andriano_cz/iStock via Getty Images

The Vanguard Energy ETF (NYSEARCA:VDE) has lost more than 20% of its value since hitting a 52-week high of $130 early this month due to rising interest rates and concerns about a recession. I believe the VDE price may fall further in the months ahead, and shares might not be able to sustain a bull run. Hence, rather than trying to ride the current momentum, investors should wait for a better opportunity as historical trends and oil demand destruction hint at the pressure on energy stocks in the months ahead.

Historical Trends Suggest Downside for VDE Shares

The World Bank expects global GDP growth to hover in the range of 2.9% for 2022 compared to 5.7% in the past year, which doesn’t bode well for oil demand. Moreover, the growth expectations for US GDP dropped to zero for the second quarter of 2022 with expectations for more volatility in the second half. Consequently, the number of bets on the US economy entering a recession increased significantly.

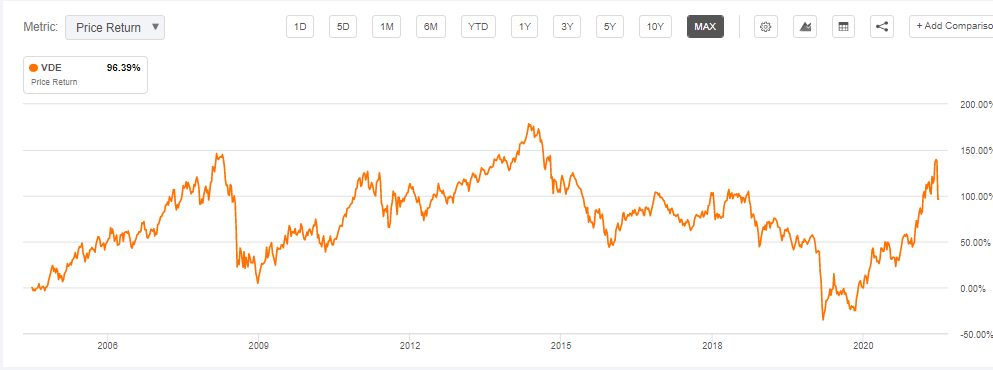

VDE price performance (Seeking Alpha)

In the past two decades, whenever a recession hits an economy and interest rates rise, energy stocks and oil prices fall so sharply. VDE shares, for instance, were trading around $140 to $150 at the end of the second half of 2008, and oil prices were also around $150 a barrel before the recession hit the US economy. In the next nine months, shares of VDE lost nearly half of their value before rebounding at the end of 2009. As shown in the chart above, the VDE share price also fell sharply in the second half of 2014 when the Fed announced monetary tightening. Moreover, VDE shares and oil prices have made a huge downward movement from 2018 onwards until the end of 2019, when the Fed raised interest rates aggressively and global GDP growth declined below 2%. In 2020, oil prices remain under significant pressure due to a covid-driven recession. Therefore, if oil prices and energy ETFs follow their historical trend, it is not a prudent strategy to buy VDE ahead of a recession.

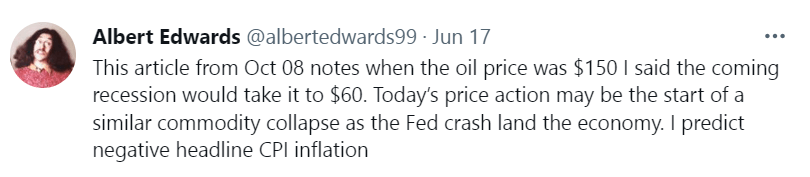

Albert Edwards’ recession prediction (Twitter)

Analysts have also hinted that the second half of 2022 might reflect the price movement of 2008. Albert Edwards, co-head of global strategy at Societe Generale and a notable bear who correctly predicted the 2008 recession and forecasted oil prices to fall by more than half, now sees similarities to what occurred in 2008. He tweeted: “Today’s price action may be the start of a similar commodity collapse as the Fed crash land the economy. I predict negative headline CPI inflation.”

Demand Destruction Would Ease Prices

Pent-up demand and economic growth in post-pandemic conditions have contributed to the robust growth in crude oil and gas prices in the past eighteen months. Moreover, sanctions on Russia further fueled supply concerns and helped push crude oil prices above $120 for the first time since 2014. Oil-producing companies have benefited from high oil prices, but soaring prices pushed inflation numbers to scary levels as well. In March, ConocoPhillips (COP) CEO Ryan Lance hinted that oil markets are approaching demand destruction pricing while Goldman had predicted that the refining crisis will lead to demand destruction in June and JPMorgan believes demand destruction has already begun.

As rates are expected to rise quarter over quarter until the end of 2023, economic growth will slow further in the second half of 2022 and ahead. In developed countries, demand destruction would be high, but it would be significantly higher in third-world countries, where inflation numbers are hovering at double-digit rates, and people and governments can’t afford to buy oil at around $120. In order to reduce their trade deficits, countries like Pakistan, Sri Lanka, Nepal, and many others are campaigning at the government level to reduce crude oil consumption.

The Russian strategy of providing discounted oil to its allies would also ease supplies. As an example, India imported one million barrels of oil a day from Russia in April and 900,000 a day in May, a significant increase from an average of 100,000 barrels per day in 2021. Similarly, China has been ramping up its crude oil imports from Russia in recent months. In May, crude imports from Russia jacked up by 55% year over year to almost 2m barrels per day, up from 1.59 million barrels in April. Thus, the IEA, which projected a 25% decline in Russian oil exports in July, now expects this target to be met in 2023. Russian oil production fell by only 7% in May, compared to the same month last year.

VDE Shares Might Fall but Dividends are Safe

Given that the share prices of energy companies are directly correlated with oil prices, there is a high probability that energy-focused ETFs, such as VDE, will experience some pressure in the second half, and may even cool off further in 2023.

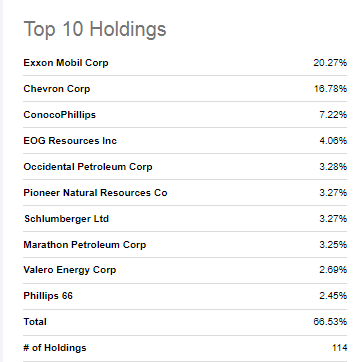

VDE top 10 stock holdings (Seeking Alpha)

While oil prices may decline in the coming months, VDE’s dividends look completely safe because its portfolio is concentrated on large-cap energy companies such as Exxon Mobil (XOM), Chevron Corporation (CVX), and ConocoPhillips. These three companies represent 44% of VDE’s overall portfolio and these companies have sustained dividend growth even in 2020 when many companies fell into bankruptcy. For instance, Exxon Mobil’s cash flows offer a complete cover to dividends. It generated $15 billion of free cash flow in the December quarter of 2021 and $10.8 billion in the first quarter of 2022, with expectations that cash flow for the June quarter would increase significantly amid high oil prices. In addition, the company’s plan to purchase 8.4% of its common stock by 2023 will further enhance its dividend stability.

Similar to Exxon Mobil, Chevron is expected to maintain robust dividend growth and financial performance. ConocoPhillips, on the other hand, appears in a much better position to benefit from healthy oil prices as it has one of the lowest breakeven levels in the industry. Last year, the company increased its dividend by 16.47%. Additionally, the robust cash generation in the past couple of quarters hints that the company is well-positioned for high double-digit dividend growth in 2022. VDE’s remaining top 10 stock holdings have also seen substantial cash flow growth over the past 18 months.

In Conclusion

Buying VDE at a multi-year high isn’t a prudent investment strategy. It also doesn’t seem attractive when considering oil and energy stocks’ historical performance during high rates and recessions. In the second half of the year, slowing economic growth and high inflation would certainly cut oil demand. Therefore, rather than riding the current momentum, which might fade soon, investors should wait for better entry points.

Be the first to comment