JamesBrey

While the Vanguard High Dividend Yield ETF (NYSEARCA:VYM) may not offer an eye-popping yield (it’s only 2.89%), the value oriented fund appears to be well-positioned for today’s uncertain and volatile market. That’s because VYM’s portfolio is over-weight in the Financials, Health Care, Energy, and Consumer Staples sectors. That is, sectors that are considered to be defensive in nature, represent “value”, and typically do well during times of high inflation and rising interest rates. As a result, it is not surprising that VYM has outperformed the S&P 500 by ~8% over the past year. That being the case, I’ll take a closer look at the Vanguard High Dividend Yield ETF today in order to see if it may make sense for an allocation within your portfolio.

Investment Thesis

As many of you know, during the recent rip-roaring bull market that ended in a bear market this year, growth stocks clobbered value and dividend paying stocks. However, all it took was a bear market to remind investors there is real “value” in having a diversified portfolio that contains an allocation to dividend paying stocks.

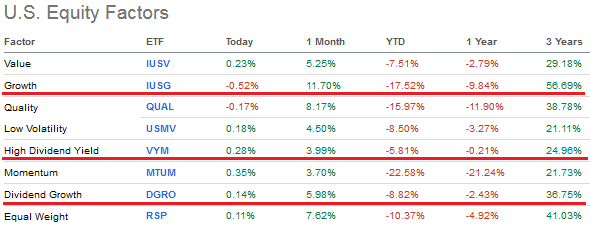

Indeed, investors need only look at the scoreboard on Seeking Alpha’s homepage to see what has taken place over the past year and the past three years:

Seeking Alpha

As can be seen in the graphic, although the “high dividend yield” and “dividend growth” growth categories have significantly outperformed “growth” over the past year, the 3-Year returns speak for themselves. That being the case, an ETF like VYM can add some stability or ballast to a portfolio in times of rocky and volatile markets. I’d argue that the current high-inflation and rising interest rate market is therefore an excellent time for investors to consider a lower-risk “value” oriented ETF like VYM.

So let’s take a look to see how the VYM has positioned investors for success going forward.

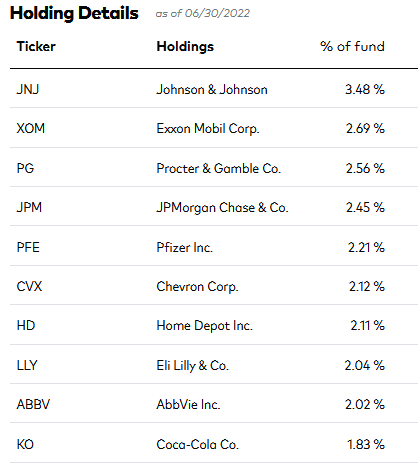

Top-10 Holdings

The top-10 holdings in the Vanguard High Dividend Yield ETF are shown below and equate to what I consider to be a relatively well-diversified 23.5% of the entire 443 stock portfolio:

Vanguard

The #1 holding is Johnson & Johnson (JNJ) with a 3.5% weight. The well-diversified healthcare and pharmaceuticals company is down only 1.5% over the past year, pays a $4.52/share annual dividend, and currently yields 2.5%.

Exxon Mobil (XOM) is the #2 holding and – combined with the #6 holding Chevron (CVX) – represents a 4.8% weighting in the O&G sector within VYM’s top-10 holdings. Exxon delivered $16.9 billion in free-cash-flow in Q2 while Chevron’s profits soared in Q2 and crushed consensus estimates. Exxon currently yields 3.97% while Chevron yields 3.59%. The stocks of both companies are up over 50% during the past 12-months.

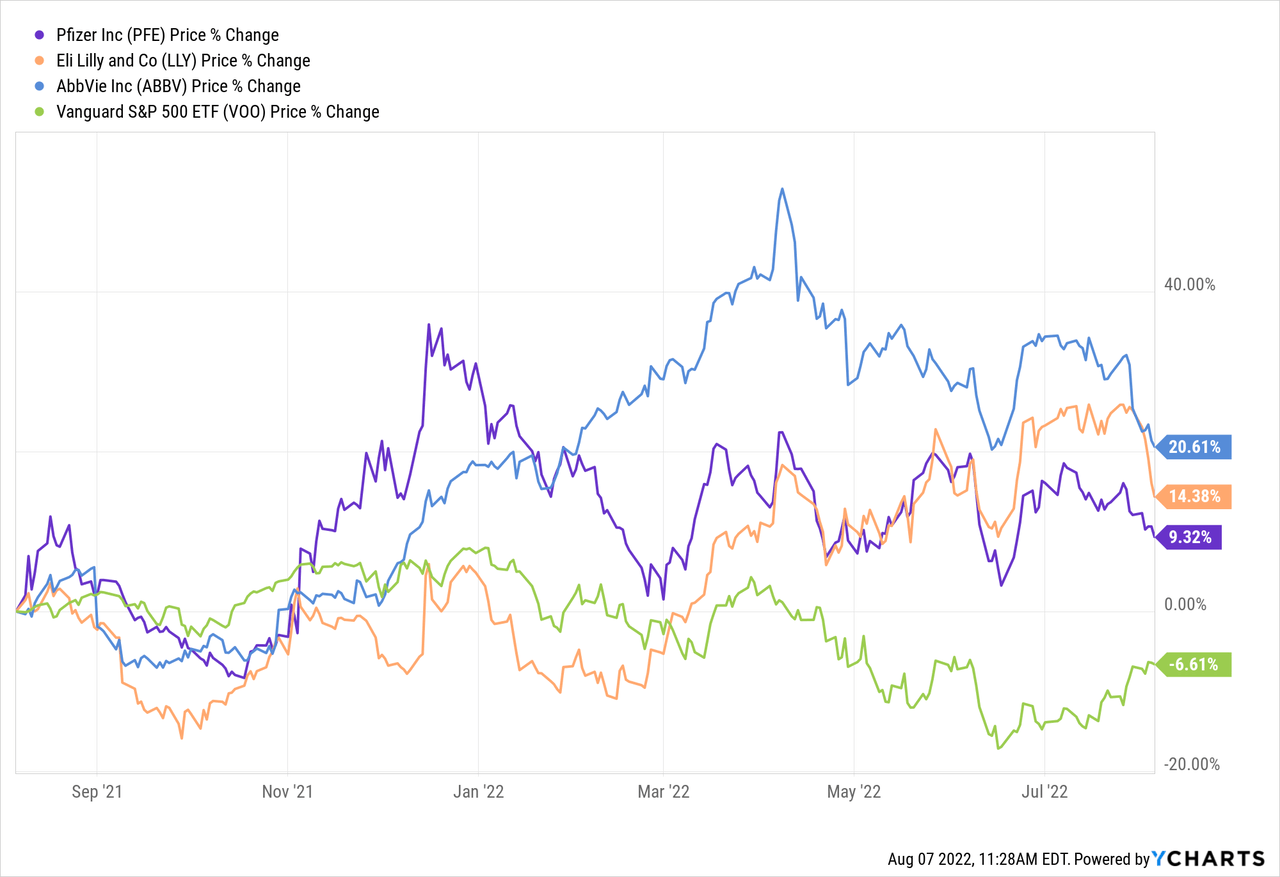

The fund’s top-10 holdings have an aggregate 6.3% weight in big pharma companies Pfizer (PFE), Eli Lilly (LLY), and AbbVie (ABBV). The three companies yield 3.2%, 1.2%, and 4.0%, respectively. All three companies have held up very well during the bear market – each one significantly outperforming the S&P 500:

Coca-Cola (KO) rounds out the top-10 with a 1.8% weight. Coke is up 12.2% over the past year and currently yields 2.71%.

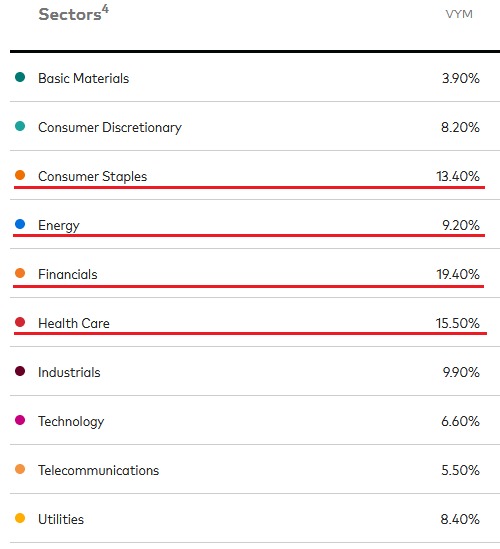

As far as the entire portfolio is concerned, the allocation of capital is weighted toward defensive sectors (or what some investors consider to be “value”) that typically outperform in periods of high-inflation and rising interest rates. Indeed, the Consumer Staples, Energy, Financials, and Health Care sectors, in aggregate, account for 57.5% of the entire portfolio:

Vanguard

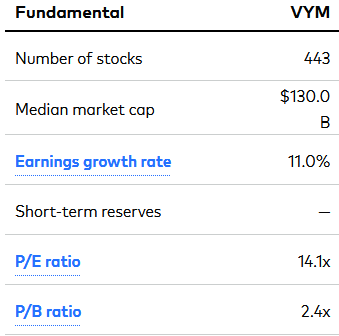

Meantime, note that a more value and yield oriented portfolio means that the VYM ETF trades at a significant discount to the overall market:

Vanguard

The current P/E and price-to-book ratios of the S&P 500 are 20.9x and 4.5x, respectively. So not only do shareholders get a better yield than the S&P 500’s 1.5%, but I would argue they also have a considerably less risky asset that is trading at a deeply discounted value as compared to the broad market. The other side of the coin is that the EPS growth rate of 11.0% won’t be that impressive to growth-oriented investors.

Performance

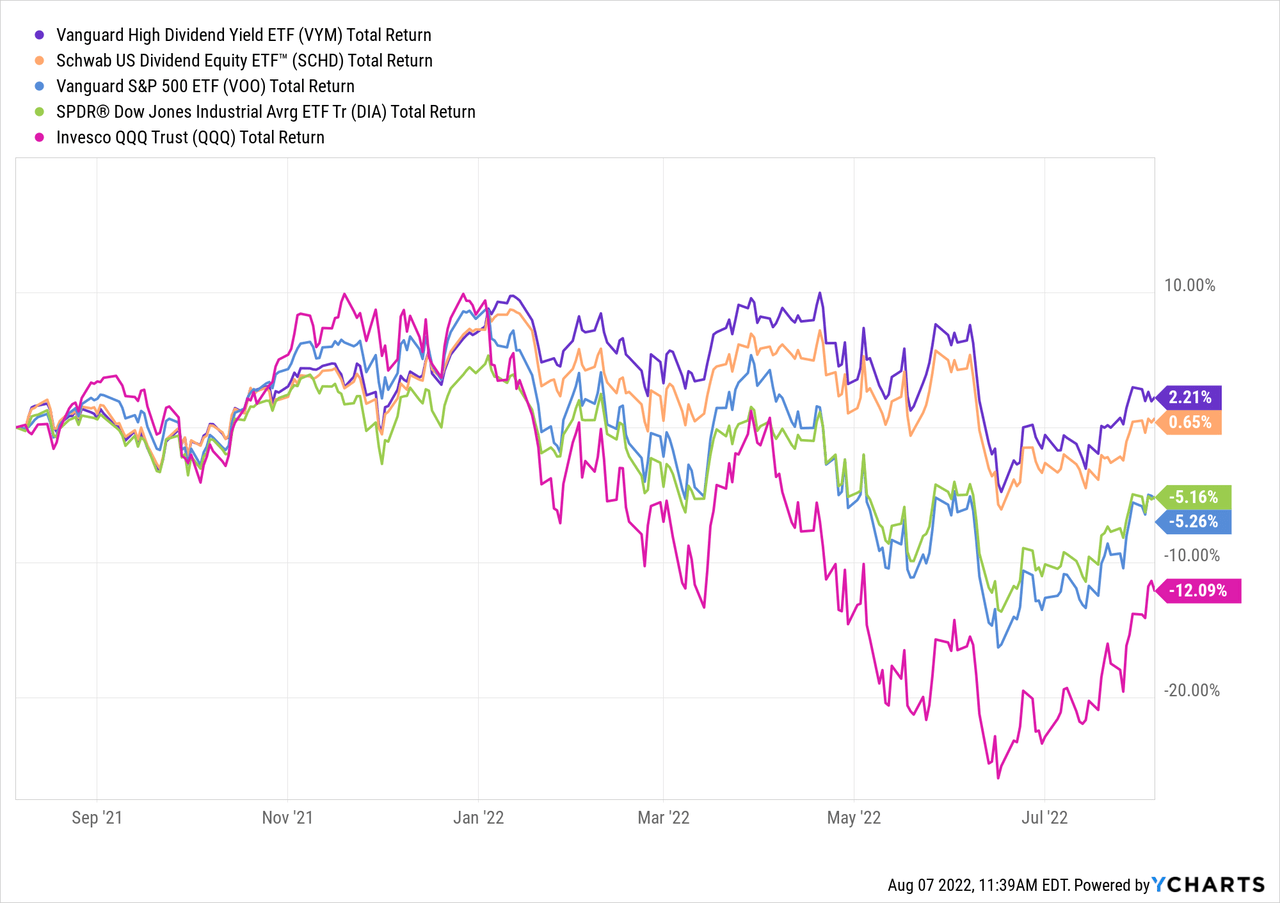

The graphic below compares the one-year performance of the VYM ETF against that of a competing fund – the Schwab U.S. Dividend Equity ETF (SCHD) – and the major market indexes as represented by the (VOO), (DIA), and (QQQ) ETFs:

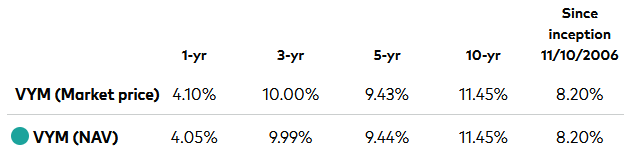

As you can see, the VYM ETF comes out on top and has outperformed the SCHD ETF by 1.5%+. The VYM ETF’s long-term track record is shown below:

Vanguard

As can be seen by the graphic, the VYM ETF has delivered a 10-year average annual return of a very solid, but unspectacular, 11.5%.

Risks

The VYM ETF is not unlike any other broad market fund these days and is therefore subject to the typical risks associated with COVID-19, high inflation, rising interest rates, a potential global economic slowdown, and Putin’s horrific war-of-choice with Ukraine as well as rising tensions as a result of the China/Taiwan/U.S. controversy. That said, I would argue that the VYM ETF is much less risky as compared to the S&P 500, DJIA, or Nasdaq-100.

VYM’s expense fee is 0.06%, and like most Vanguard funds, is a very cost-efficient fund. The median market cap in the portfolio is $130 billion, and the fund has assets of $55.6 billion. That being the case, I have no liquidity related concerns whatsoever.

Summary & Conclusions

Though the Vanguard High Dividend Yield ETF only yields 2.89%, I find the ETF to be quite attractive here. In my opinion, the portfolio is very well constructed to navigate through the current high-inflation and rising interest rate environment. The value-oriented portfolio trades at a significant discount to the S&P 500 while also having an arguably lower risk profile. For those investors looking for decent – though unspectacular – income and have been building up cash to invest in the market, they could certainly do worse than allocating some capital to the VYM ETF, which I rate a BUY.

Be the first to comment