure 9: Executive Compensation Table (Source: proxy filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

As for IP, the company has 15 issued patents as well as foreign counterparts for atacicept (also expects 12 years of market exclusivity from approval date in US given that the drug candidate is a biologic). Licensed patent portfolio covering MAU868 includes 3 issued US patents as well as pending applications and foreign counterparts. Patents covering atacicept are expected to expire between 2022 and 2029 (I don’t like this short lifespan, including composition of matter patents expiring 2022). Patents for MAU868 are expected to expire in 2036.

Final Thoughts

To conclude, at the current valuation I acknowledge there is high upside potential for long term investors given attractive opportunities targeted in IgAN and lupus nephritis. I appreciate how Vera’s management wisely chooses indications where there is a clear precedent for approval and predecessor drugs made it to market utilizing novel endpoints that recently became accepted. IgAN is a particularly attractive indication as hopefully over the years to come diagnosis shifts to non-invasive means (instead of kidney biopsy). Vera has an intriguing approach here as they essentially aim to turn off the faucet upstream (disease-modifying) versus competitors that work downstream. Perhaps one day they can show sufficient data highlighting the relationship between Gd-IgA1 and proteinuria to allow the former to be used in regulatory endpoints, but it’s very premature at this point to say that.

As for devil’s advocate, I’m not sure how competitive the 27.7% proteinuria reduction they achieved in prior small study is given peers on the horizon about to receive regulatory approval with greater efficacy than Tarpeyo has shown. Burden of proof is still on Vera to produce better results in the ongoing controlled study with higher number of patients. I also wonder how valuable atacicept can be given the small economic terms of the deal (same question goes for MAU868). Also, management’s language surrounding efficacy appears to be lowering investors’ expectations (bear thesis is this is a decent candidate, but not on par with lead competitors in the space). Also, as noted prior, the IP expiration dates (particularly composition of matter) for atacicept concerns me.

For readers who are interested in the story and have done their due diligence, I cannot recommend the stock at this time. Burden of proof is on upcoming data readout to convince the market (and myself) that atacicept really has the potential to be a contender in IgAN.

From an ROTY perspective (focus on next 12 months), I might choose to revisit the stock after the ORIGIN readout IF data is sufficiently promising (or also when MAU868 is more advanced in pivotal studies).

Key risks here include additional dilution via secondary offering in mid to late 2023 and disappointing results from the ORIGIN phase 2b readout in early 2023 (namely the scenario where data is good, but still not on par with peers in the IgAN space). Increasing competition in IgAN is a real concern here as well and I think peers such as Travere Therapeutics and Chinook Therapeutics could have significant lead time to achieve penetration and a dominant market share. Likewise, I’m not sure how to quantify the actual market potential of MAU868 (management seems to think it could be used broadly in a prophylactic manner, but to my eyes it appears to be a niche product at best).

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. I look forward to your thoughts in the comments section below.

Be the first to comment