Just_Super/iStock via Getty Images

“Litigation: A machine which you go into as a pig and come out of as a sausage.” ― Ambrose Bierce

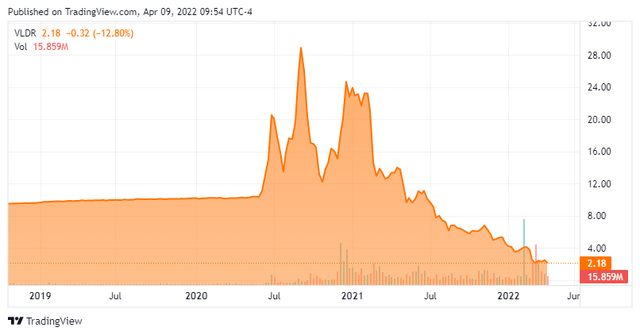

Today, we take our first in depth look at Velodyne Lidar (NASDAQ:VLDR), a small cap concern in the fast growing Lidar sensor space. This is our second foray into this sub-sector of the market, as we recently profiled Luminar Technologies (LAZR). Velodyne Lidar came public via a SPAC and after the past year, the shares find themselves deep in ‘Busted IPO‘ territory. Can the stock rebound and alleviate the pain for its shareholders? We attempt to answer that question via the analysis below.

VLDR – Stock Chart (Seeking Alpha)

Company Overview

Velodyne Lidar is based out in San Jose, California. The company produces surround-view lidar for autonomous vehicles, drones, security, mobile robots, and mapping applications; and solid state lidar for advanced driver assistance systems and autonomous applications. Velodyne also provides lidar-based perception software paired with sensors. The company aims to be a low-cost, high-quality, high-volume manufacturing concern. The stock currently trades at just over two bucks a share and sports an approximate market capitalization of $450 million.

VLDR – Product Portfolio (March Company Presentation)

The company’s growth plans have been overshadow by a soap opera of litigation. Three weeks ago, the founder of the company David Hall filed a business proposal seeking the removal of the current Chairman Michael Dee for cause. They also proposed to nominate three candidates for election to the company’s board of directors. The reasons for these actions were listed in the filing as:

Over the past sixteen months, as the Company’s stock price has declined nearly 90%, we have been deeply troubled by certain directors’ anti-stockholder actions and have made it a point to raise these concerns publicly… We attribute this extreme loss in stockholder value, neglect of technology and complete disregard for sound corporate governance directly to a broken Board of Directors under the control of Chairman Michael Dee. We believe Mr. Dee has breached his fiduciary duties and is more focused on advancing his own self-serving agenda than helping save the Company, as evidenced by his changing director classes to avoid having to stand for re-election.

The sniping between Mr. Hall, Mr. Dee and other members of the board has been ongoing since the founder was ousted from his leadership role at the company back in February of last year. Mr. Dee was installed when Velodyne Lidar went public through a reverse merger with SPAC Graf Industrial. The company lost its CEO at the time (replace earlier this year) last summer and this story has been somewhat of a ‘novela‘ that has been an overhang for the shares for more than a year now.

VLDR – Company Vision (March Company Presentation)

Like most in this space, Velodyne Lidar has scores of customers with multi-year agreements for future production across several sectors of the economy. During the fourth quarter, the company entered into a warrant agreement with Amazon (AMZN). The warrants will vest over time, based on discretionary payments to Velodyne by Amazon of up to $200 million. This warrant covers nearly 40 million potential shares. The warrant may be exercised any time before Feb. 4, 2030 at an exercise price of $4.18 per share.

VLDR – Business Footprint (March Company Presentation)

Fourth Quarter Results

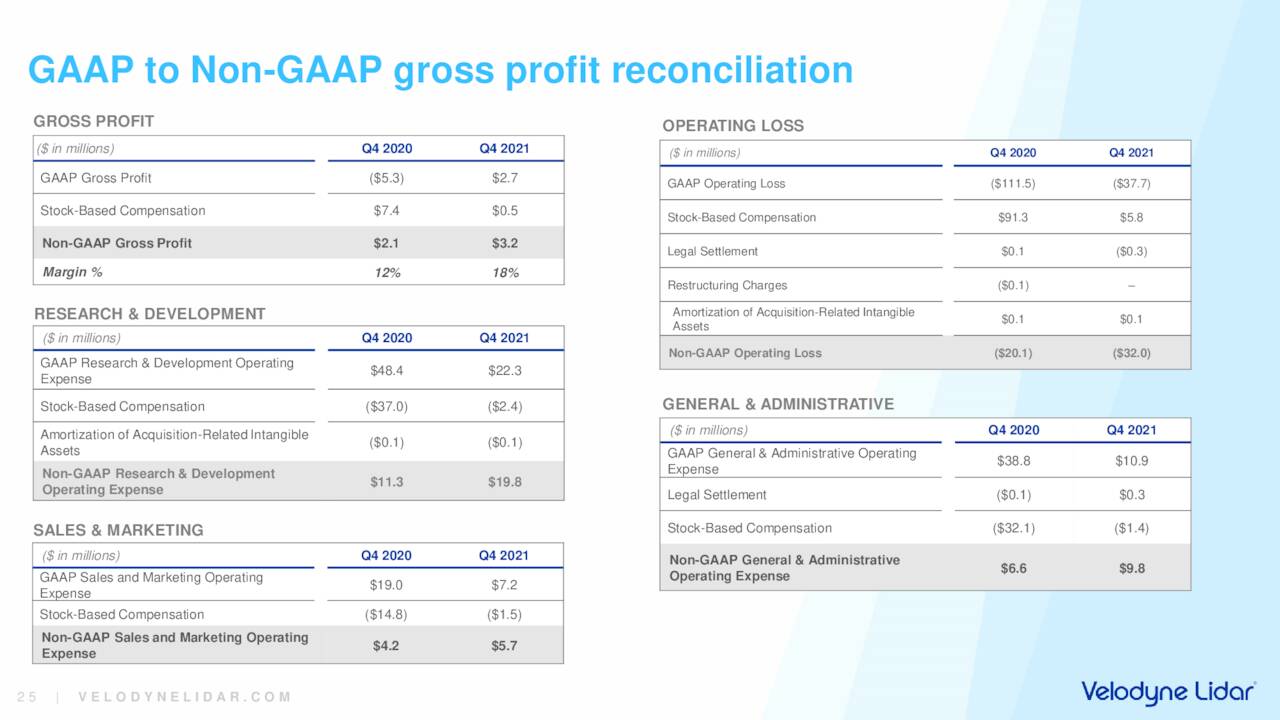

At the end of February, the company posted fourth quarter numbers. Velodyne posted a non-GAAP loss of 16 cents a share. Revenues came in at $17.5 million, down not quite two percent from 4Q2020. Both bottom and top line numbers were slightly above the analyst consensus at the time.

VLDR – 4th QTR GAAP Reconciliation (February Company Presentation)

Leadership guided to $10 million to $12 million of sales in 1Q 2022. The company did ship 4,900 sensor units during the quarter, an all-time quarterly record. For the year, the company shipped some 15,000 units.

VLDR – Company Snapshot (March Company Presentation)

Analyst Commentary & Balance Sheet

The analyst community is not sanguine on Velodyne’s prospects at the moment. So far in 2022, five analyst firms including Bank of America and Citigroup have either maintained or downgraded to Hold, Sell or Neutral ratings. On Needham ($5.90 price target) and Oppenheimer ($12 price target, down from $25 previously) have reissued Buy ratings this year.

Several insiders did purchase just over $300,000 of shares in aggregate in March. However, this was swamped by selling by the company’s founder who sold over $25 million worth of his stake one month ago. Not surprising given the ongoing litigation. He still owns approximately 10% of the company’s shares after the sale.

Just over six percent of the outstanding float in the stock is currently sold short as well right now. The company ended FY2021 with nearly $295 million of cash and marketable securities on its balance sheet after posting a GAAP net loss of $37.5 million for 4Q2021.

Verdict

The current analyst consensus has the company posting similar loss (67 cents a share) as sales fall nearly 20% from FY2021’s levels to approximately $50 million. Analysts do see sales rebounding some 50% in FY2023 to nearly $75 million and the company’s net loss narrowing slightly in 2023.

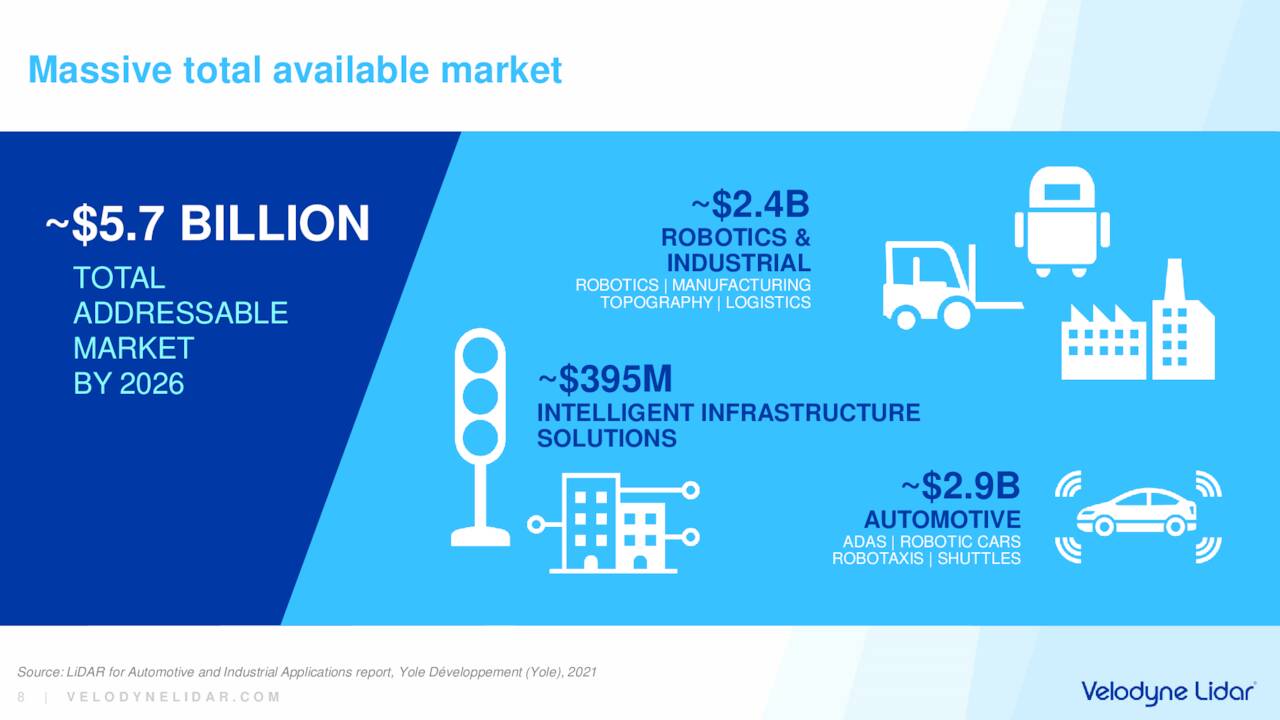

VLDR – Potential Market (March Company Presentation)

The company is targeting a significant and fast growing market segment. It also has a nice cash hoard on the balance sheet. However, in addition to the litigation soap opera that continues to play out with no known end in sight, Velodyne Lidar has failed to hit financial targets due in part to production issues. When the company came public, it projected it would produce nearly $700 million in sales in FY2024. That goal has long been a pipe dream at this point.

The stock is not expensive on a price to sales basis if Velodyne even achieves half of its previous FY2024 revenue projections, taking into consideration the current cash on the balance sheet. That said, I am staying on the sidelines on VLDR until litigation is resolved and management delivers more consistent sales traction myself.

“If someone tries to steal your watch, by all means fight them off. If someone sues you for your watch, hand it over and be glad you got away so lightly.” ― John Mortimer

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment